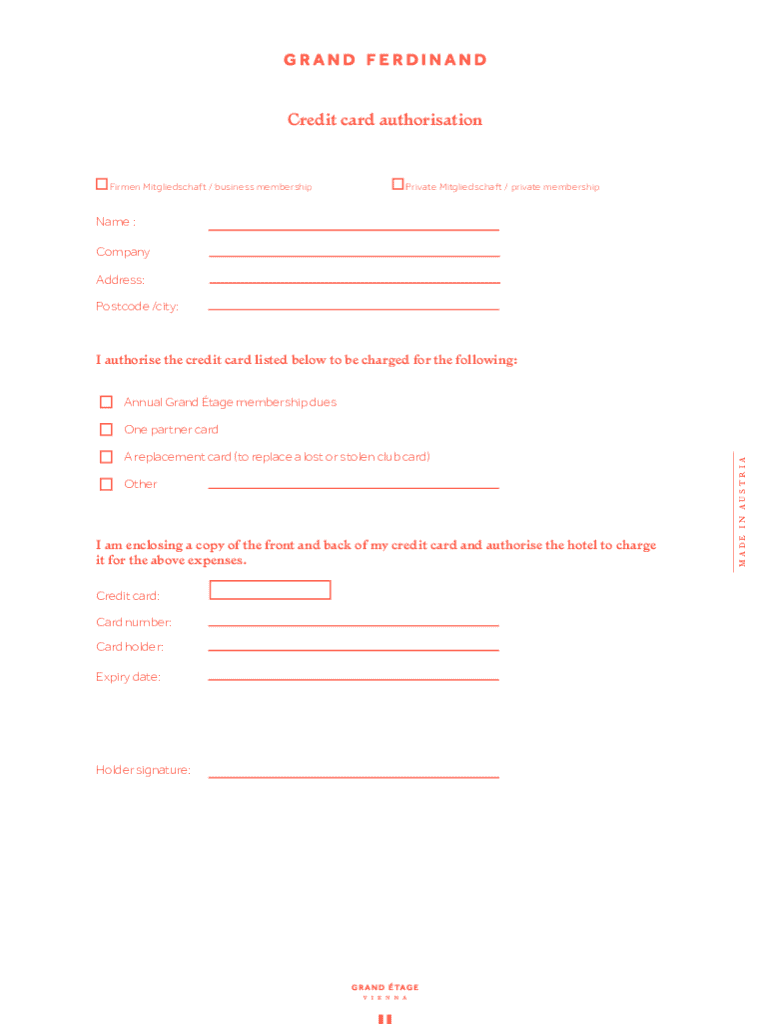

Get the free Credit Card Authorisation

Get, Create, Make and Sign credit card authorisation

How to edit credit card authorisation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorisation

How to fill out credit card authorisation

Who needs credit card authorisation?

Credit Card Authorization Form: A Comprehensive Guide

Understanding the credit card authorization form

A credit card authorization form is a vital document in financial transactions that allows a merchant to obtain permission from a cardholder to charge their credit card for a specified amount. This form serves as a necessary tool to authorize payments and provides legal protection for both the merchant and the cardholder. By having a credit card authorization form on hand, businesses can streamline their transaction processes, minimize disputes, and enhance their operational efficiency.

The importance of this form cannot be overstated—it acts as an assurance to businesses that the cardholder consents to the charges. Without this authorization, merchants risk exposure to chargebacks and fraud, which can significantly impact their bottom line. Thus, using a credit card authorization form is essential for safeguarding revenues and customer relationships.

The role of credit card authorization forms in business

Credit card authorization forms play a critical role in the operational framework of businesses. They not only protect merchants from financial liability but also establish a clear record of client authorization for payments. One of the primary reasons businesses utilize these forms is to mitigate chargeback risks—these can arise when customers dispute a transaction, often leading to financial losses if the merchant cannot prove authorization.

Furthermore, their role extends into ensuring payment security and integrity. In an era when data breaches and fraud are rampant, having a structured system for collecting payment authorization helps firms maintain a level of security for both sensitive customer information and their own financial operations.

Benefits of using a credit card authorization form

The advantages of employing a credit card authorization form extend beyond mere compliance; they touch on trust, efficiency, and security. By prompting customers to authorize payments via a formal channel, businesses instill a sense of trust and transparency in their transactions. Customers feel more secure knowing their payment information is handled responsibly.

Additionally, utilizing these forms streamlines payment processes. By having all necessary information predefined and secured in one place, businesses can process transactions swiftly, reducing delays and improving customer satisfaction. This efficiency is crucial, especially in service industries where time is of the essence. Moreover, the structured approach aids in significantly reducing chargeback abuse, as customers must acknowledge and agree to the terms laid out in the authorization form.

Practical steps to create a credit card authorization form

Creating a credit card authorization form involves several steps to ensure it is effective and compliant. Selecting the right template is the first critical decision point. Factors such as industry standards and the specific needs of your business will guide this choice. For example, a service-based industry may include fields relevant to service descriptions, while e-commerce businesses might focus on shipping details.

Once a template is chosen, customizing your form using pdfFiller can significantly enhance its effectiveness. The step-by-step customization process allows businesses to add branding, adjust fields based on various transaction types, and even incorporate interactive elements that make filling out the form easier for customers. It's essential to ensure the language used in the form adheres to legal standards, thus safeguarding your business against potential liabilities.

Managing your credit card authorization forms

Proper management of credit card authorization forms is crucial post-execution. Best practices for storing these signed documents should focus on security and accessibility. Digital storage solutions are often preferred, allowing businesses to secure forms while maintaining easy access for retrieval. Implementing strong password protections and encryption can further enhance security.

The duration for retaining authorization forms can depend on local laws and the specific needs of your business. As a rule of thumb, retaining forms for a minimum of three years is common, but it’s advisable to consult with legal counsel for guidance specific to your jurisdiction. Furthermore, pdfFiller provides tools to track authorizations and payments while allowing edits and accesses from anywhere, ensuring businesses maintain an organized and compliant document management system.

Frequently asked questions (faqs)

Throughout the process of utilizing credit card authorization forms, several questions often arise. A common inquiry is, 'What is a credit card authorization form used for?' Essentially, it is employed to grant permission for charging a credit card for a specified amount, ensuring that merchants are legally protected against unauthorized transactions. The second lingering question many businesses have is, 'How long should you keep credit card authorization forms?' A practical retention period is usually three years, but this may vary based on regional regulations.

Another frequent concern is related to declining cards post-authorization. In such cases, businesses typically have to inform the customer immediately and may need to request an alternative payment method. Lastly, many wonder if there are alternatives to credit card authorizations, such as digital payment processors that can provide different dispute resolution methods. However, these alternatives may lack the legal backing and clarity provided by traditional authorization forms.

Case studies on effective use of credit card authorization forms

Examining real-life examples of businesses implementing credit card authorization forms can provide valuable insights. For instance, Business X decreased payment processing time significantly after adopting a structured credit card authorization method. By ensuring customers filled out comprehensive authorization forms before services were rendered, they reduced transaction disputes and streamlined their operational workflow. This shift not only enhanced customer satisfaction but also reduced administrative burdens related to transaction management.

On the contrary, Business Y faced a surge in chargebacks due to overlooking authorization processes. After integrating a robust credit card authorization form into their operations, they observed a remarkable decline in chargebacks. By ensuring every transaction was documented and authorized, they fortified their defense against customer disputes, ultimately preserving their revenue and reputation.

Overview of related document management solutions

In a world where smooth documentation is essential for business success, comparing manual versus automated forms handling reveals significant benefits of automation. Manual handling can lead to errors, delays, and difficulties in retrieval, while automated systems offer enhanced accuracy and speed. Transitioning to automated handling allows businesses greater flexibility in managing their credit card authorization forms alongside other vital documentation.

Integrating e-signature solutions, such as those offered by pdfFiller, further streamlines the process. E-signatures not only speed up authorization but also maintain transaction integrity and security. Businesses can explore additional document templates on pdfFiller that address various paperless documentation needs, aiding them in reducing clutter while promoting efficient workflow.

Industry trends and future of credit card authorization

Emerging technologies are significantly impacting payment security. From biometric verification to blockchain technology, these innovations are reshaping how businesses approach credit card authorizations. As customers become more tech-savvy, businesses are required to adapt to these changes by integrating advanced security measures that protect sensitive information.

Additionally, shifts in consumer behavior regarding payments illustrate a desire for simpler, faster transaction methods. More consumers gravitate towards digital wallets and contactless payment methods, suggesting that traditional forms may evolve. Businesses must keep an eye on these trends to remain competitive while ensuring compliance and security in their transaction processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit card authorisation?

How do I execute credit card authorisation online?

How do I edit credit card authorisation on an Android device?

What is credit card authorisation?

Who is required to file credit card authorisation?

How to fill out credit card authorisation?

What is the purpose of credit card authorisation?

What information must be reported on credit card authorisation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.