Get the free Compliance Calendar for Federal Reporting

Get, Create, Make and Sign compliance calendar for federal

Editing compliance calendar for federal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out compliance calendar for federal

How to fill out compliance calendar for federal

Who needs compliance calendar for federal?

Compliance calendar for federal form: Detailed how-to guide

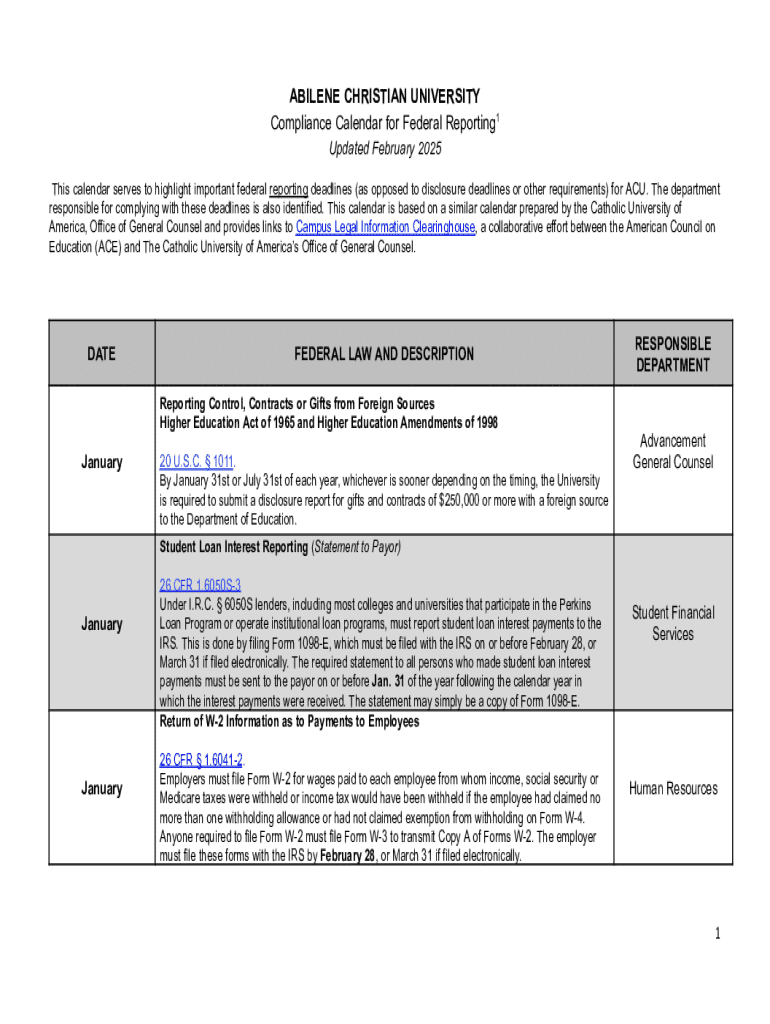

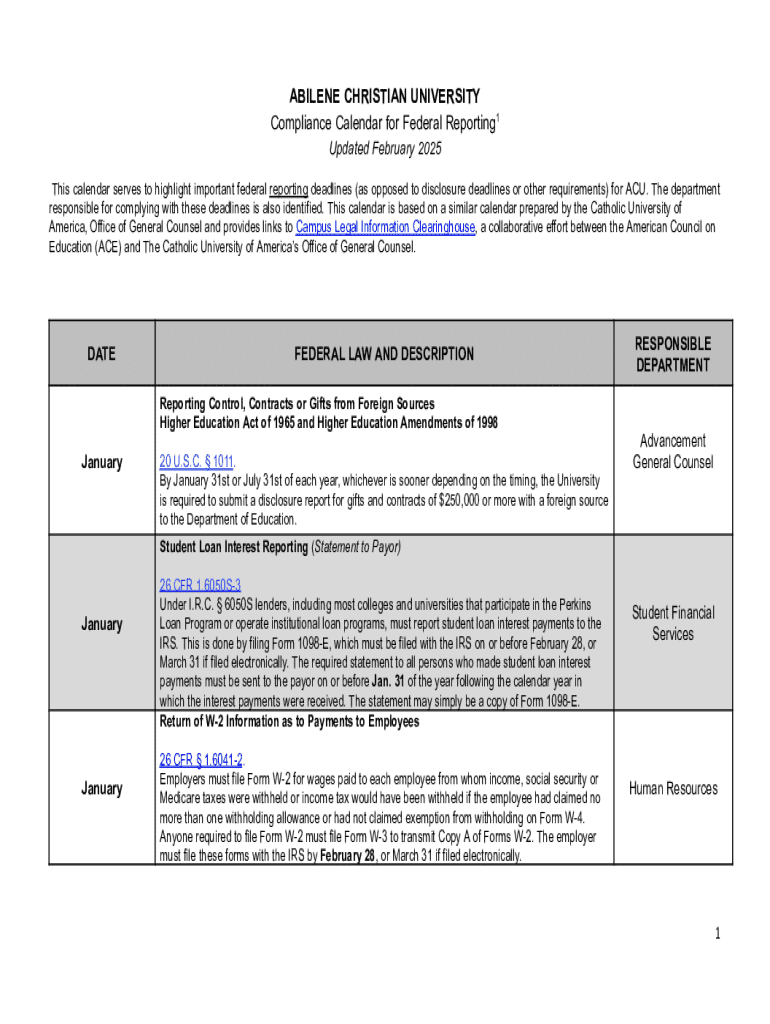

Overview of compliance calendars

A compliance calendar specifically for federal forms is an essential tool for individuals and organizations to manage various reporting and filing obligations. It serves as a centralized schedule that outlines all critical deadlines, helping businesses avoid penalties and maintain adherence to federal regulations. The importance of a compliance calendar cannot be understated, as it plays a vital role in ensuring that deadlines are met, thus safeguarding against possible legal issues and financial repercussions.

Using a compliance calendar for federal forms offers numerous benefits. Firstly, it provides a clear view of upcoming due dates, which reduces the likelihood of missed filings. Secondly, it enhances organization and efficiency, allowing teams to allocate resources effectively. Finally, a well-maintained compliance calendar assists in tracking changes in federal regulations, ensuring that businesses remain informed and compliant without falling behind.

Understanding federal forms

Federal forms are documents required by various government agencies for regulatory compliance. They can be broadly categorized into several types, each serving different purposes within the framework of federal regulations. Key categories include tax forms, employment forms, and compliance-specific forms.

Each of these forms has associated deadlines that must be adhered to, which can often vary annually or quarterly. Understanding these deadlines is crucial in preventing mishaps that can lead to fines or non-compliance issues.

Creating your compliance calendar

Creating a compliance calendar tailored to your specific needs involves a few strategic steps. By following a methodical approach, you can develop an effective tool for managing your federal form obligations.

Recommended tools like pdfFiller can streamline the compliance calendar creation process. Their interactive tools facilitate document management, ensuring that you can easily track deadlines and make necessary updates.

Monthly breakdown of federal compliance deadlines

Establishing a monthly overview of compliance deadlines assists businesses in organizing and prioritizing their filing obligations. Below is a summary of compliance deadlines by month, highlighting specific forms due at various times throughout the year.

Each month has specific forms due, and it’s important to stay organized to avoid any penalties. Implementing best practices such as early preparation and timely submissions can greatly reduce stress during peak filing periods.

Best practices for managing federal form compliance

Effectively managing your compliance calendar requires adherence to several best practices that ensure smooth operations year-round. Automated reminders and alerts can serve as excellent tools for tracking deadlines, minimizing the chances of oversight. Set reminders at least a week before due dates to give yourself adequate time to prepare.

Regularly reviewing and updating your compliance calendar is equally important. Changes in regulation or your business structure can impact your compliance obligations. Keeping your calendar current helps avoid surprises. Collaboration with team members is also vital; ensure that everyone knows their roles and responsibilities regarding compliance. Regular check-ins can foster accountability and teamwork.

Advanced compliance strategies

For organizations looking to take their compliance efforts a step further, integrating the compliance calendar with other business processes can enhance workflow and efficiency. This approach often involves aligning your accounting and payroll functions with your compliance efforts. By connecting these processes, you ensure that financial obligations reflect the necessary compliance deadlines.

Human resource management is another area where synchronization can yield benefits. By integrating HR data with compliance calendars, HR teams can streamline the handling of employee forms like W-2s or I-9s, thereby ensuring compliance with federal employment regulations.

Leveraging cloud-based solutions for compliance access and collaboration can significantly aid compliance efforts. Platforms like pdfFiller serve as centralized platforms for document management, providing tools for e-signing and editing. This not only facilitates timely submissions but also enhances team collaboration, allowing multiple users to access and manage documents seamlessly.

Common challenges and solutions

Navigating the complexities of federal compliance can present various challenges. One of the primary obstacles faced by organizations is the frequent changes in federal regulations. Staying updated requires diligence; subscribing to regulatory newsletters or setting Google Alerts for specific compliance changes can help organizations keep abreast of new developments.

Additionally, organizations often have to adjust to new forms and deadlines as regulations evolve. Maintaining flexibility in your compliance calendar allows quick adjustments when required. Lastly, organizational changes, such as personnel shifts or changes in management, can disrupt established compliance routines. Ensuring that compliance training is part of onboarding can mitigate this risk.

Frequently asked questions (FAQs)

Understanding the intricacies of federal compliance forms leads many to seek clarity on common issues. One frequently asked question surrounds how best to stay informed about updates to federal forms. Effective practices include subscribing to official agency updates and actively participating in relevant webinars or seminars. Utilizing resources like pdfFiller can also provide the latest templates and forms related to compliance.

Another common inquiry is regarding the potential consequences of missing a compliance deadline. Fines and penalties vary based on the specific federal form but can lead to significant financial liabilities and potentially languish into legal matters. Using a compliance calendar diligently can prevent these scenarios. Lastly, users often question how pdfFiller can assist in the compliance process. pdfFiller offers a suite of features designed for efficient document management, including interactive templates, e-signing options, and team collaboration tools, simplifying the entire compliance process.

Interactive tools and resources

pdfFiller provides a range of interactive tools and resources to enhance the management of federal forms and compliance obligations. Users can access a library of templates tailored for various federal forms, facilitating quick and accurate document preparation. The platform's form-filling tools streamline the document creation process, enabling users to efficiently complete forms with ease.

Additionally, pdfFiller allows for secure signing and sharing of documents, ensuring that compliance reporting is both timely and trustworthy. Leveraging these tools not only saves time but also minimizes errors, making the entire form management process simpler and more efficient.

Summary of key takeaways

In conclusion, developing a well-structured compliance calendar for federal forms significantly enhances an organization’s ability to meet regulatory deadlines. This guide highlights the critical tools, strategies, and best practices for managing compliance effectively. By staying organized, leveraging advanced tools like pdfFiller, and building collaborative approaches, both individuals and teams can foster a culture of compliance that supports their operational integrity.

Continuous learning and adaptation to new federal requirements is essential for sustained compliance. Embracing these practices not only safeguards against regulatory pitfalls but also empowers users to maintain efficiency in their document management activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify compliance calendar for federal without leaving Google Drive?

How do I edit compliance calendar for federal on an iOS device?

How can I fill out compliance calendar for federal on an iOS device?

What is compliance calendar for federal?

Who is required to file compliance calendar for federal?

How to fill out compliance calendar for federal?

What is the purpose of compliance calendar for federal?

What information must be reported on compliance calendar for federal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.