Get the free Check Request Form

Get, Create, Make and Sign check request form

How to edit check request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check request form

How to fill out check request form

Who needs check request form?

Understanding the Check Request Form: A Comprehensive Guide

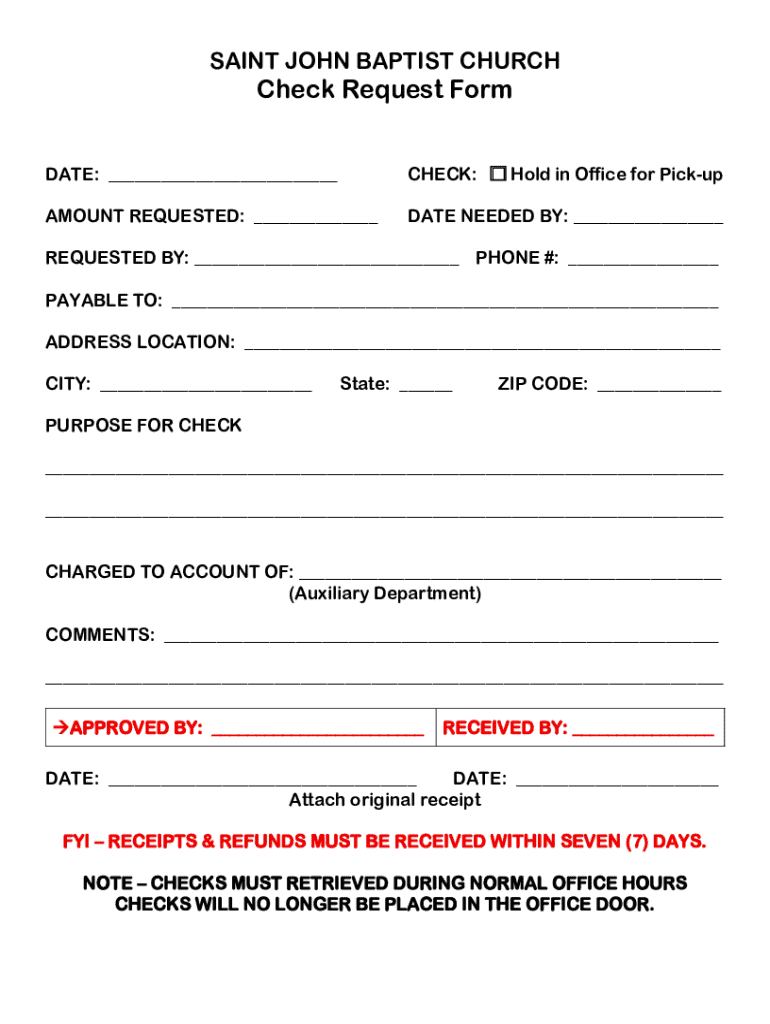

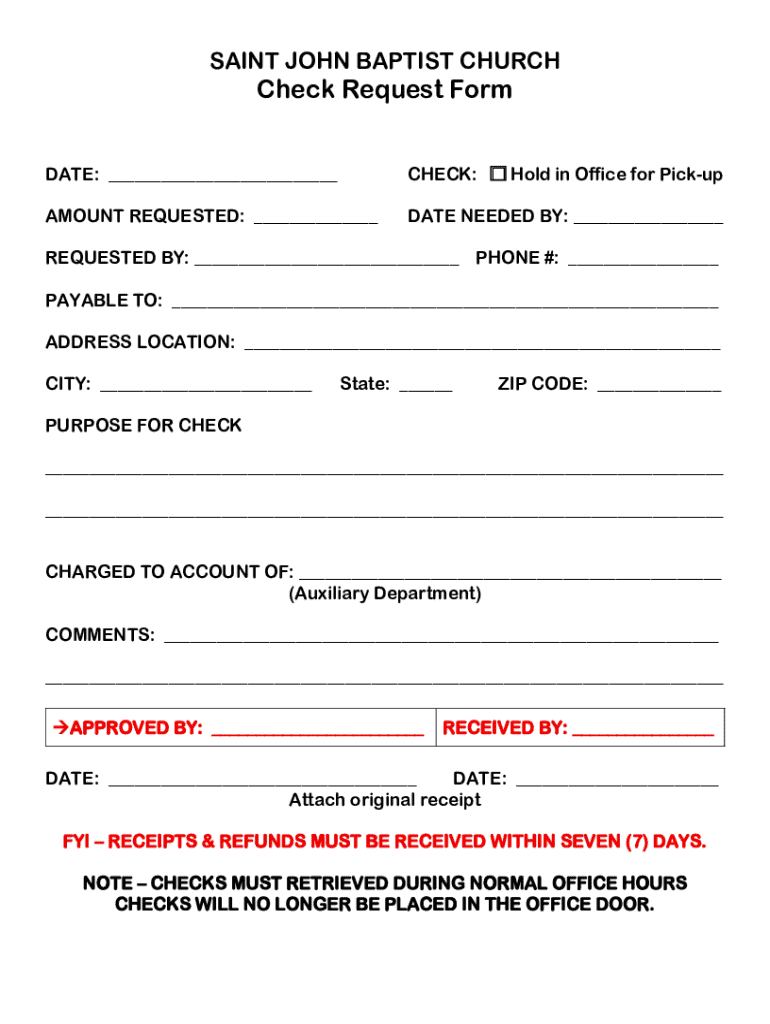

What is a check request form?

A check request form is a formal document that individuals or organizations use to request the disbursement of funds via a check. This form serves as a record of the transaction and typically includes key details such as the payee, the amount requested, and the purpose of the payment. By standardizing the request process, it ensures that all necessary information is provided, minimizing errors and facilitating quicker approvals.

The importance of accurate check requests cannot be understated. An incomplete or incorrectly filled form can lead to delays in payment, unnecessary confusion, and financial discrepancies. A well-structured check request form promotes efficiency and enhances clarity in financial operations, making it essential for both individuals and organizations.

Benefits of using a check request form

Utilizing a check request form streamlines the payment process. With identifiable fields, it guides users to provide all required information, reducing the chances of mistakes and ensuring that requests are processed swiftly. This structure also allows finance teams to quickly review and approve requests, thus speeding up the overall workflow.

Moreover, check request forms significantly improve financial tracking. Each request creates a tangible record of outgoing payments, facilitating budget management and financial audits. By maintaining an organized tracking system, organizations can better understand their spending patterns and make informed financial decisions.

Lastly, a check request form enhances accountability and transparency. When payments are documented through formal requests, it creates a clear trail of expenditures, which is indispensable for auditing purposes. This increases trust among team members and fosters an environment of financial responsibility.

When to use a check request form

Check request forms are typically used in various scenarios, such as paying vendors for services rendered, reimbursing employees for expenses, or processing payments for one-time projects. They are especially useful when the payment amount is significant or when regular invoices are not being processed.

It's crucial to differentiate between check requests and other payment methods. Unlike standard invoices, which may cover multiple transactions, a check request form addresses a single payment request, making it more precise. Other payment methods, like credit card transactions or electronic payments, might not require a formal request, but the check request form remains vital in scenarios requiring documented proof for future reference.

Key components of a check request form

A well-designed check request form should include several key components. Essential details should feature prominently, ensuring that all necessary information is captured for processing. Firstly, payee information, which includes the name and address of the individual or entity receiving the payment, is vital. Secondly, the amount requested must be specified clearly to avoid confusion.

Additionally, a purpose or reason for the request should be included, as this context helps finance personnel understand the nature of the transaction. Optional information can also enhance processing speed, such as specific invoice numbers, project codes, or even fields for signatures from department heads to authorize the request.

Sample check request forms

Examining sample check request forms can provide a clearer understanding of how these documents are structured. Various formats exist, ranging from simple one-page forms to more complex multi-page requests, depending on organizational requirements. Common features typically include clearly labeled sections for payee details, amounts, reasons, and approvals.

By analyzing the key components in sample forms, users can identify best practices for designing their own check request templates. For instance, incorporating a section for expense categorization can help streamline the accounting process and offer better visibility into financial operations.

How to fill out a check request form

Filling out a check request form accurately is imperative for timely processing. Step 1 involves gathering all necessary information before starting the form. This includes the payee’s contact details, the exact amount needed, and the purpose of the funds.

Step 2 is completing each section thoroughly. It’s vital to review each field carefully to avoid incomplete submissions. Moving to Step 3, take the time to review the form for accuracy, as even minor errors can delay payment. Finally, in Step 4, submit the completed form to the appropriate department or individual responsible for processing check requests within your organization.

Interactive tools for creating a check request form

Creating a check request form has never been easier with tools like pdfFiller. Their platform offers pre-made templates that users can customize to fit their needs. Accessing ready-to-use forms saves time, allowing users to focus on other essential tasks.

The advantages of cloud-based editing are significant. Users can create, edit, and share forms from anywhere with internet access. The added ability to integrate eSigning features allows for quick approvals, further expediting the payment process. This modern approach to document management drastically reduces the likelihood of paperwork getting lost or mishandled.

Managing check request forms

Effective management of check request forms is essential for financial health. Using tools like pdfFiller, users can track requests seamlessly. Advanced tracking features enable users to see where a request is in the approval process, providing transparency and accountability.

Furthermore, papFiller allows for archiving and storing forms for compliance purposes. Organizations can easily access historical forms for audits or financial reviews, ensuring that they meet necessary regulatory guidelines. Collaboration functions enable multiple parties to be involved in the request process, streamlining approvals and communication.

Common mistakes to avoid when submitting a check request

There are several common pitfalls when submitting a check request form. Failing to provide complete information is one of the most significant errors. Missing details can lead to rejection or delays in processing.

Another mistake is not adhering to company policies surrounding check requests. Each company typically has its own protocol for how these forms should be used, and overlooking such guidelines can complicate the approval process. Lastly, delaying submission during time-sensitive requests can result in critical oversights, such as missing deadlines for vendor payments or project funding.

Key takeaways on check request forms

The importance of consistency and accuracy when utilizing check request forms cannot be overstated. By following standardized procedures for filling out and submitting these forms, organizations can enhance financial efficiency and reliability. Each form should be considered a crucial component of the payment process.

Additionally, using platforms like pdfFiller supports the efficient management of these forms. Access to customizable templates, tracking features, and collaborative tools streamlines the overall experience, making managing finances more effective.

Check request form examples in different contexts

Check request forms can vary widely based on the context in which they are used. For example, corporate environments often use more detailed forms that include departmental codes and specific project references, while nonprofit organizations may prioritize transparency and simplicity in their forms.

Personal check request forms, on the other hand, might focus on reimbursement requests or small-scale payments, potentially requiring less detail overall. Each type has unique customization options available in pdfFiller, ensuring that users can create forms that best serve their needs, no matter the circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send check request form for eSignature?

Can I edit check request form on an Android device?

How do I complete check request form on an Android device?

What is check request form?

Who is required to file check request form?

How to fill out check request form?

What is the purpose of check request form?

What information must be reported on check request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.