Get the free Credit Approval Form

Get, Create, Make and Sign credit approval form

Editing credit approval form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit approval form

How to fill out credit approval form

Who needs credit approval form?

Credit Approval Form - A Comprehensive How-To Guide

Overview of credit approval forms

A credit approval form is a crucial document utilized by financial institutions, lenders, and businesses to assess a borrower’s creditworthiness. Its primary purpose is to collect essential data regarding the applicant's financial history, employment status, and overall ability to repay debts. The importance of these forms cannot be overstated, as they help determine whether an individual or organization qualifies for loans, credit lines, or leasing agreements.

Common scenarios where a credit approval form is required include applying for personal loans, mortgages, rental housing, and business loans. These scenarios often involve significant financial commitments, making it essential for creditors to verify the applicant's ability to meet their obligations.

Understanding the different types of credit approval forms

Credit approval forms can vary significantly based on the type of applicant. Personal credit approval forms are generally used by individuals seeking credit or loans for personal use. These forms often include sections for personal identification, income verification, and credit history.

On the other hand, business credit approval forms cater to companies applying for loans or lines of credit. Such forms may ask for extensive business financials, including revenue statements, tax returns, and business plans. Understanding these types allows applicants to prepare appropriately and enhances their chances of approval.

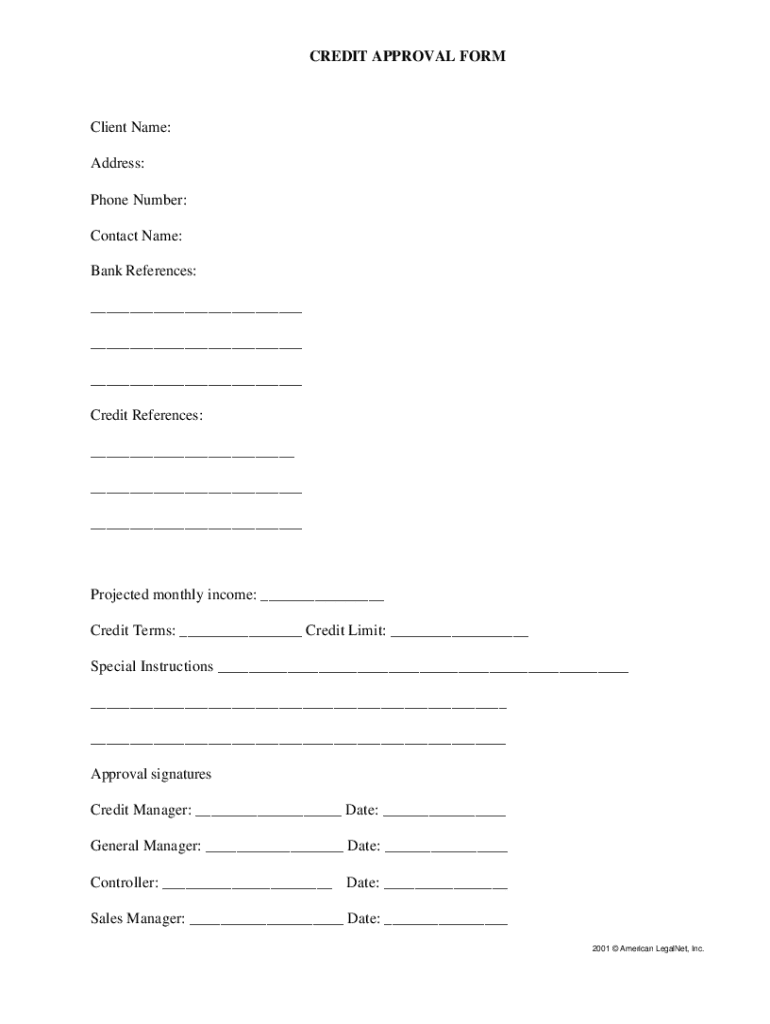

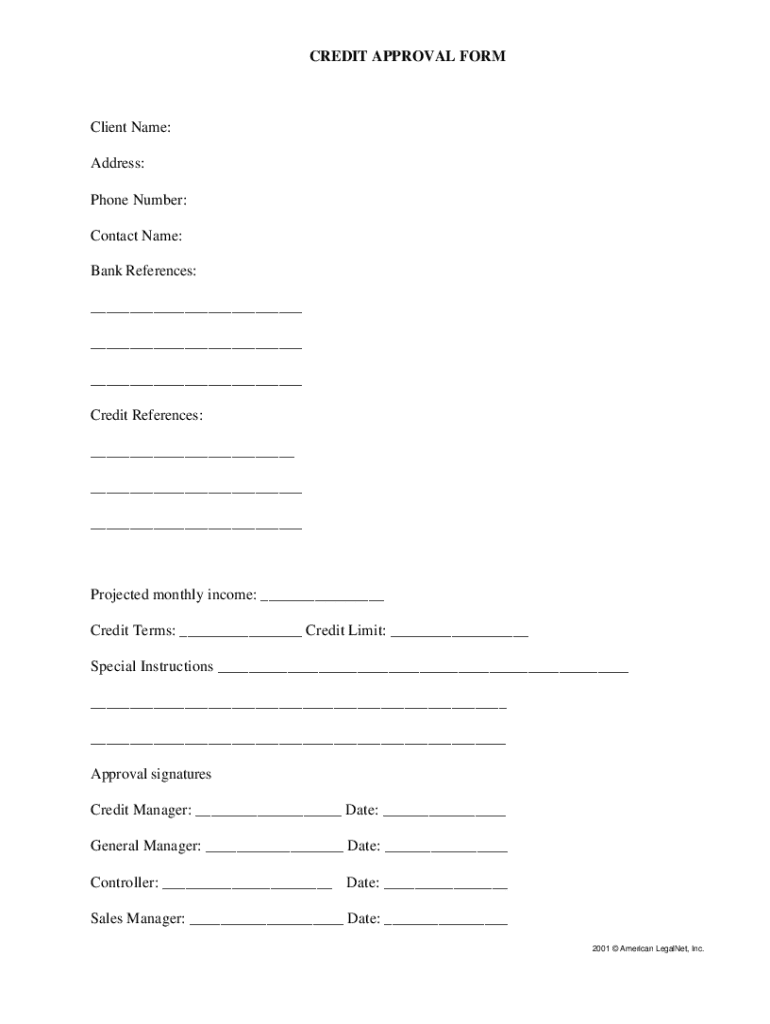

Key components of a credit approval form

Understanding the essential components of a credit approval form is key to successful completion. Primarily, these forms require personal identification details, including name, address, Social Security number, and date of birth. Additionally, providing accurate financial information such as income, monthly expenses, and liabilities is vital.

Employment details also play a critical role. Applicants must supply information regarding their current job or business, including position, salary, and length of employment. Supporting documents are equally important and often include income proofs such as pay stubs or bank statements, alongside credit history reports that summarize one’s credit behavior. Finally, mandatory signatures and approvals indicate the applicant's consent for credit investigation.

Step-by-step guide to completing a credit approval form

Completing a credit approval form can be straightforward with the right approach. Start by gathering necessary information, including your financial documents such as tax returns, bank statements, and recent pay stubs. This upfront organization saves time and ensures accuracy during the application process.

Once you have all your materials, fill out the form carefully. Each section is typically divided into distinct categories — personal information, financial data, and employment details — so be thorough. Avoid common mistakes like providing outdated information or skipping crucial sections, as these can lead to unnecessary delays.

After completing the form, it’s essential to review it meticulously. Create a checklist to verify that all information is correct and that all required documents are attached. Finally, submit the form through your lender's preferred method, whether online or offline. Keep track of your submission to follow up if necessary.

Editing and managing your credit approval form with pdfFiller

pdfFiller offers users powerful editing tools to manage credit approval forms efficiently. If you need to correct or update any information in your application, simply use the platform's editing features, allowing you to add, remove, or modify data with ease.

Moreover, collaborating with others has never been easier. You can share your form with family members or colleagues for input or review directly through the platform. Ensuring document security is paramount, so pdfFiller employs encryption and privacy features that protect your sensitive information throughout the editing and sharing process.

Signing your credit approval form

In today's digital landscape, electronic signatures have gained wide acceptance. When completing your credit approval form via pdfFiller, you have the option to eSign directly within the platform. This feature not only streamlines the process but also provides a legally valid means of signing documents.

The step-by-step process for eSigning is user-friendly. After filling out your credit approval form, simply click the eSign button, follow the prompts, and follow the simple process. This electronic method significantly reduces delays associated with mailing paper forms, thus speeding up the approval process.

FAQs about credit approval forms

Many applicants have questions related to credit approval forms. For instance, if your application is denied, it's crucial to understand the next steps. Frequently, lenders provide the reasons for denial, allowing you to rectify any issues before reapplying.

Another common question concerns the timeline for approval. The approval process duration can vary, generally ranging from a few hours to several days, depending on the lender. Additionally, if adjustments are necessary post-submission, many lenders allow applicants to update their forms, although this may extend the processing time.

Real-world applications and case studies

Successful credit approval scenarios are abundant, showcasing the significance of completing credit approval forms accurately. For instance, a small business owner who meticulously filled out their credit approval form with accurate financial details and supporting documents was able to secure a significant loan that facilitated business expansion. This success story demonstrates the impact of careful preparation when applying for credit.

Similarly, individuals often find that a well-completed credit approval form can lead to favorable rental agreements or mortgage approvals. These case studies underline the correlation between thorough documentation and increased chances of success in credit applications.

Troubleshooting common issues

It's not uncommon for applicants to encounter challenges with their credit approval forms. Common issues may include filling out forms incorrectly, missing documentation, or lack of sufficient income verification. When faced with rejections, it's essential to determine the cause and make necessary adjustments.

For those needing help, most lenders offer customer support services. Reaching out for assistance can provide clarity on why your application may have been rejected and how to navigate the resubmission process effectively.

Best practices for credit approval form management

Managing your credit approval form efficiently involves a few best practices. Regularly updating your information is critical, especially when significant changes occur in your employment or financial situation. Keeping all relevant documents organized can streamline future application processes, allowing you to respond swiftly when needed.

Additionally, staying informed about changes in credit approval policies from lenders ensures you remain compliant and aware of any new requirements that may arise. An organized approach significantly boosts your chances of success when seeking credit.

Final thoughts on credit approval forms

Credit approval forms play a pivotal role in financial transactions, facilitating safe lending practices. The continuous evolution of technology, especially through platforms like pdfFiller, simplifies the management of these documents. Embracing digital solutions not only enhances the user experience but also promotes proactive management of credit forms, enabling smoother transitions through the approval process.

By using pdfFiller, individuals and businesses can navigate through the complexities of credit approval forms with confidence, making accurate submissions that improve their chances of obtaining credit.

Connect with us

For additional support regarding credit approval forms or to share your success stories, reach out to us. Our community thrives on shared experiences and learning from one another. Engage with us today to enhance your document management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit approval form?

Can I create an electronic signature for signing my credit approval form in Gmail?

How do I complete credit approval form on an Android device?

What is credit approval form?

Who is required to file credit approval form?

How to fill out credit approval form?

What is the purpose of credit approval form?

What information must be reported on credit approval form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.