Get the free Certificate of Filing

Get, Create, Make and Sign certificate of filing

Editing certificate of filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of filing

How to fill out certificate of filing

Who needs certificate of filing?

A comprehensive guide to the Certificate of Filing Form

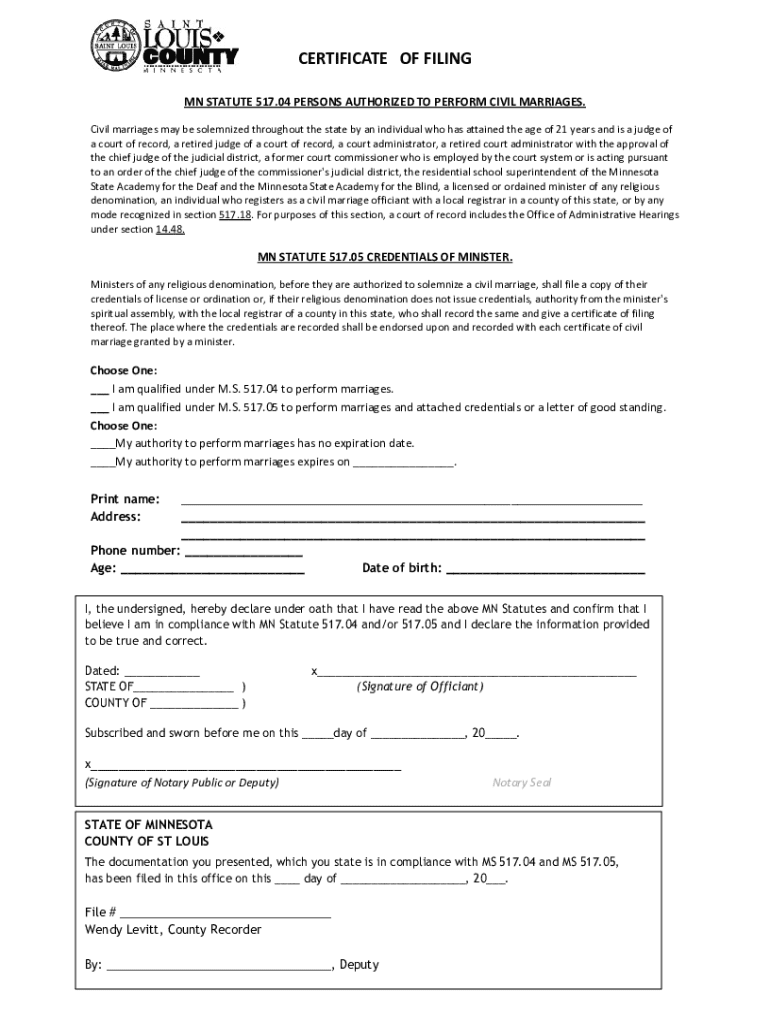

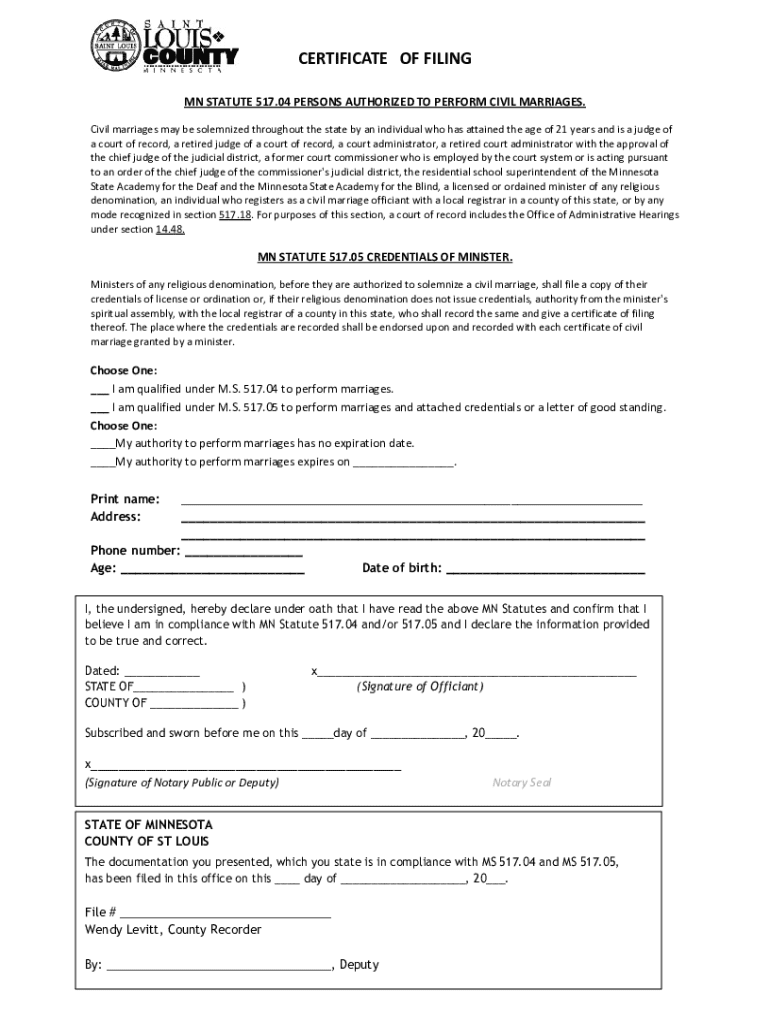

Overview of the Certificate of Filing Form

The Certificate of Filing is a critical document in business operations, officially recognizing the registration of a business entity with the state. This document signifies that a business has complied with the necessary legal requirements for incorporation or registration, often required for both new and existing business entities.

The importance of the Certificate of Filing cannot be overstated. It serves as proof of a business’s legal existence and standing, making it essential for operations, financing, and entering into contracts. Without this document, a business may encounter obstacles in securing loans, obtaining permits, or even opening a business bank account.

Common uses of the Certificate of Filing include applying for business licenses, establishing a business's credibility with partners and suppliers, and fulfilling compliance with local and federal regulations.

Understanding the filing process

Understanding the filing process is essential to successfully obtain your Certificate of Filing. This process can vary based on the method you choose. There are primarily two types of filing: online and traditional mail.

Types of filing

1. Online Filing: Many states allow businesses to file their Certificate of Filing through an online portal. This method offers numerous advantages, including speed and convenience.

To file online using pdfFiller, follow these steps: navigate to the required form on the pdfFiller website, enter your information, use the editing features to customize your document, and then submit electronically.

2. Filing by Mail or In Person: Alternatively, you may choose to file your Certificate of Filing by mail or in person. This method requires you to complete the form manually and send it to the appropriate state office.

Filing deadlines

Filing deadlines are crucial for compliance. Each state has specific deadlines, and failing to adhere to these can result in penalties. Therefore, key dates should be documented. Ensure that you regularly check your state's filing schedule to avoid any complications.

Penalties for late filing may include additional fees, and in severe cases, it may jeopardize your business's status. Timely submission is key to maintaining good standing.

Preparing your Certificate of Filing Form

Effective preparation involves gathering all the necessary information to accurately complete your Certificate of Filing Form. This step is foundational in ensuring that your filing is smooth and trouble-free.

Gathering necessary information

Essential information you will require includes the business name, the principal address, the type of business entity, and the names of the authorized signatories. Collecting supporting documents such as identification and any relevant licenses will also expedite the process.

Utilizing pdfFiller for preparation

Using pdfFiller can significantly enhance your preparation process. The platform offers interactive tools designed to assist in filling out the form accurately. Tips for using pdfFiller include leveraging its editing features to clarify any sections and using the signature tool for a quick and secure signing process.

The benefits of editing and signing documents digitally can't be overstated. Not only does it save time, but it also reduces the risk of errors that can occur with traditional pen-and-paper methods.

Step-by-step instructions for completing the Certificate of Filing Form

Filling out the Certificate of Filing Form correctly is critical to ensuring a successful filing. A section-by-section breakdown will guide you through this process.

Section-by-section breakdown

Common mistakes to avoid

When filling out the Certificate of Filing Form, some common errors include mismatched names with official documents, missing signature fields, or incorrect entity types. Ensure accuracy by double-checking information before submission.

To avoid these mistakes, consider using pdfFiller’s validation features, ensuring all necessary fields are complete and correctly filled.

Fees and payment information

Understanding the costs associated with filing your Certificate of Filing Form is vital for budgeting purposes. Each state has its fee structure, typically consisting of a base filing fee as well as potential additional fees for expedited processing.

Understanding the costs

Payment methods

Acceptable payment options during filing vary by state, but commonly include credit cards, electronic checks, or bank transfers. Be sure to verify the payment methods accepted to avoid submission delays.

After filing: what to expect

After submitting your Certificate of Filing Form, it’s essential to know what to expect in terms of processing times and next steps. The processing time can vary significantly from state to state.

Processing time

Typical turnaround times for processing can range from a few days to several weeks. Factors that may affect processing time include the volume of submissions, the complexity of filings, and any errors in the submitted forms that may require additional communication.

If your application is rejected

If your Certificate of Filing application is rejected, common reasons include incomplete or inaccurate information. To rectify issues, promptly follow the instructions provided in the rejection notice and ensure all corrections are made before resubmitting.

Additional information and resources

Navigating the intricacies of business filings can be challenging. Additional resources can help clarify the requirements related to the Certificate of Incorporation for domestic business corporations, which may also need to be filed in conjunction.

Updates from the Division of Corporations

Staying informed about updates from the Division of Corporations is key for compliance. Regular visits to your state's website or signing up for updates can help ensure you’re aware of any new filing requirements or changes.

Contacting the state office

If questions arise during the filing process, contacting the state office directly can provide clarity. Methods to reach out include phone consultations, email inquiries, and in-person visits to local offices.

Utilizing pdfFiller for all your filing needs

pdfFiller is an indispensable tool for users needing a comprehensive platform for document management. Its features cater to various needs, making the document creation process seamless.

Overview of pdfFiller’s features

Benefits of using pdfFiller

The advantages of using pdfFiller include the convenience of accessing your documents from anywhere, allowing for flexibility in your workflow. Seamless e-signatures and document editing capabilities empower users to handle filings and paperwork without hassle.

Related links

For those looking for a more streamlined experience, directories offorms related to business filings can guide you through the related processes. Utilize state-specific requirements and regulations to ensure you are following the correct legal framework.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify certificate of filing without leaving Google Drive?

How do I execute certificate of filing online?

Can I create an eSignature for the certificate of filing in Gmail?

What is certificate of filing?

Who is required to file certificate of filing?

How to fill out certificate of filing?

What is the purpose of certificate of filing?

What information must be reported on certificate of filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.