Get the free Ct-644

Get, Create, Make and Sign ct-644

How to edit ct-644 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-644

How to fill out ct-644

Who needs ct-644?

CT-644 Form: A Comprehensive How-To Guide

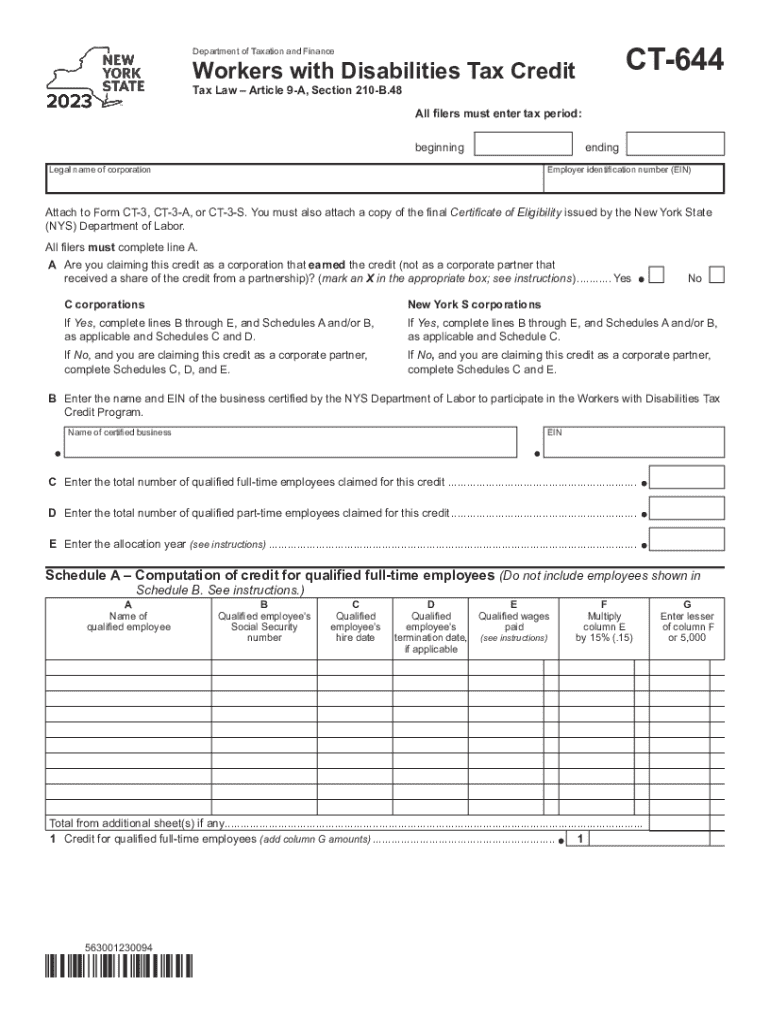

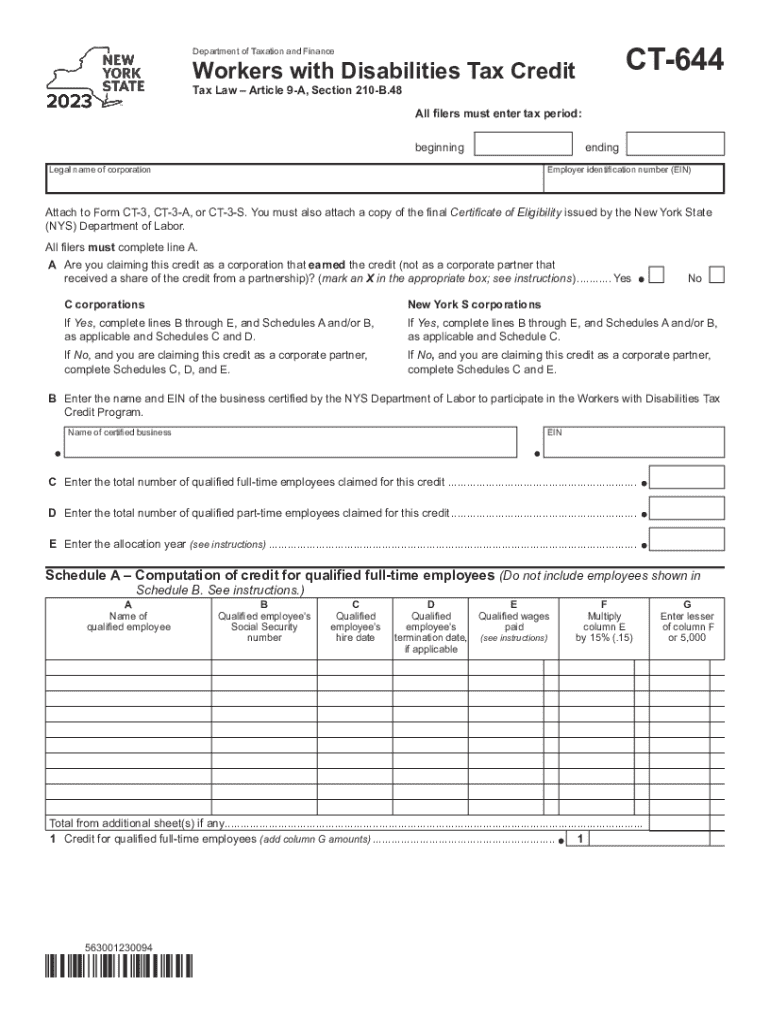

Understanding the CT-644 Form

The CT-644 form is a critical document primarily used for financial reporting and compliance purposes, typically required by state tax authorities in Connecticut. It serves as a means to provide necessary disclosures regarding the financial state of a business entity, fostering transparency and accountability.

Filling out the CT-644 form accurately is paramount, as it aids institutions in meeting regulatory requirements and can significantly influence the financial standing and operational reputation of a business. Understanding its purposes is essential to navigating the complexities of financial management.

Preparing to fill the CT-644 form

Before diving into the CT-644 form, proper preparation is crucial. You'll need several important pieces of information and documentation to ensure the accuracy and completeness of your submission. Your personal identification, alongside your contact details, should be readily available.

Moreover, gather financial records that illustrate your business's financial performance, including income statements and balance sheets. Having these documents at your fingertips will streamline the filling process.

In addition, be vigilant about common mistakes that could derail your submission. Omitting required fields or entering inaccurate data are pitfalls you should avoid. A thorough review of the entire form prior to submission can save significant time and prevent possible penalties.

Step-by-step instructions for completing the CT-644 form

Completing the CT-644 form doesn't require a degree in accounting, but it does demand attention to detail. The form can generally be divided into three sections: the General Information section, the Financial Data section, and the Documentation & Signatures section.

Section-by-Section Breakdown

In the General Information section, you’ll provide your company name, address, and identification numbers. This information sets the stage for your filing and ensures that the correct authorities can associate the data with the right entity.

Next, the Financial Data section demands precise entries. You'll be summarizing your financial performance, and accuracy is vital here to avoid potential audits. Finally, in the Documentation & Signatures section, signing off confirms that the information provided is true and accurate.

Adhere to the following tips for each section:

Editing the CT-644 form with pdfFiller

Accessing and editing the CT-644 form through pdfFiller enhances your experience significantly. You can navigate the site easily and find the CT-644 form within their extensive library of templates.

Once located, you'll find interactive editing tools that allow you to add, delete, or modify fields seamlessly. This feature is pivotal for individuals or teams collaborating on the document.

Utilizing Interactive Editing Tools

Incorporating digital signatures is another feature offered by pdfFiller. It streamlines the finalization process, ensuring your document can be signed electronically. Collaboration is simplified as well. Team members can share the document and assign review tasks, with options for commenting and suggesting changes in real-time, facilitating constructive feedback.

Signing the CT-644 form electronically

Digital signatures are not only legally binding but also highly accepted across various institutions. Utilizing an e-signature on the CT-644 form ensures compliance with modern document management practices.

To eSign the CT-644 form using pdfFiller, simply follow the easy steps provided within the platform. The process is user-friendly, allowing you to add your signature with just a few clicks. If preferred, alternative signature methods are also available, catering to various user needs.

Managing your CT-644 form

After completing the CT-644 form, managing it effectively ensures you retain its clarity and accessibility for future reference. One primary aspect to consider is saving and exporting options. pdfFiller allows you to download your document in multiple formats, such as PDF and DOCX, catering to any documentation standards required by your organization.

Additionally, storing your documents in the cloud brings numerous benefits, from enhanced security to access from multiple devices. Keeping track of different versions is straightforward with pdfFiller's version control features, making it easy to revert to previous versions if necessary.

Security is a pivotal concern when handling sensitive information. pdfFiller employs robust data encryption and various privacy settings, ensuring your documents remain confidential and secure during the entire management process.

Common queries and troubleshooting

Navigating the world of form submission often raises several queries. Commonly, users ask what to do if they make a mistake on the CT-644 form. The best course of action is to review and correct the error promptly before the form is officially submitted.

Moreover, understanding how to submit the completed form is vital. Typically, forms can be submitted electronically or via mail, depending on the requirements specified by the state.

For troubleshooting common issues, familiarize yourself with potential technical difficulties on the pdfFiller platform. If you encounter persistent problems, reaching out to support can assist in resolving your queries efficiently.

Best practices for future form submissions

To ensure efficient form management in the future, consider implementing organizational strategies. Keeping your files and documents neatly arranged can significantly reduce stress when submitting forms like the CT-644.

Setting reminders for deadlines relevant to the CT-644 form or any other important submissions is another best practice. Not only does this keep you organized, but it also helps you stay compliant with regulatory expectations.

Additionally, exploring other forms available on the pdfFiller platform can broaden your document capabilities. Customizing templates for team use fosters consistency and efficiency, especially when dealing with recurring forms and submissions.

Conclusion remarks on the CT-644 form process

Understanding and completing the CT-644 form with accuracy is a vital skill for professionals managing financial reporting and compliance. Remember to utilize the features of pdfFiller to enhance your workflow, especially regarding editing, collaborating, and securely managing your documents.

The insights provided in this guide aim to empower you with the knowledge and tools to navigate the CT-644 form process seamlessly, ensuring that your submissions are not only compliant but also thorough and accurate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ct-644 directly from Gmail?

How do I make changes in ct-644?

How do I edit ct-644 straight from my smartphone?

What is ct-644?

Who is required to file ct-644?

How to fill out ct-644?

What is the purpose of ct-644?

What information must be reported on ct-644?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.