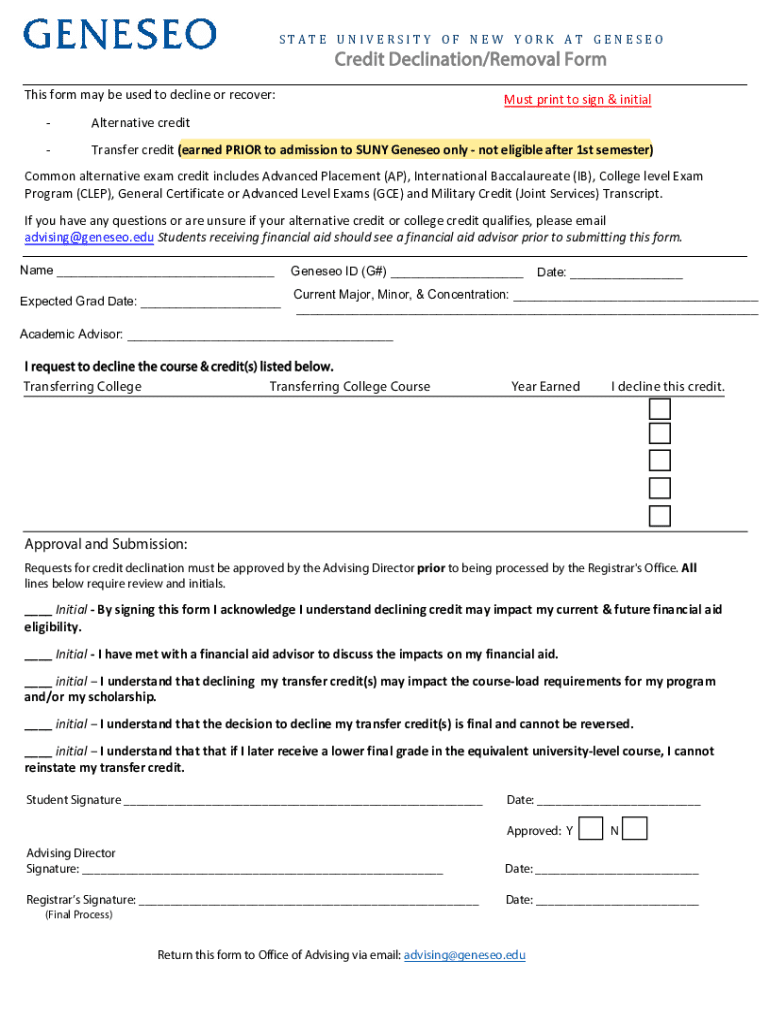

Get the free Credit Declination/removal Form

Get, Create, Make and Sign credit declinationremoval form

How to edit credit declinationremoval form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit declinationremoval form

How to fill out credit declinationremoval form

Who needs credit declinationremoval form?

Comprehensive Guide to the Credit Declination Removal Form

Understanding credit declination

Credit declination occurs when a lender refuses a request for credit. This refusal can stem from various factors that raise red flags about a borrower’s financial reliability. Understanding the nuances of credit declination is crucial for anyone seeking to improve their financial health.

Common reasons for credit declination include insufficient credit history, a high debt-to-income ratio, and errors in credit reports. Individuals with limited borrowing experience may find themselves unapproved due to a lack of credit scores, while those with high levels of existing debt may exceed acceptable ratios. Additionally, inaccuracies within a credit report can lead to unwarranted declines.

The impact of credit declination on financial health can be severe, limiting access to loans and favorable interest rates and possibly affecting future credit applications. A persistent decline can tarnish an individual’s financial reputation, making it crucial to address these issues head-on.

Importance of the credit declination removal form

The credit declination removal form serves as a formal request to have a denial reviewed or reconsidered. This documentation is essential for individuals who believe their application was unjustly declined due to incorrect information or a lack of understanding from the lender's side.

You should use the credit declination removal form when you receive a denial notification and believe that rectifying the issues leading to the decline can result in a different outcome. By formally contesting a decimation, you can significantly enhance your chances of securing credit.

Preparing to fill out the credit declination removal form

To effectively fill out the credit declination removal form, it is essential to gather your necessary information, including personal identification and relevant financial details. Having these readily available will streamline the process and enhance your submission's accuracy.

Moreover, understanding your rights under the Fair Credit Reporting Act (FCRA) is vital. This federal law empowers consumers to dispute inaccuracies and seek corrections, ensuring transparency in credit reporting. You must leverage these rights to advocate for your financial interests.

Step-by-step guide to completing the credit declination removal form

Completing the credit declination removal form can be broken down into manageable steps to ensure accuracy and completeness.

Submitting your credit declination removal form

Once your form is ready, submission can take place in various ways. The recommended method is to submit electronically through pdfFiller, which ensures a quicker processing time.

Alternatively, you can mail or fax the completed manuscript. If choosing these methods, ensure that you confirm the recipient's information to prevent your documents from getting lost.

Tracking submission status is equally important. Ensure you have a confirmation receipt if submitting via mail or fax to verify that your form was received.

What to expect after submitting your form

After submitting your credit declination removal form, it typically takes a few weeks for processing. Be prepared for any inquiries or requests for additional documentation from the credit provider.

The possible outcomes include approval of your request, resulting in a reevaluation of your credit application, or denial, wherein you may be provided with reasons justifying the decision. Should your request be denied, it is advisable to reassess your situation and consider alternative means to improve your credit standing.

Tools and resources on pdfFiller for managing your documents

pdfFiller offers a suite of interactive features to assist users in completing their forms and managing their documents effectively. You can customize templates specifically for the credit declination removal form, making it user-friendly.

Collaboration tools allow for team reviews, ensuring more than one person can contribute to the documentation process. Additionally, pdfFiller’s eSigning capabilities facilitate a smooth signing process without needing to print, scan, or physically send documents.

FAQs related to the credit declination removal process

When dealing with the credit declination removal process, individuals often have pressing questions. It's crucial to be informed about the timeline and processes that follow your application.

User testimonials and success stories

Many users have successfully navigated the credit declination removal process utilizing pdfFiller. Real-life examples highlight how individuals transformed their credit situations by effectively communicating their cases.

Numerous testimonials illustrate the empowerment felt by users who found a streamlined process for document management. The experience of leveraging tools such as collaborative editing and secure storage bolsters users' chances of achieving credit improvement.

Maintaining a healthy credit profile post-removal

Once your credit declination removal request is processed, it’s crucial to maintain a healthy credit profile moving forward. Regular monitoring of your credit score through available services can prevent future declines.

Additionally, implementing best practices for building your credit, such as timely bill payments, reducing existing debts, and avoiding unnecessary credit inquiries, is essential. If you find yourself struggling, resources for financial counseling can provide valuable guidance to help navigate your financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit declinationremoval form without leaving Google Drive?

How do I complete credit declinationremoval form online?

How do I make edits in credit declinationremoval form without leaving Chrome?

What is credit declination removal form?

Who is required to file credit declination removal form?

How to fill out credit declination removal form?

What is the purpose of credit declination removal form?

What information must be reported on credit declination removal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.