Get the free Critical Illness Rider Claim Form

Get, Create, Make and Sign critical illness rider claim

Editing critical illness rider claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness rider claim

How to fill out critical illness rider claim

Who needs critical illness rider claim?

Understanding the Critical Illness Rider Claim Form: A Comprehensive Guide

Understanding the critical illness rider

A critical illness rider is an add-on to a life insurance policy that provides additional benefits when the policyholder is diagnosed with a critical illness. This rider typically pays a lump sum benefit upon the diagnosis of covered illnesses, which can aid in covering medical expenses and ensuring financial stability during challenging times.

The importance of critical illness coverage cannot be overstated; it provides peace of mind and financial support. In the face of serious health challenges, this can be a lifeline for families. Many policies cover illnesses like cancer, heart attack, stroke, renal failure, and even major organ transplants.

Purpose of the critical illness rider claim form

Submitting a claim using the critical illness rider claim form is essential for policyholders seeking to access the benefits of their insurance policy. Without a properly filled claim form, benefits may be delayed or denied. The form acts as a formal request to the insurer to begin the claims process.

Filing a claim allows the policyholder to recover costs associated with their illness. Benefits of filing include receiving a lump sum that can cover medical bills, living expenses, and any additional costs incurred during treatment. It's a crucial step to guide individuals and families back to financial stability during distress.

During the claims process, expect to have discussions with your insurer regarding the details of your diagnosis and treatment. Having complete documentation will expedite this process, ensuring that you receive the support you need swiftly.

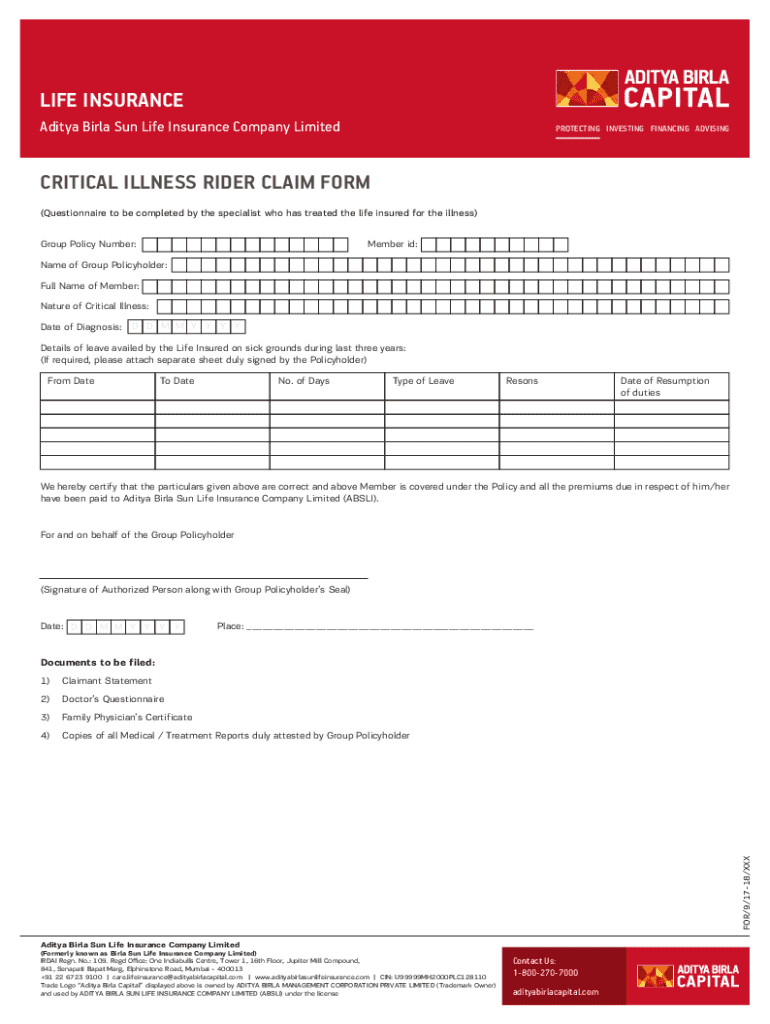

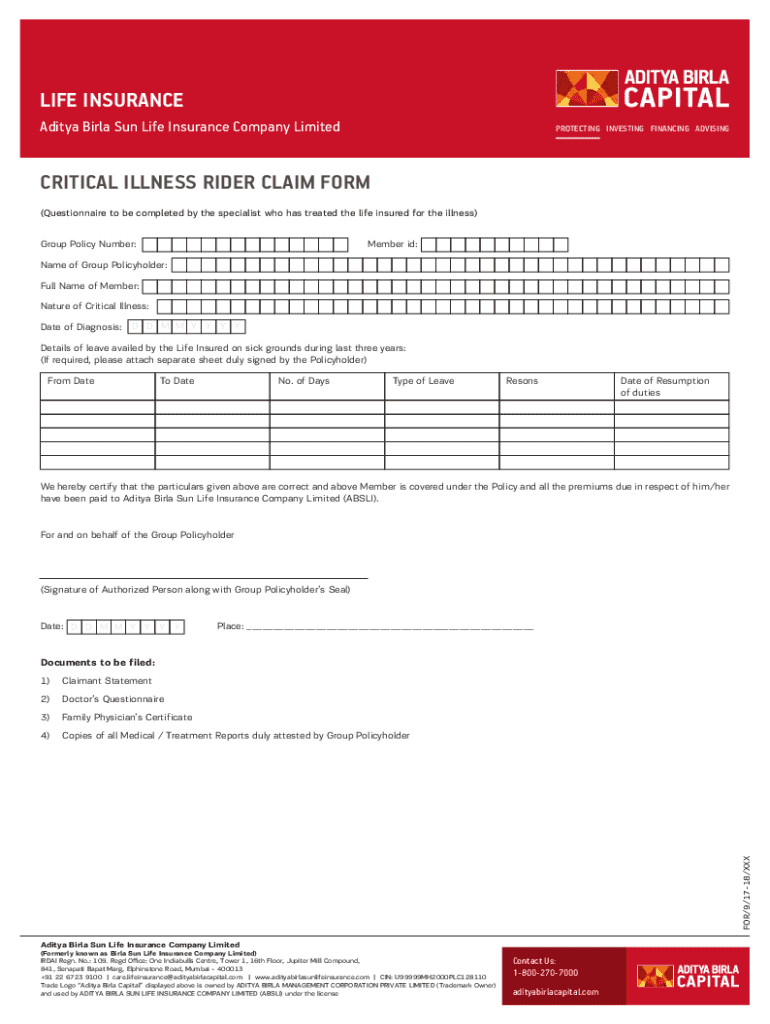

Preparing to fill out the claim form

Before completing the critical illness rider claim form, gather essential documents to ensure a smooth process. Commonly required documents include your policy number and details, which verify your coverage, as well as medical records that detail your diagnosis and treatment. Proof of treatment, including invoices and bills, and identification documents may also be necessary.

Essential documents required

In addition to documents, gather key information before starting the form. Make note of the patient’s details, the claimant’s relationship to the patient, as well as the dates of diagnosis and treatment. Documenting healthcare provider’s information will also streamline the process.

Step-by-step guide to completing the claim form

Filling out the critical illness rider claim form can seem daunting. However, breaking it down into sections makes the process manageable. Here are the key sections of the form you will need to complete:

Section 1: Policy information

In this section, you will enter your policy number and describe the type of coverage you have. Be precise; any inconsistencies could lead to unnecessary delays.

Section 2: Patient details

Here, you provide the personal details of the patient. Ensure the information is accurate and clarify the relationship you have with the patient—this is critical for the claims evaluation.

Section 3: Illness and treatment information

In this section, detail the critical illness diagnosed, being as specific as possible. Additionally, document the treatment plan undertaken—this step is crucial as it directly affects the approval of your claim.

Section 4: Signatures and declarations

Lastly, review the declaration carefully before submitting. Accurate signatures are essential, as incorrect or missing signatures may delay your claim. Double-check all information provided for consistency.

Common mistakes to avoid

Submitting the critical illness rider claim form can be straightforward if you avoid common pitfalls. One major mistake is providing incomplete information, which might result in delays or denials. Make sure every section is filled out thoroughly.

Another common issue is missing supporting documentation, which is critical for the processing of your claim. Ensure all required documents accompany your application. Additionally, providing incorrect or inconsistent details can jeopardize your claim. Finally, always follow specific instructions for submission provided by your insurer.

Interactive tools and features to assist with your claim

Using tools like pdfFiller can significantly enhance your claims process. Through its seamless document editing features, you can fill out the critical illness rider claim form digitally, making adjustments quickly and easily.

Another significant feature is the eSignature functionality, which allows you to sign documents electronically, saving time and ensuring compliance. Collaboration options are also available, which is beneficial for teams managing claims together. Lastly, utilizing cloud-based document storage enables secure management of your files from anywhere.

Frequently asked questions

Many policyholders have questions about the claims process for the critical illness rider claim form. One common query is: 'How long does the claims process take?' Generally, the timeline can vary based on the insurer and the complexity of the case. Staying in communication with your insurer can provide clarity on the anticipated timeline.

Another frequently asked question is, 'What happens if my claim is denied?' In such cases, you can discuss the reasons for denial with your insurer. Often, missing documentation or unclear information is the issue. If a claim is denied, policyholders can appeal the decision; inquire about the appeal process directly through your insurer.

Lastly, many individuals wonder, 'What should I do if I need assistance?' Your insurer’s customer support team is equipped to help you through the entire process, from filling out forms to understanding your policy coverage better.

Additional tips for a smooth claims experience

Organizing your records is key to a successful claims experience. It’s advisable to keep all documents related to your insurance policy, treatment history, and correspondence with your insurer in one accessible location. This organization will prove invaluable when submitting your claim.

Staying in communication with your insurer is equally important. Regularly follow up on your claim status to ensure everything is progressing as expected. If any issues arise, being proactive can help resolve them before they turn into bigger problems.

Finally, remind yourself to carefully read all instructions related to the claims process. Understanding every requirement and guideline will make the entire experience much smoother and help alleviate any potential confusion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit critical illness rider claim from Google Drive?

How can I get critical illness rider claim?

How do I edit critical illness rider claim straight from my smartphone?

What is critical illness rider claim?

Who is required to file critical illness rider claim?

How to fill out critical illness rider claim?

What is the purpose of critical illness rider claim?

What information must be reported on critical illness rider claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.