Get the free Court Knocks Down IRS's Claims as Creditor in Bankruptcy ...

Get, Create, Make and Sign court knocks down irss

Editing court knocks down irss online

Uncompromising security for your PDF editing and eSignature needs

How to fill out court knocks down irss

How to fill out court knocks down irss

Who needs court knocks down irss?

Court knocks down IRS form: What you need to know

Overview of recent court decision regarding IRS form

A federal court recently ruled against a particular IRS form, stating that its implementation and requirements were not consistent with legal standards. This decision has raised questions among taxpayers and the IRS, suggesting potential changes in how tax forms are designed and enforced. The form in question, once deemed critical for tax compliance, has now become a focal point for discussion regarding the IRS's approach to taxation and regulation.

Understanding IRS forms: An inside look

IRS forms serve pivotal roles in the landscape of tax compliance, ranging from individual income tax returns to business-related forms. Each form caters to specific taxpayer needs and circumstances. For instance, Form 1040 allows individuals to file their annual income tax returns, while forms such as 941 and 940 are crucial for business payroll tax reporting.

Accurate submission of these forms is paramount for compliance and ensuring that taxpayers do not face legal penalties or other repercussions. Errors can lead to audits, fines, or even criminal charges in extreme cases, underscoring the importance of understanding each form's requirements.

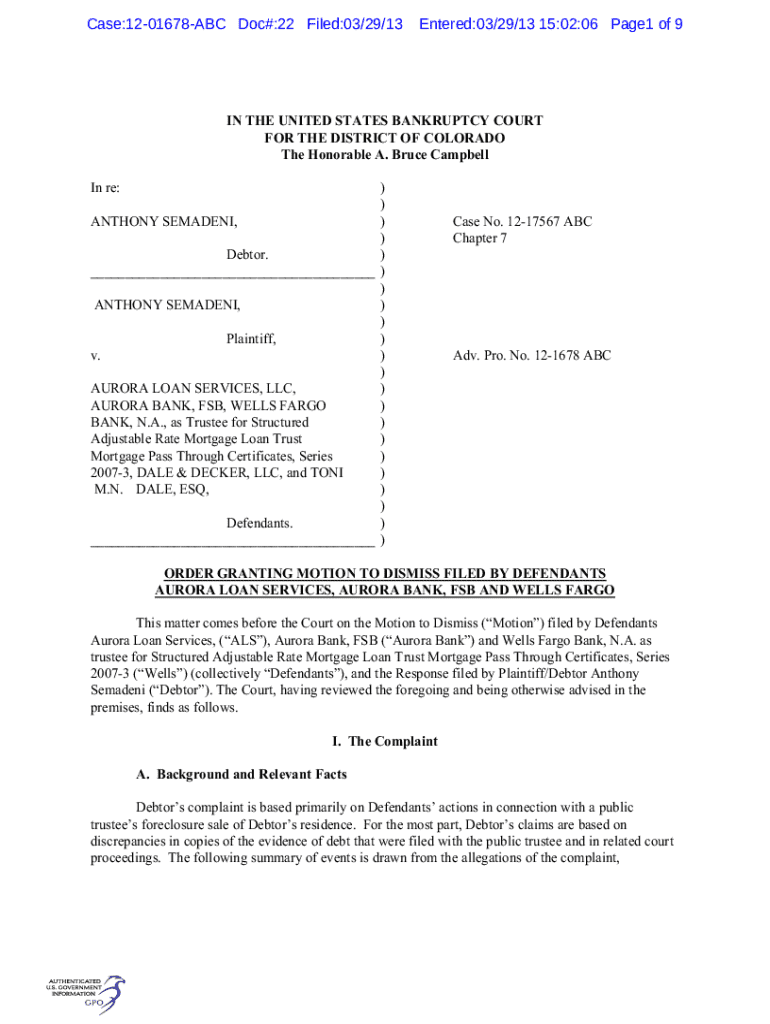

Case background: Schafer and Weiner PLLC et al. . United States

The case Schafer and Weiner PLLC et al. v. United States revolved around the dispute regarding the validity and enforcement of an IRS form. Schafer and Weiner, a law firm specializing in tax matters, contested the legality of the form, arguing that it created unnecessary complexities and inaccuracies in tax compliance.

Key arguments from the plaintiffs highlighted the form's vague language and a lack of clarity, which they believed infringed upon taxpayers' rights. Conversely, the IRS defended its form as essential for collecting accurate tax data. The judge's ruling favored the plaintiffs, leading to the conclusion that the form was unenforceable as it stood.

Implications of the ruling: Effects on taxpayers

This court ruling holds significant ramifications for various taxpayers, including individuals, businesses, and tax professionals. Individuals might no longer be subject to penalties tied to the contested form, while businesses may find relief from the cumbersome reporting requirements associated with it.

Tax professionals, on the other hand, must stay vigilant and adapt their practices in anticipation of potential changes to IRS procedures in response to this ruling. The decision may lead the IRS to reassess this form and similar documentation, aiming for greater clarity and compliance facilitation in future tax policies.

The IRS response: Next steps and guidance

In light of this court decision, the IRS has begun to outline its response strategy. They are evaluating the implications of the ruling and considering necessary adjustments to the forms and procedures currently in use. The IRS is expected to share guidance for taxpayers who previously completed the now-challenged form, ensuring they understand their rights and any subsequent actions they may need to take.

Additionally, the IRS should start developing clearer guidelines around any replacement forms or processes that may emerge as a result of this ruling. Taxpayers are encouraged to regularly check IRS bulletins and resources for updates on this matter.

How to navigate form changes: A step-by-step guide

Navigating IRS form changes can seem daunting, but with a systematic approach, you can manage them effectively. Here’s a simple guide to assist you:

Future considerations for taxpayers

As IRS processes evolve, it's essential for taxpayers to remain informed about any potential shifts that may affect them. Staying updated can prevent compliance issues and allow for proper planning with respect to tax obligations.

To mitigate risks associated with form submissions, consider establishing a routine for document management. Organizing financial records, using digital tools for storage, and setting reminders for updates can enhance your compliance efforts significantly.

Leveraging technology for document management and compliance

In today's fast-paced world, leveraging technology is essential for effective document management. pdfFiller offers services that streamline document creation, editing, and management—all from a single, cloud-based platform. With features like e-signing and collaborative tools, users can enhance their efficiency and ensure compliance with IRS regulations.

This platform allows users to create secure and compliant documents, access them from anywhere, and work collaboratively without the hassle of traditional paperwork. By adopting such technology, individuals and teams can reduce errors associated with form completion and maintain organized records.

FAQs about IRS forms and legal rulings

As taxpayers grapple with the implications of a recent court decision, several common questions arise regarding IRS forms and their requirements. Understanding the specifics can help alleviate confusion and provide clarity.

Case studies: Real-life impacts of IRS decisions

Historically, court rulings surrounding IRS forms have had lasting effects on both individuals and businesses. For example, a previous case regarding an incorrect penalty related to a different IRS form led to significant changes in how penalties were assessed, ultimately benefiting taxpayers who were wrongly penalized.

In navigating these changes, businesses adapted by adopting new software solutions to ensure compliance with updated forms. Success stories emerged, highlighting how technology—like pdfFiller—helped streamline document management, thereby avoiding unnecessary penalties and complexities in tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit court knocks down irss in Chrome?

Can I create an electronic signature for the court knocks down irss in Chrome?

Can I create an eSignature for the court knocks down irss in Gmail?

What is court knocks down irss?

Who is required to file court knocks down irss?

How to fill out court knocks down irss?

What is the purpose of court knocks down irss?

What information must be reported on court knocks down irss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.