Get the free Credit Card Authorisation - Right to Information. Credit card authorisation form for...

Get, Create, Make and Sign credit card authorisation

How to edit credit card authorisation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorisation

How to fill out credit card authorisation

Who needs credit card authorisation?

Credit Card Authorization Form: Comprehensive How-to Guide

Understanding credit card authorization forms

A credit card authorization form is a document that allows merchants to charge a customer’s credit card for a specified amount, usually for a one-time purchase or services rendered. This form not only captures the customer's consent but also streamlines payment processes, ensuring clarity and security for both parties involved.

The importance of using credit card authorization forms cannot be understated. They help protect businesses from chargeback disputes, which can arise when a customer contests a charge. By having a signed authorization, merchants can demonstrate that they have permission to charge the card, thus mitigating financial losses. Moreover, these forms support legal compliance by ensuring that merchants operate within regulatory frameworks regarding customer data.

Key participants in the authorization process include the merchant, who processes the payment; the cardholder, who permits the charge; and the payment processor, which facilitates the transaction. Each of these parties plays a vital role in the successful execution of credit card transactions.

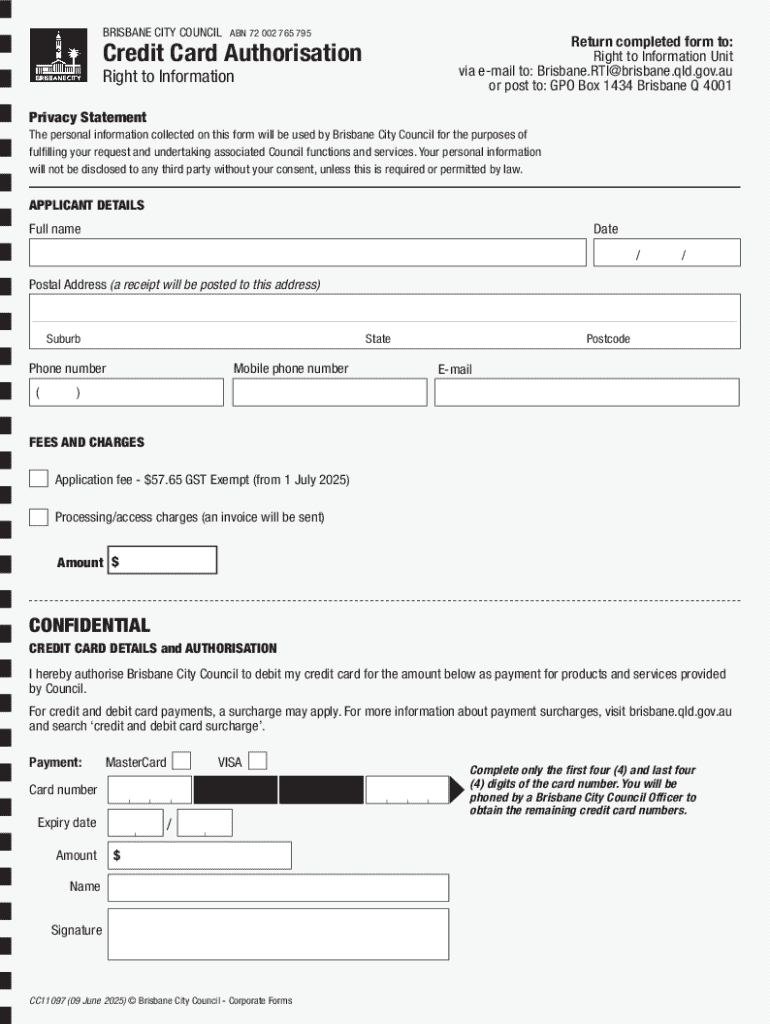

Essential components of a credit card authorization form

When designing a credit card authorization form, several essential components must be included to ensure clarity and completeness. Required information typically involves the cardholder's name, contact details, card number, expiration date, the amount to be charged, and the date of the transaction. Additionally, the merchant’s details, including business name and contact information, should also be part of the form.

Optional sections may enhance the form's functionality. For instance, including a CVV section, which requires the card security code, adds an extra layer of security. If the payment is for a subscription service, a recurring payment agreement clause could also be valuable.

Lastly, legal considerations are crucial; the form must include a section where the cardholder provides consent, ensuring compliance with laws surrounding payment processing and data protection.

Benefits of using a credit card authorization form

Using a credit card authorization form provides significant benefits, particularly in chargeback prevention strategies. By capturing explicit consent from the customer, merchants can defend themselves against unexpected chargebacks, which can severely impact their revenue.

Additionally, these forms enhance the efficiency of payment processes. They standardize the information needed for transactions, reducing confusion during payment and ensuring a smoother experience for the customer. This streamlining also translates to better cash flow for businesses.

From the perspective of customers, these forms improve financial security. Knowing that their payment information is handled appropriately fosters trust in the business and its practices, reinforcing customer loyalty and long-term relationships.

Ultimately, credit card authorization forms play a pivotal role in maintaining trust in transactions. Their proper usage assures customers that their financial information is being treated with the utmost care and respect.

How to create a credit card authorization form

Creating a credit card authorization form requires careful consideration of several factors. Start by identifying your specific needs and purpose. Understand what kind of transactions you will be facilitating and tailor the form accordingly.

Choosing a format is the next step; you can opt for a fillable PDF, an online form, or even a printed version, depending on how you plan to collect payments. Once you select a format, add the necessary fields and questions as discussed in earlier sections, ensuring to incorporate all essential components.

Ensuring compliance with legal standards is crucial, especially regarding data protection regulations. Engaging with resources that provide template compliance can simplify this process.

When deciding between templates and creating a form from scratch, utilize tools like pdfFiller, which offers numerous advantages such as easy customization of PDF templates and ready-made formats that you can adapt to your business needs.

Interactive tools on pdfFiller enable easy customization through simple drag-and-drop features and editing capabilities, making the process of creating and managing credit card authorization forms more accessible and efficient.

Best practices for using and storing credit card authorization forms

Safeguarding signed authorization forms is critical for maintaining the security of sensitive customer data. Whether storing digitally or physically, it’s essential to employ recommended security measures. For digital storage, using encrypted databases and secure access protocols helps protect against unauthorized access.

For physical documents, consider locked files or secure cabinets. Monitoring access to these documents is equally important. This ensures that only authorized personnel can handle sensitive information.

As for retention, businesses should be aware of how long credit card authorization forms must be kept. While this can depend on local laws, it’s generally advisable to keep these forms for a minimum of three to five years. However, after fulfilling legal requirements, be sure to dispose of them securely to prevent data breaches.

Handling customer data responsibly extends beyond physical storage protocols; educate your staff on the importance of data protection and compliance to promote a culture of security within your organization.

Frequently asked questions (FAQ)

One common question is whether businesses are legally obligated to use credit card authorization forms. While not universally mandated, utilizing these forms is strongly recommended to prevent disputes and chargebacks. Having such documentation offers merchants protections that may not be available without it.

Another frequent inquiry concerns why a credit card authorization form might not include a CVV section. This often depends on regional regulations and the decisions of individual merchants, especially when they prioritize specific security measures over others.

Understanding card on file implications is also critical. Storing cardholder data can lead to vulnerabilities if proper encryption and compliance measures are not adhered to, stressing the importance of secure data handling practices.

Related resources and tools

For those looking to streamline their operations further, pdfFiller offers recommended templates for credit card authorization forms that can be adapted for various industries and business models. This can save time and resources while ensuring compliance with necessary regulations.

Additionally, learning how to eSign documents securely can complement the use of credit card authorization forms, enhancing the overall transaction security. Understanding payment processing fees related to authorization forms ensures that you remain informed about potential costs associated with these transactions, allowing for better financial planning.

Moreover, tips for effective conflict resolution in transactions can aid merchants in handling disputes more efficiently, underscoring the importance of maintaining clear communication and proper documentation throughout the payment process.

Connecting with our community

At pdfFiller, we invite you to engage with our community by sharing your experiences with credit card authorization forms. Your insights could be invaluable for other businesses facing similar challenges.

To stay updated with the latest best practices, subscribe to our newsletter for ongoing tips and resources. Additionally, you can engage with us on social media for additional insights and community interaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit card authorisation online?

Can I create an electronic signature for signing my credit card authorisation in Gmail?

How do I fill out the credit card authorisation form on my smartphone?

What is credit card authorisation?

Who is required to file credit card authorisation?

How to fill out credit card authorisation?

What is the purpose of credit card authorisation?

What information must be reported on credit card authorisation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.