Get the free Custom Homeowners Application

Get, Create, Make and Sign custom homeowners application

Editing custom homeowners application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out custom homeowners application

How to fill out custom homeowners application

Who needs custom homeowners application?

Custom Homeowners Application Form: A How-to Guide

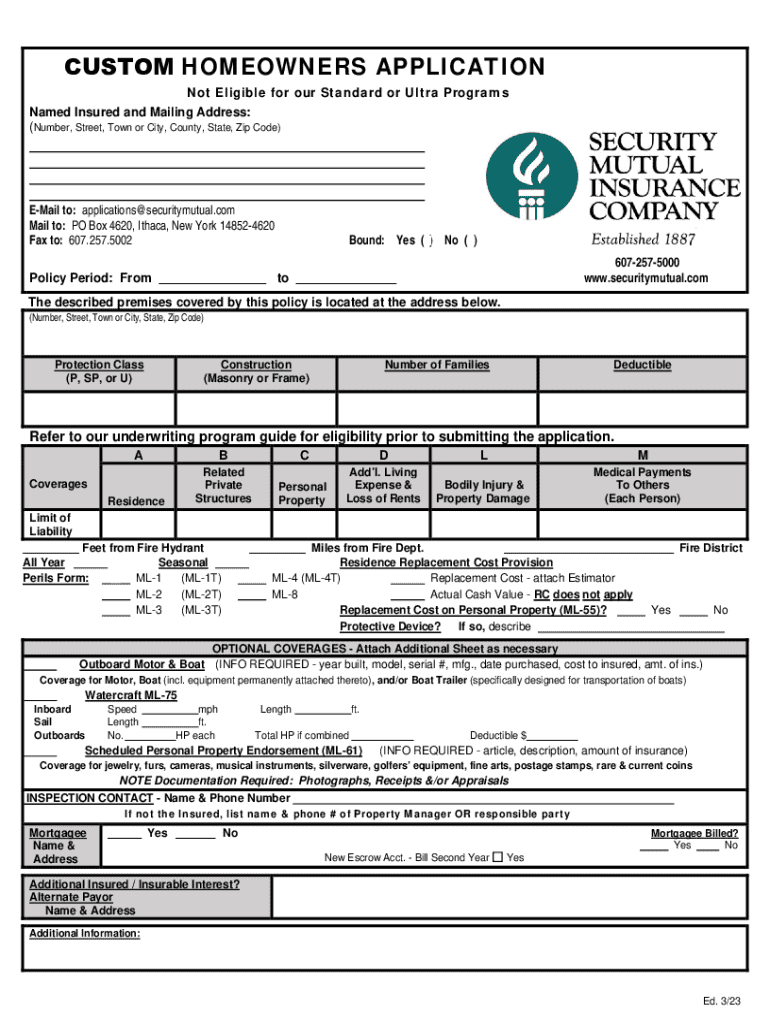

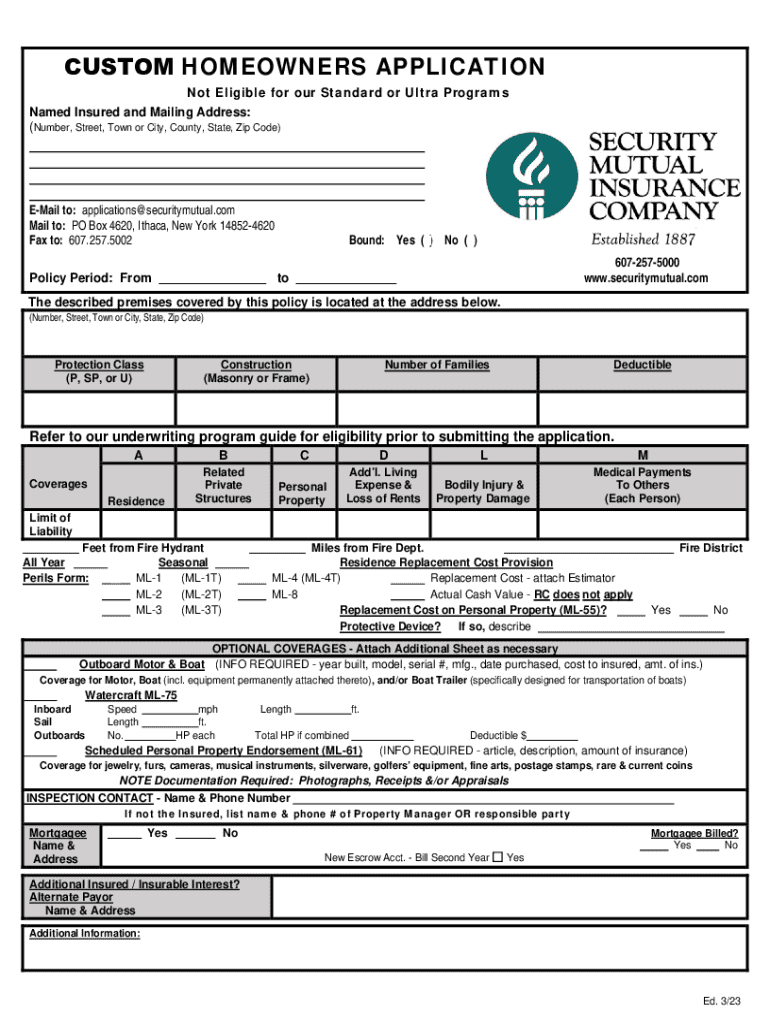

Overview of the custom homeowners application form

The custom homeowners application form plays a crucial role in the homeowners insurance process, serving as the primary document used to gather essential information about the applicant and their property. This form is vital for insurance providers, as it helps them assess risks and determine appropriate coverage options.

Using pdfFiller for managing this application form brings significant benefits. It simplifies document management by allowing users to easily fill out, edit, and eSign forms without the hassle of printing or physical paperwork. Furthermore, pdfFiller enables seamless access for both individuals and teams from anywhere, promoting efficiency and collaboration.

Step-by-step guide to completing the custom homeowners application form

Completing a custom homeowners application form requires careful attention to detail to ensure all necessary information is provided accurately. Here’s a structured approach to filling out this essential document.

Editing the form post-completion

After completing your application form, you might find it necessary to make changes. This is a straightforward process with pdfFiller, which allows users to easily edit their forms at any stage. You can add, remove, or modify information, ensuring every detail is accurate before submission.

Available formatting options in pdfFiller further enhance user experience, enabling proper alignment and presentation of the data entered. This flexibility can make a significant difference, particularly when submitting forms that require professional appearance.

eSigning the application

eSigning is an integral part of the application process. It confirms your acknowledgment of the information provided and your agreement to the terms and conditions specified in the form. PdfFiller simplifies this by offering a clear step-by-step guide for eSigning your document.

After signing, it’s crucial to save the document securely in the cloud. This ensures access whenever needed, whether for follow-ups with your insurance provider or for record-keeping.

Features of pdfFiller that enhance the application process

PdfFiller is rich in features that significantly enhance the experience of completing a custom homeowners application form. One standout component is its collaboration tools, which allow users to share their forms with team members for input or feedback effectively.

Common pitfalls and how to avoid them

Completing a custom homeowners application form can come with several common pitfalls. One major mistake involves providing incorrect or incomplete property values and coverage limits, which could lead to underinsurance or denial of claims. Ensure all values reported are aligned with your property’s actual worth.

Examples of customized homeowners application forms

Custom homeowners application forms can vary significantly based on specific homeowner needs, geographical location, and property types. For example, a rural property may require unique coverage details compared to an urban dwelling. Real-life case studies illustrate how customized applications enhance user experience during the insurance claim process.

Advanced features for power users

For users seeking to leverage pdfFiller to its fullest extent, several advanced features enrich the application process. One potent capability is the integration of pdfFiller with other software tools, allowing seamless workflows and data sharing.

Best practices for managing your homeowners application forms

To ensure your custom homeowners application forms remain effective and security is maintained, following best practices is crucial. Maintain updated records through regular reviews, ensuring each document reflects the current situation surrounding your property and insurance needs.

Testimonials and user experiences

Users have praised pdfFiller for its ability to streamline the process of completing a custom homeowners application form. Testimonials highlight how the platform has transformed their document management, allowing them to focus more on their property and less on paperwork.

Next steps after submission of the application

After submitting your custom homeowners application form, it is essential to understand the review process undertaken by insurance providers. Typically, you can expect a thorough evaluation of the information provided.

Following up with your insurance provider is advisable to confirm that the application is being processed. Be proactive in communication, and always clarify what next steps to expect, such as potential requests for more information or timelines for decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify custom homeowners application without leaving Google Drive?

How do I make edits in custom homeowners application without leaving Chrome?

How do I edit custom homeowners application straight from my smartphone?

What is custom homeowners application?

Who is required to file custom homeowners application?

How to fill out custom homeowners application?

What is the purpose of custom homeowners application?

What information must be reported on custom homeowners application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.