Get the free Credit Reference Form

Get, Create, Make and Sign credit reference form

Editing credit reference form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit reference form

How to fill out credit reference form

Who needs credit reference form?

The Comprehensive Guide to Credit Reference Forms

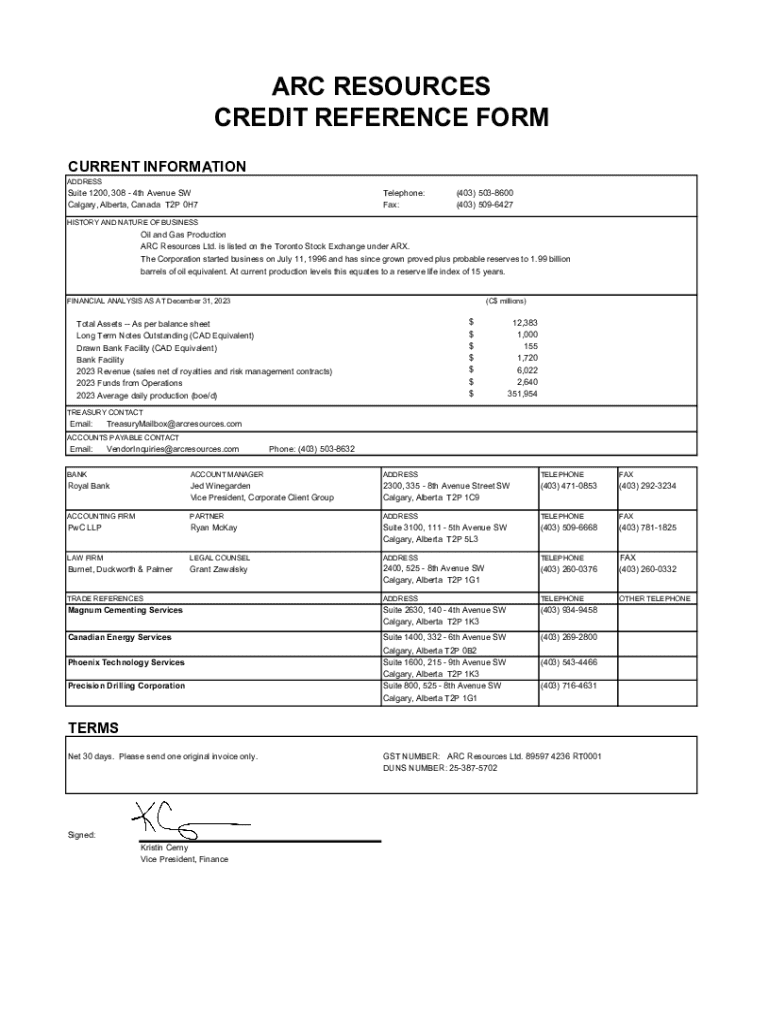

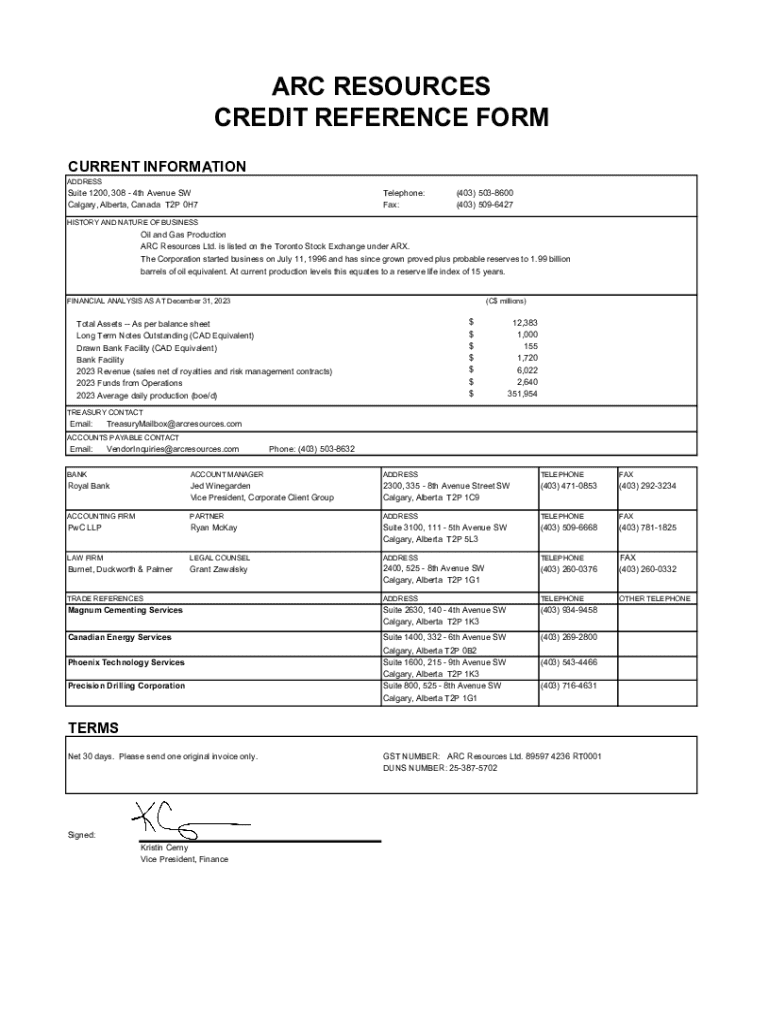

Understanding the credit reference form

A credit reference form is a crucial document used primarily in financial transactions where the lender needs to assess the creditworthiness of a borrower. This form typically provides a detailed overview of the applicant's financial background, including their credit history, employment status, and financial obligations.

Its necessity arises in various scenarios, such as applying for loans, renting accommodation, or establishing business partnerships. Lenders and landlords require this documentation to make informed decisions, ensuring that applicants can meet their financial commitments.

Importance of accurate information

Completing the credit reference form with accurate information is essential. Discrepancies or inaccuracies can lead to misinterpretations of your creditworthiness, possibly resulting in denied applications or unfavorable terms.

Incorrect submissions not only affect immediate financial opportunities but can also tarnish your long-term financial reputation. Individuals must diligently verify every detail before submission to safeguard their financial future.

Key components of a credit reference form

Understanding the components of a credit reference form helps ensure you provide all necessary information. The form generally consists of distinct sections, each requiring specific details that lenders assess during the evaluation process.

Personal information section

The personal information section captures required details such as your full name, address, date of birth, and contact information. This lays the foundation for establishing your identity and facilitates further verification.

Financial history section

In the financial history section, applicants must provide information about their employment history, including job titles, employer names, and durations of employment. Additionally, you should include income details, which help lenders assess your ability to meet repayment obligations.

Credit score and report information

Including your credit score in the form is crucial as it represents a snapshot of your creditworthiness. A higher score typically indicates a lower risk to lenders. You can obtain your credit report from various agencies, and it's advisable to review it for any inaccuracies that need correction.

Step-by-step guide to completing the credit reference form

Completing the credit reference form can seem daunting, but following a structured approach simplifies the process. Here’s a step-by-step guide to help you through.

Step 1: Gather necessary documentation

Before starting the form, you should gather pertinent documents such as recent pay stubs, tax returns, bank statements, and identification. This preparation ensures that you have all required information at your fingertips, which can speed up the completion process.

Step 2: Filling out the personal information section

While filling out the personal information section, be diligent. Ensure that all names, addresses, and contact details are spelled correctly and match the documentation you are submitting.

Step 3: Detailing your financial history

When detailing financial history, be honest and precise. Break down your employment history in chronological order, including job titles and responsibilities, to give lenders a comprehensive view of your professional background.

Step 4: Review your credit information

Before finalizing the form, double-check all the information provided. Pay special attention to numerical entries, ensuring they align with your financial documents.

Step 5: Finalizing the form

Make sure every section of the form is completed and clearly formatted. After reviewing, sign the form electronically or manually, whichever is required, then submit it according to the specified instructions.

Editing and managing your credit reference form online

In the digital age, managing documents online offers significant advantages. With tools such as pdfFiller, users can easily edit and manage their credit reference form efficiently.

Using pdfFiller for document management

pdfFiller provides an intuitive interface for editing PDFs, making it easy to modify your credit reference form as needed. Whether you need to update your credit score or revise personal information, the e-signature and collaboration tools streamline the process.

How to edit and reuse the credit reference form

Creating templates for your credit reference form within pdfFiller ensures that future submissions are more straightforward. Once you've filled out a form correctly, save it as a template for quick access across different applications.

Cloud storage and access

Storing your documents in the cloud means you can retrieve and edit your credit reference forms from anywhere, which is particularly useful for individuals and teams working remotely. Accessibility ensures a smooth process when immediate adjustments are necessary.

eSigning and collaborating on your credit reference form

The ability to eSign your credit reference form is a significant advantage of using digital tools. This feature saves time and eliminates the need for printing or scanning.

How to eSign your credit reference form

To add an electronic signature, simply navigate to the signature field within your document in pdfFiller, select 'eSign,' and follow the prompts to create your signature. It's secure, fast, and legally binding.

Collaborating with others

If you're submitting the form as part of a team, pdfFiller allows you to invite others to collaborate on the document. This feature facilitates real-time feedback and edits, ensuring everyone involved is on the same page.

Common mistakes to avoid when filling out a credit reference form

Mistakes on a credit reference form can lead to application rejections or unfavorable lending terms. It's vital to recognize common pitfalls and avoid them.

Overlooking required information

One significant error is failing to complete mandatory fields. It's often helpful to go through guidelines available with the form to ensure nothing is missed.

Misrepresenting your financial status

Inflating income or misrepresenting debts can severely damage your credibility. Being honest establishes trust and may lead to better financial opportunities.

Delaying submission

Submitting the credit reference form late can affect financial evaluations, particularly in competitive housing or lending markets. Strive to submit the form promptly to ensure you maximize your opportunities.

FAQs about credit reference forms

Many users have questions regarding the nuances of credit reference forms. Below are some helpful clarifications.

What should do if my credit reference form is rejected?

If your form is rejected, review the feedback provided by the lender or landlord. Correct any inaccuracies and ensure the information presented reflects your true financial position before resubmitting.

How often should update my credit reference form?

Regular updates to your credit reference form are necessary, especially after significant financial changes like a new job or altered debts. Aim to review your form annually or before any significant application.

Can submit a credit reference form without a strong credit score?

While a strong credit score is beneficial, it's not the only factor lenders consider. Providing a detailed financial history and references can help contextualize a lower score.

Additional support and resources

Navigating the complexities of credit reference forms can be simplified with the right support tools.

Accessing help within pdfFiller

pdfFiller offers customer support for users who need further assistance with complex filling requirements. Their team can guide you step-by-step through the process.

Utilizing community forums and guides

Engaging with online forums where users share experiences related to credit reference forms can provide invaluable insights and tips that may aid in completing your own forms more effectively.

Real-world applications of credit reference forms

Credit reference forms play a vital role in a multitude of scenarios, influencing key moments in one's financial journey.

Examples of situations requiring a credit reference form

For instance, if you're renting a home, landlords frequently ask for a credit reference to ensure you have the financial capacity to pay rent. Similarly, when applying for loans, lenders closely scrutinize these forms as they assess risk levels.

Importance in business partnerships

In a business context, credit reference forms are beneficial for evaluating potential partners. This ensures that the financial history aligns with the business's goals, fostering reliable partnerships.

Enhancing your creditworthiness through proper documentation

Providing a well-structured credit reference form not only aids immediate financial applications but also enhances your long-term creditworthiness.

Building a strong financial profile

After submitting your credit reference form, continue focusing on maintaining a strong financial profile. Pay bills on time, manage debts wisely, and monitor your credit score for fluctuations to ensure your financial health remains robust.

Leveraging pdfFiller for future financial needs

Utilizing pdfFiller for managing not just credit reference forms but all significant financial documents creates a streamlined process for future transactions. This tool can become an essential part of your financial toolkit, aiding in organization and efficient approvals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit reference form?

How can I edit credit reference form on a smartphone?

How can I fill out credit reference form on an iOS device?

What is credit reference form?

Who is required to file credit reference form?

How to fill out credit reference form?

What is the purpose of credit reference form?

What information must be reported on credit reference form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.