Get the free Certificate of Exemption

Get, Create, Make and Sign certificate of exemption

Editing certificate of exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption

How to fill out certificate of exemption

Who needs certificate of exemption?

Certificate of Exemption Form: A Comprehensive How-to Guide

Understanding the certificate of exemption form

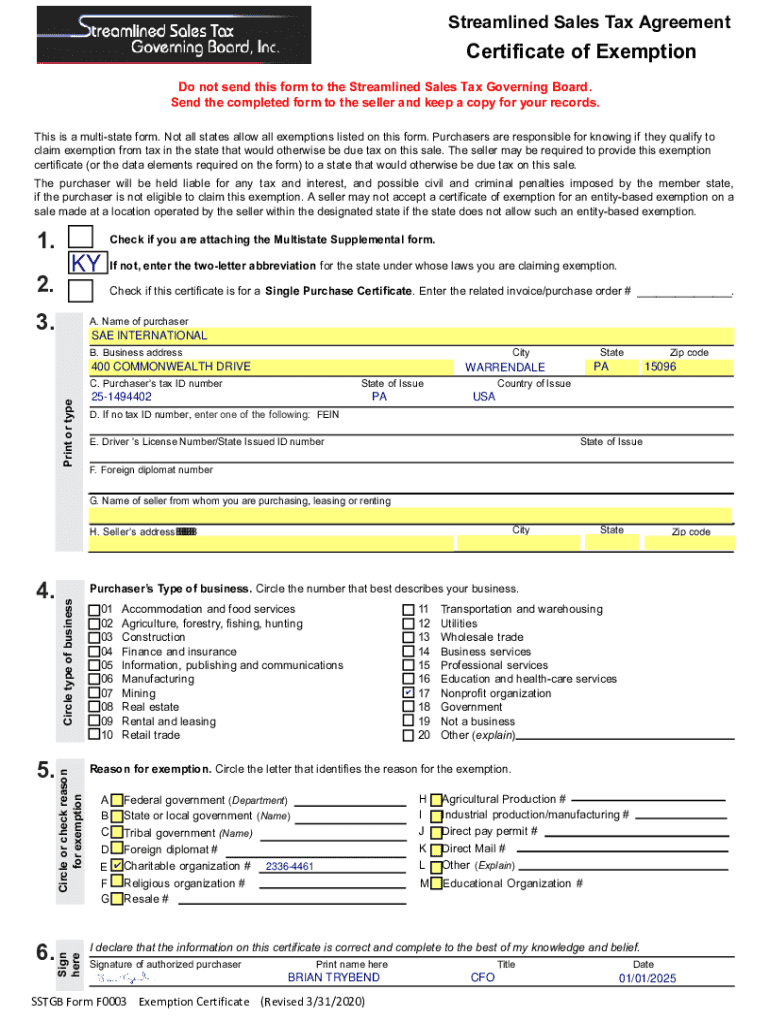

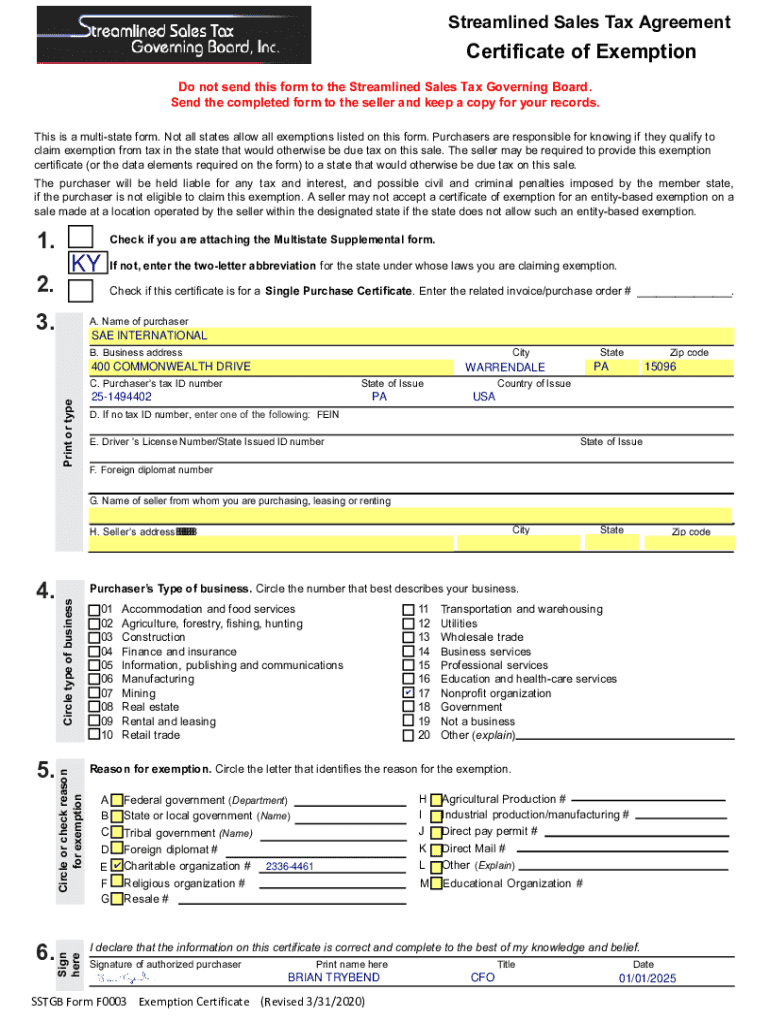

A Certificate of Exemption (CoE) is a vital document used by individuals and organizations that seek to legally exempt themselves from paying certain taxes on purchases. This form is especially significant in tax management as it allows eligible parties to facilitate exempt transactions, thereby relieving them from the financial burden of taxes. The essence of the CoE is to clarify and document that specific purchases are not subject to sales or income taxes under applicable laws.

Common situations requiring a certificate of exemption include non-profit entities purchasing goods for charitable purposes, bulk purchases by government agencies, and certain transactions made by educational institutions. Understanding when and how to employ this form can lead to significant savings and compliance with state laws.

Types of certificates of exemption

Different types of exemption certificates serve various purposes depending on the specific tax situation. The most common include:

Variations by state can significantly affect the requirements and acceptance of these forms. Each state may have different stipulations about who qualifies for exemptions and what documentation is required. It's essential for users to familiarize themselves with their local regulations.

Who can use a certificate of exemption?

Not everyone can utilize a certificate of exemption. Generally, the eligible individuals comprise those belonging to tax-exempt organizations, governmental bodies, and, under certain conditions, individual consumers making specific types of purchases. Tax-exempt organizations include entities like charities, religious institutions, and educational groups that can substantiate their tax-exempt status.

Other qualified purchasers may include affiliated groups or government contractors. As such, understanding the limitations and eligibility criteria is crucial for ensuring compliance and avoiding penalties.

Step-by-step instructions for completing the certificate of exemption form

Completing a certificate of exemption form correctly is essential for ensuring validity. Here’s how you can do it effectively:

Using pdfFiller to efficiently create and manage your certificate of exemption form

pdfFiller provides an excellent platform for creating and managing your certificate of exemption form. Users can easily access templates tailored to their needs, streamlining the document creation process.

Features offered by pdfFiller include editing tools for customized entries, allowing users to add specific details to their forms easily. With eSignature capabilities, users can secure quick approvals and ensure faster processing times. The platform also offers collaboration features, making it ideal for teams who need to work together on form completion.

Submitting your certificate of exemption form

Once your certificate of exemption form is completed, the next step is submission. Acceptable methods of submission vary based on your local regulations but generally include online submission and mailing instructions.

After submission, processing timeframes may vary widely. It’s advisable to confirm receipt with the relevant agency and address any follow-up actions as required to ensure your exemptions are honored.

Special considerations when using a certificate of exemption

Using a certificate of exemption opens the door to various tax benefits, yet it comes with specific restrictions. Not all purchases qualify for exemption, and misuse may result in penalties.

Frequently asked questions (FAQs)

Commonly, people have numerous questions about the certificate of exemption form. Understanding these can clear up uncertainties and facilitate smoother transactions.

Interactive tools and resources

For individuals seeking to streamline their experience with the certificate of exemption form, pdfFiller offers various interactive tools and resources.

Case studies: successful use of the certificate of exemption

Real-world examples of successfully utilizing a certificate of exemption illustrate its practical benefits. In Example 1, an individual utilized their exemption certificate to purchase building materials for a charitable project, resulting in substantial savings that redirected funds to community welfare.

In Example 2, a non-profit organization streamlined its procurement process using exemption certificates, allowing them to allocate more resources towards their mission. Such case studies highlight how both individuals and organizations maximize the financial advantages conferred by the certificate of exemption.

Comparison of certificate of exemption forms state-by-state

A comparative analysis of certificate of exemption forms across states can simplify understanding and compliance. Factors including acceptance of forms, necessary documentation, and the scope of exemptions can vary significantly.

By outlining these differences in a clear format, users can quickly navigate the complexities of exemption forms across various jurisdictions.

Next steps after obtaining your certificate of exemption

Once you have successfully obtained your certificate of exemption, maintaining thorough records is paramount. This includes filing the certificate in an easy-to-access location and keeping copies of exempt purchases for auditing purposes.

Consider periodically reviewing your exemption status and renewing your certification when necessary to avoid any lapses in eligibility. Awareness of the changing regulatory landscape ensures that you're equipped to benefit from any new exemptions that arise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify certificate of exemption without leaving Google Drive?

How do I edit certificate of exemption on an iOS device?

How can I fill out certificate of exemption on an iOS device?

What is certificate of exemption?

Who is required to file certificate of exemption?

How to fill out certificate of exemption?

What is the purpose of certificate of exemption?

What information must be reported on certificate of exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.