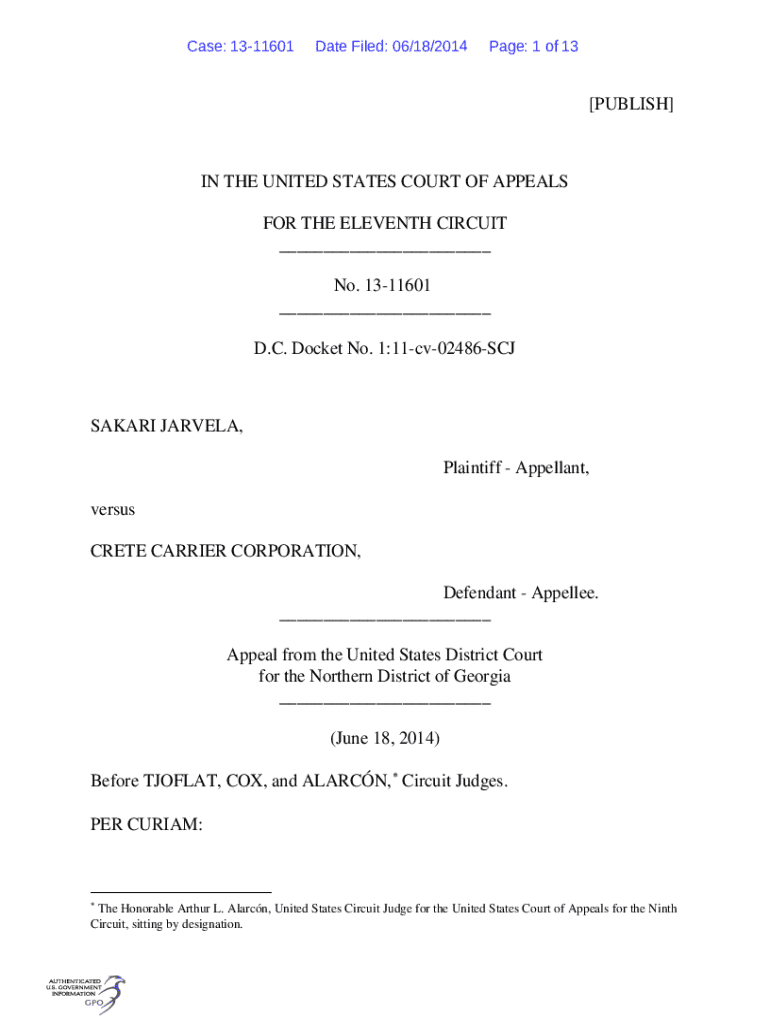

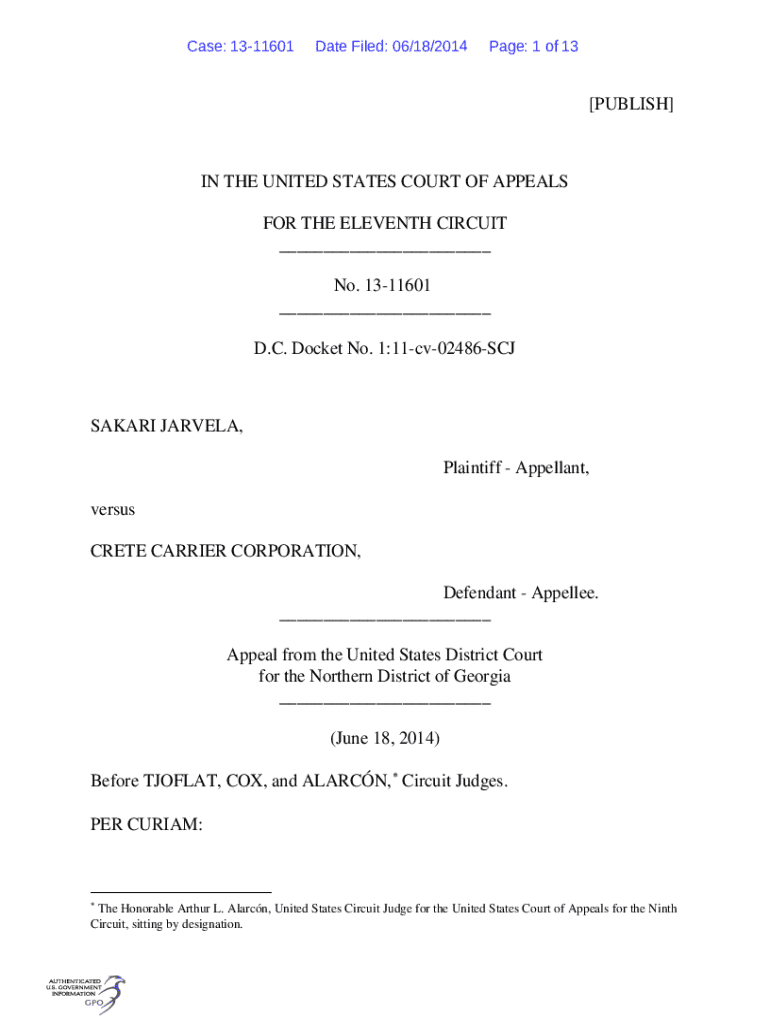

Get the free Case: 13-11601

Get, Create, Make and Sign case 13-11601

Editing case 13-11601 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 13-11601

How to fill out case 13-11601

Who needs case 13-11601?

Comprehensive Guide to the Case 13-11601 Form

Overview of case 13-11601 form

The case 13-11601 form is a critical document used in various legal and administrative situations. Primarily associated with bankruptcy filings under Chapter 13, this form serves to outline the debtor's financial situation and proposed payment plan to creditors. Its purpose is to facilitate the restructuring of debts while allowing an individual the opportunity to retain their assets.

Key features of the form include clearly defined sections for personal information, financial disclosures, and proposed repayment terms, making it easier for courts and creditors to evaluate the case. The significance of the case 13-11601 form lies in its role within the bankruptcy process, offering individuals a legally sanctioned pathway to regain financial stability while complying with judicial requirements.

Components of the case 13-11601 form

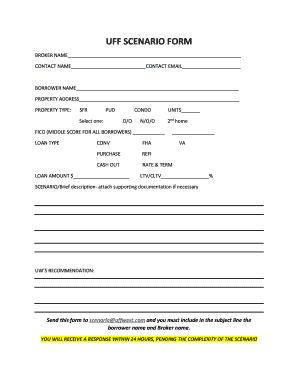

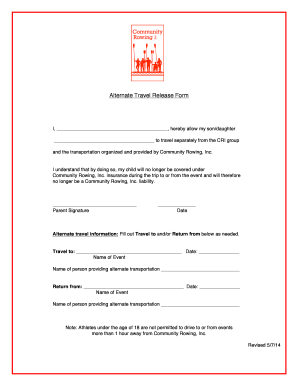

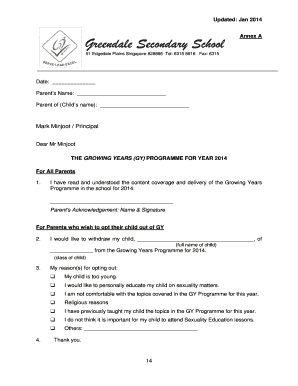

The case 13-11601 form comprises several essential components that must be accurately completed for the process to proceed smoothly. Each section serves a distinct purpose and collects necessary information for the case evaluation.

Commonly required attachments also play a significant role, including proof of income, tax returns, and a detailed list of debts. These documents substantiate the claims made in the case 13-11601 form, demonstrating financial necessity to the court.

Instructions for filling out the form

Filling out the case 13-11601 form requires careful attention to detail. Start by gathering all necessary personal and financial information. This includes your full name, address, income details, and a complete list of debts and assets.

Common mistakes to avoid include omitting required information, using incorrect figures, or failing to attach necessary documentation. Double-checking your entries before submission can significantly reduce the risk of errors.

Editing and customizing the case 13-11601 form

Once you have completed the case 13-11601 form, you may find the need to edit and customize it to suit your specific circumstances. Using tools like pdfFiller can facilitate this process efficiently.

For clarity and readability, consider using clear fonts and maintaining consistent formatting throughout your document. Following these tips will help ensure your form is professional and compliant.

Signing the case 13-11601 form

Signing the case 13-11601 form is a crucial step in the submission process. With the rise in electronic documentation, platforms like pdfFiller offer options for electronic signatures that are recognized legally in most jurisdictions.

Always cross-reference the signing requirements to ensure that your submission meets the legal standards in your area. This precaution can avoid unnecessary complications.

Submitting the case 13-11601 form

Submission methods for the case 13-11601 form can vary based on the local court rules. Most courts allow for online submissions, mail options, or in-person filings. Choosing the right method is essential for timely processing.

Be mindful of required submission timings and deadlines as failure to adhere can result in delays or even dismissal of your case. Tracking your submission status is a wise practice to keep informed about your case's progress.

Managing your case after submission

After submitting the case 13-11601 form, it's essential to manage your documentation effectively. pdfFiller offers a robust platform for document management that can assist you in tracking your case.

Monitoring your case progress is made simpler with document tracking features that notify you of any updates or required actions as your case moves through the judicial system.

Frequently asked questions (FAQs) about the case 13-11601 form

When navigating the complexities of the case 13-11601 form, various questions may arise. Addressing these can help prevent misunderstandings and missteps.

Case studies or examples

Understanding how the case 13-11601 form is utilized can often be illustrated with real-world examples. Many individuals have successfully navigated the bankruptcy process using this form.

Success stories often highlight the importance of thorough documentation and accurate information. Utilizing resources like pdfFiller has helped many individuals streamline their forms, leading to quicker resolutions of their cases.

Additional considerations and best practices

Before submitting the case 13-11601 form, consulting with a legal advisor can provide beneficial insights and ensure all aspects of the form are correctly addressed. Keeping abreast of changes in legal requirements related to the form is also vital to avoid potential pitfalls.

Adopting best practices in documenting your financial situation can significantly enhance your chances of a successful bankruptcy filing, ensuring that the case 13-11601 form works to your benefit.

Interactive tools and resources on pdfFiller

pdfFiller provides invaluable resources to assist you with the case 13-11601 form and similar documents. From creation templates to interactive tools, users can find the necessary assets to streamline their paperwork.

Leveraging these tools can significantly enhance your experience and allow you to navigate your documentation needs more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify case 13-11601 without leaving Google Drive?

Can I create an electronic signature for signing my case 13-11601 in Gmail?

How do I fill out case 13-11601 using my mobile device?

What is case 13-11601?

Who is required to file case 13-11601?

How to fill out case 13-11601?

What is the purpose of case 13-11601?

What information must be reported on case 13-11601?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.