Get the free Cp 575 E

Get, Create, Make and Sign cp 575 e

How to edit cp 575 e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cp 575 e

How to fill out cp 575 e

Who needs cp 575 e?

CP 575 E Form: A Comprehensive Guide

Understanding the CP 575 E Form

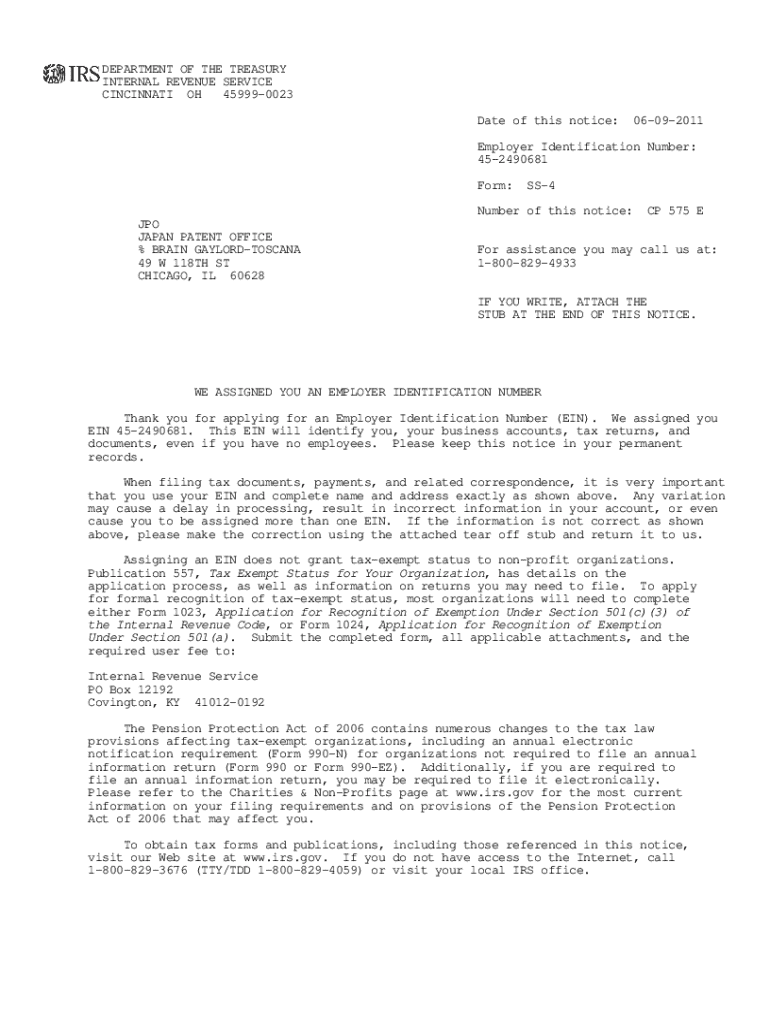

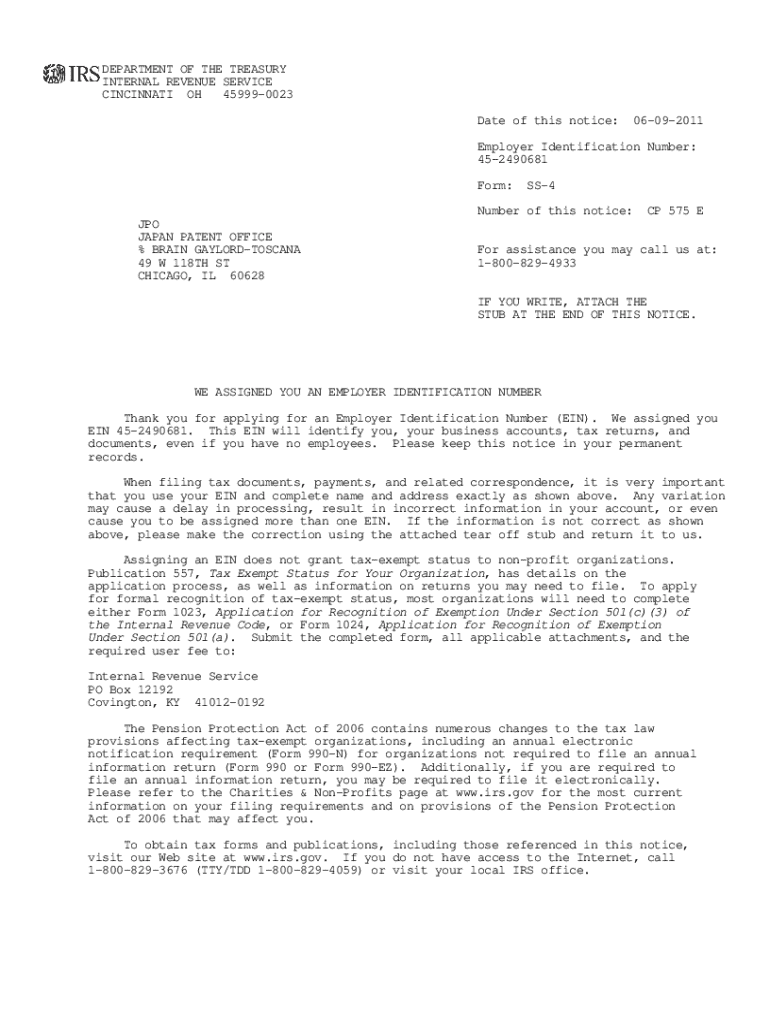

The CP 575 E Form is an official notice issued by the IRS that serves as confirmation of your Employer Identification Number (EIN). This essential document helps businesses and tax-exempt organizations establish their identity for purposes ranging from banking to tax filings. Its importance in IRS communications cannot be overstated, as this form not only validates the EIN but also provides crucial information about the business or organization.

The form acts as an acknowledgment from the IRS, confirming that your EIN application has been processed and accepted. This is particularly important for new businesses or entities seeking tax-exempt status, as the EIN is a critical component of compliance and identification in legal and financial matters.

Why you might need a CP 575 E Form

There are several scenarios in which a CP 575 E Form will be issued. Most commonly, it is provided after the successful application of an EIN, which can be required for various business activities, including opening bank accounts, filing tax returns, and applying for business licenses. Non-profit organizations also need an EIN to apply for tax-exempt status, making the CP 575 E Form vital for these entities.

If you are ever challenged by the IRS, having the CP 575 E Form on hand can serve as proof of your EIN status. It conveys not just your EIN, but also substantiates your business operations in the eyes of the law, solidifying your compliance with federal regulations.

The role of the CP 575 E Form in obtaining an EIN

An Employer Identification Number (EIN) is a unique identifier for businesses issued by the IRS, similar to a Social Security number for individuals. This number is essential for various business operations, including paying employees, filing taxes, and securing loans. Without an EIN, a business may face significant complications in legal and taxation matters.

The CP 575 E Form specifically serves as confirmation of your EIN issuance. Once your application for an EIN is approved, the IRS sends you this form, which contains vital information, including the EIN itself, the legal name of the business, and the effective date of the EIN. For new businesses and non-profit organizations, possessing this confirmation is critical for establishing credibility and compliance.

Steps to obtain your CP 575 E Form

To obtain a CP 575 E Form, you first need to apply for an EIN. Here’s a step-by-step guide to complete the EIN application:

Once your application is submitted, you can expect the CP 575 E Form to arrive via mail. Generally, if you applied online, you might receive it within a few days. However, if you applied by mail, it may take up to four weeks to receive your CP 575 E Form. Factors such as IRS workload and accuracy of your submission can affect these timelines.

What to do if you lose your CP 575 E Form

Losing your CP 575 E Form can have implications for your business, as it serves as crucial documentation for your EIN. It's essential to retain the CP 575 E Form for future reference, especially when dealing with tax filings or business registrations. However, if you find yourself unable to locate this important document, there are ways to retrieve it.

To request a duplicate CP 575 E Form from the IRS, follow these steps:

After following these steps, the IRS will process your request and should send you a duplicate copy of your CP 575 E Form in the mail.

The format and components of the CP 575 E Form

The CP 575 E Form is formatted as a letter from the IRS and contains several key sections. The layout typically includes the IRS logo at the top, followed by your business's name, address, and EIN. The document is short and straightforward but packed with essential information.

Its most important components consist of:

Understanding each component helps ensure you have the accurate information necessary when conducting business or dealing with tax matters.

Frequently asked questions (FAQs) about the CP 575 E Form

There are common queries surrounding the CP 575 E Form that potential applicants might have. For instance, one concern is whether an existing business needs to apply for a new EIN. Generally, if there are any major changes, such as a change in ownership, business structure, or significant rebranding, a new EIN may be necessary.

Another frequently asked question pertains to inaccuracies on the CP 575 E Form. If the information on your CP 575 E Form is incorrect, it is vital to address the issue promptly. Contacting the IRS to correct any discrepancies will help avoid complications down the road.

Additionally, individuals often wonder about the difference between the CP 575 E Form and IRS Form 147C. While both forms convey EIN information, IRS Form 147C is a confirmation letter that can be requested to get the EIN if the CP 575 E Form is not available.

Additional tools and resources

There are several resources to assist you in handling the CP 575 E Form effectively. For example, pdfFiller offers powerful solutions for document management. With pdfFiller, you can edit, e-sign, and manage your CP 575 E Form directly from their cloud-based platform.

This allows for seamless collaboration and easy access to your documents whenever and wherever you need them. Additionally, pdfFiller features interactive tools for filling out forms, making it less daunting to complete applications.

Expert insights and pro tips

Navigating IRS guidelines can be challenging. To streamline the process, it's helpful to become familiar with the IRS's requirements concerning EIN applications and CP 575 E Forms. Double-checking your information before submitting can save time and mitigate delays.

It's also essential to keep your CP 575 E Form secure. Storing it in a safe place and backing it up digitally ensures that you have access to it in case of loss. Practicing these best practices will safeguard your business interests and ensure smooth operations.

Related topics and further learning

For ongoing business success, understanding more about EINs and compliance is critical. Exploring resources related to tax filings, EIN applications, and other business essentials can enhance your knowledge and prepare you for future challenges.

Consider diving deeper into document-related topics offered through pdfFiller, as these resources can provide valuable insights and tools to assist in efficient document management and operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cp 575 e directly from Gmail?

How do I fill out cp 575 e using my mobile device?

How do I fill out cp 575 e on an Android device?

What is cp 575 e?

Who is required to file cp 575 e?

How to fill out cp 575 e?

What is the purpose of cp 575 e?

What information must be reported on cp 575 e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.