Get the free Cash Isa Internal Transfer Form

Get, Create, Make and Sign cash isa internal transfer

Editing cash isa internal transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash isa internal transfer

How to fill out cash isa internal transfer

Who needs cash isa internal transfer?

Cash ISA Internal Transfer Form - How-to Guide

Understanding cash isa internal transfers

A Cash ISA, or Individual Savings Account, serves as a valuable savings tool that allows individuals to save money without incurring tax on the interest earned. This means that every pound saved in a Cash ISA grows without being diminished by tax obligations, making it a popular choice for many savers in the UK. Not only do Cash ISAs offer tax-free interest, but they also provide the flexibility to access funds, depending on the terms of the account.

The importance of internal transfers comes into play when savers wish to manage their funds better or capitalize on more competitive interest rates offered by different ISA providers. Transferring money within ISAs allows for liquidity and accessibility of funds while still enjoying the unique tax benefits that these accounts provide. It's essential to consider the implications of transferring funds, such as interest rates and the types of accounts involved, as these factors influence the overall return on your investment.

Preparing for an internal transfer

Before initiating a Cash ISA internal transfer, there are several key considerations to assess. First, evaluate your current Cash ISA's performance. Are the interest rates competitive compared to other providers? Then, conduct a thorough investigation of potential new Cash ISA providers to find those that fit your financial goals and preferences best, emphasizing interest rates and terms.

Next, it's crucial to understand transfer limits and rules that may apply when moving funds between ISAs. Many providers have specific conditions regarding transfer amounts or restrictions related to existing funds. Being aware of these details helps in smooth transactions and avoids unexpected complications.

Lastly, gather the necessary documents for the internal transfer process. Common issues faced by individuals include forgetting to provide essential personal information or discrepancies in account details, which can lead to delays.

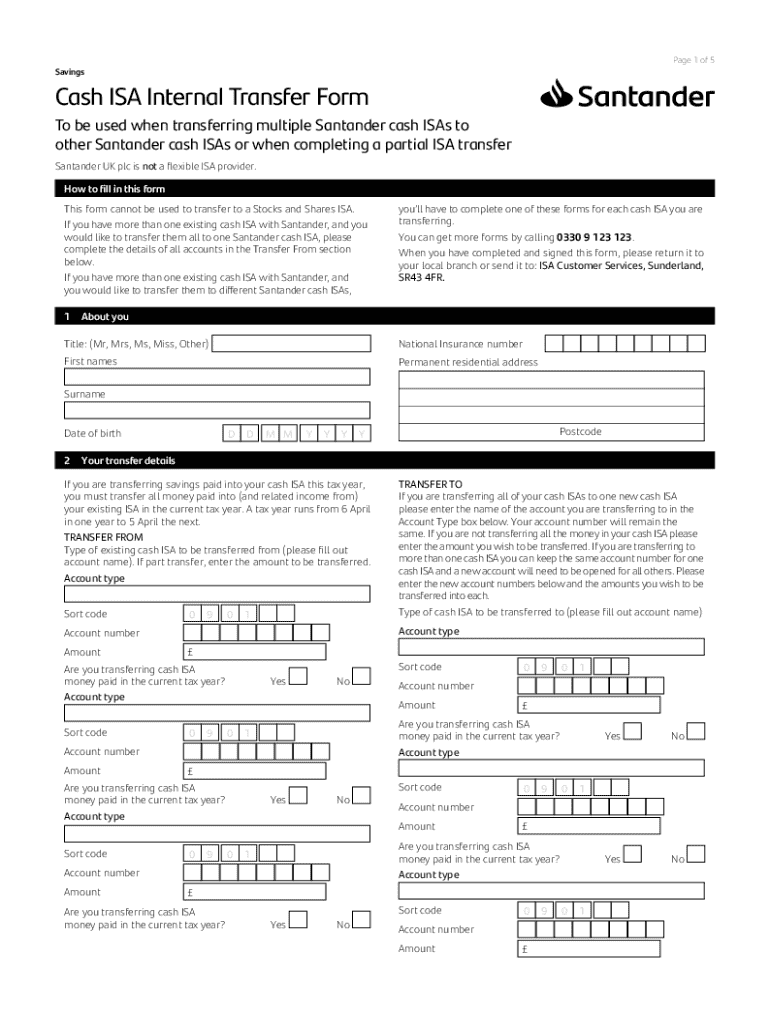

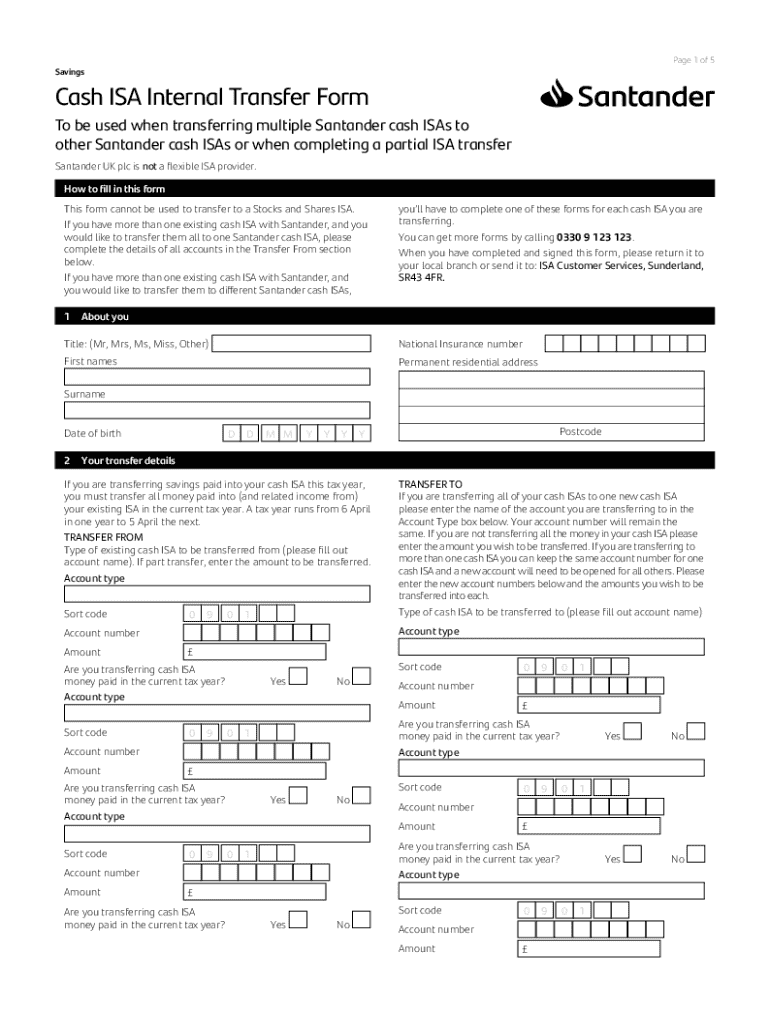

Completing the cash isa internal transfer form

Accessing the internal transfer form is straightforward, particularly through platforms like pdfFiller. To find this specific form, navigate to their templates library and search for 'Cash ISA internal transfer form.' Once located, you can start filling it out using the guided steps available on the platform.

When completing the internal transfer form, you will need to input several required details clearly and accurately. These details generally include your personal information, such as name and address, as well as your current ISA provider’s name and account number. Additionally, you'll need to specify the new ISA provider details to ensure a seamless transfer.

Ensure that all fields are completed accurately to avoid processing issues. Using tools such as pdfFiller makes it easy to fill out forms digitally and submit them hassle-free.

Don't forget to sign and date the form. Using an eSignature is crucial as it authenticates your request and facilitates swift processing. pdfFiller provides tools to sign documents electronically, ensuring compliance and saving time.

Submitting your internal transfer request

Once you have completed the cash ISA internal transfer form, the next step is submission. You have multiple submission methods available. Users can choose between electronic submissions for faster processing or mailing the form directly to the new provider. Using electronic submission methods is highly recommended due to their efficiency and reduced processing time.

If you are using pdfFiller, you can send the form directly from the platform, which is incredibly handy. Moreover, tracking your transfer progress is essential. Most ISA providers offer a way to monitor the status of your transfer, allowing you to stay informed throughout the process.

Common issues and troubleshooting

During the transfer process, various unforeseen issues may arise. Identifying these common problems early can save you time and hassle. Errors on the application form, such as incorrect personal information or account numbers, are frequent culprits that can delay transfers significantly.

If you encounter such misunderstandings, contacting both your current and new ISA providers is essential to resolve any issues quickly. They can assist you in clarifying what needs correction or where the process might be stuck.

In cases of unexpected delays, take proactive steps by assessing the situation and advocating for your rights as a consumer. Knowing your rights can help you stand firm and ensure prompt resolution.

Leveraging pdfFiller for document management

Utilizing a platform like pdfFiller offers numerous advantages when managing cash ISA transfers. The ability to edit, sign, and manage documents seamlessly from a single, cloud-based platform streamlines the entire process. pdfFiller provides tools that enhance collaboration, which is particularly beneficial for teams managing multiple accounts or transfers simultaneously.

Expert tips for managing your cash ISA documents online include creating a structured organization system that allows easy retrieval of important paperwork. Utilize the cloud storage options offered by pdfFiller for secure document management that can be accessed from anywhere.

Additional considerations post-transfer

Once the internal transfer is complete, it's critical to perform a post-transfer checklist. Make sure that your funds are allocated correctly in the new Cash ISA and confirm the interest rate along with the terms outlined by the new provider. Contacting them directly can help clarify any lingering doubts about the specifics of your new account.

Moreover, it's vital to review your cash ISA strategy regularly to maximize your financial benefits effectively. The economic landscape is continually evolving, and staying informed can help you adapt to changing interest rates or policy shifts. Adjusting your ISA strategy based on personal financial goals is essential for long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cash isa internal transfer?

How do I edit cash isa internal transfer online?

Can I create an electronic signature for signing my cash isa internal transfer in Gmail?

What is cash isa internal transfer?

Who is required to file cash isa internal transfer?

How to fill out cash isa internal transfer?

What is the purpose of cash isa internal transfer?

What information must be reported on cash isa internal transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.