Get the free Ct-706/709 Ext

Get, Create, Make and Sign ct-706709 ext

Editing ct-706709 ext online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-706709 ext

How to fill out ct-706709 ext

Who needs ct-706709 ext?

Comprehensive Guide to the ct-706709 Ext Form

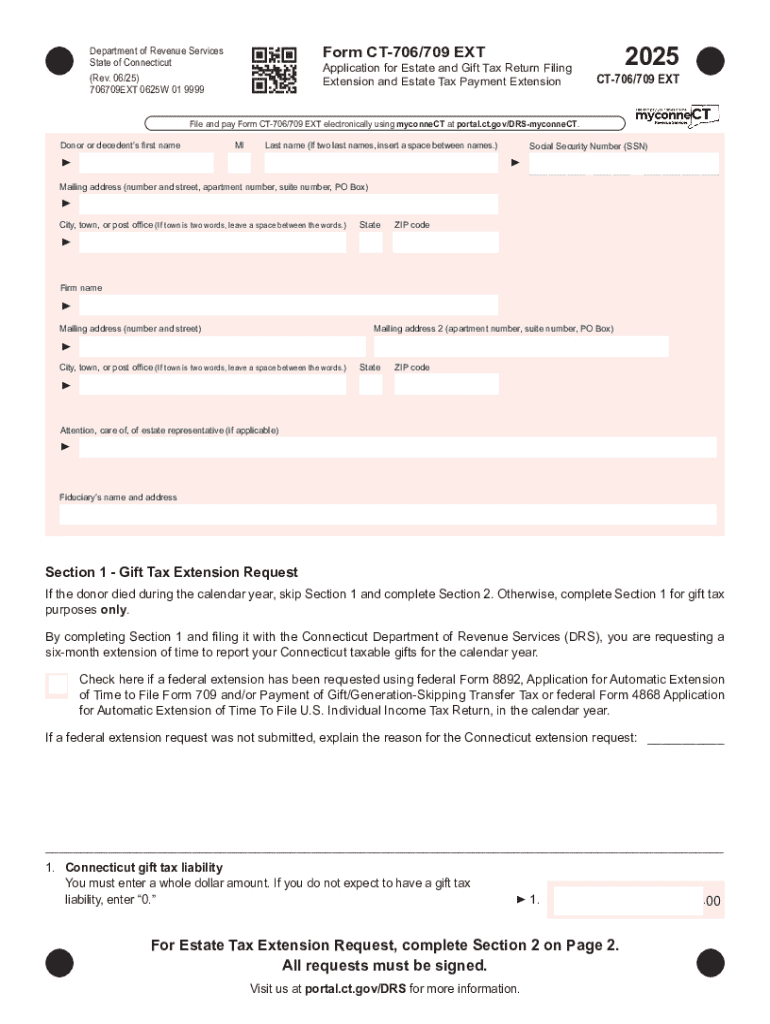

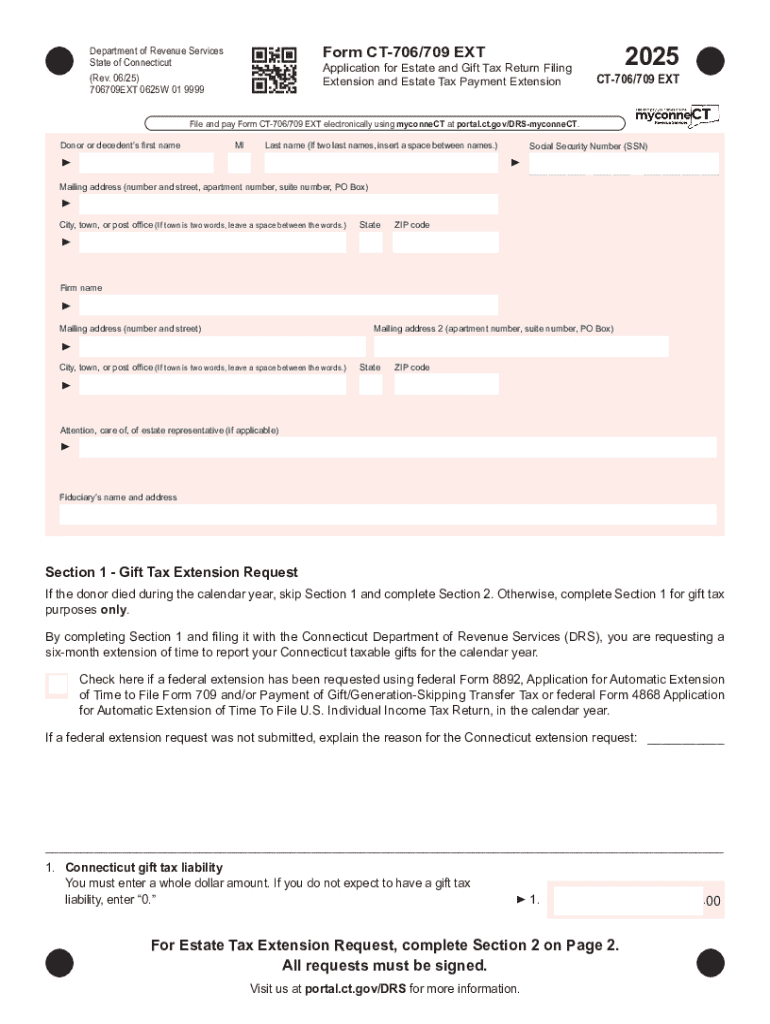

Overview of the ct-706709 ext form

The ct-706709 ext form is a specific document utilized primarily for tax purposes within certain jurisdictions. This form serves to provide detailed information regarding specific financial matters that require transparency and clarity for both taxpayers and regulatory bodies. Its primary goal is to ensure that relevant parties have access to accurate financial reporting, thus facilitating effective tax management.

Accurately completing the ct-706709 ext form is critical. Errors or omissions can lead to complications, including financial penalties or audits. Given the importance of precise data submission in tax-related matters, individuals and businesses find themselves needing to devote time and attention to this process.

Key features of the ct-706709 ext form

The ct-706709 ext form is divided into several distinct sections, each serving a specific function. Understanding these sections is crucial for effectively completing the form. The primary components typically include general taxpayer information, detailed financial disclosures, and a declaration of accuracy.

Required information generally encompasses personal identification, earnings, tax deductions, and any other relevant financial details. Users should prepare to enter specifics about their income sources, allowable deductions based on applicable regulations, and any other necessary financial insights.

Step-by-step instructions for filling out the ct-706709 ext form

Before diving into the ct-706709 ext form, preparation is critical. Start by gathering necessary documents, such as previous tax returns, W-2 forms, and any other financial statements that support your income claims. Understanding what information needs to be entered is crucial in ensuring a seamless completion process.

Detailed instructions for each section include:

To ensure accuracy, double-check each entry against your supporting documents. Common mistakes include typos in numbers and misreporting income sources, both of which can complicate the review process.

Editing and managing the ct-706709 ext form

Once the ct-706709 ext form is filled out, editing is easy with pdfFiller. To access the form in the editor, simply upload the completed document, where you can utilize various editing tools such as highlights, text boxes, and more. This feature is particularly useful for those who may need to adjust information after initially filling the form.

Saving and version control are also vital. Options for saving your work include automatic cloud backups and exporting to various formats. Tracking changes and versions ensures that all modifications are documented, which helps maintain a clear audit trail.

eSigning the ct-706709 ext form

The eSigning process for the ct-706709 ext form is seamless within pdfFiller’s platform. Once you are ready to sign, pdfFiller’s tools allow you to add your signature electronically. This not only expedites the signing process but ensures that documents remain secure and legally binding.

You can also request signatures from others directly via the platform. All parties can sign electronically, facilitating quicker approvals. Understanding the validity and legal considerations during eSigning is essential. Recognized by most jurisdictions, eSigned documents hold the same legal weight as traditionally signed forms.

Collaborating on the ct-706709 ext form

For teams working together, sharing the ct-706709 ext form is critical. pdfFiller allows users to share the form effortlessly with team members, enabling real-time collaboration. Utilizing collaboration tools empowers teams to edit or comment directly within the document.

Feedback features enhance this collaborative experience, allowing users to provide constructive comments or ask questions directly in the text. This functionality leads to clear communication, ensuring everyone involved is on the same page regarding the form’s completion.

Form management and storage

One of the significant advantages of using a tool like pdfFiller is the cloud-based storage it provides. This feature ensures that all documents, including the ct-706709 ext form, can be accessed from anywhere, making it convenient for users who may be on the move or working from different locations.

Organizing forms within pdfFiller is also straightforward. Users can create folders and categorize forms as needed, streamlining access and retrieval. The ability to access the form anytime, anywhere, underscores the practicality of a cloud solution in today’s fast-paced environment.

Related forms and templates

In addition to the ct-706709 ext form, several similar forms serve related purposes. Understanding when to use these forms can aid in comprehensive financial management. Related forms include income tax return forms, estate planning documents, and various compliance certificates.

Familiarity with similar templates in pdfFiller can further enhance document handling, streamlining processes and reducing time spent on form completion. Links to other useful templates are readily accessible within the pdfFiller platform.

Form preview and interactive tools

Before finalizing any form, being able to preview the ct-706709 ext form is invaluable. pdfFiller offers a preview feature, allowing users to view the form as it would appear once filled, ensuring that all information is correct. This check serves as a final review stage to catch any errors.

Interactive features in pdfFiller enhance usability. For instance, demo of editable fields lets users test the form's functionalities before committing to filling it out. A visual representation of completed forms can also provide a clear understanding of how the document will look upon submission.

Frequently asked questions (FAQs)

Users frequently have inquiries regarding the ct-706709 ext form, including its purpose and the required documents to complete it. Common troubleshooting tips include ensuring that all information is current and aligned with the most recent tax guidelines.

If you encounter specific issues or need further assistance with pdfFiller, the platform offers extensive resources and customer support options to guide users effectively through the process of form completion and management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ct-706709 ext online?

How do I edit ct-706709 ext straight from my smartphone?

How do I fill out the ct-706709 ext form on my smartphone?

What is ct-706709 ext?

Who is required to file ct-706709 ext?

How to fill out ct-706709 ext?

What is the purpose of ct-706709 ext?

What information must be reported on ct-706709 ext?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.