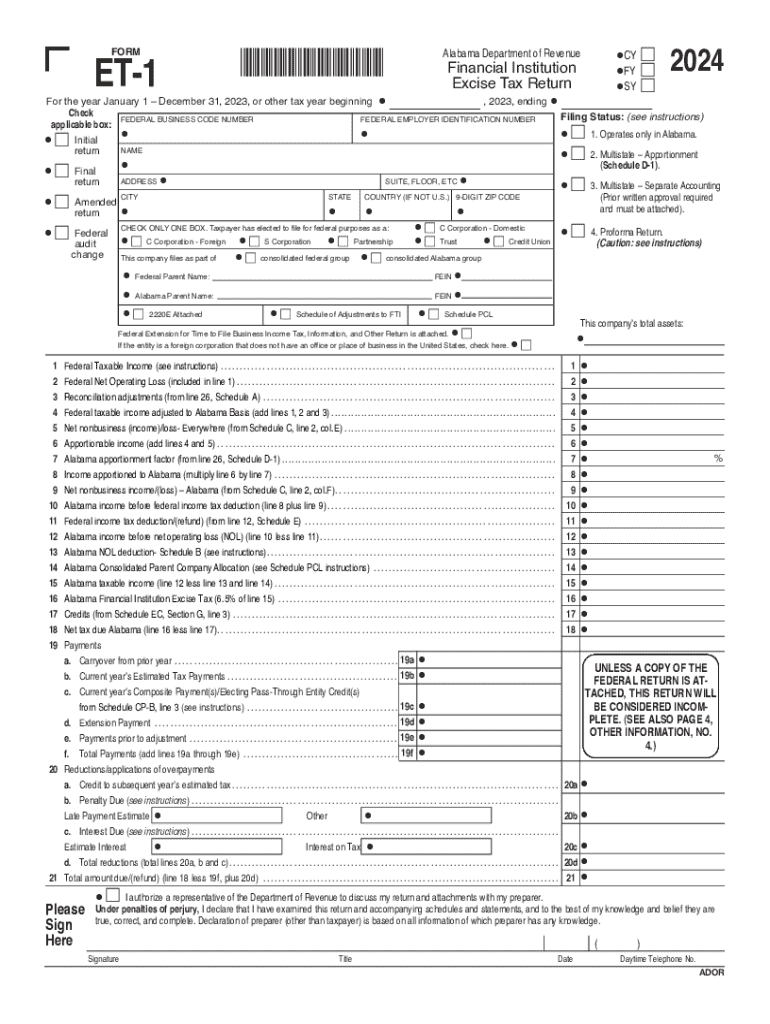

Get the free Et-1

Get, Create, Make and Sign et-1

How to edit et-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out et-1

How to fill out et-1

Who needs et-1?

Comprehensive Guide to the ET-1 Form: Completing Your Employment Tribunal Claim

Understanding the ET-1 form

The ET-1 Form is a key document used to initiate a claim to an Employment Tribunal in the United Kingdom. It is essential for individuals seeking redress against their employers regarding workplace disputes, including wrongful dismissal, discrimination, and wage issues. Without this form, prospective claimants cannot formally begin the legal process to resolve their complaints.

The primary purpose of the ET-1 Form is to outline the details of your claim, including the nature of the issue, the parties involved, and the remedies sought. This form serves as your first point of contact with the Employment Tribunal and sets the stage for the proceedings that follow. Therefore, accurately completing the ET-1 is crucial, as errors or omissions could lead to delays or dismissal of your claim.

Preparing to complete the ET-1 form

Before filling out the ET-1 Form, there are several key considerations to keep in mind. First, it’s vital to check the deadline for submitting your claim. Typically, claims must be filed within three months of the issue occurring; missing this deadline can severely hinder your case.

Additionally, contacting the Advisory, Conciliation, and Arbitration Service (ACAS) is essential. ACAS provides a free service aimed at resolving workplace disputes and requires that parties attempt conciliation before progressing to a tribunal. They can offer valuable guidance on the mediation process and potential remedies.

Seeking professional advice from a solicitor or legal advisor experienced in employment law can also be beneficial. They can guide you on how to frame your claim, helping to avoid common pitfalls that may affect your case. Furthermore, gathering all necessary documentation is crucial for substantiating your claim.

Step-by-step guide to completing the ET-1 form

Completing the ET-1 Form involves several structured steps. Understanding the form's layout is critical for effective completion. The ET-1 Form is divided into sections that require specific information about you, your employer, and the nature of your claim.

Starting from sections 1 through 7, you’ll provide personal information, including your contact details and your employer's information, as well as a brief history of your employment. This background is vital for establishing the context of your claim.

Section-by-section breakdown:

Common mistakes to avoid when filling out the ET-1 form

When completing the ET-1 Form, many claimants make common mistakes that can hinder their case. One of the most frequent issues is failing to fill out all required sections accurately or completely. As a result, ensuring you provide comprehensive responses is critical. Double-check each section to confirm that no details are overlooked.

Another area where claimants often falter is misunderstanding the claims process itself. It’s essential to clearly know the nature of your claim and the specifics you'll need to articulate. Submitting inappropriate or incorrect documentation can also lead to challenges during the hearings.

What happens after you submit the ET-1 form?

Once you submit your ET-1 Form, you can expect a timeline of events. The Employment Tribunal typically acknowledges receipt of your claim within a few days. Following acknowledgment, the tribunal will examine your submission and determine whether they have the authority to hear your case.

If the claim is accepted, the tribunal will forward the details to your employer, who must respond to the claim within a specified timeframe. Staying proactive in communication with your employer and the tribunal can pave the way for a smoother process.

Tips for managing your employment tribunal case

Managing your employment tribunal case effectively involves organization and diligence. Start by sorting all your paperwork and evidence relevant to your claim. Create a dedicated file that includes your ET-1 Form, correspondence with your employer, witness statements, and any other supporting documents.

Keeping track of deadlines is critical to ensure compliance with tribunal requirements. Using digital calendars and reminders can help maintain a timeline of necessary actions and responses. Additionally, effective communication with any legal advisors involved can provide clarity and support throughout the process.

Utilizing pdfFiller for your ET-1 form needs

pdfFiller offers a seamless solution for completing and managing your ET-1 Form. Through our platform, users can easily edit the PDF format of the ET-1, filling in required sections with confidence. This reduces errors associated with handwritten forms and streamlines the submission process.

The eSigning feature on pdfFiller enables users to sign their ET-1 documents electronically, ensuring compliance with tribunal requirements while saving time. Furthermore, our collaboration tools provide teams with the ability to work together on the document, making it easy to share notes, changes, and timelines.

Case studies and examples

Understanding the experiences of others who have gone through the process of completing ET-1 Forms can be beneficial. Many claimants have successfully navigated the complexities of the form, often citing the importance of careful preparation and documentation. For instance, a claimant who faced dismissal was able to detail the timeline of events and related correspondence effectively in their ET-1 Form, leading to a favorable settlement.

Conversely, some individuals encountered challenges when they overlooked crucial details about their employment background or failed to specify their desired outcome, resulting in complications during the tribunal process. These case studies emphasize the significance of diligence and attention to detail when filling out the ET-1.

Next steps after filing your claim

Upon filing your ET-1 Form and receiving confirmation, preparation for the tribunal hearing becomes the priority. Understanding the expected procedures, the importance of presenting your case logically and coherently, and preparing any necessary witnesses can dramatically impact the outcome.

Make use of available resources, and consider mock hearings to familiarize yourself with the tribunal environment. Keep a line of communication open with your legal representative to ensure you receive appropriate guidance leading up to the hearing.

Frequently asked questions (FAQs) about the ET-1 form

Claimants often have numerous queries surrounding the ET-1 Form and the tribunal processes. Common questions include how to handle multiple claimants, the allowable claims period before filing, and what types of evidence are most effective in supporting a case. Misconceptions, such as believing that legal representation is not necessary, can further complicate proceedings.

Stay informed: Ongoing updates and changes to employment laws

Awareness of current employment laws and tribunal processes is essential for claimants. Regularly checking legal resources, government websites, and credible news outlets can provide updates on any changes affecting how your claim may be handled. Subscribing to newsletters from employment law firms or advocacy groups can also be beneficial.

Incorporating continuous learning into your approach not only ensures compliance but may also impact the effectiveness of your case strategy. Keeping informed about shifts in employment law will enhance your ability to navigate your claim successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit et-1 from Google Drive?

How can I edit et-1 on a smartphone?

How do I edit et-1 on an Android device?

What is et-1?

Who is required to file et-1?

How to fill out et-1?

What is the purpose of et-1?

What information must be reported on et-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.