Get the free Credit-based Insurance - insurance ohio

Get, Create, Make and Sign credit-based insurance - insurance

Editing credit-based insurance - insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit-based insurance - insurance

How to fill out credit-based insurance

Who needs credit-based insurance?

Credit-based insurance: Understanding the insurance form

Understanding credit-based insurance

Credit-based insurance utilizes credit information to determine a consumer's risk and set insurance premiums. This type of insurance relies on the premise that an individual's credit history can provide insights into their likelihood of filing a claim. Hence, many insurers include credit scores as a significant factor when assessing policyholders.

Insurance providers deeply value credit-based insurance scores because they can effectively forecast risk; a lower score may indicate increased risk, leading to higher premiums. Conversely, a higher score can translate to more favorable rates. Insurers believe that understanding an individual's credit life helps them better assess the chances of claims. Understanding the nuances of this system is vital for consumers so they can accurately navigate their insurance journeys.

The role of credit history in insurance

Credit history plays a vital role in determining insurance premiums. Insurers factor various elements into their calculations, including payment history, amount owed, credit length, types of credit in use, and new credit inquiries. These elements collectively form the basis of an individual's overall credit score. By examining these factors, insurers can identify potentially high-risk applicants who may be more likely to file claims.

However, many misconceptions exist about how credit impacts insurance. For instance, some people believe that merely having a poor credit score will automatically disqualify them from obtaining coverage, which is not always true. Also, the impact of credit on premiums can vary significantly depending on the insurer and state regulations, making it crucial for consumers to comprehensively analyze their options. Understanding the link between credit scores and insurance helps in maximizing their coverage opportunities.

Benefits of credit-based insurance

Credit-based insurance holds several advantages for consumers, chiefly the potential for lower insurance premiums. Insurers typically view individuals with superior credit histories as lower risk, allowing them access to better rates. This system incentivizes consumers to maintain good financial practices and, in turn, reduces their insurance costs. Access to a broader range of coverage options also enhances flexibility for the insured.

Moreover, the correlation between credit scores and insurance risk assessment can benefit individuals. A solid credit score may not only lower premiums but also enhance negotiation power for better coverage options. As insurers continue to embrace data-driven methodologies in their practices, consumers with favorable credit profiles will find themselves in a prime position to benefit from advantageous terms.

Your rights in credit-based insurance

Consumers have specific rights regarding credit-based insurance, especially concerning coverage denials. If an individual is denied coverage due to their credit history, they have the right to request an explanation from the insurer. This transparency ensures that customers are informed of the factors impacting their premiums and decisions will not be based solely on an automated system. Moreover, customers are entitled to free copies of their credit reports if they are affected by such decisions.

Additionally, there are legal protections in place concerning the use of credit in insurance. The Fair Credit Reporting Act (FCRA) mandates that consumers receive accurate credit information and the opportunity to dispute any inaccuracies. Insurance companies must also inform consumers when they utilize credit information to make underwriting decisions, ensuring that the process remains transparent and fair.

Interactive tools and resources

Understanding your credit is foundational to navigating credit-based insurance. To begin, you might want to access your credit report, which can be done online through various platforms. Here’s a summarized step-by-step process to obtain your credit report:

Tools such as credit score calculators provide excellent resources for assessing your financial health and are helpful in forecasting potential insurance costs. It’s imperative to work on strategies to improve and maintain a good credit score, as this will directly benefit future insurance transactions.

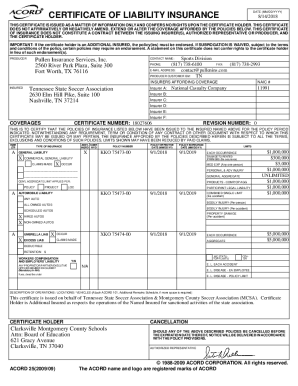

Filling out the credit-based insurance form

When applying for credit-based insurance, completing the insurance form accurately is critical. Start with the personal information section, where you provide your name, contact information, and perhaps Social Security number. This information is essential for the insurer to accurately assess your application.

Next, you'll need to detail your credit history. This might include data reflecting your outstanding debts, payment histories, and any recent credit inquiries or defaults. Ensure all entries are accurate, as discrepancies could delay your application or impact your premiums.

Managing your credit-based insurance documents

Staying organized with your credit-based insurance documents is vital for simplifying management and ensuring you have quick access when needed. Start implementing strategies such as creating designated folders—either physical or digital—specifically for insurance-related materials. Sorting documents by policy type or date can be beneficial for retrieval purposes.

To safeguard important records, consider leveraging document management tools, including digital solutions offered by pdfFiller. Utilizing their platform allows you to edit, eSign, and securely store your documents, ensuring everything is cloud-based for easy access from any location. The seamless organization of your insurance documents will empower you to maintain clarity in your coverage choices.

Finding the right insurance provider

Selecting an insurance provider that integrates credit-based insurance practices is essential for securing the best rates. Start by researching local and national insurance companies known to utilize credit scores in their underwriting process. Comparative analysis of insurance quotes is crucial: ensure you examine not just the cost but also the extent of coverage each provider offers.

When engaging with an insurance agent, prepare questions that will clarify how they utilize your credit score. Inquire about the factors that may influence your rates and what alternatives exist if your score isn't ideal. Insightful communication with your agent can lead to better understanding and ensure you receive policies tailored to your needs.

FAQs on credit-based insurance

Numerous consumers have common queries regarding credit-based insurance, primarily revolving around its impact on premiums and eligibility. For instance, one might wonder how their credit score can affect their insurance rates. Generally, a higher score correlates with lower premiums, while lower credit scores can lead to increased rates due to perceived risk.

Another frequent question is whether an individual can dispute an insurance decision based on their credit. If coverage or rate adjustments seem unjust, individuals retain the option to contest the insurer’s decision based on inaccurate credit reports. Familiarizing oneself with these rights can significantly equip consumers as they navigate the system.

Case studies and real-world examples

Many individuals have enjoyed significant financial savings by leveraging credit-based insurance policies. For example, a young driver with a strong credit history found an auto insurance provider that offered competitive rates, which led to a savings of over 30% compared to others who didn't factor in credit scores. On the contrary, a homeowner who neglected their credit could find themselves facing premiums nearly double those of their credit-savvy counterparts.

Different insurance sectors reflect varied implications of credit. In the realm of auto insurance, insurers often base their calculations on the belief that good credit correlates with responsible driving habits. For homeowners, the stakes are similar; insurers often use credit scores as a metric for potential claims frequency, thereby influencing actual policy costs based on credit history.

Support and resources

For assistance with credit-based insurance forms or navigating this comprehensive field, several resources are available. Consumers can contact help centers tailored to consumer inquiries. Additionally, accessing state-specific regulations can inform individuals of their rights and guidelines applicable in their jurisdiction.

Organizations for credit repair and management also provide consultation, ensuring consumers are well-informed about their credit standings and implications. By connecting with these resources, individuals actively take charge of their financial future and insurance engagements.

Current trends and future of credit-based insurance

The landscape of credit-based insurance is evolving as industry practices become more sophisticated and data-driven. Insurers are increasingly relying on comprehensive analytics to assess consumer risk accurately. This means potential enhancements in how credit is used, allowing companies to reduce biases inherent in traditional models and create more personalized policies for consumers.

Moreover, with advancements in technology and a growing emphasis on data privacy, the future of credit scoring in insurance may see significant shifts. Emerging trends indicate that insurers might rely more on alternative data sources, leading to greater inclusivity in the market and permitting even those with insufficient credit histories to secure insurance. As these transformations unfold, consumers need to stay informed and actively engage with evolving practices.

[Your interactive component]

For those looking to streamline the process of filling out credit-based insurance forms, pdfFiller offers online tools geared towards enhancing user experience. From calculators to templates, users can conveniently access what they need to optimize their documentation process.

Additionally, PDF templates specific to credit-based insurance forms can be found, enabling users to save time and promote accuracy. These resources not only simplify the documentation journey but also empower individuals to manage their insurance needs effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit-based insurance - insurance?

Can I sign the credit-based insurance - insurance electronically in Chrome?

Can I edit credit-based insurance - insurance on an Android device?

What is credit-based insurance?

Who is required to file credit-based insurance?

How to fill out credit-based insurance?

What is the purpose of credit-based insurance?

What information must be reported on credit-based insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.