Get the free Ct-225-a/b

Get, Create, Make and Sign ct-225-ab

How to edit ct-225-ab online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-225-ab

How to fill out ct-225-ab

Who needs ct-225-ab?

CT-225-A Form How-to Guide

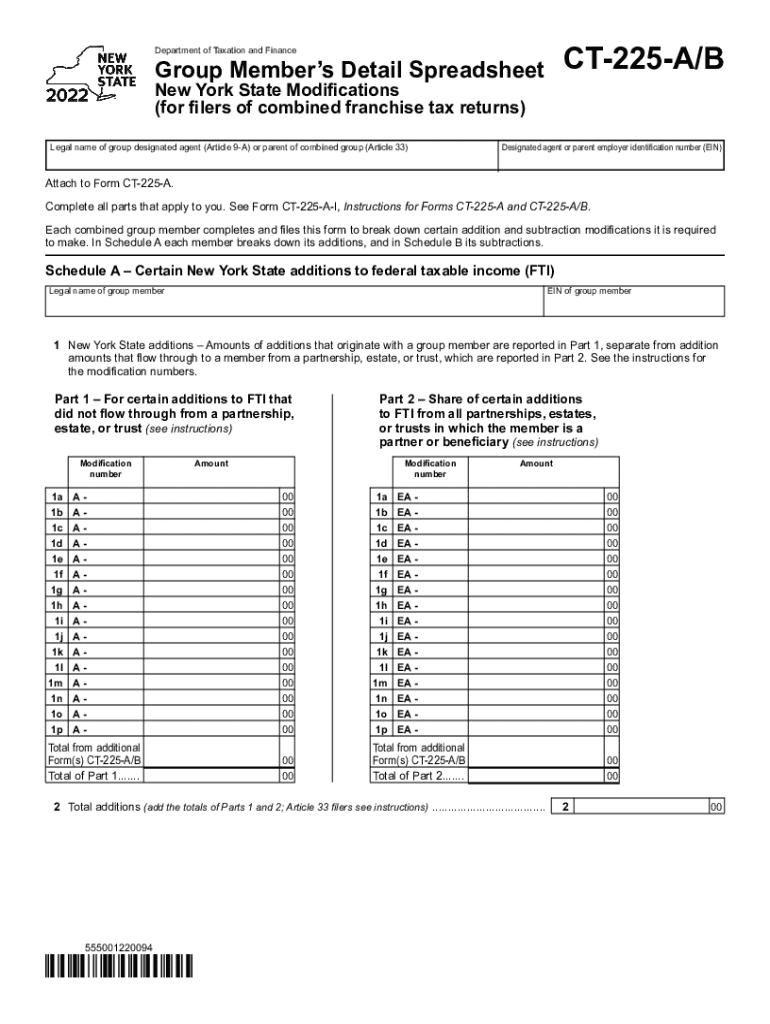

Overview of the CT-225-A Form

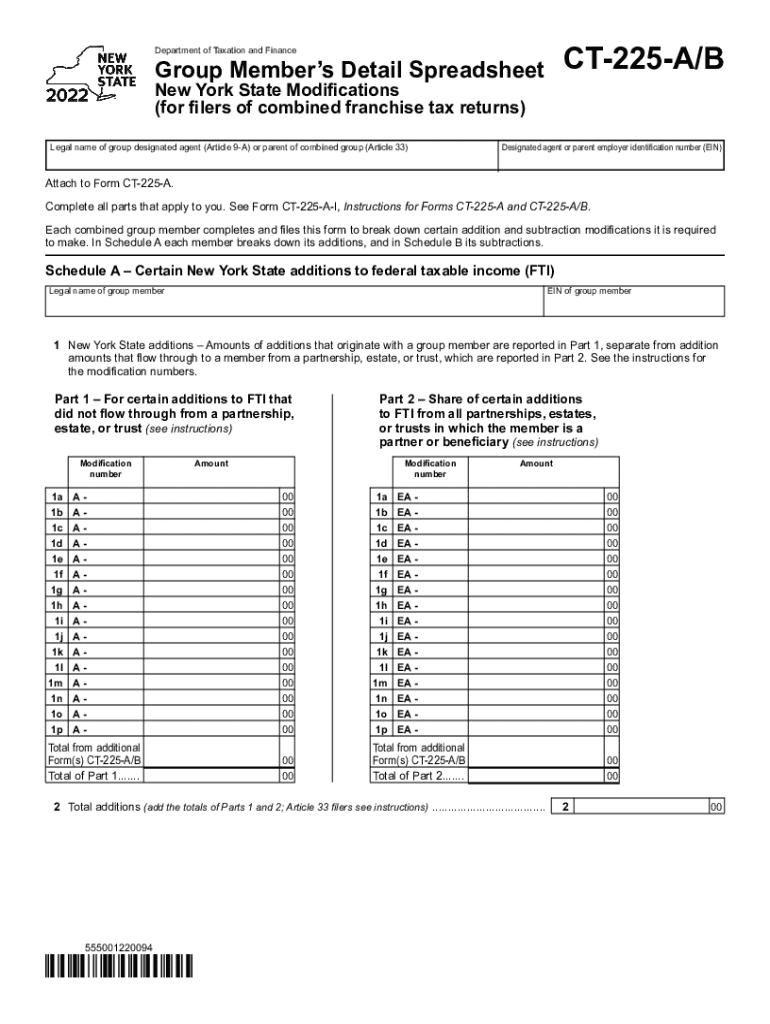

The CT-225-A Form is a critical document used for New York business tax purposes, specifically designed for corporate franchise tax calculations. It serves multiple purposes, including calculating the tax liability of corporations and assessing their compliance with state tax obligations. Given its significance, completing the CT-225-A Form is essential for accurate tax reporting, ensuring that businesses meet their fiscal responsibilities to the state.

Understanding the purpose of the CT-225-A Form not only helps businesses comply with legal mandates but also aids in identifying potential tax savings. Accurate completion can affect your tax liability directly, which is why precision in filling out this form is paramount.

Eligibility and filing requirements

Filing the CT-225-A Form is mandatory for corporations operating in New York that are subject to the state corporate franchise tax. This includes domestic corporations, as well as foreign corporations doing business in New York. Corporations must submit the form if they are subject to the franchise tax under Article 9-A or Article 9 of the New York State Tax Law.

Key deadlines for submission vary depending on the corporation’s fiscal year. Generally, the CT-225-A Form must be filed on or before the date your corporation's corporate tax return is due. Corporations should note these deadlines to avoid penalties—late submissions may incur interest and penalties on the amount owed.

Accessing the CT-225-A Form

Accessing the CT-225-A Form is straightforward. It is available for download directly from the New York State Department of Taxation and Finance website, where users can find it in various formats, including PDF and online fillable options. The PDF option allows for easy printing, while the online form can be completed directly in your browser.

To facilitate filling out the CT-225-A Form, users can also utilize platforms like pdfFiller, which provides an efficient way to manage, edit, and sign the document electronically. To download the form from pdfFiller, simply visit their website, navigate to the forms section, search for CT-225-A, and click on the download link.

Detailed instructions for completing the CT-225-A Form

To accurately complete the CT-225-A Form, follow this step-by-step guide, which breaks down the form by section and explains what information is required. One important aspect is to gather all necessary information before starting, including financial records, tax identification numbers, and previous tax returns. This preparation will streamline the completion process and minimize errors.

Both Schedule A and Schedule B are critical components of the CT-225-A Form. Schedule A generally contains base information regarding income and expenses, while Schedule B deals with specific tax deductions and credits. Ensure that each section is filled out thoroughly and reflects the corporation’s accurate financial position.

Line-by-line instructions for the CT-225-A Form

Each line of the CT-225-A Form has specific instructions that you must heed for proper completion. Start by entering your corporation’s identifying information, followed by financial data such as gross income and deductions. Pay special attention to common entries, as incorrect information here can lead to processing delays or unwanted audits.

Understanding the difference between the CT-225-A and CT-225-A/B is crucial because the latter is specifically designated for corporations eligible for specific tax credits. If your corporation falls under this category, additional sections have special instructions that must be followed. Depending on your corporate structure, there are unique distinctions to consider as well.

New York State modifications and considerations

When filling out the CT-225-A Form, it’s vital to understand New York State modifications that can affect your tax liability. These include both additions and subtractions from federal adjusted gross income. Corporations should be well-versed in these specific modifications to ensure accurate calculations.

Understanding what constitutes an addition to federal income versus what can be subtracted is essential. For instance, certain state tax refunds or tax credits may be added to income, whereas specific deductions such as pension contributions may be eligible for subtraction from your taxable income.

FAQs about the CT-225-A Form

Many questions arise regarding the CT-225-A Form, particularly from new filers. Common misconceptions include the belief that only certain corporations need to file or that all forms can be submitted without thorough review. It’s essential to approach the process with diligence to avoid potential penalties.

Issues related to submission and processing can also be common. When submitting your CT-225-A Form electronically through platforms like pdfFiller, understanding the submission process is key. Too often, submitters overlook signature requirements or submission acknowledgments, which are critical to ensure successful filing.

Troubleshooting common issues

When filling out the CT-225-A Form, encountering errors is commonplace. Common issues include misreported income, incorrect financial statements, or forgetting necessary schedules. To resolve these issues, double-check all entries before submission and use the online editing tools available through pdfFiller to make corrections quickly.

If you experience difficulty while submitting your form online, ensure you are connected to a stable internet connection and that your software is up to date. Many errors stem from technical glitches that can be avoided with proper preparation.

Tools for efficient document management

Using tools like pdfFiller significantly simplifies the completion, editing, and signing of the CT-225-A Form. The cloud-based platform allows for seamless document management, enabling users to access their documents from anywhere at any time. This is important for the modern corporate environment where flexibility is desired.

Furthermore, pdfFiller offers collaborative tools which can be highly beneficial for teams working on the same tax forms. Multiple users can edit, comment, and review in real-time, enhancing efficiency and reducing the likelihood of mistakes.

Contact information and support

If you need assistance with the CT-225-A Form, there are multiple avenues available for support. The New York State Department of Taxation and Finance provides guidance on their website, which includes detailed FAQs and contact information for further inquiries. Users can also reach out to pdfFiller’s support services for issues related to their platform, such as technical difficulties or questions about using the tools provided for filling out forms.

Navigating tax documentation can be complex, but knowing where to find help can alleviate that stress. Both state resources and online support can help ensure that you complete your CT-225-A Form accurately.

Additional forms and resources

When preparing to file the CT-225-A Form, it’s beneficial to have access to other related forms and templates. These may include prior year tax returns, forms for specific deductions, and any supplemental documents required by the New York State Department of Taxation and Finance. The pdfFiller platform not only provides access to the CT-225-A Form but also offers a comprehensive library of related documents.

Gathering all necessary forms can streamline your filing process. Additionally, taking advantage of external resources for tax assistance—such as professional services or tax consultation websites—can enhance your understanding and compliance.

Privacy & security reminder

When filling out the CT-225-A Form, data privacy is crucial. With sensitive information involved, users should take steps to ensure their documents are secure during the filing process. pdfFiller ensures the confidentiality of user information through robust security measures that protect your data at every step of the process.

Using platforms that prioritize privacy can help ease concerns about data handling during tax filing. Always ensure you’re using secure networks and trustworthy software for submitting confidential documents like tax forms.

Linked topics

Understanding the CT-225-A Form can also lead to exploring related topics, such as broader tax implications for corporations, strategies for minimizing tax liabilities, and recent changes in tax legislation that affect various corporate structures. Expanding your knowledge in these areas can provide deeper insights into effective corporate tax management.

These linked topics not only enhance comprehension of the CT-225-A Form but also equip business owners and tax professionals with the necessary tools to navigate corporate taxation more efficiently.

User testimonials

Users of pdfFiller have shared various positive experiences while managing the CT-225-A Form. Many emphasize the ease of completing and editing documents online and the convenience of signing forms digitally. The collaborative features also receive appreciation, allowing teams to work simultaneously, which reduces the time needed to complete the form.

These testimonials highlight the effectiveness of pdfFiller in simplifying document management tasks, making it a preferred platform for professionals handling multiple tax forms while ensuring compliance with New York State requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ct-225-ab without leaving Google Drive?

How do I execute ct-225-ab online?

How can I fill out ct-225-ab on an iOS device?

What is ct-225-ab?

Who is required to file ct-225-ab?

How to fill out ct-225-ab?

What is the purpose of ct-225-ab?

What information must be reported on ct-225-ab?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.