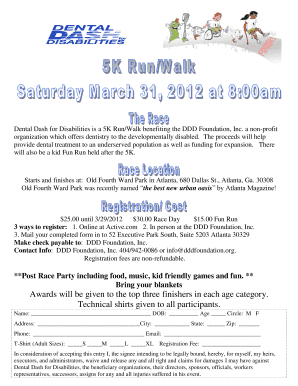

Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

How to edit campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Campaign finance receipts and form: A comprehensive how-to guide

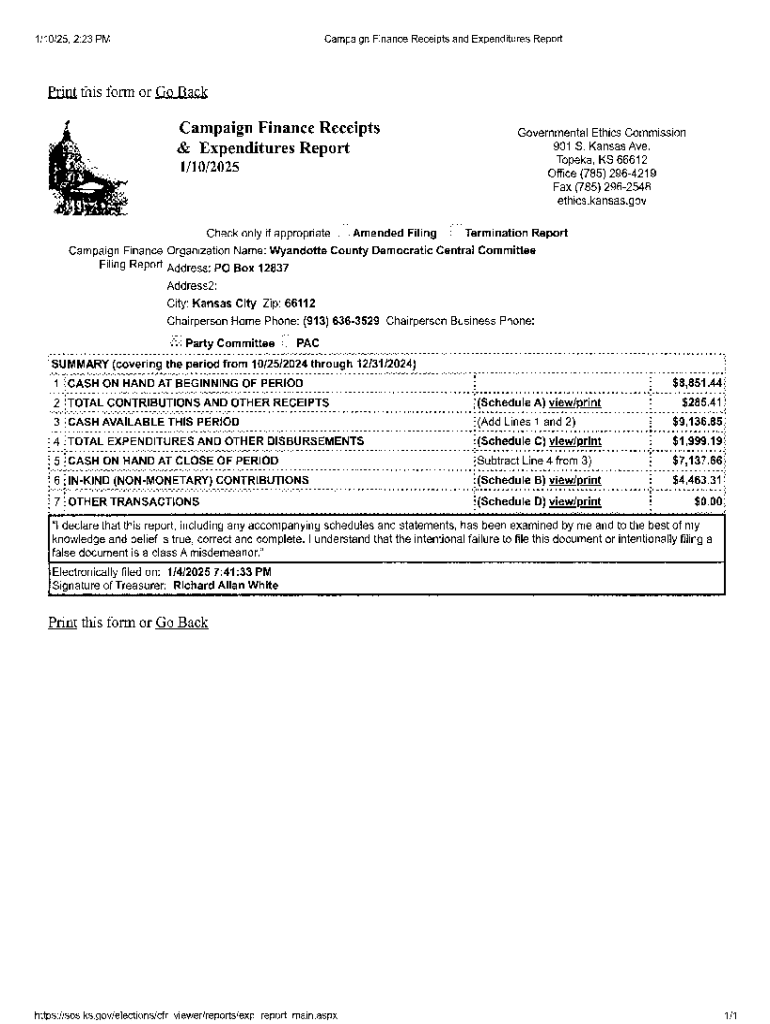

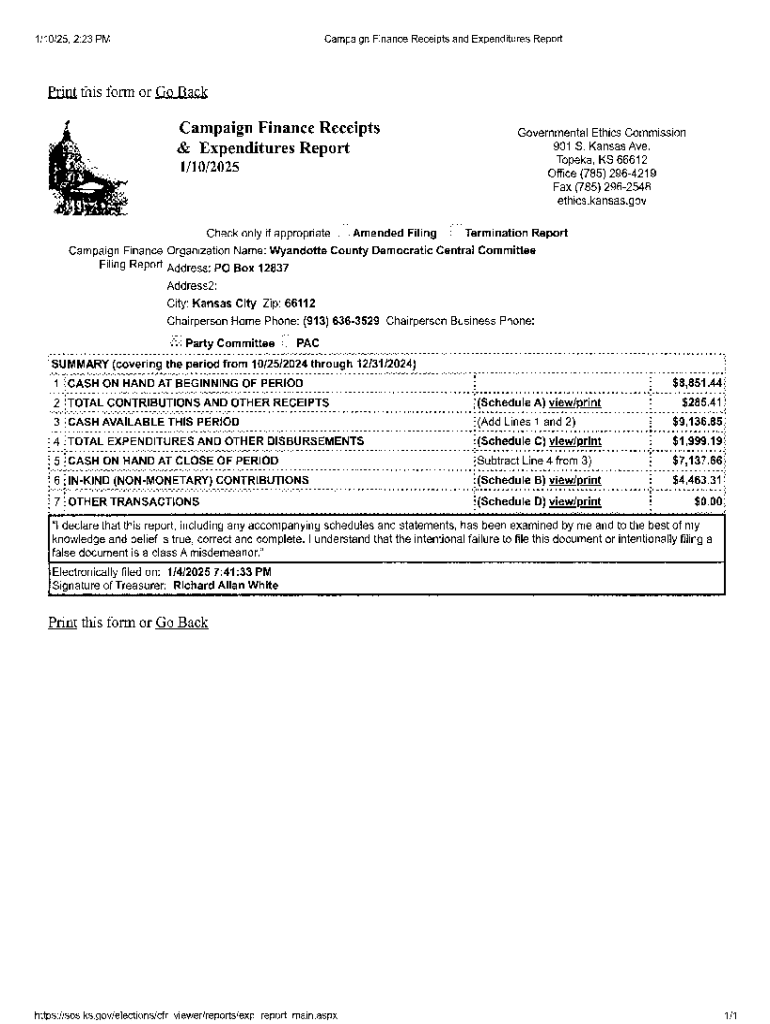

Understanding campaign finance receipts

Campaign finance receipts serve as documented proof of contributions made to political campaigns or organizations. These receipts outline the details of each contribution, ensuring transparency and accountability in campaign financing.

Their importance cannot be overstated; effective management of these receipts is crucial for compliance with various laws and regulations governing political financing. Moreover, they play a pivotal role in public trust, as transparency regarding source and amount of funding impacts voter perception.

Overview of necessary forms

Navigating the world of campaign finance forms can be daunting, especially given the variations between states and federal requirements. Generally, forms are designed to collect detailed information on contributions to ensure compliance with political finance laws.

Key common forms include the FEC Form fundraising report and state-specific contributions forms. It’s crucial for campaign managers to understand these forms in depth, as they often differ in structure and required information.

Steps to prepare campaign finance receipts

Preparing campaign finance receipts involves a methodical approach. Begin by gathering all necessary contributor information and contribution details. Each element plays a role in ensuring the accuracy of your receipts.

Once you have the required information, collect supporting documents such as acknowledgments and, if necessary, donor registration forms. These documents provide crucial evidence of contributions and enhance compliance.

Filling out the campaign finance receipt form

Filling out campaign finance forms accurately is vital. Each section of the form requires care to ensure proper reporting. Start with the Contributor Information Section, which requires basic details about the donors.

Detail the Contribution Information Section with specifics concerning the nature of the donation, including the amount and payment method. Lastly, don’t forget the Certification Section, which requires signatures attesting to the validity of the information provided.

Editing and managing your form with pdfFiller

pdfFiller provides a robust platform to manage campaign finance forms seamlessly. Upload your PDF documents into the system, allowing for easy editing in minutes. This enables real-time collaboration with team members to ensure every detail is accurate.

Furthermore, pdfFiller's document organization tools help in saving and categorizing your forms. The platform also supports the e-signature process, making it legal and official in a matter of clicks.

Filing requirements for campaign finance receipts

Campaign finance receipts have specific filing requirements, with deadlines varying at state and federal levels. It's essential to stay informed about these timelines to avoid penalties. States often have different requirements from federal mandates, making familiarity with both crucial.

Determining the right filing method—whether electronic or paper—depends on both the campaign’s scale and jurisdiction. Implement effective record-keeping practices to ensure that all documents are retrievable and compliant.

Interactive tools available on pdfFiller

pdfFiller offers a variety of interactive tools that support effective campaign finance management. One standout feature is the Form Builder, which allows for easy customization of documents according to your specific needs.

Moreover, integrating with existing campaign management tools streamlines operations. Utilizing data analytics helps track contributions, providing valuable insights for future fundraising efforts.

Understanding compliance and legal considerations

Compliance with fundraising laws is imperative for all campaigns. Key regulations involve contribution limits, disclosure requirements, and serious penalties for noncompliance. Frequent audits often trigger from inconsistency or reporting mistakes in financial receipt management.

Staying informed about changes in legislation is critical. Utilize trusted resources to keep abreast of regulatory updates. Understanding the potential triggers for audits can help hone compliance strategies effectively.

Case studies: Successful campaigns and their financing

Analyzing successful campaigns can provide valuable insights into effective campaign finance management. For instance, a local campaign in [Your City] managed to leverage small donations effectively, utilizing a comprehensive system of receipts and legal compliance that led to greater community engagement and financial success.

In the case of high-profile campaigns, understanding the intricacies of managing substantial financial resources and the reliance on professional management teams for compliance is crucial. pdfFiller has played a role in simplifying documentation processes for these successful campaigns.

FAQs and troubleshooting

Campaign finance management can raise numerous questions. What if a donor requests to remain anonymous? How do I correct a mistake on a filed receipt? Understanding the common hurdles can help streamline the overall process.

Many campaigns encounter similar issues, such as having insufficient information on a donor or missing signatures. Effective solutions to these dilemmas can be achieved through thorough preparation and utilizing resources offered by platforms like pdfFiller.

Next steps: Moving forward with your campaign finance management

As campaigns evolve, so must the strategies for compliance and record keeping. Establishing a systematic approach to manage campaign finance receipts can bring not only order but also efficiency to your documentation process.

Utilizing pdfFiller for subsequent campaigns can streamline your processes significantly. Setting automated reminders for filing deadlines will further ensure you remain compliant without the last-minute rush associated with document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit campaign finance receipts and online?

How do I fill out the campaign finance receipts and form on my smartphone?

How do I fill out campaign finance receipts and on an Android device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.