Get the free Crs Self-certification Form for Individuals

Get, Create, Make and Sign crs self-certification form for

Editing crs self-certification form for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs self-certification form for

How to fill out crs self-certification form for

Who needs crs self-certification form for?

CRS Self-Certification Form: Complete Guide for Financial Compliance

Understanding the CRS self-certification form

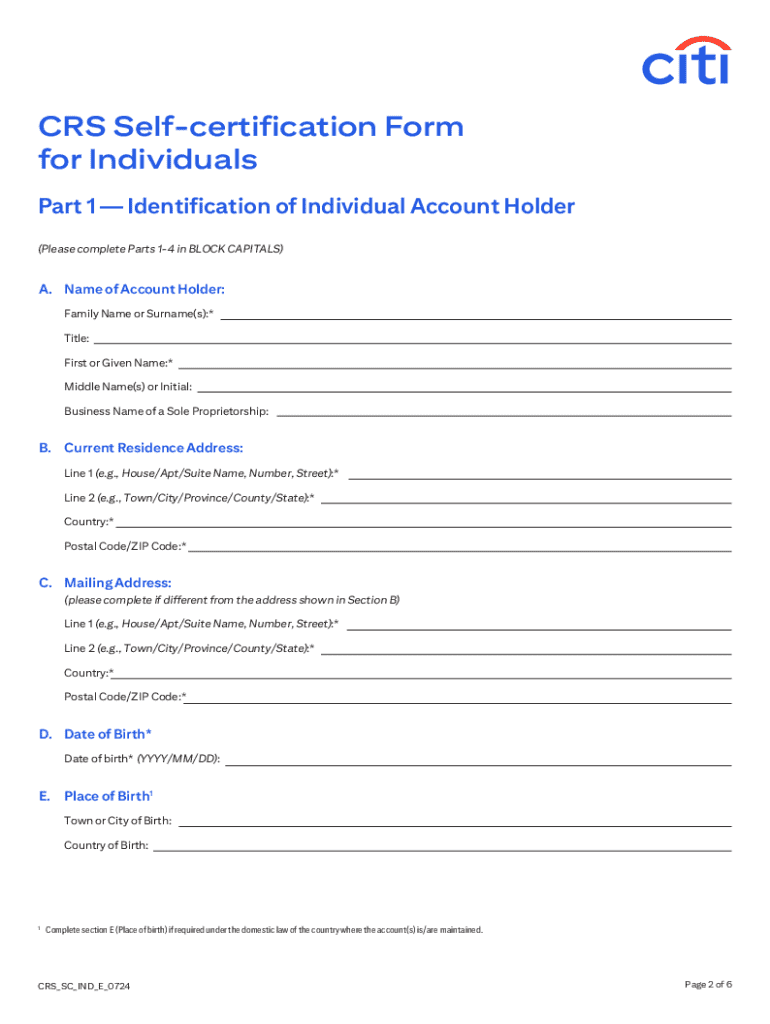

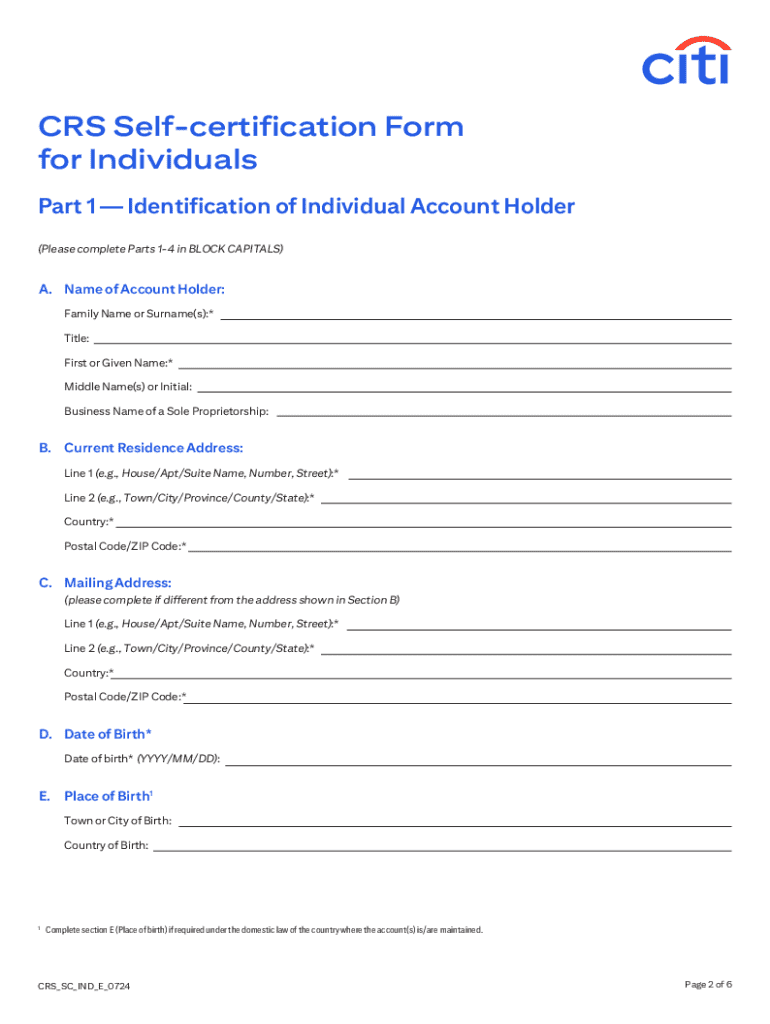

The CRS Self-Certification Form is a fundamental document for individuals and entities dealing with international financial activities. Established under the Common Reporting Standard (CRS), the form serves to identify the tax residency of account holders for the purpose of promoting tax compliance and financial transparency. It is particularly crucial in today's globalized economy where cross-border financial activities are commonplace.

The significance of this form cannot be overstated; it ensures that financial institutions can accurately report certain information about account holders to tax authorities in their respective countries. This not only helps in fulfilling international tax obligations but also significantly reduces the risk of tax evasion, thereby increasing compliance and accountability among global taxpayers.

Who needs to fill out the CRS self-certification form?

Typically, two main groups are required to complete the CRS Self-Certification Form: individual taxpayers and entities with foreign ownership or investments. Individual taxpayers include those who have financial accounts in jurisdictions where CRS is enacted, needing to certify their tax status and residency appropriately.

Entities, such as corporations or partnerships, which have foreign shareholders or are engaged in international transactions, must also submit this form. This requirement helps ensure that tax authorities are aware of potential tax obligations connected to these foreign holdings, fostering a spirit of cooperation and transparency.

Key components of the CRS self-certification form

Understanding the critical components of the CRS Self-Certification Form aids in accurate completion. The first section requires personal information, which includes full name and address—details that must correspond to official identification. Furthermore, the date of birth alongside the country of birth is essential, particularly for validating identity and residency.

Next, tax information is pivotal; it encompasses tax identification numbers (TINs) for each country where the individual or entity is a tax resident. Tax residency declaration is mandatory, detailing where one is tax liable, while capturing any specific exemptions or treaties preventing double taxation.

Lastly, the signature and declaration section is vital. By signing, individuals confirm that all provided information is accurate and truthful. It's important to underscore that misrepresenting information can lead to severe implications, including financial penalties or legal actions.

Step-by-step guide to completing the CRS self-certification form

Completing the CRS Self-Certification Form may seem daunting, but breaking it down into manageable steps simplifies the process immensely. The first step involves gathering necessary information. Collect documents such as your ID, tax identification numbers (TINs), and any other relevant certificates that exhibit your tax residency status.

The subsequent step is filling out personal details accurately and comprehensively. Ensure that the information matches your official documents to avoid discrepancies. When you reach the tax residency section, take time to understand your residency scenarios particularly if you hold citizenship in more than one country.

Once the form is filled out, reviewing your completed CRS Self-Certification Form is critically important. Common errors include incorrect TINs or mismatched residency declarations. A thorough double-check can save you from unnecessary complications down the line.

Finally, complete the process by signing and dating your form. Note that there are options for both digital and physical signing, depending on your situation and the requirements of the receiving institution.

Editing and managing your CRS self-certification form

After filling out the CRS Self-Certification Form, managing it effectively is essential. Utilizing pdfFiller offers several advantages for document management, including features for editing, annotating, and electronically signing the form with ease. The user-friendly interface allows for quick adjustments should your information change or if you need to correct any errors after initial completion.

Another benefit is the cloud-based convenience of pdfFiller. This functionality enables you to access and manage your documents from anywhere, making it easier than ever to ensure your form is current and accurate. This is especially useful for individuals and teams that may require collaboration when completing or reviewing the document.

Collaboration tools further enhance the ease of managing your CRS form. You can easily share the document with team members or advisors, allowing for real-time feedback and input, creating a seamless and inclusive approach to tax documentation.

Common pitfalls and FAQs

As with any form, there are common pitfalls that individuals encounter when completing the CRS Self-Certification Form. Misunderstandings about tax residency and tax identification numbers can lead to inaccuracies. It is essential to fully understand which country or countries regard you as a tax resident to accurately complete the form. Potential errors in providing TINs may also result in complications, including rejection of the form.

Several frequently asked questions arise among users of the CRS Self-Certification Form. For instance, what should you do if you’re a dual resident? It is advisable to consult your local tax authority or a tax professional to determine your obligations in such cases. Additionally, users often wonder how modifications in residency affect the CRS form, which typically requires resubmission to reflect those changes accurately.

Additional assistance and support options

Navigating tax documentation such as the CRS Self-Certification Form can be complex, so seeking additional assistance often proves beneficial. Working with tax professionals who have expertise in international tax matters can help clarify obligations and ensure compliance. They provide you with tailored advice to prevent potential pitfalls.

Moreover, leveraging online resources and tools, especially templates and guides available on pdfFiller, can provide valuable insights and streamline the completion process. Community forums also exist where users can share experiences and solutions, serving as a splendid support network for those needing guidance.

Staying compliant post-submission

After submitting your CRS Self-Certification Form, it is crucial to understand the next steps in maintaining compliance. Processing times can vary, so be prepared for a waiting period. Understanding what happens after submission helps reduce anxiety, as you can anticipate any feedback or follow-up from tax authorities.

Keeping records of your submission is equally important. Documentation serves as proof of compliance and offers essential protection should any disputes arise in the future. Additionally, should your circumstances change – such as moving to a new country – guidelines suggest you submit amended information promptly to ensure accuracy in tax residency declarations.

Final thoughts on the CRS self-certification form

Empowering yourself with knowledge around the CRS Self-Certification Form is vital to fulfilling your role in achieving tax compliance. By familiarizing yourself with the nuances of this crucial document, you can navigate your financial responsibilities with confidence. Eventually, leveraging platforms like pdfFiller not only enables efficient document management but also enhances your overall experience with filling out, signing, and storing your forms securely.

As you engage with the CRS Self-Certification Form, remember the benefits that come from being proactive and informed, positioning yourself to meet tax compliance requirements effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit crs self-certification form for online?

How can I edit crs self-certification form for on a smartphone?

How do I edit crs self-certification form for on an Android device?

What is crs self-certification form for?

Who is required to file crs self-certification form for?

How to fill out crs self-certification form for?

What is the purpose of crs self-certification form for?

What information must be reported on crs self-certification form for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.