Get the free Rev-1164

Get, Create, Make and Sign rev-1164

Editing rev-1164 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rev-1164

How to fill out rev-1164

Who needs rev-1164?

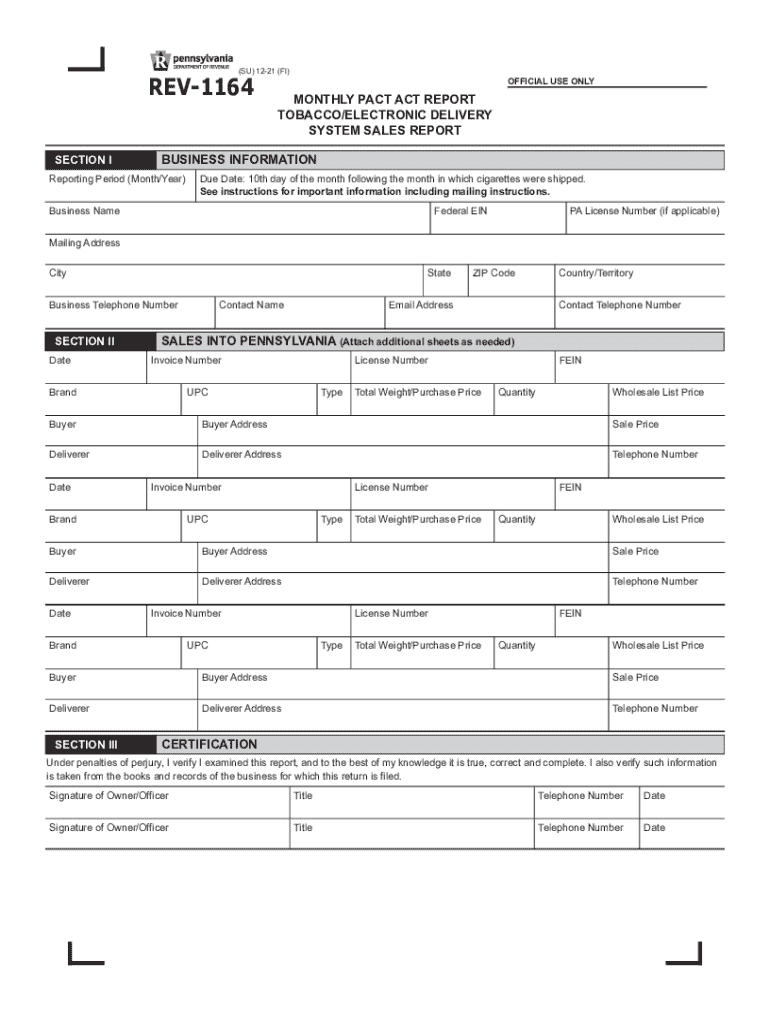

Complete Guide to the REV-1164 Form: Filling, Editing, and Managing Made Easy

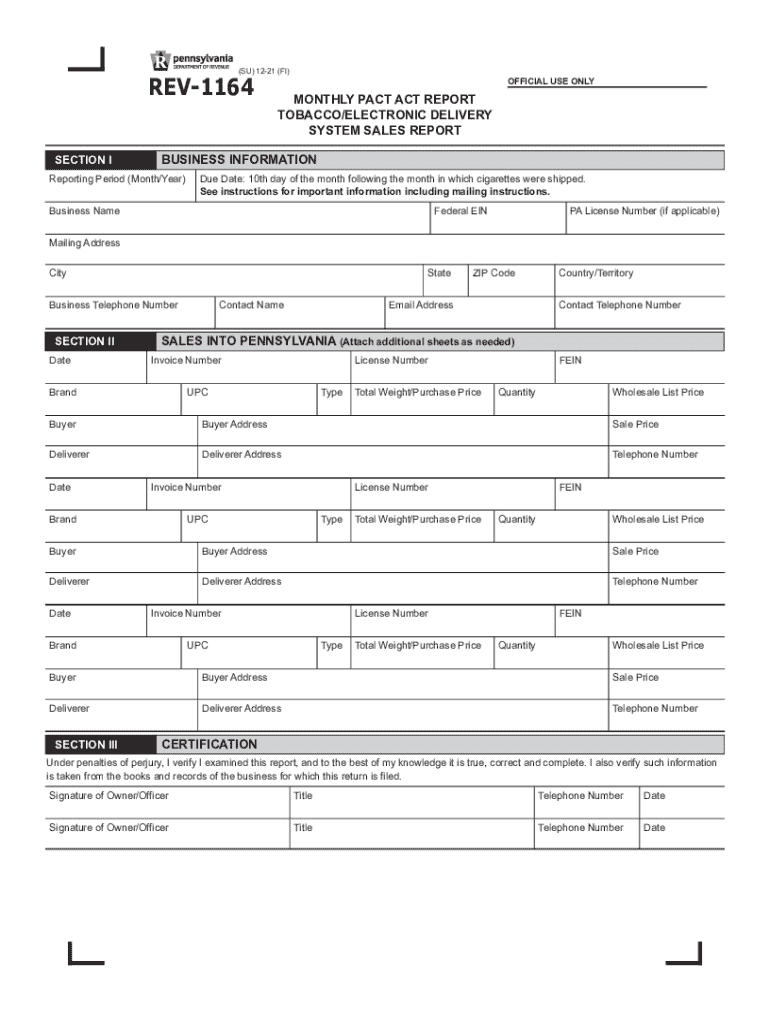

Understanding the REV-1164 form

The REV-1164 form is a crucial document used primarily in Pennsylvania for the purpose of claiming exempt status on sales and use tax. Its primary intent is to enable specific organizations such as non-profits and government entities to exempt themselves from sales tax obligations. Understanding the REV-1164 form is essential for businesses and organizations that wish to navigate their tax responsibilities effectively.

This form is typically required by organizations that qualify under the tax exempt category, ensuring compliance with state laws while taking advantage of available exemptions. The REV-1164 form is essential across various sectors from educational institutions to charitable organizations, highlighting its versatility and importance.

Key features of the REV-1164 form

The REV-1164 form contains several key features structured to simplify the process of documenting tax exemptions. Key sections make it easy to provide necessary information, ensuring clarity and accuracy. The form’s sections include personal information, exempt status details, and signatures, providing a comprehensive tool for claimants.

Accurate information is critical when submitting the REV-1164 form, as inaccuracies can lead to delays or denials of tax exempt status. Different users might require additional considerations based on their specific eligibility criteria, and it’s important to understand how these factors play into the overall process.

Steps for filling out the REV-1164 form

Filling out the REV-1164 form involves a few straightforward steps that can simplify the process significantly. Each step is crucial for ensuring that users provide the most accurate and comprehensive information.

Step 1: Gather necessary information and documents. Make sure you have your identification on hand, including your tax ID number. You’ll also need supporting documentation that validates your exemption claims, such as your organization's charter or incorporation papers.

Step 2: Access the REV-1164 form—the easiest way is through the Pennsylvania Department of Revenue website, where the form can be found in PDF format, or alternatively, it can be obtained from various tax offices.

Step 3: Fill in the form accurately. This process involves detailing personal information and financial details, including the nature of the purchases being claimed for exemption. Common pitfalls include leaving sections blank or misrepresenting your organizational status; double-check all entries to avoid these errors.

Editing and modifying the REV-1164 form

Editing your REV-1164 form may become necessary if you find that details need updates or corrections. Such modifications can prevent issues during submission and help maintain compliance. Utilizing tools like pdfFiller can make these edits seamless.

In pdfFiller, there is a step-by-step guide on editing your REV-1164 form where users can simply upload their completed document for re-editing. Additionally, comments or additional information can be inserted easily to clarify or expand on specific points.

Signing and submitting the REV-1164 form

Once the REV-1164 form is correctly filled out, signing and submission are the final steps to complete the process. Understanding eSignatures' legal validity is crucial, as these signatures carry the same weight as traditional ones in the eyes of the law.

Using pdfFiller, you can follow an interactive guide to sign the form electronically. This method is not only convenient but also speeds up the submission process. After signing, you'll need to choose a submission method—either online via the state portal or through traditional mail, depending on your preference.

Managing your REV-1164 form

After submitting the REV-1164 form, managing the document effectively becomes essential. A cloud-based platform like pdfFiller offers various features that allow users to store their documents securely and access them from anywhere at their convenience.

Furthermore, collaboration tools enable teams to work together on the REV-1164 form, enhancing productivity. With team members able to provide input and track changes, it fosters communication and efficiency. phpFiller ensures tracked changes and version history so that users can monitor their documents' evolution over time.

Frequently asked questions

Many users have questions surrounding the REV-1164 form. Common inquiries often concern filling out specific sections, the legal consequences of improperly handled exemptions, and what to do when encountering difficulties during submission.

If issues arise, pdfFiller provides excellent support resources to guide users through troubleshooting commonly shared problems. It’s beneficial to reach out or consult documentation whenever there's uncertainty regarding the submission process.

Conclusion

Utilizing the REV-1164 form is essential for organizations seeking sales tax exemption, and leveraging tools like pdfFiller can significantly enhance the efficiency of the process. By providing features for editing, signing, and managing documents from a centralized platform, users can streamline their operations.

Embracing these features not only simplifies the handling of the REV-1164 form but also empowers organizations to operate efficiently while ensuring compliance with all relevant tax regulations. The combination of accurate documents and effective management is key to a successful exemption process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify rev-1164 without leaving Google Drive?

Where do I find rev-1164?

How do I edit rev-1164 in Chrome?

What is rev-1164?

Who is required to file rev-1164?

How to fill out rev-1164?

What is the purpose of rev-1164?

What information must be reported on rev-1164?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.