Get the free Cement Masons & Plasterers 401(k) Trust

Get, Create, Make and Sign cement masons plasterers 401k

How to edit cement masons plasterers 401k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cement masons plasterers 401k

How to fill out cement masons plasterers 401k

Who needs cement masons plasterers 401k?

Cement masons plasterers 401(k) form: A comprehensive guide

Overview of the Cement Masons and Plasterers 401(k) plan

Understanding the importance of a 401(k) for cement masons and plasterers is crucial for preparing for retirement. The construction industry often comes with unpredictable job stability, making a reliable retirement savings plan essential. A 401(k) allows workers in this field to set aside pre-tax earnings, which then grow tax-deferred until retirement.

Key benefits of participating in a 401(k) include the ability to reduce taxable income, employer matching contributions, and the power of compounding interest over time. These advantages can significantly boost retirement savings, especially for those whose roles may not provide pensions or other guaranteed retirement benefits.

Eligibility criteria for enrollment in the Cement Masons and Plasterers 401(k) plan typically require a certain length of service and being actively employed in a qualifying job role. Familiarizing yourself with these factors is key for optimizing your participation.

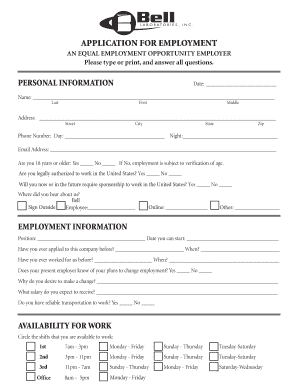

Essential forms and documents

To enroll in the 401(k) plan, specific forms and documents are essential. The following list outlines the required forms:

Accessing these forms is straightforward on pdfFiller, a tool designed for easy document management. You can follow this step-by-step guide to find the forms you need.

1. Visit the pdfFiller website. 2. Use the search bar to enter 'Cement Masons Plasterers 401(k) Form'. 3. Select the appropriate document type from the results. 4. Download or start editing directly online.

Completing the 401(k) enrollment form

Filling out the 401(k) enrollment form can seem daunting, but breaking it down can simplify the process. The form usually consists of several key sections, including personal information, employment details, and your contribution choices.

To ensure your form is completed accurately, consider these tips: Avoid common mistakes like reading questions too quickly, double-checking your entry for typos, and ensuring coherence in your personal information. Best practices include saving your progress frequently and utilizing online support through pdfFiller if questions arise during completion.

Managing your 401(k) contributions

Once you're enrolled, managing your contributions becomes critical. Filling out the contribution amount section should be done carefully to align with your financial goals. Consider factors such as current living expenses, upcoming financial responsibilities, and long-term retirement objectives when deciding on your contribution rate.

Understanding termination of deferrals is equally important. If you find yourself needing to pause contributions due to financial changes, it’s essential to inform your plan administrator and follow the correct procedures to prevent penalties.

Key forms and important documents for 401(k) management

There are several key forms and documents that participants need to manage effectively. The Summary Plan Description (SPD) serves as an overview of the plan features, providing clarity on benefits, eligibility, and any changes that may occur over time.

Frequently asked questions (FAQs)

New participants often have questions about managing their 401(k). Here are answers to some frequently asked questions:

Contact information for support

If you're facing challenges in managing your documents, don't hesitate to reach out for support. pdfFiller provides dedicated customer support to assist with anything related to your 401(k) forms and documents.

For further inquiries regarding the 401(k) plan, consider visiting the plan’s website for resources or FAQs tailored to the Cement Masons and Plasterers community.

Utilizing pdfFiller for document management

pdfFiller streamlines the document management process significantly. You can easily edit PDFs necessary for your 401(k) forms, ensuring they meet your needs perfectly before finalizing.

Interactive tools for enhanced understanding

To facilitate your understanding of 401(k) plans, pdfFiller offers interactive tools that can help clarify your options.

Best practices for 401(k) plan participants

To maximize the benefits of your 401(k), consider regularly reviewing your plan performance. Monitor investment growth, adjust your contributions as necessary, and stay informed about your investment options.

Balancing contributions with day-to-day financial needs is key, paving the way for a stable future once retirement arrives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute cement masons plasterers 401k online?

How do I edit cement masons plasterers 401k in Chrome?

Can I create an electronic signature for signing my cement masons plasterers 401k in Gmail?

What is cement masons plasterers 401k?

Who is required to file cement masons plasterers 401k?

How to fill out cement masons plasterers 401k?

What is the purpose of cement masons plasterers 401k?

What information must be reported on cement masons plasterers 401k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.