Get the free Corporate Online Banking Application

Get, Create, Make and Sign corporate online banking application

Editing corporate online banking application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate online banking application

How to fill out corporate online banking application

Who needs corporate online banking application?

Navigating the Corporate Online Banking Application Form

Understanding corporate online banking

Corporate online banking refers to the suite of financial services that banks offer to businesses via secure online platforms. This service enables companies to manage their finances from virtually anywhere, promoting efficiency and operational flexibility. The importance of corporate online banking cannot be overstated; it allows businesses to perform transactions, manage accounts, handle payroll, and generate reports with just a few clicks.

The benefits of corporate online banking include time savings, improved cash flow management, and the ability to monitor financial activities in real-time. Companies can access their accounts 24/7, allowing for immediate responses to cash flow challenges or financial opportunities. Additionally, online banking platforms are equipped with advanced security features such as encryption, multi-factor authentication, and fraud detection, ensuring that corporate data remains protected against cyber threats.

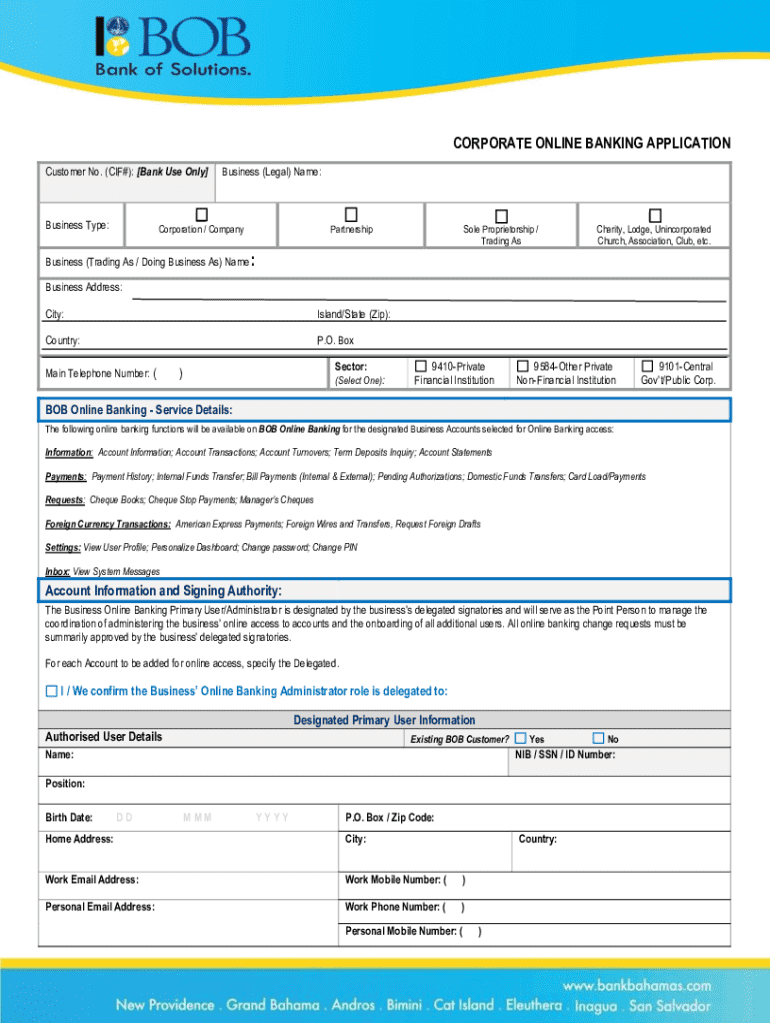

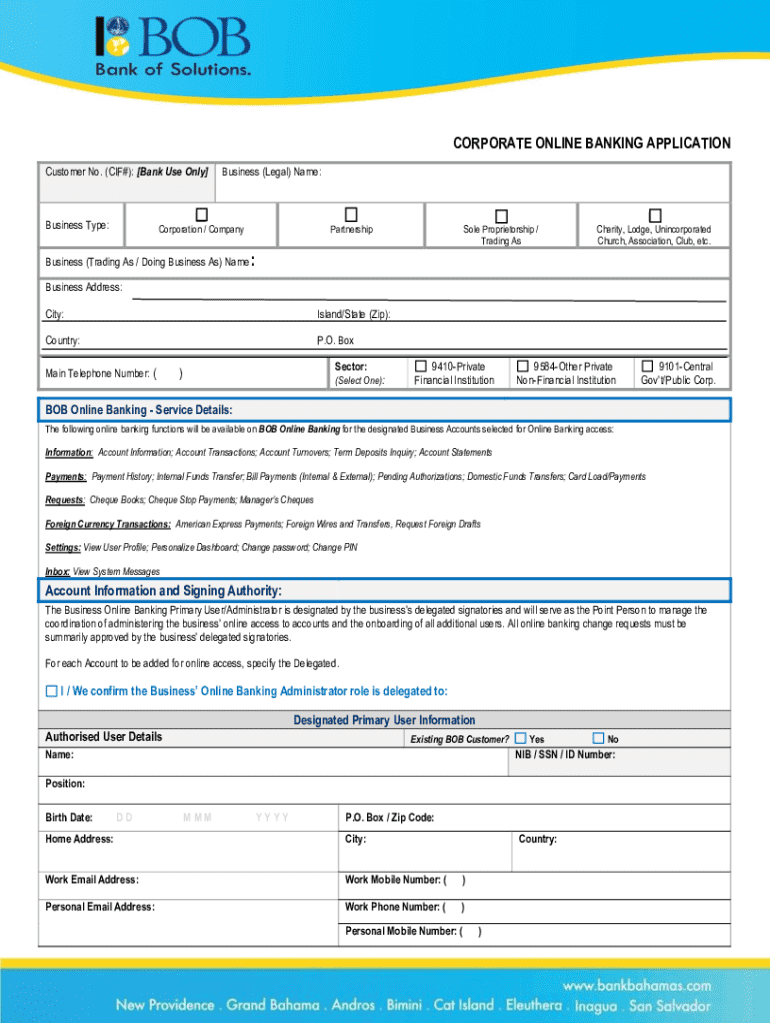

Overview of the corporate online banking application form

The corporate online banking application form is the initial step required by businesses to access the online banking services provided by their financial institution. This form collects essential information about the company, the nature of its banking requirements, and the authorized individuals who will manage the account. By filling out this form, businesses can request access to various online banking functionalities tailored to their operational needs.

The purpose of the application form is not only to enable access to banking services but also to ensure that the bank confirms the legitimacy and the operational needs of the business. Banks often have strict eligibility criteria, which may include the business's legal formation status, minimum account funding, and specific documentation verification.

Step-by-step guide to filling out the corporate online banking application form

Filling out the corporate online banking application form may seem daunting at first, but breaking it down into manageable steps can simplify the process. To start, gather all the required information and documentation. Missing data can delay processing times and may lead to complications.

Step 1: Gathering required information

Before you even open the application form, ensure you have the following documents prepared: identification documents for all authorized signatories, legal business documents such as incorporation papers, and your business’s tax identification number. This preparation is essential for a smooth application process.

Step 2: Completing the application form

The application form typically comprises several sections, each requiring specific information. Start with the business information section, where you'll provide details such as the legal name of the business, type of business entity, and contact details. Next, select the type of accounts you wish to open, whether it's a business savings account, checking account, or more specialized accounts. Lastly, you’ll need to include the authorized signatories, naming individuals who have permission to operate the account.

Step 3: Reviewing your application

Before submitting the application, take time to review the entire form for accuracy. Common errors such as misspelled names, incorrect identification numbers, and missing documents can delay approval. Double-checking all sections ensures that the application is both complete and accurate.

Interactive tools for completing the form

To streamline the application process, tools like pdfFiller provide features that make completing forms more efficient. With online fillable forms, you can edit and add necessary information quickly without printing anything out. This functionality saves time and reduces errors commonly associated with handwritten forms.

The platform also allows for real-time collaboration, meaning multiple team members can work on the form simultaneously, providing immediate feedback and reducing the chances of miscommunication. In addition to these tools, signing the form electronically is straightforward: you simply create a digital signature and apply it directly to the document, ensuring legal compliance with electronic signing regulations.

Submitting the application

After thoroughly reviewing your application and ensuring all information is accurately entered, it’s time to submit your corporate online banking application. Most banks will offer a variety of submission methods. You can often submit the form online via the bank's secure portal, email the scanned application, or even deliver it in person to your local branch.

Tracking the status of your application is just as important as the submission itself. Most banks provide notifications via email or text to inform you about the progress of your application. Setting notifications can help ensure that you stay updated, especially concerning any additional information the bank might require.

Frequently asked questions (FAQs)

While applying for corporate online banking, you might have several questions regarding the process. One common inquiry is what to do if you encounter issues with the online form. Most banks provide customer support to assist you with any technical problems or inquiries about specific sections of the application.

Another common question relates to the duration of approval. Approval times can vary significantly based on the bank and the complexity of the application, anywhere from a few hours to several days. If you find yourself needing to edit your application post-submission, many banks allow you to do so quickly, provided you reach out in a timely manner. Should your application be denied, the bank will typically provide a reasoning, allowing you to rectify any issues.

Customer support for the corporate online banking application

Accessing customer support can be crucial during the application process. Familiarize yourself with the best practices for contacting customer support representatives. Having relevant information ready, such as your business identification and application details, can expedite the resolution of your issues.

Utilizing resources, such as pdfFiller's Help Center, can also be incredibly beneficial. Here, you can access video tutorials and guides tailored to navigating the corporate online banking application effectively. They can provide visual, step-by-step processes, thereby enhancing your understanding.

Benefits of using pdfFiller for corporate online banking forms

Using pdfFiller to manage your corporate online banking forms offers a multitude of advantages. The platform's seamless integration with business processes allows companies to create, edit, and manage their forms digitally, which significantly reduces the need for physical paperwork. This not only enhances operational efficiency but also aligns with environmentally friendly practices.

Moreover, pdfFiller enhances document security and compliance. Features such as secure storage, audit trails, and legally binding electronic signatures ensure that your banking documents are well-protected. Businesses can have peace of mind knowing that their sensitive financial information and documentation are safeguarded against unauthorized access.

Tips for managing your corporate banking online efficiently

Once your corporate online banking is set up, managing your accounts effectively is crucial. Adopting best practices for online banking security is a top priority. Always use strong passwords, monitor account activity regularly, and enable two-factor authentication where possible. These measures will help protect your accounts from potential fraud and cyber threats.

Regularly monitoring your accounts allows you to track spending patterns and assess cash flow more effectively. Implementing a routine for account maintenance can save you pain points down the line, ensuring that you are aware of transaction limits, fee structures, and any upcoming changes to your banking policies.

Additional tools & guides for corporate banking

As the world of corporate banking continues to evolve, staying informed about related applications and document templates becomes necessary. Companies might benefit from leveraging various tools combined with their banking platforms to simplify processes such as invoicing, expense tracking, and financial reporting.

Keeping an eye on future enhancements and updates in online banking services will ensure that your business continues to operate efficiently. Innovations in technology can lead to even more streamlined processes, giving businesses the edge in financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in corporate online banking application?

Can I create an eSignature for the corporate online banking application in Gmail?

How do I edit corporate online banking application on an Android device?

What is corporate online banking application?

Who is required to file corporate online banking application?

How to fill out corporate online banking application?

What is the purpose of corporate online banking application?

What information must be reported on corporate online banking application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.