Get the free Form 990 (2023)

Get, Create, Make and Sign form 990 2023

How to edit form 990 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 2023

How to fill out form 990 2023

Who needs form 990 2023?

Form Form: A Comprehensive Guide for Nonprofits

Overview of Form 990

Form 990 is a crucial document that nonprofits in the United States must file annually. This form serves several critical purposes — primarily ensuring transparency and accountability within the nonprofit sector. By requiring detailed information about an organization’s financial performance and activities, Form 990 ensures that donations are used appropriately, thus instilling trust among donors and the general public.

In terms of compliance requirements, Form 990 is mandated by the IRS. Nonprofits that fail to file this essential document risk losing their tax-exempt status, which can severely impede their operations. For organizations seeking to build or maintain public credibility, completing and submitting Form 990 correctly is imperative.

In 2023, several key updates have been introduced to enhance the form’s clarity and the information it gathers. New reporting requirements were added to address contemporary issues like digital fundraising and operational transparency, making it imperative for organizations to stay updated with these changes to avoid potential penalties.

Understanding the structure of Form 990

The structure of Form 990 includes multiple sections, each serving a distinct purpose. An overview of these sections is essential for effective completion. The main sections include:

Familiarizing yourself with essential terminology is also crucial. Common terms include 'tax-exempt status,' 'revenues,' and 'functional expenses,' which have specific implications for nonprofits. Understanding these terms will facilitate a smoother reporting process.

Filling out Form 990 — step-by-step guide

Completing Form 990 requires careful preparation. First, gather all requisite information, including financial records and governance details. Having a well-organized collection of documents will ease the process significantly.

Now, let’s breakdown the filing process into actionable steps, focusing on how to fill out each part as follows:

Common mistakes to avoid include errors in financial reporting, like incorrect figures or omissions, and issues with data entry, where numbers are transposed or miscalculated. Double-checking your entries can save your organization from potential compliance issues.

Tips for efficiently managing Form 990

Utilizing tools like pdfFiller can greatly streamline the process of filling out Form 990. This platform offers interactive tools designed for easy editing and filling. For instance, its digital signature features ensure that your completed form meets compliance regulations efficiently.

Collaboration features further enhance usability. With capabilities for real-time editing and commenting, teams can work together seamlessly. The ability to share and review documents within the same platform eliminates communication hurdles often found in the traditional filing process.

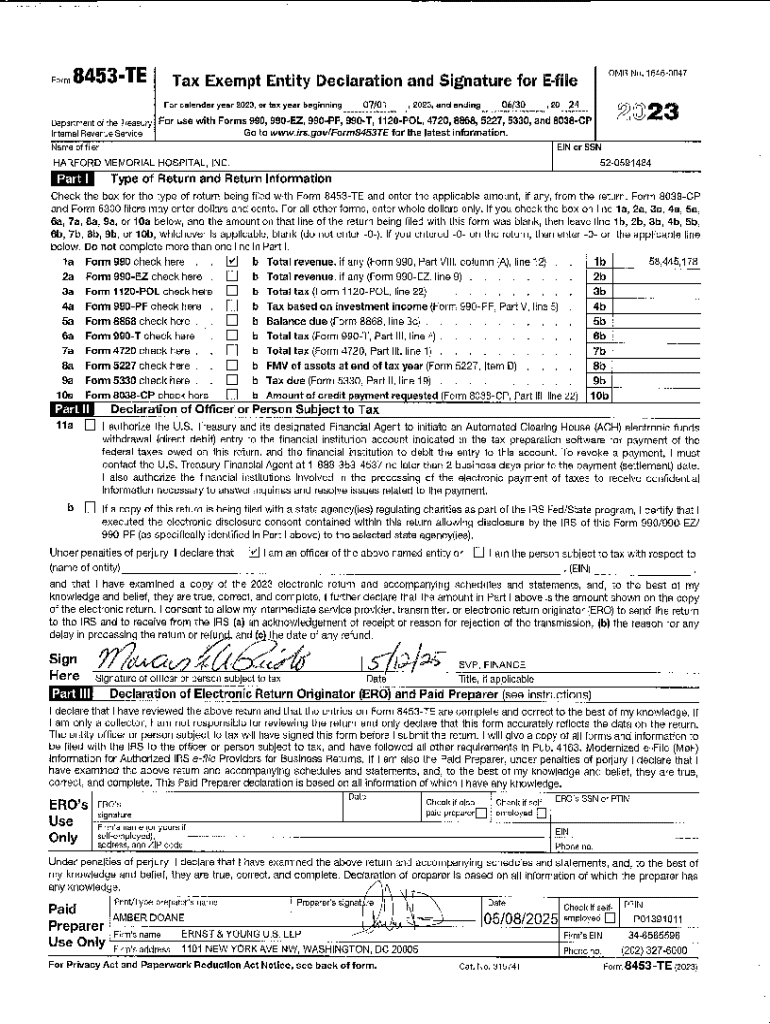

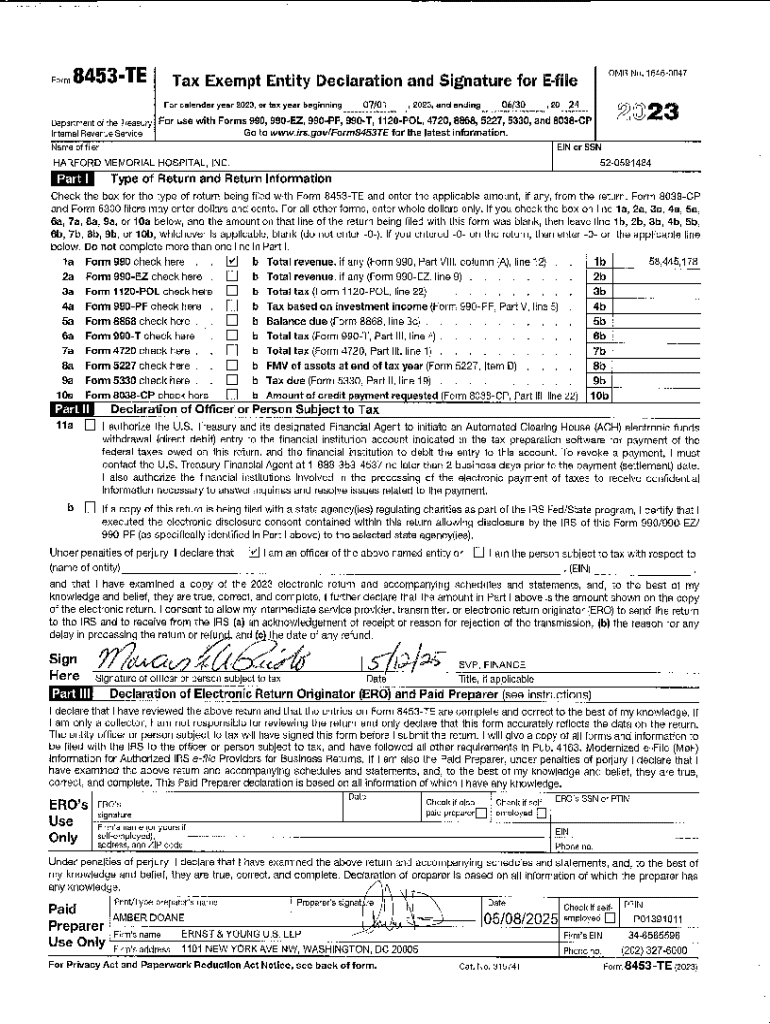

Finalizing and submitting Form 990

Once you've filled out Form 990, it's vital to conduct a review checklist before submission. Ensure that all information is accurate, complete, and well-organized. Don’t forget to include any required attachments such as financial statements or schedules.

Submission methods offer flexibility. You can choose between e-filing or paper filing, though e-filing is generally quicker and more efficient. Be aware of deadlines, as failing to file on time can lead to significant penalties, including fines or loss of tax-exempt status.

Post-submission steps

After submitting Form 990, you’ll want to track your submission carefully. Confirming receipt by the IRS is simple—typically, an acknowledgment will be generated for e-filed forms, while paper submissions may take longer to process.

In case the IRS sends correspondence regarding your submission, be prepared to respond promptly. Common IRS inquiries may relate to discrepancies in reported data or missing information. Addressing these queries efficiently will help maintain your nonprofit’s good standing.

Frequently asked questions

Understanding common questions about Form 990 can clear up confusion and equip organizations to manage this process more effectively. For example, what happens if Form 990 is filed late? Typically, late submissions result in penalties, and organizations may lose their tax-exempt status if they fail to file for three consecutive years.

Another common query pertains to public access to Form 990 data. Anyone can access Form 990 submissions through various online databases, ensuring organizational transparency. Lastly, if you need to amend an already filed Form 990, it's essential to file Form 990-X, providing clarity on corrections.

Resources for further assistance

For additional resources, accessing the IRS website is a vital step, where you can find the latest forms and comprehensive instructions. Additionally, pdfFiller offers a robust help center, ensuring users can navigate the complexities of Form 990.

Engaging with nonprofit support networks can also be beneficial. Many organizations offer workshops, webinars, and personal consultations that can enhance your understanding of Form 990 and improve your overall filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 990 2023 from Google Drive?

Can I create an electronic signature for signing my form 990 2023 in Gmail?

How do I edit form 990 2023 straight from my smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.