Get the free Form 40-f

Get, Create, Make and Sign form 40-f

How to edit form 40-f online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 40-f

How to fill out form 40-f

Who needs form 40-f?

A Comprehensive Guide to the Form 40-F Form

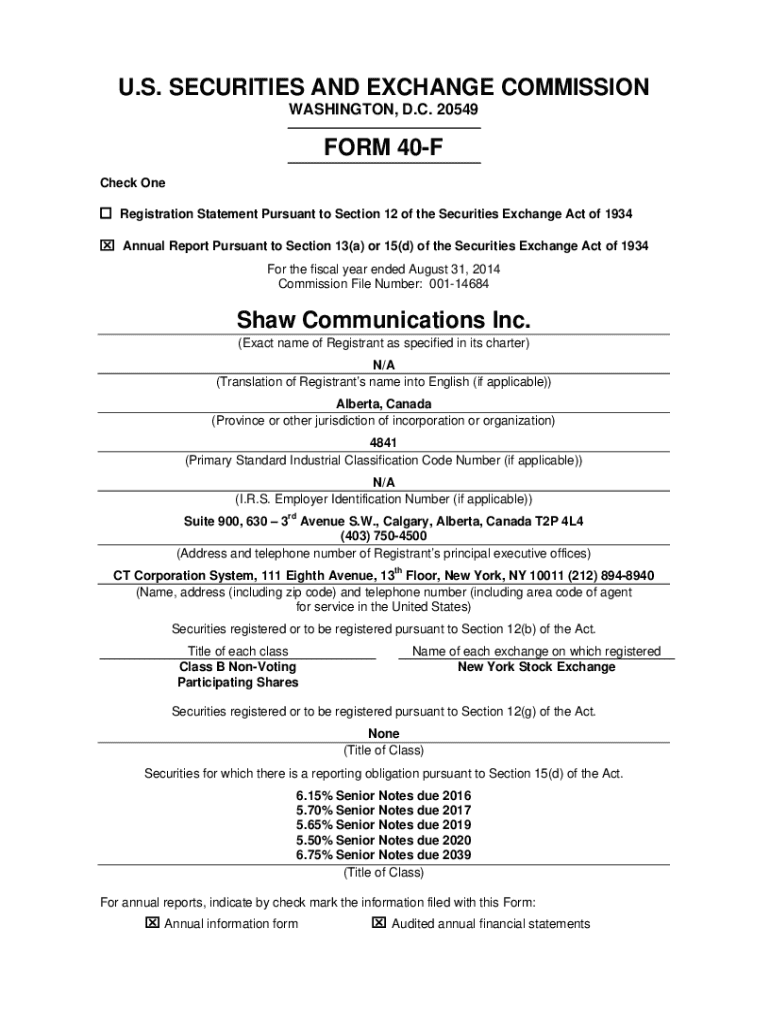

Understanding the Form 40-F

Form 40-F is a specific filing document used by certain foreign issuers in compliance with the regulations laid out by the U.S. Securities and Exchange Commission (SEC). This form primarily serves as a registration and reporting tool for foreign companies that trade on U.S. exchanges, allowing them to disclose essential financial and operational information to U.S. investors.

The importance of Form 40-F cannot be understated; it ensures that foreign companies adhere to the same high standards of transparency and accountability expected of domestic companies. By offering U.S. investors a clear insight into foreign entities, Form 40-F plays a critical role in fostering trust and facilitating capital flows between jurisdictions.

Key differences between Form 40-F and 20-F

While both forms aim to provide financial transparency, Form 40-F is specifically designed for foreign companies that are already listed on U.S. exchanges under certain conditions, whereas Form 20-F is used more broadly by foreign private issuers that want to register their securities in the U.S. An individual or company should opt for Form 40-F primarily when they meet the specific listing criteria set by the SEC.

Who needs to file Form 40-F?

Filing Form 40-F is required for foreign companies that have registered any of their securities under Section 12 of the Securities Exchange Act of 1934. Specifically, this includes companies that have more than 300 U.S. shareholders or different criteria that classify their SEC compliance needs. Understanding the eligibility criteria is crucial and can save organizations significant time and effort.

Moreover, foreign companies that are subject to the rules and regulations of a foreign jurisdiction must understand the implications they face when operating in the U.S. market. This includes special considerations for foreign-domiciled entities regarding their disclosure and compliance with U.S. financial accounting standards.

Contents of the Form 40-F

Form 40-F consists of several critical sections that cumulatively fulfill SEC requirements. Each section is aimed at providing detailed insights about the issuer’s operations, financial condition, and governance, thus ensuring transparency for investors. Understanding what goes into your Form 40-F can be the difference between a successful filing and a rejection.

Some of the primary sections and required components include financial statements, management's discussion and analysis (MD&A), risk factors, and corporate governance disclosures. Each of these sections serves a vital function in presenting a complete picture of the entity’s financial health and operational risks.

Filing process for Form 40-F

The filing process for Form 40-F consists of several organized steps that simplify preparation and submission. Begin by gathering all relevant documents, including financial statements and governance guidelines. A clear organization of these materials will facilitate a smoother completion of the form.

Next, each section of the form needs to be filled out carefully, ensuring compliance with the prescribed standards and criteria. An attention to detail at this stage can prevent delays due to incomplete filings or cross-referencing errors. Make sure of important deadlines; late submissions can result in penalties or reputational damage.

Common challenges and solutions

Filing Form 40-F presents various challenges, often stemming from misunderstandings about disclosure requirements. Frequent errors include failing to meet filing deadlines, incomplete information, or inaccuracies in financial reporting. Being aware of these common pitfalls can significantly reduce the risk of rejection from the SEC.

To surmount these challenges, implementing robust internal review processes is critical. Engaging teams in thorough discussions about disclosure expectations, and employing checklists can ensure completeness and accuracy, fostering a smoother filing experience.

Utilizing pdfFiller for Form 40-F

pdfFiller offers significant advantages when it comes to completing Form 40-F. The interactive platform allows users to edit documents easily and accurately, integrate financial data directly into the form, and streamline the eSigning process. These features simplify compliance and enhance operational efficiency.

Collaboration features enable team members to work on the same document simultaneously, allowing for real-time updates and input. This makes pdfFiller an invaluable tool for companies looking to ensure their filings meet the rigorous standards expected by the SEC.

Managing and storing your Form 40-F

Proper document management and storage solutions are essential in maintaining compliance for Form 40-F filings. Utilizing cloud storage solutions allows for secure, accessible, and organized filing of important compliance documents. This ensures that all necessary forms and supporting data are readily available for audits or future filings.

Additionally, consistently updating your documentation can safeguard against any discrepancies in future filings. By maintaining a well-organized archive of all submissions and drafts, a company can easily prepare for regulatory changes and audits.

Related forms and resources

In addition to Form 40-F, companies should be aware of Form 20-F, which serves a similar purpose for foreign entities but under different circumstances. Understanding when to interchange these forms is vital for ensuring compliance and legal integrity.

Additionally, companies should remain cognizant of other regulatory requirements such as Form 10-K or 8-K that might intertwine with their filing responsibilities. Each form serves distinct compliance purposes, and familiarity with this landscape is essential.

Stay connected and explore more

Continuing education and engagement with financial experts can enhance your understanding and efficiency in filing Form 40-F. Following resources like pdfFiller can provide ongoing insights and tips on compliance and document management.

Engaging with a community of similar professionals can provide invaluable support throughout the complexities of regulatory compliance. This collaborative approach can lead to improved practices and more effective navigation through financial disclosure requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 40-f online?

Can I create an electronic signature for the form 40-f in Chrome?

Can I create an eSignature for the form 40-f in Gmail?

What is form 40-f?

Who is required to file form 40-f?

How to fill out form 40-f?

What is the purpose of form 40-f?

What information must be reported on form 40-f?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.