Cash Advance Agreement Template free printable template

Show details

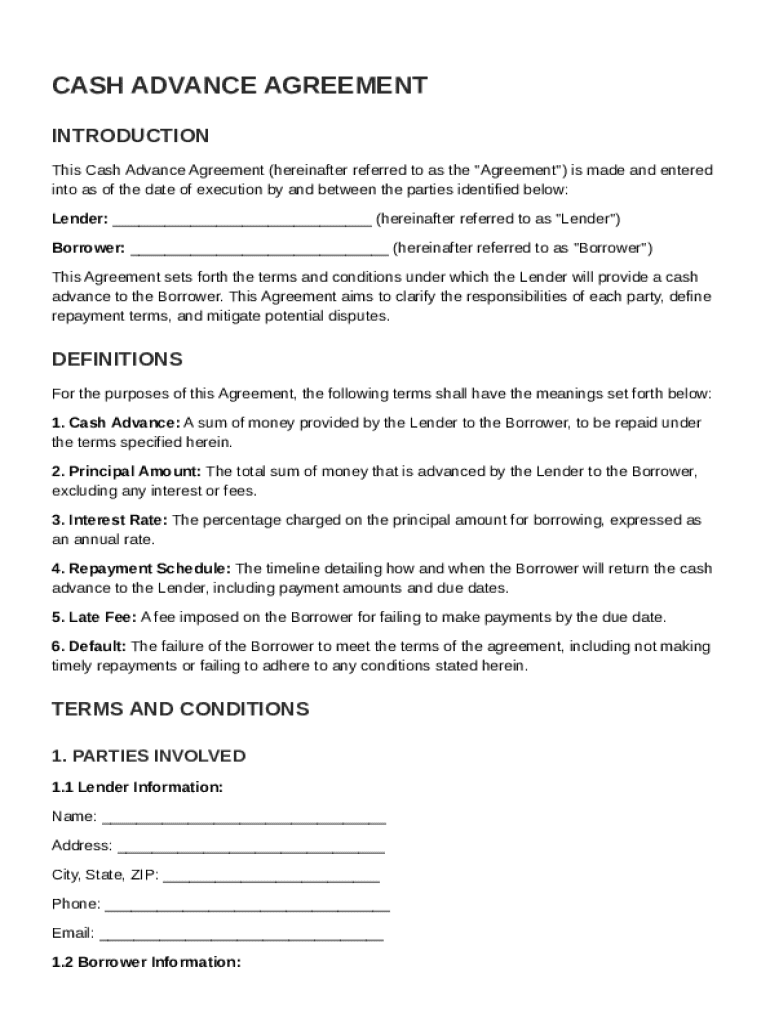

This document outlines the terms and conditions for a cash advance agreement between a Lender and Borrower, including responsibilities, repayment terms, and definitions of key terms.

We are not affiliated with any brand or entity on this form

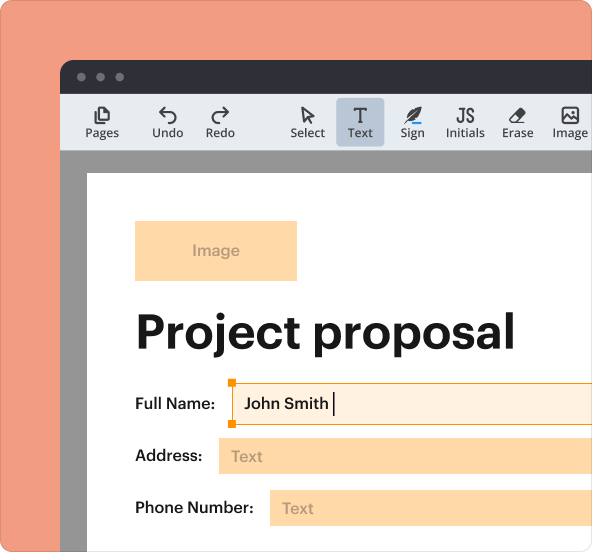

Why pdfFiller is the best tool for managing contracts

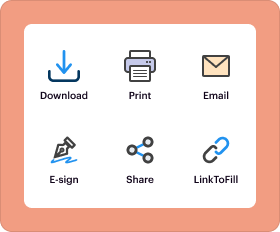

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Cash Advance Agreement Template

A Cash Advance Agreement Template is a legal document that outlines the terms and conditions under which a borrower receives a cash advance from a lender.

pdfFiller scores top ratings on review platforms

I enjoy the simplicity of it all!!

Pleased.

I found it helpful, but hard to find the print menu.

Great site for legal forms needed.

Sometimes I get lost or confused about how to save a document I have just uploaded as a pdf file, but then I find the "Save As" button.

very helpful and easy to navigate

Who needs Cash Advance Agreement Template?

Explore how professionals across industries use pdfFiller.

Cash Advance Agreement Template: Comprehensive Guide

A Cash Advance Agreement Template form is an essential document that outlines the conditions of a cash advance between a borrower and a lender. This guide will provide the comprehensive steps needed to understand, create, and manage this important agreement effectively.

What is a cash advance agreement?

A Cash Advance Agreement is a legally binding document that provides the terms and conditions under which a borrower agrees to receive a cash advance from a lender. Recognizing the importance of having a written agreement can help prevent misunderstandings and serve as a reference point in case of disputes.

-

It specifies the borrowing terms, interest rates, repayment schedules, and consequences of default.

-

A written agreement clarifies expectations and offers legal protections for both parties.

-

For borrowers, it provides access to funds, while lenders can engage in regulated lending practices.

What are the key terms defined in a cash advance agreement?

Understanding the key terms in a Cash Advance Agreement is critical to ensure both parties are on the same page.

-

This refers to a specific amount of money borrowed against a future income or revenue, intended for immediate use.

-

The principal amount is the actual sum of money borrowed, excluding interest and fees.

-

This is how the lender calculates the cost of borrowing money, usually expressed as a percentage.

-

This details when payments are due and the amount of each payment, critical for avoiding late fees.

-

Fees charged when a payment is not made by the due date, potentially increasing the overall cost of borrowing.

-

This occurs when a borrower fails to meet repayment obligations, which can result in serious financial consequences.

Who are the parties involved in the cash advance agreement?

In any cash advance transaction, two primary parties are involved: the lender and the borrower, each with distinct responsibilities.

-

The lender is the individual or institution providing the cash advance, responsible for outlining the loan terms.

-

The borrower must adhere to the terms of the agreement and repay the advance on time, fulfilling their financial obligations.

-

Both parties must include necessary contact information: name, address, and contact details to ensure accountability.

How to craft your cash advance agreement?

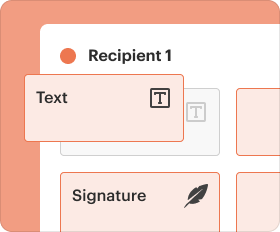

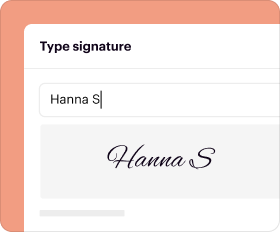

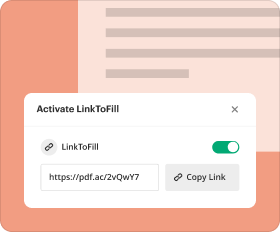

Crafting an effective Cash Advance Agreement requires clear articulation of terms and conditions. Using tools like pdfFiller can streamline this process.

-

Utilize the user-friendly interface to input all relevant details directly into the Cash Advance Agreement Template.

-

pdfFiller offers a variety of tools to customize the template to fit specific lending situations.

-

Incorporate electronic signatures to ensure the authenticity of the document, making it legally binding.

What details should you consider when determining a cash advance?

When determining a cash advance, clarity on certain details is important to make informed borrowing decisions.

-

Decide on the principal amount you wish to borrow, keeping in mind your repayment capabilities.

-

Clearly state how you intend to use the funds to maintain transparency and accountability.

-

Understanding the differences between fixed and variable rates can significantly impact your financial planning.

How to execute the agreement?

Executing a Cash Advance Agreement requires careful attention to detail, ensuring all procedural steps are followed.

-

Establish when the cash advance will be made and when repayments are due.

-

Ensure that both parties are adhering to local laws concerning lending practices and agreements.

-

Take advantage of pdfFiller’s features for organizing documents and tracking progress.

How to manage your cash advance after execution?

Once the Cash Advance Agreement is executed, effective management is essential to ensure compliance and prevent defaults.

-

Use pdfFiller’s management tools to track payments and stay on top of deadlines.

-

Maintain open lines of communication for updates, changes, or issues that may arise.

-

Be proactive in addressing late payments to avoid penalties and maintain a good relationship with your lender.

What common pitfalls should you avoid in cash advance agreements?

Avoiding common pitfalls can help ensure a smooth borrowing experience and protect your financial interests.

-

Ensure all terms and conditions are clear to both parties to prevent misunderstandings.

-

Neglecting to document agreements can lead to significant legal issues and disputes.

-

Understand the legal implications of defaults to safeguard against unexpected liabilities.

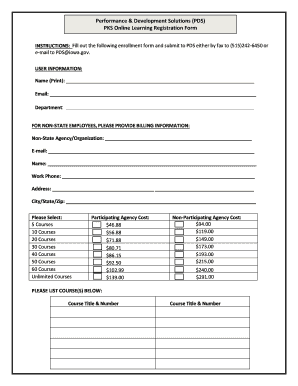

How to fill out the Cash Advance Agreement Template

-

1.Access the PDF template of the Cash Advance Agreement on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the lender's full name and contact details in the designated sections.

-

4.Next, enter the borrower’s information, including their name and address.

-

5.Specify the cash advance amount in the provided field.

-

6.Outline the repayment terms, including the repayment schedule and interest rates, if applicable.

-

7.Include any fees or additional charges related to the cash advance clearly in the agreement.

-

8.Review the document for accuracy, ensuring all information is correct and complies with legal requirements.

-

9.Finally, save the completed document and share it with the involved parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.