Corporate Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender provides a loan to a borrower, including definitions, loan amount, interest rate, payment terms, representations, covenants, events

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

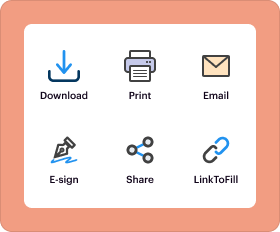

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Corporate Loan Agreement Template

A Corporate Loan Agreement Template is a legal document that outlines the terms and conditions under which a lender provides a loan to a corporation.

pdfFiller scores top ratings on review platforms

Love this

LIttle different to work through thought would be easier

Great

SMOOTH

gooood

I do a lot of forms for people and businesses and this app/website is a very good tool necessity for what I do.

Who needs Corporate Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Corporate Loan Agreement Template Guide

A Corporate Loan Agreement Template form enables businesses to secure financing needed for growth, operational expenses, or other financial needs. It ensures that all parties are on the same page regarding the terms and conditions of the loan arrangement.

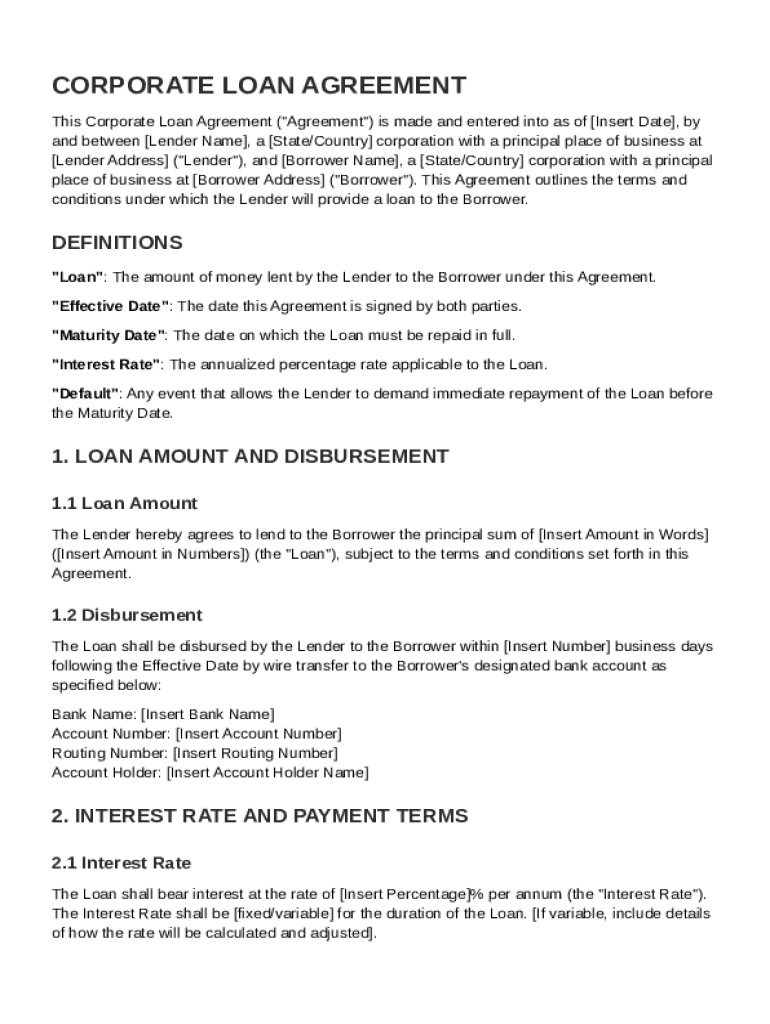

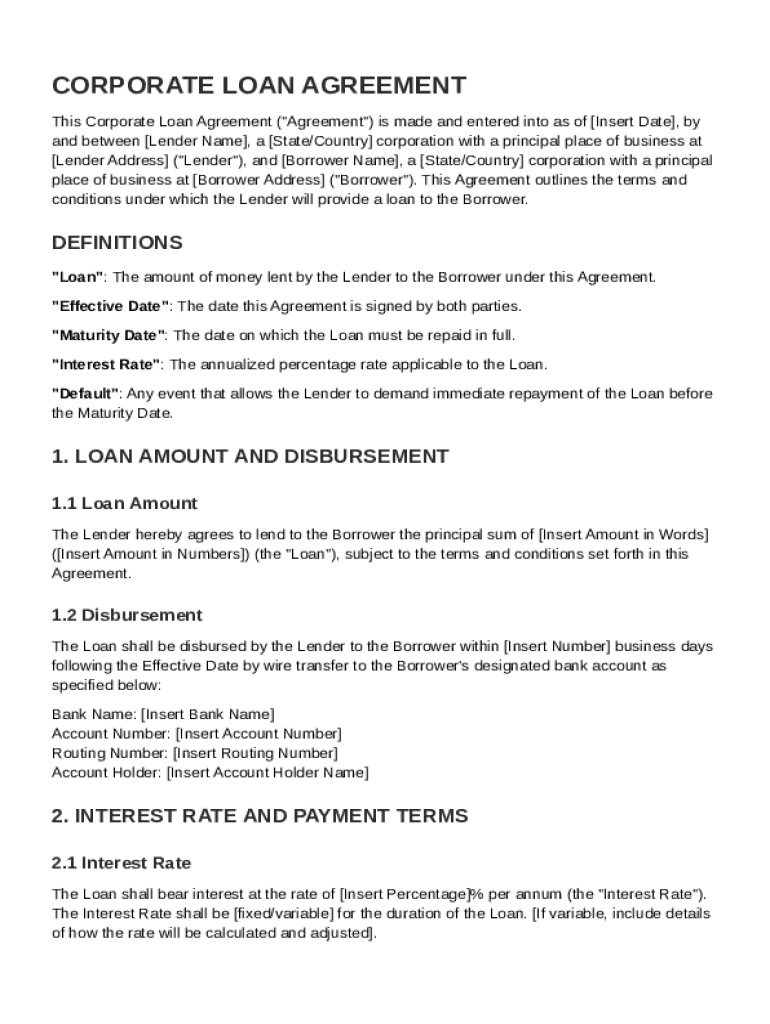

Understanding the Corporate Loan Agreement

A Corporate Loan Agreement is a legal document that establishes the terms under which one party lends money to another business. This agreement outlines important components such as the loan amount, interest rates, repayment terms, and the obligations of both the lender and borrower. Having a formal agreement is crucial as it protects the lender’s interests and offers a clear framework for repayment.

-

This agreement is a binding contract that defines the specific loan conditions between a lender and a business borrower.

-

These include loan amount, interest rates, repayment terms, and default conditions that govern the agreement.

-

It ensures clarity and legal protection for both parties, minimizing the risk of disputes.

Essential elements to include

To create a comprehensive Corporate Loan Agreement Template form, several essential elements must be included. These aspects ensure the agreement covers all necessary details for effective execution.

-

The effective date marks when the agreement is considered valid, requiring signatures from both parties.

-

Full legal names, addresses, and contact information must be provided to avoid ambiguity.

-

Details regarding the loan amount, repayment schedule, and terms should be clearly specified.

-

Indicate whether the interest rate is fixed or variable and explain the rationale behind it.

-

Clearly outline what constitutes a default, including non-payment or other breaches of the agreement.

Defining key terminology

Understanding key terms used in a Corporate Loan Agreement is vital for both lenders and borrowers. These definitions help clarify the obligations and rights of each party involved.

-

The loan refers to the sum of money borrowed that must be repaid within a specified period.

-

This is the date by which the full loan amount must be repaid, including interest.

-

The interest rate is a percentage of the loan amount charged as a cost of borrowing.

-

A default occurs when the borrower fails to meet the terms of repayment, triggering consequences as outlined in the agreement.

Loan amount and disbursement process

The loan amount and its disbursement process are critical aspects of the loan agreement. Determining the correct amount and understanding how funds are transferred can help facilitate smoother transactions.

-

Calculate the loan amount based on the borrower’s needs and the lender’s assessment of creditworthiness.

-

Detail the method of disbursement, whether through bank transfer, check, or other means.

-

Provide relevant banking information needed to process the transaction effectively.

Interest rate and payment terms explained

The interest rate and payment terms are crucial for determining the financial impact of taking a loan. Understanding these elements helps borrowers prepare for their repayment obligations.

-

A clear breakdown of how the interest rate affects monthly payments over the life of the loan.

-

Clarify how often payments are due, whether monthly, quarterly, etc., along with acceptable payment methods.

-

Include insights on how to calculate the total cost of the loan, including principal and interest.

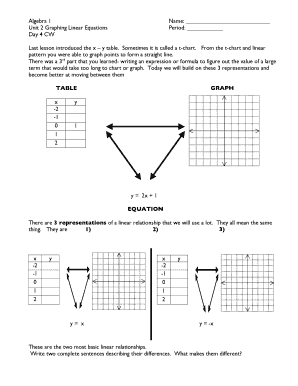

Step-by-step instructions for filling out the template

Filling out the Corporate Loan Agreement Template form requires careful preparation and attention to detail. Following a step-by-step guide ensures accuracy and completeness.

-

Collect necessary documents and details about loan terms, borrower information, and financials.

-

Follow a structured process from entering the effective date to securing signatures from both parties.

-

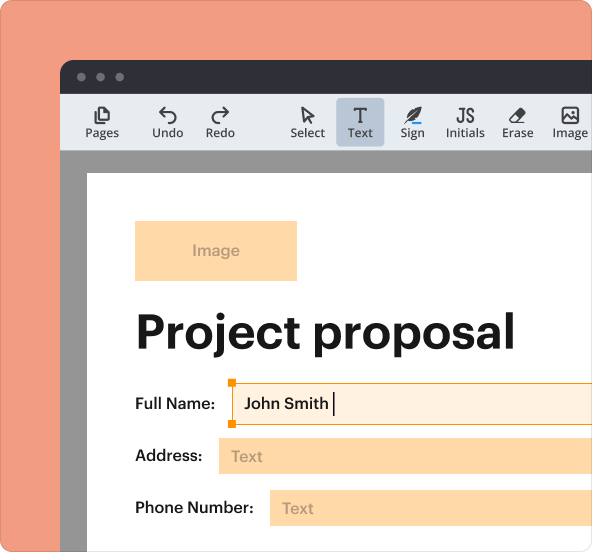

Use pdfFiller's platform for easy editing, completion, and management of the loan agreement.

Legal compliance and recommendations

Ensuring legal compliance is paramount when creating a Corporate Loan Agreement. Multiple factors including regional laws and best practices should be considered.

-

Understand specific regulations governing loans in your region to avoid legal issues.

-

Implement best practices such as having clear terms and obtaining professional reviews of the agreement.

-

Consulting a lawyer is advisable when drafting or modifying loan agreements to ensure legality.

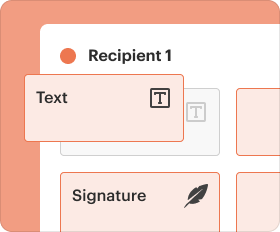

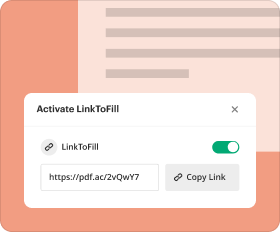

Interactive tools and features on pdfFiller

Utilizing pdfFiller can streamline the process of managing a Corporate Loan Agreement. The platform offers several features that enhance efficiency and collaboration.

-

Easily alter your Corporate Loan Agreement Template to meet specific requirements using intuitive editing tools.

-

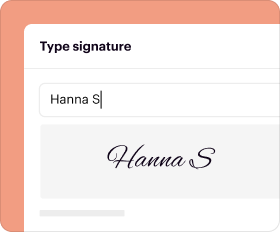

Facilitate collaboration with stakeholders by enabling eSigning directly on the platform, resulting in faster execution.

-

Organize and manage various documents in one place, ensuring easy retrieval and oversight.

How to fill out the Corporate Loan Agreement Template

-

1.Download the Corporate Loan Agreement Template from a reliable source.

-

2.Open the template in pdfFiller or a compatible PDF editor.

-

3.Begin by filling in the borrower's details, including the corporation's name, address, and contact information.

-

4.Next, input the lender's information, ensuring that the name and address are accurate.

-

5.Specify the loan amount in the designated field and clarify the interest rate and repayment terms.

-

6.Fill in the duration of the loan, including any grace periods, if applicable.

-

7.List any collateral being offered against the loan and its description in the respective section.

-

8.Detail the governing law clause, indicating which jurisdiction will oversee the agreement.

-

9.Review all the sections for completeness and accuracy before signing.

-

10.Once all fields are completed, save the document, and either print for wet signatures or send electronically for digital signing.

How do you write a loan agreement between companies?

A well-structured loan agreement should follow established practice and include these key sections in order: parties' details (names and addresses), loan amount and purpose, interest rates and calculation method, repayment schedule, security provisions (if applicable), and default conditions.

How do I create a loan agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

What is an inter corporate loan agreement?

A company can give loans and guarantees, acquire securities or make investments in another company or body corporate with the consent of the board or shareholders. Such loans given by a company to other companies or body corporates are known as inter-corporate loans.

How to write an agreement loan letter?

Loan Agreement Template Interest Rate. The Parties agree the Interest Rate for this loan shall be _% to be accrued monthly. Loan Term. This Loan shall be for a period of _ years/months. Repayment. The Parties agree the Borrower shall pay the Lender $ per month on the day of each month.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.