Convertible Note Contract Template free printable template

Show details

This document outlines the terms and conditions under which an investor provides a loan to a company in the form of a convertible note, detailing the conversion of the loan into equity, repayment

We are not affiliated with any brand or entity on this form

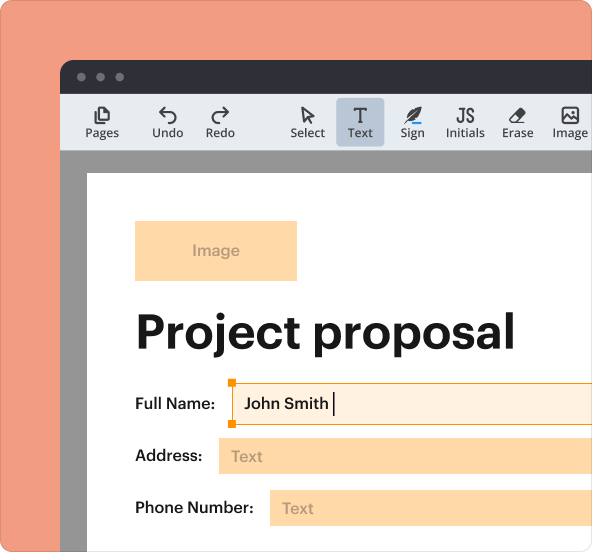

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Convertible Note Contract Template

A Convertible Note Contract Template is a legal document that outlines the terms under which a loan can be converted into equity in a company.

pdfFiller scores top ratings on review platforms

When going from preview back to editable view all imputed info disappeared. Not sure why that happened but I selected cancel and all info reappeared.

As a new user, I found the software easy to use even without taking the tour.

I feel like being able to do this (fill in forms) is almost a miracle. But like with most good things you have to practice, which I will be happy to do. Thank you.

I am about to try a "big" project: i.e. preparing a Pre-printed PDF format Quit Claim Deed. If PDFfiller doesn't work I will have to invest in a typewriter. I'll update this again if I can when I have finished.

Very cool and useful perfect for everything I needed.

I like the features but am trying to use this as an educational tool for college students interested in criminal justice.

very good, it is a little hard to navigate. The user interface could be cleare

Who needs Convertible Note Contract Template?

Explore how professionals across industries use pdfFiller.

Convertible Note Contract Template Guide

How does a convertible note work?

A convertible note is a form of short-term debt that a startup can issue to investors, essentially allowing them to convert their investment into equity at a later date. Investors provide funding to the startup, and in return, they receive a convertible note that specifies the terms of the loan, including the interest rate and the maturity date. This type of financing is crucial for startups seeking to raise funds quickly without having to assign a specific valuation to the company upfront.

What are the key features of convertible notes?

-

Convertible notes allow startups to postpone determining their valuation until a later financing round, which can attract more investors.

-

They usually come with a nominal interest rate, which accrues until conversion or payment.

-

This is when the note must convert into equity or be repaid, putting pressure on the company to follow through with its financing plan.

-

Investors often receive shares at a discount compared to the next round of investors to reward early risk.

What are the core components of the convertible note agreement?

-

Include the effective date of the agreement, marking when the terms apply.

-

Clearly identify the company and investors to establish legal responsibilities and rights.

-

Specify the exact amount being borrowed to maintain transparency between the parties.

-

Detail the interest to be charged, providing clarity on potential future repayments if conversion does not occur.

-

Indicate when the note will mature, triggering either conversion to equity or repayment.

-

Define what qualifies as future funding that allows conversion of the notes into equity.

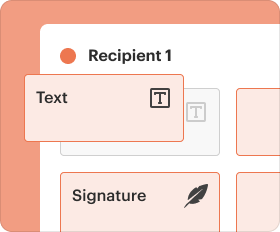

How do you fill out your convertible note agreement?

Completing a convertible note agreement requires careful attention to detail. Start with the template, filling in the parties involved, fund amounts, and other critical terms. Utilize interactive tools available on pdfFiller for document editing, allowing you to easily modify the template according to your specific requirements.

-

Follow the guidelines to ensure each section is completed in accordance with legal standards.

-

Use pdfFiller to make edits seamlessly and enhance the document's presentation.

-

Be cautious about omitting critical information, as this can lead to legal complications down the line.

What are the legal considerations and compliance for convertible notes?

When creating a convertible note, it's essential to comply with local regulations. Different regions may require specific legal frameworks that govern investment contracts. Failure to adhere can lead to severe consequences, including penalties or invalidation of the contract.

-

Research the legal requirements specific to your region to ensure all bases are covered.

-

Understand the risks of not following the stipulated terms, which could affect investor trust.

-

Consulting with a legal expert can save time and mitigate risks in the drafting process.

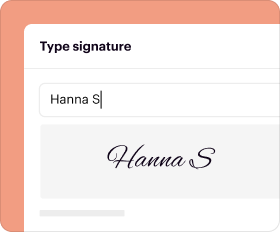

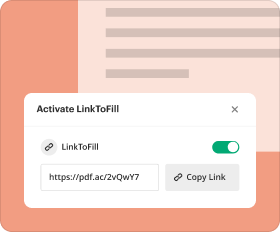

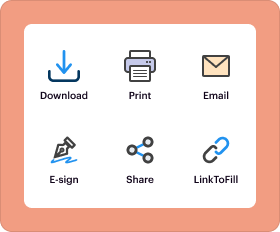

How do you sign and manage your convertible note online?

Digital signature solutions like eSigning through pdfFiller can streamline the process of finalizing your convertible note agreement. This not only saves time but also enhances collaboration among various stakeholders who may need to review and sign the document.

-

Follow the prompts on pdfFiller to easily add your electronic signature.

-

Utilize tools for multiple stakeholders to ensure everyone involved can contribute efficiently.

-

Store the completed agreement on the cloud and share it securely with interested parties.

What are best practices for long-term management of convertible notes?

-

Keep records of payment schedules to ensure obligations are met promptly.

-

Maintain good investor relations by staying transparent about updates or changes in the business.

-

Plan ahead for the best timing to convert notes into equity to benefit both the company and investors.

What are the latest industry insights on convertible notes?

The landscape of convertible financing is constantly evolving. Currently, trends indicate a growing preference for convertible notes among early-stage startups due to their flexibility and reduced negotiation friction. Case studies showcase successful financing models leveraging notes, underscoring their viability as a strategic fundraising tool.

-

Investors show increased adaptability in negotiation processes surrounding convertible notes.

-

Numerous startups have raised substantial funds through convertible notes, demonstrating their effectiveness.

-

Industry professionals predict that convertible notes will continue to play a significant role in startup financing strategies.

How to fill out the Convertible Note Contract Template

-

1.Begin by downloading the Convertible Note Contract Template from pdfFiller.

-

2.Open the document in pdfFiller and review the sections to understand its structure and required information.

-

3.Fill in the 'Investor Details' with the name and contact information of the investor providing the funds.

-

4.Input the 'Company Information', including the name and address of the startup seeking investment.

-

5.Determine and enter the 'Loan Amount' that the investor is providing to the company.

-

6.Set the 'Interest Rate' as per the agreement terms between the investor and the company.

-

7.Specify the 'Maturity Date', which is the date when the note must be repaid if not converted into equity.

-

8.Describe the 'Conversion Terms' clearly outlining how and when the loan can be converted into equity.

-

9.Review all sections for accuracy and clartity before making any necessary adjustments.

-

10.Once complete, save the document and share it with all parties involved for signatures.

-

11.Ensure that both the investor and the company retain copies of the signed contract for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.