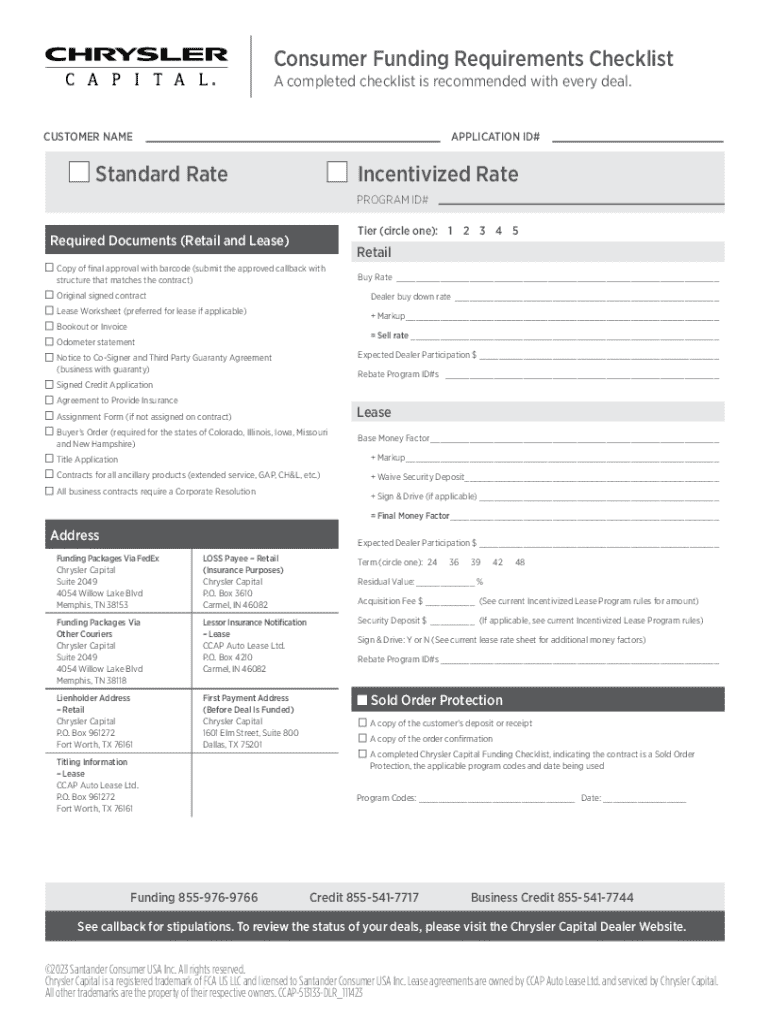

Get the free Consumer Funding Requirements Checklist

Get, Create, Make and Sign consumer funding requirements checklist

How to edit consumer funding requirements checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer funding requirements checklist

How to fill out consumer funding requirements checklist

Who needs consumer funding requirements checklist?

Consumer funding requirements checklist form: Your ultimate guide

Understanding consumer funding requirements

Consumer funding encompasses any financial assistance or resources that individuals leverage to secure loans or credit to fulfill their needs. Understanding the key components of funding requirements is vital, as these elements affect your potential for securing financial support. Various factors influence these requirements, including credit score, income level, and existing debt, which collectively determine how lenders evaluate your application.

The landscape of consumer funding options is diverse, ranging from mortgages and personal loans to credit cards and auto financing. Each category presents its own specific requirements that need to be understood to maximize your chances of approval. Familiarizing yourself with the ins and outs of these funding options is essential for anyone looking to navigate the often-complex world of consumer financing.

Essential components of a consumer funding requirements checklist

A consumer funding requirements checklist is a crucial tool designed to facilitate the preparation of your funding applications. It typically consists of several key components, ensuring that all necessary information is collected for a smooth approval process.

Moreover, the checklist can be customized based on your specific situation. For instance, first-time borrowers might require different documentation than those seeking to refinance existing loans. Additionally, specific loan types, like mortgages or personal loans, have distinct requirements that must be accounted for.

Step-by-step instructions for completing the checklist

Successfully filling out the consumer funding requirements checklist requires preparation and attention to detail. First things first, gather all necessary documents, including identification, financial paperwork, and evidence of credit history. Reviewing your financial capability is also important, as understanding your current debt-to-income ratio will help you evaluate how much you can afford.

Once you have your documents, start completing each section of the checklist systematically. In the personal information section, include your details accurately to avoid any mistakes. The financial information section needs to reflect your current financial standing, while credit and income verification should provide clear evidence of your repayment ability.

Ensure that all details are accurate and compliant with lender requirements; any discrepancies can lead to delays or denials during the approval phase.

Tips for using the consumer funding checklist effectively

Utilizing a consumer funding requirements checklist effectively requires careful attention to detail. One common mistake is overlooking the fine print in the documentation requirements, which can lead to incomplete applications. Take extra time to cross-check each item on your checklist before submission.

In today's digital age, leveraging technology can significantly streamline the process. Tools such as pdfFiller offer cloud-based solutions for document creation and editing, which can be immensely helpful. These solutions not only allow for better organization but also facilitate real-time collaboration, making it easier for individuals and teams to manage their applications.

The significance of document management in the funding process

Proper document management cannot be understated when it comes to securing funding. Well-organized documentation not only eases the approval process but also plays a significant role in determining interest rates and terms. Lenders typically favor applicants who present their materials in an orderly fashion, as it reflects diligence and responsibility.

With tools like pdfFiller, users can easily create, edit, and eSign documents, facilitating every step of the funding process. The platform provides real-time collaboration features, allowing teams to engage effectively while accessing their documents from any location. This cloud access streamlines communication and enhances efficiency, making it easier to finalize applications.

The funding application journey: From checklist to approval

Completing the checklist is only the first step in your funding journey. Once all necessary information is compiled, the next stage involves the submission of your application. Typically, this includes submitting the completed checklist along with the supporting documents to your chosen lender.

Understanding the review process is crucial; lenders will scrutinize your information, verify your credentials, and assess your financial stability. Preparation is key; ensuring all required documents are organized can simplify this process. After submission, ensure you're available to answer any queries from the lender regarding your documentation.

Case studies: Successful funding through effective checklist use

Many individuals have successfully navigated the funding landscape by utilizing a comprehensive consumer funding requirements checklist. For instance, one first-time borrower who meticulously followed the checklist secured a home mortgage with favorable terms after providing all required documentation accurately.

Additionally, a small business team that collaborated using pdfFiller's document management tools was able to streamline their application for a business loan. By working together, they accessed and edited their files in real-time, resulting in a successful funding outcome. These case studies highlight the effectiveness of using a well-prepared checklist combined with the right technological tools.

FAQs about the consumer funding requirements checklist

Navigating a consumer funding application often brings questions to mind. For instance, many applicants worry about what documentation is crucial for approval or how to handle timelines effectively. Understanding what to include in your application will save time and reduce anxiety. Be aware that the timeline for approval can vary, often depending on the lender and the complexity of your application.

If your application is denied, it is essential to seek clarification from the lender regarding the reasons for denial. Often, issues stem from incomplete documentation or insufficient financial evidence. Addressing these concerns promptly can enhance your chances in future applications.

Valuable resources for funding insights

For individuals seeking further guidance, numerous resources provide insights on consumer funding. There are guides available that break down the nuances of different loan types, along with tools designed for budgeting and financial planning.

Additionally, community support platforms can offer assistance and share experiences among borrowers. Engaging with these resources enhances your understanding of the funding landscape, equipping you with the knowledge needed to make informed decisions.

About pdfFiller: Your partner in document management

pdfFiller stands out as a reliable partner in document management, empowering users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. It simplifies the process of document handling, ensuring that you have all the tools you need at your fingertips.

Users have reported increased efficiency and satisfaction when utilizing pdfFiller's services. With built-in PDF editing capabilities, eSigning solutions, and collaboration features, pdfFiller is geared toward making the funding process as smooth as possible.

Stay informed: Trends in consumer funding

The world of consumer funding is evolving rapidly, with emerging trends and innovations shaping the way individuals access financial support. Recent statistics indicate a rise in digital lending platforms, providing alternatives to traditional banks. These innovations create more diverse consumer funding solutions tailored to modern financial needs.

Staying informed about compliance and regulatory changes is equally important. As consumer finance regulations shift, being aware of these changes ensures that you are prepared and compliant, making it easier to navigate the complex landscape of consumer funding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consumer funding requirements checklist for eSignature?

How do I edit consumer funding requirements checklist in Chrome?

Can I edit consumer funding requirements checklist on an iOS device?

What is consumer funding requirements checklist?

Who is required to file consumer funding requirements checklist?

How to fill out consumer funding requirements checklist?

What is the purpose of consumer funding requirements checklist?

What information must be reported on consumer funding requirements checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.