Get the free Cfop 170-14

Get, Create, Make and Sign cfop 170-14

Editing cfop 170-14 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cfop 170-14

How to fill out cfop 170-14

Who needs cfop 170-14?

A Comprehensive Guide to the cfop 170-14 Form

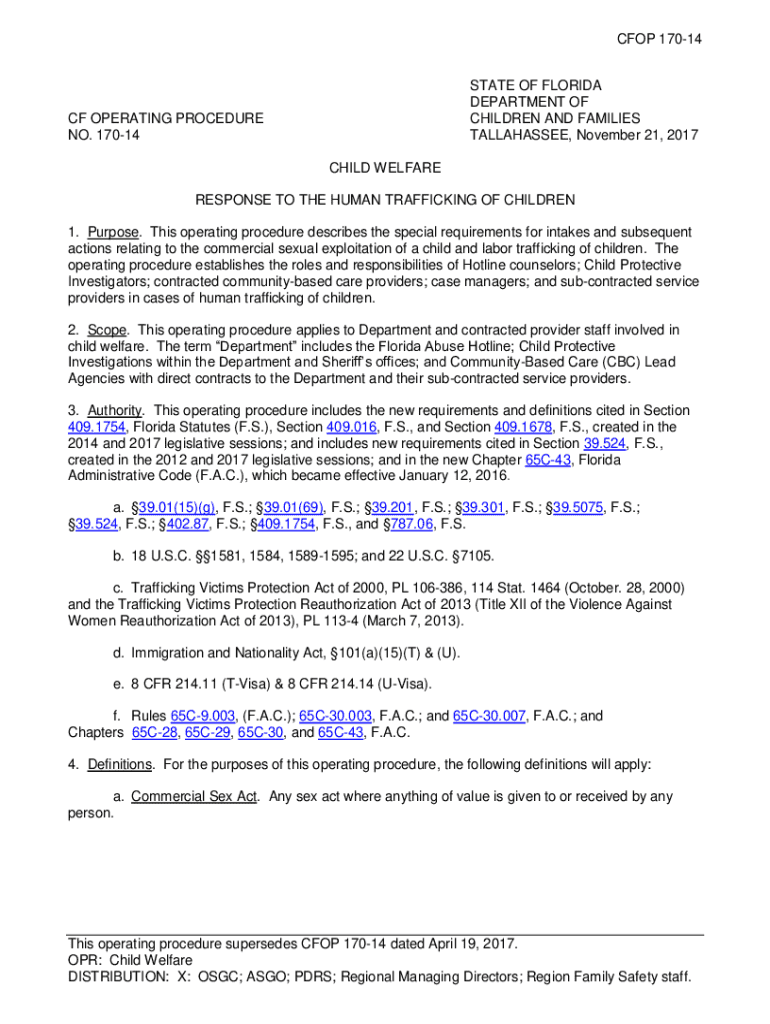

Understanding the cfop 170-14 form

The cfop 170-14 form is an essential document that plays a crucial role in various tax and business transactions, particularly in the context of property transfers and sales. This form helps ensure compliance with state tax regulations and provides necessary information that federal and state authorities require for accurate reporting. Filing this form accurately is vital as it impacts both the tax obligations of involved parties and overall financial transparency.

The importance of the cfop 170-14 form cannot be overstated. When properly completed, it helps avoid potential legal issues connected with improper reporting, underpayment of taxes, or incorrect documentation of asset transfers. For businesses and individuals alike, ensuring that every detail is filled out correctly not only maintains compliance but also fortifies trust among stakeholders involved in business transactions.

Who needs the cfop 170-14 form?

Various individuals and businesses find themselves needing the cfop 170-14 form. Typically, this includes real estate agents, property sellers, buyers, and legal professionals involved in property transactions. Specifically, those who engage in interstate transactions may find themselves under particular scrutiny and thus require the precise documentation provided by the cfop 170-14.

Scenarios that necessitate filing this form can include the sale of commercial properties, transfers of ownership, and situations where tax implications or assessments need to be documented formally. Understanding whether you need to fill out the cfop 170-14 form before engaging in a property transaction can save you time and potential issues later on.

Key components of the cfop 170-14 form

The cfop 170-14 form consists of several key sections that provide a comprehensive overview of the transaction being reported. Understanding the specified components is crucial for accurate completion, so let's break that down.

Common terminology

As with many legal documents, the cfop 170-14 form contains specific terminology that may not be familiar to all users. It’s beneficial to understand these terms to navigate the form more effectively.

Step-by-step instructions to fill out the cfop 170-14 form

Completing the cfop 170-14 form may seem daunting, but following a structured approach can simplify the task. Preparation is key to this process, so let's break down the steps.

Preparation before you start

Before you begin filling out the cfop 170-14 form, gather all necessary documents and information. This includes the title deed, tax identification numbers for all parties, financial statements, and details regarding the property involved. Having this information at hand will enable you to fill out the form accurately.

Filling out the form

Completing each section methodically helps in minimizing mistakes and ensures that you gather all necessary information.

Visual aids

Utilizing examples of completed cfop 170-14 forms as visual aids can significantly enhance your ability to fill out the form correctly. Viewing examples helps clarify what information is expected and can help you avoid common pitfalls.

Editing and verification of your cfop 170-14 form

Once the cfop 170-14 form is filled out, the next crucial step is editing and verifying the information provided. It's essential to review each section thoroughly to ensure accuracy.

Using pdfFiller to edit your form

pdfFiller offers a user-friendly platform for editing your cfop 170-14 form. With its editing tools, you can make adjustments, correct errors, and update any missing information quite conveniently. The benefits of using a cloud-based editing tool include real-time collaboration with team members and the ability to access your forms anytime, anywhere.

Checklist for verification

eSigning the cfop 170-14 form

eSigning the cfop 170-14 form enhances its security and allows for quick processing. The legal implications of eSigning are significant; it binds all parties to an agreement and ensures that the document holds up in court if necessary.

How to eSign using pdfFiller

Using pdfFiller, eSigning your cfop 170-14 form is straightforward. To electronically sign the form, follow these steps:

If there are multiple signers, pdfFiller supports adding additional signatures, ensuring a smooth collaborative process for all parties involved.

Managing and submitting your cfop 170-14 form

After completing the cfop 170-14 form and securing necessary signatures, the next task is submission. Knowing your options for submitting the form can facilitate a more efficient process.

Options for submitting the form

Regardless of the submission method chosen, adhering to best practices, such as submitting ahead of deadlines, helps ensure a timely processing of your form.

Tracking and storing your form with pdfFiller

pdfFiller enables the secure storage of your completed cfop 170-14 forms, allowing for easy access and retrieval. Using features for tracking the status of submitted forms can provide peace of mind, ensuring that you know when the form has been received and processed.

Frequently asked questions (FAQs)

Understanding the specifics of the cfop 170-14 form raises several pertinent questions. Below are some common inquiries:

Troubleshooting common issues

Even with careful preparation, issues may arise during the completion or submission of the cfop 170-14 form. Knowing how to address these can save time and frustration.

Common errors and how to resolve them

Contacting support

If issues persist, reaching out to pdfFiller’s dedicated customer support can provide the necessary assistance. Learning the available support channels—such as chat, email, or phone—ensures you have help when needed.

Additional features of pdfFiller to enhance your document management

Beyond editing and completing the cfop 170-14 form, pdfFiller offers additional features that streamline document management and collaboration.

Document collaboration tools

The ability to collaborate with team members on the cfop 170-14 form is vital for ensuring that all input is considered. pdfFiller allows multiple users to review and edit documents, enhancing teamwork and project completion speed.

Integrations with other software

Integrating pdfFiller with other software solutions can enhance your workflow. For example, using pdfFiller alongside accounting software ensures that your financial documents align seamlessly, further reducing the chances of errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify cfop 170-14 without leaving Google Drive?

Can I create an electronic signature for signing my cfop 170-14 in Gmail?

Can I edit cfop 170-14 on an iOS device?

What is cfop 170-14?

Who is required to file cfop 170-14?

How to fill out cfop 170-14?

What is the purpose of cfop 170-14?

What information must be reported on cfop 170-14?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.