Get the free Central Kyc Registry | Know Your Customer (kyc) Application Form | Legal Entity/ Oth...

Get, Create, Make and Sign central kyc registry know

Editing central kyc registry know online

Uncompromising security for your PDF editing and eSignature needs

How to fill out central kyc registry know

How to fill out central kyc registry know

Who needs central kyc registry know?

Central KYC Registry Know Form: A Comprehensive Guide

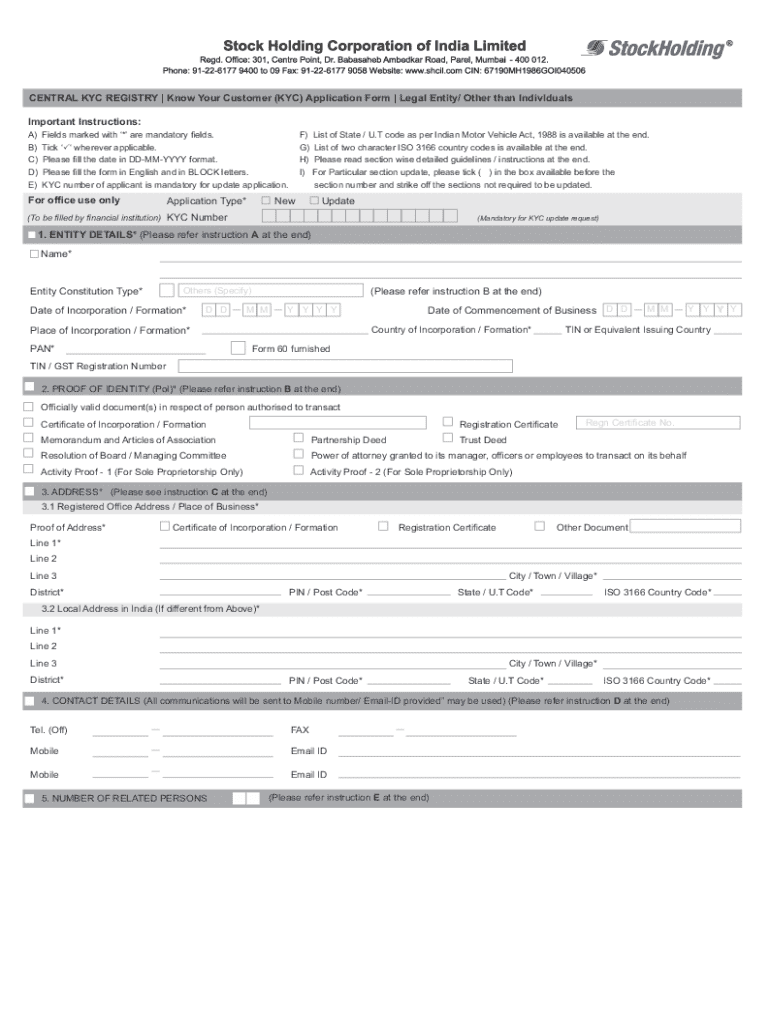

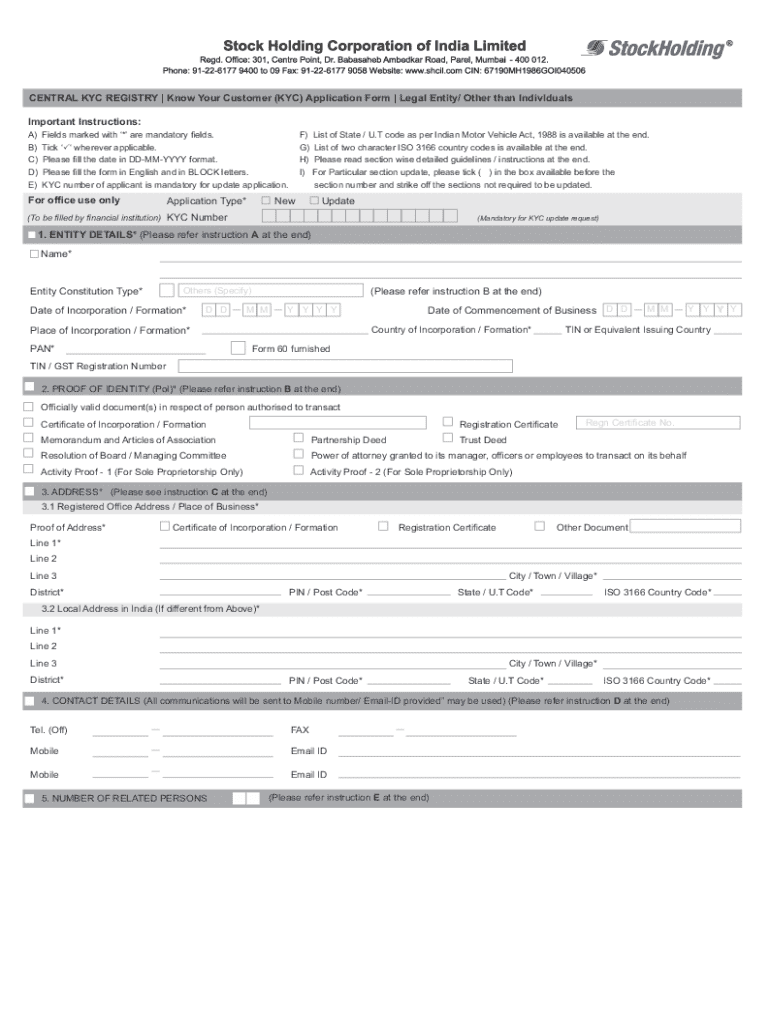

Understanding the Central KYC Registry

Know Your Customer (KYC) refers to the process of a business verifying the identity of its clients. This practice is widely implemented in the financial sector to ensure that businesses understand the risks associated with their customers. The Central KYC Registry serves as a centralized platform to store customer information gathered through KYC processes.

The importance of KYC cannot be understated. Integral for preventing fraud and money laundering, KYC ensures that financial institutions can conduct business safely and within the regulatory frameworks. With the rise of digital banking, the need for a robust KYC structure becomes even more critical.

The Central KYC Registry provides a systematic approach to managing customer data across various sectors, ensuring compliance and reducing redundancy in data collection. It assists entities in adhering to regulatory requirements by storing necessary and verified documents in one place, thus streamlining the KYC process.

Utilizing a Central KYC Registry offers key benefits, including enhanced compliance with regulatory standards, lowering the risk of financial misconduct, and improving customer experience through quicker onboarding processes.

Navigating the Central KYC Registry Form

The Central KYC Registry Form is designed to collect essential information to identify and verify customers adequately. This form primarily gathers personal and financial information, ensuring that organizations have the requisite data to perform their due diligence.

Individuals and businesses engaging with financial institutions need to fill out this form. Essentially, anyone seeking to initiate a banking relationship or similar transactional connections within the financial space is required to provide their information through this form.

The format of the Central KYC Registry Form is user-friendly and straightforward. Accessing the form can typically be done online through the website of the concerned financial institution or from the Central KYC Registry portal, where various templates may be available.

Detailed instructions for filling out the Central KYC Registry form

Before filling out the Central KYC Registry Form, certain prerequisites must be met. These include gathering necessary documents and ensuring eligibility criteria are satisfied—typically, this includes proof of identity, address, and financial information.

To effectively complete the form, follow these steps:

Avoid common mistakes like incorrect data entry or failing to include required documents. Double-check all entries before submission to prevent delays or rejections.

Frequently asked questions about the Central KYC Registry

After submitting the Central KYC Registry Form, applicants often wonder about the next steps. Typically, the form will undergo a review process where the financial institution evaluates the submitted information against the regulatory criteria.

Once submitted, the form generally cannot be edited. If errors occur, most institutions have a procedure to address these, such as contacting customer support.

For ongoing concerns, here are a few tips to ensure a smooth registration:

Utilizing pdfFiller for Central KYC Registry Form management

pdfFiller offers a robust platform for managing the Central KYC Registry Form, providing users with cloud-based access to streamline their document processes. With pdfFiller, editing, signing, and sharing KYC documents becomes a more manageable task, especially for teams.

Creating and managing your KYC Form using pdfFiller involves several key features:

Integrating the KYC Form into your workflow ensures efficient document handling, secure storage, and detailed tracking of document changes, enhancing overall productivity.

Advanced tools and features of pdfFiller for form efficiency

pdfFiller provides advanced tools that enhance the efficiency of form completion for the Central KYC Registry. These innovations can significantly improve user experience and reduce the time spent on document handling.

Case studies: Successful applications of Central KYC Registry Form

Understanding practical applications of the Central KYC Registry Form can offer valuable insights. For example, a financial institution implemented the Central KYC Framework to significantly enhance its customer onboarding process, resulting in a 40% drop in onboarding time.

Another startup benefited from improving its KYC processes by integrating pdfFiller into its operations. This led to a reduction in errors and an overall increase in team efficiency as all documents and information became accessible in one location.

These examples demonstrate the importance of an effective KYC approach, showcasing best practices that can be emulated by other organizations aiming to improve their compliance and customer service.

Staying compliant with regulatory changes in KYC

Regulatory changes impacting KYC norms can occur rapidly. Organizations must stay informed about recent regulations that could affect their KYC processes. Monitoring these changes helps businesses remain compliant and mitigate risks associated with non-compliance.

pdfFiller aids users in staying ahead of compliance requirements, offering features that allow for easy updates and adjustments to documents as regulations change. The software's adaptability makes it easier for teams to comply with evolving KYC regulations effectively.

Looking ahead, trends suggest a shift toward more automated KYC processes, driven by advancements in technology. Organizations that leverage tools like pdfFiller will likely lead in compliance efforts.

Interactive tools and resources on Central KYC Registry

For those seeking additional resources regarding the Central KYC Registry Form, several interactive tools are available. Downloadable templates can assist users in creating compliant KYC documents quickly.

Moreover, pdfFiller offers video tutorials that guide users on making the most of the platform. Webinars and live Q&A sessions provide real-time support for those facing challenges in KYC compliance.

Engaging with these resources can empower individuals and teams to navigate the complexities of the KYC process efficiently, ensuring their documentation stays compliant and up-to-date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in central kyc registry know?

Can I create an electronic signature for the central kyc registry know in Chrome?

How do I edit central kyc registry know straight from my smartphone?

What is central kyc registry know?

Who is required to file central kyc registry know?

How to fill out central kyc registry know?

What is the purpose of central kyc registry know?

What information must be reported on central kyc registry know?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.