Get the free Critical Illness Claim Form

Get, Create, Make and Sign critical illness claim form

How to edit critical illness claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness claim form

How to fill out critical illness claim form

Who needs critical illness claim form?

Critical Illness Claim Form How-to Guide

Understanding critical illness insurance

Critical illness insurance is a specialized policy designed to provide financial support in the event that the insured is diagnosed with a serious health condition. In essence, this type of insurance can alleviate the monetary burden associated with medical treatments, allowing individuals to focus on their recovery without the added stress of financial concerns. Commonly covered illnesses include cancer, heart attack, stroke, and other significant health challenges. It's crucial to familiarize yourself with the specific coverage details as they can vary widely from policy to policy.

Filing a claim for a critical illness is not just a procedural step; it represents a critical financial lifeline for many individuals and families. The claims process enables policyholders to access funds swiftly, which can be vital in meeting the costs of medical treatments, ongoing care, and even daily living expenses during recovery. Understanding the requisite steps to submit your claim properly can significantly streamline the process, ensuring that you receive the benefits entitled to you under your policy.

Preparing to fill the critical illness claim form

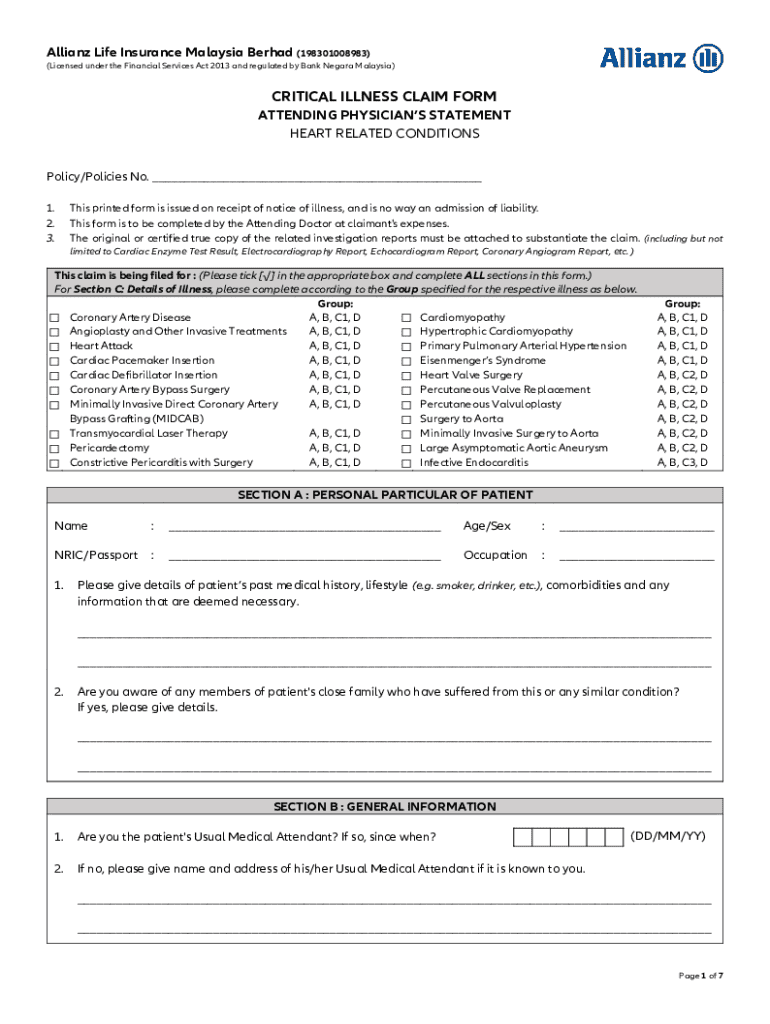

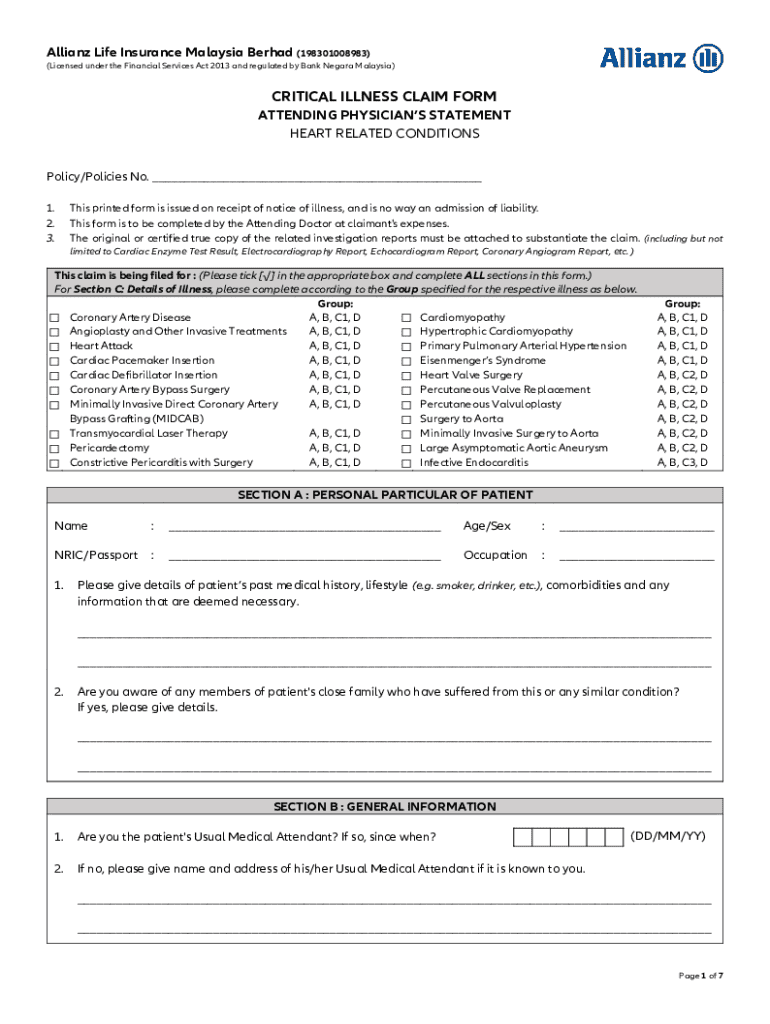

Before filling out the critical illness claim form, it's essential to gather necessary documentation to support your claim. The primary documents required often include medical records that validate your diagnosis, your policy information, and any additional correspondence with your insurance provider. Collecting these documents beforehand provides a smoother filing experience and minimizes delays.

Including key information in the claim form is critical. You should provide personal details for both the policyholder and the insured individual, along with a detailed account of the critical illness diagnosis. Most insurers also require additional treatment information to support your claim. Reviewing your policy will help you understand any specific clauses concerning waiting periods or exclusions, ensuring that you are fully informed about the coverage specifics before submitting your claim.

Step-by-step guide to completing the claim form

To initiate your claim process, you first need to access the critical illness claim form. Typically, this form can be found on your insurance provider’s website or directly accessed through pdfFiller, which offers an intuitive interface for form management. By using a tool like pdfFiller, you can easily print, edit, and manage your claims documents from anywhere, enhancing your overall experience.

Filling out the claim form involves several sections, each requiring specific information. In the personal information section, you’ll provide your name, address, and contact details. The next section typically requests claimant information and details regarding the diagnosis of the critical illness, including the date of diagnosis and attending physician details. Be thorough and concise. Common mistakes that can lead to processing delays include omitting information or misreporting. Always double-check your entries to ensure accuracy.

Submitting your claim

Once your claim form is completed, it’s time to submit it. Many insurers now offer the option to submit claims electronically through platforms like pdfFiller, which allows for fast processing. If you prefer traditional methods, ensure that you mail the claim form to the designated address provided by your insurer, using a traceable mailing service whenever possible.

Tracking your claim status can be done by contacting your insurer directly or through their online system. Understanding the expected timelines is essential, as some claims may be processed quickly, while others can take longer, especially if further information is required. If your claim is denied, familiarize yourself with common reasons and follow the appropriate steps to appeal the decision. Most policies offer an appeals process, enabling you to address any discrepancies or missing documentation.

Utilizing pdfFiller for your claim form needs

pdfFiller is an invaluable tool for managing your critical illness claim form. The platform's editing features allow you to customize the form as required, ensuring that all necessary information is accurately captured. You can also leverage e-signing capabilities, making it easier to submit your claim electronically. The collaboration features enable you to share your forms with your healthcare providers or family members for a network of support.

Additionally, pdfFiller offers cloud-based document storage, allowing you to keep all your insurance-related documents organized and accessible. This online management ensures that you always have the necessary information at your fingertips—helping you stay ahead of any claim deadlines or renewal dates.

Frequently asked questions (FAQs)

When navigating the complexities of a critical illness claim form, queries often arise. One common concern is, 'What if my condition is not listed in the policy?' Many insurers have provisions for conditions not explicitly covered, allowing you to submit supporting documentation that can lead to approval based on the severity and implications of your illness.

Understanding these nuances can empower you to navigate any unexpected situations that may arise during the claims process. Always review your policy thoroughly and don’t hesitate to reach out to your insurer for clarification.

Testimonials and success stories

Hearing from those who have successfully navigated the critical illness claims process can inspire and inform. Many users have shared about their experiences leveraging pdfFiller to streamline their claims, highlighting how the platform's user-friendly interface and innovative features helped them obtain their benefits efficiently. From first-time filers to seasoned veterans in managing health-related paperwork, stories abound that showcase the robust capabilities of pdfFiller in ensuring a stress-free experience.

One such testimonial notes how easy it was to collaborate with family members, all while keeping documentation organized within the digital platform. These positive experiences underline the importance of being equipped with the right tools when dealing with insurance claims—a crucial aspect of securing the financial support you need during challenging health-related times.

Tips for a smooth claims process

To facilitate a seamless claims experience, proactive communication with your insurer is paramount. Maintain clear lines of communication to check on claim status and updates. This transparency can often expedite the process and increase chances for success.

By employing these best practices, you can be better positioned to navigate the complexities of your critical illness claim form, ensuring that you receive the benefits you deserve without unnecessary delays.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit critical illness claim form online?

How do I make edits in critical illness claim form without leaving Chrome?

How do I fill out the critical illness claim form form on my smartphone?

What is critical illness claim form?

Who is required to file critical illness claim form?

How to fill out critical illness claim form?

What is the purpose of critical illness claim form?

What information must be reported on critical illness claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.