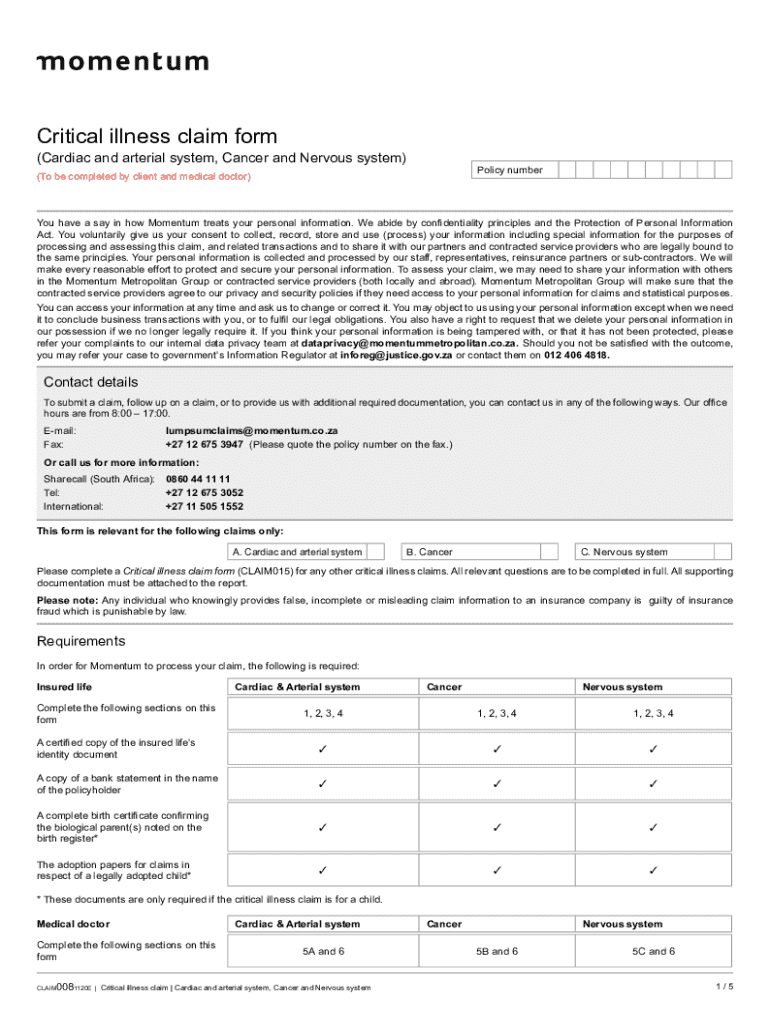

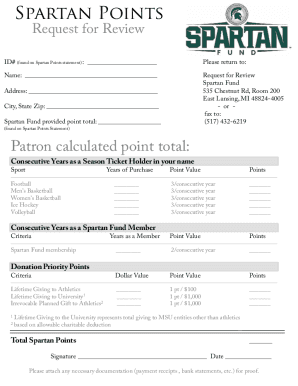

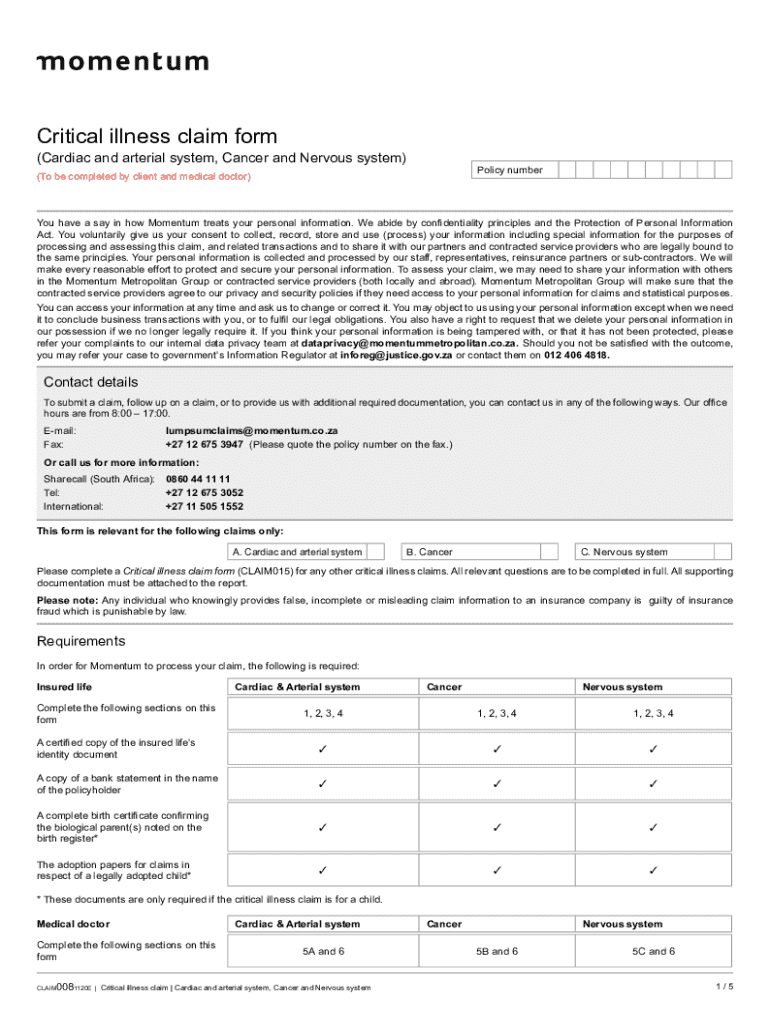

Get the free Critical Illness Claim Form

Get, Create, Make and Sign critical illness claim form

How to edit critical illness claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out critical illness claim form

How to fill out critical illness claim form

Who needs critical illness claim form?

Critical Illness Claim Form: A Comprehensive Guide

Understanding critical illness insurance

Critical illness insurance is a specialized form of coverage that provides financial support when an insured individual is diagnosed with one of a set list of critical illnesses. The primary purpose of this insurance is to alleviate the financial strain associated with treatment and recovery, allowing policyholders to focus on their health rather than monetary concerns. Understanding critical illness claims is essential as it ensures that policyholders have access to the benefits they have paid for during their time of need.

By filing a critical illness claim, you can gain access to funds for outpatient treatments, inpatient hospital costs, or even supplementary living expenses. This is crucial since substantial medical bills can accrue very quickly during treatment and recovery. Understanding how to navigate the claim process can protect your rights and ensure timely access to funds.

Common critical illnesses covered

Knowing the specific illnesses covered under your policy is vital for making an informed decision and preparing for the claim process. Each policy may differ; therefore, reviewing your specific coverage details ensures you understand what conditions trigger benefits.

Overview of the critical illness claim process

Navigating the claim process for critical illness insurance requires understanding the key steps involved. The journey typically begins with notifying the insurance company of your diagnosis and requesting a claim form. Following this, you need to gather the necessary documents, including medical records and policy information, to support your claim. Accuracy in documentation is crucial, as incomplete or incorrect submissions can delay the processing time.

Once you've submitted your claim form and documentation, the insurer will review your submission. This review process can vary widely, with standard claims taking several weeks to months. Various factors, such as the complexity of your case and the thoroughness of the provided documentation, can significantly influence the overall processing speed.

Key steps in the claim process

Preparing to fill out the critical illness claim form

Before you start filling out the critical illness claim form, it is essential to gather all necessary documentation to support your claim. Typically, this will include your medical records detailing the diagnosis, documentation from your healthcare provider, your insurance policy number, and any additional information related to your condition. Organizing these documents beforehand can streamline the process and minimize errors.

Utilizing tools like pdfFiller for document management can be advantageous, allowing you to store and access important files easily. Make sure you review your policy details thoroughly to understand what documentation is required. Each insurance provider may have its specific requirements, and being prepared will significantly speed up the claim process.

Understanding form sections

Critical illness claim forms typically consist of several sections that require detailed information. This might include personal information, details about the diagnosed illness, medical history, and information about current treatments. Filling out these sections clearly and accurately is crucial to prevent any delays or issues with your claim. Take the time to review each section carefully, ensuring that you provide precise information that reflects your situation.

Filling out the critical illness claim form

Completing the critical illness claim form requires careful attention to detail. Start by accurately filling out your personal information, including your full name, address, and contact details. Then, move on to the section detailing your medical condition. Clearly state the diagnosis and include any relevant dates, such as when the diagnosis was made and the treatments undertaken.

Common pitfalls during this process include providing vague answers or omitting critical information. Always double-check your answers for clarity and completeness before submitting the form. If you encounter unclear questions, do not hesitate to reach out to your insurance provider for clarification rather than guessing.

Step-by-step guide

Submitting your critical illness claim

After completing the critical illness claim form, it's time for submission. Most insurance providers offer multiple submission methods, including online portals and mail-in options. Online submissions are often faster, but ensure that you keep a digital copy for your records. Additionally, be mindful of any deadlines for submitting your claim as outlined by your insurance provider.

Consider timing your submission strategically. If submitting online, ensure that your connection is stable to avoid potential interruptions while uploading documents. If submitting by mail, use a reliable postal service and consider obtaining tracking information to confirm delivery.

Follow-up process

Once your claim is submitted, it is essential to remain proactive in tracking its status. Most insurers will provide a timeline for when you can expect feedback. Don't hesitate to follow up with your insurance company to inquire about your claim status, especially if you don’t receive a response within the expected timeframe.

Keep a detailed log of your communications with the insurer, including dates, times, and names of representatives you spoke with. This documentation can be invaluable if issues arise or if you need to escalate your case.

What to expect after submission

Following submission, your claim will undergo a review process by the insurance company. It’s crucial to understand that claims may be assessed in various ways, including medical reviews or even investigative reviews if further verification is needed. The insurance provider will evaluate the extent of your illness and how it aligns with the policy criteria.

Outcomes can vary: your claim may be accepted, rejected, or the insurer may request additional information. It is important to stay informed during this phase and understand your options, especially if faced with a rejection. Most insurers have an appeals process in place that allows you to contest their decision, which can be a critical step in securing the benefits you deserve.

Possible outcomes

Managing your critical illness claim

Managing a critical illness claim can be overwhelming, particularly during a challenging time. Document management plays a vital role in keeping track of your claim process. Utilizing platforms like pdfFiller is particularly useful for organizing your documents and ensuring that everything is in one place. This can simplify the process when additional documentation is requested by the insurer.

Consider using digital tools for electronic signatures and edits on forms to accelerate your workflows. Keeping all related paperwork accessible ensures you won’t have to scramble for information when unexpectedly asked for it. This kind of organization can ease the overall strain of managing your claim.

Document management tips

Common challenges and solutions

Dealing with complicated or denied claims can be one of the most arduous parts of the process. If your claim is rejected, it is crucial to understand the reasons and communicate with your insurer for clarity. Gather any additional documentation or evidence that supports your case and prepare an appeals letter outlining your position.

Furthermore, the emotional toll associated with critical illness can be substantial. It’s important to seek support from friends, family, or professional counseling during this time. Building a supportive network can help you cope with the stress and anxiety associated with both the illness and the claims process.

Navigating complex claims

Enhancing future claims experience

After navigating the claim process, it’s important to prepare for any future claims that may arise. Maintaining accurate and organized records will make subsequent claims more efficient. Consider developing a system that ensures all relevant documents are stored in one accessible location, such as a dedicated folder in a document management platform like pdfFiller.

Implementing a comprehensive documentation strategy not only aids in managing immediate claims but also establishes a solid foundation for any future claims you might pursue. Consistent organization can significantly reduce stress when facing the need for further claims.

Keeping records for future claims

How pdfFiller supports ongoing documentation needs

pdfFiller emerges as a powerful solution for organizing your critical illness claim documentation. The platform not only allows users to fill out forms seamlessly, but also to edit, sign, and share important documents with ease. With its cloud-based functionality, users can access their forms from anywhere, making it easier to respond promptly when additional information is required.

Features like digital signatures and real-time collaboration tools enable users to manage their documents effectively, providing an impressive and straightforward approach to handling all future claims. Engaging with pdfFiller enhances your ability to respond promptly and accurately to any requests, ultimately supporting a smoother claims process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in critical illness claim form without leaving Chrome?

Can I create an eSignature for the critical illness claim form in Gmail?

How do I fill out critical illness claim form using my mobile device?

What is critical illness claim form?

Who is required to file critical illness claim form?

How to fill out critical illness claim form?

What is the purpose of critical illness claim form?

What information must be reported on critical illness claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.