Get the free Crs Self Certification Form for Indvidual Clients

Get, Create, Make and Sign crs self certification form

Editing crs self certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs self certification form

How to fill out crs self certification form

Who needs crs self certification form?

Understanding the CRS Self Certification Form: A Comprehensive Guide

Understanding the CRS self certification form

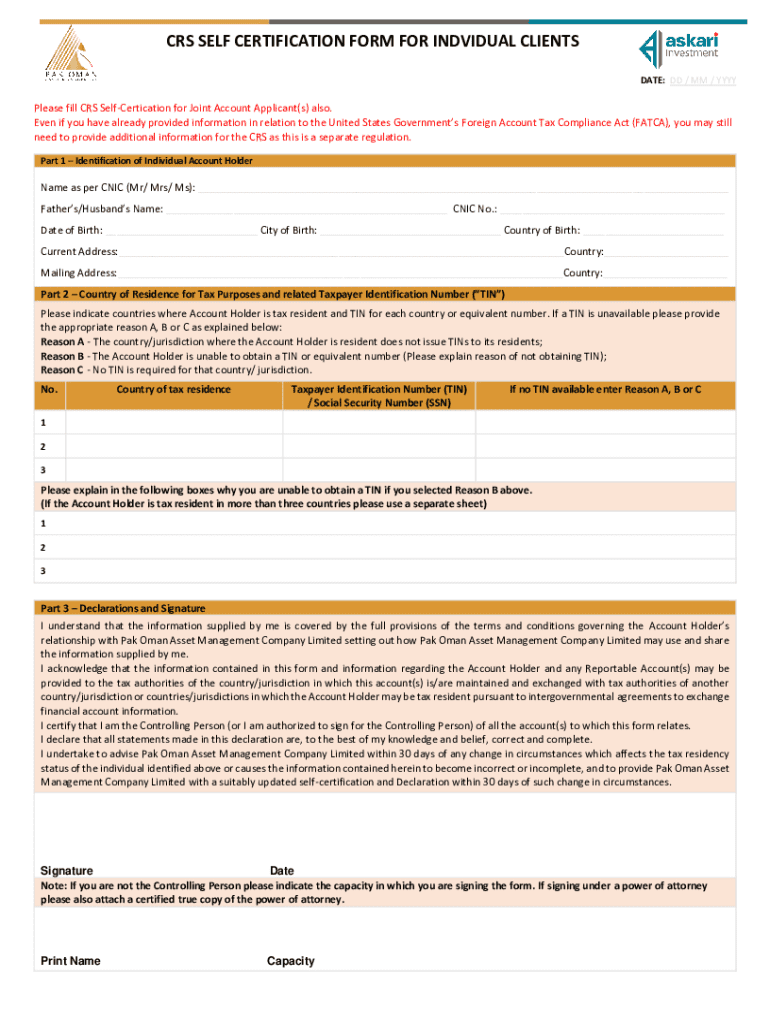

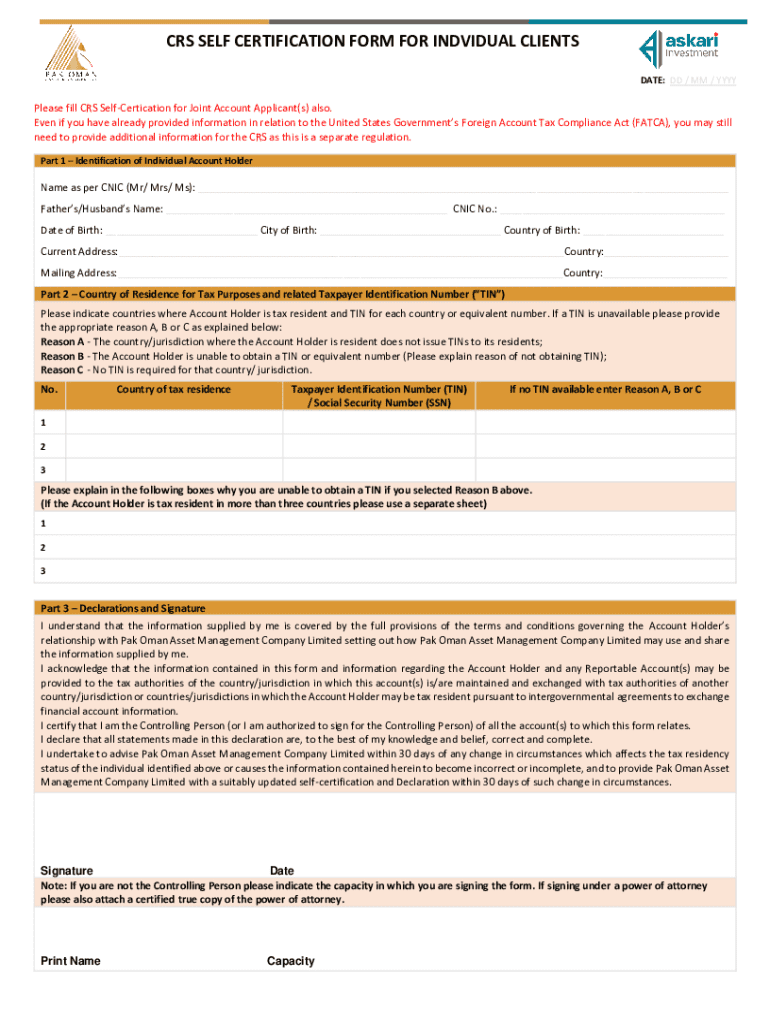

The CRS self certification form is a crucial document used under the Common Reporting Standard (CRS), which was developed by the Organization for Economic Co-operation and Development (OECD). This form plays a vital role in tax compliance by providing financial institutions with the necessary information about an individual's or entity's tax residency status. Its main objective is to promote tax transparency and combat tax evasion by ensuring that countries share information about foreign tax residents.

The importance of this form cannot be overstated. By correctly completing the CRS self certification form, individuals and entities can fulfill their tax obligations, reducing the risk of penalties and ensuring that they are in good standing with tax authorities.

Who needs to complete the form?

Generally, both individuals and entities need to complete the CRS self certification form. Individuals, including citizens and residents, must declare their tax residency status to help financial institutions determine whether they fall under CRS regulations. Similarly, entities such as corporations or partnerships are required to certify their tax residency as applicable. It's important to note that specific requirements may vary by jurisdiction, so it’s essential to check local laws and guidelines before submission.

Key components of the CRS self certification form

The CRS self certification form includes several sections that require attention to detail. The primary components are personal information, tax residency status, and the signature declaration. In the personal information section, you’ll provide essential details such as your name, address, and date of birth. This information is used to identify you correctly.

Identifying your tax residency status is critical, as it dictates your reporting obligations. Residents of jurisdictions that are participating in the CRS must accurately declare their residency to ensure compliance. Furthermore, the signature and declaration section signifies that the information provided is accurate to the best of your knowledge and that you understand the implications of submitting false information.

To avoid complications, understanding common terminology associated with the CRS is also beneficial. Familiarize yourself with terms like 'tax residence' and 'reportable accounts' to navigate the form more comfortably.

Step-by-step instructions for completing the CRS self certification form

Completing the CRS self certification form may seem daunting at first, but breaking it down into manageable steps can simplify the process. The first step is gathering all the necessary information and documents beforehand. You will need proof of identity, tax residency certificates, and potentially other financial information to support your claims.

After gathering your information, you'll move on to filling out the form. Start with the personal information section — ensure all details are entered accurately to prevent processing issues. Next, in the tax residency section, make sure to accurately assess your residency status. You may wish to consult tax documentation or authorities to confirm your tax residence. Finally, don’t forget to sign and date the declaration to validate the document.

Editing and managing your CRS self certification form

Mistakes can happen, and when they do, using pdfFiller tools for streamlined editing can save time and reduce frustration. pdfFiller offers easy-to-use features that allow you to quickly edit the CRS self certification form if you notice errors post-completion. Additionally, it’s useful to save different versions of the form to keep track of changes and updates.

When it comes to signing the form, pdfFiller enhances this process by providing secure eSigning options. eSigning is not only convenient but also ensures that your document remains legally binding. By following simple steps within the pdfFiller platform, you can seamlessly eSign your CRS self certification form, adding an additional layer of security while ensuring compliance.

Common challenges when submitting the CRS form

Submitting the CRS self certification form can lead to several challenges, often stemming from omitted or incorrect information. One common issue is failing to include all necessary documentation or leaving sections of the form incomplete. Always review the form thoroughly before submission to ensure nothing is left out.

Another recurring challenge is declaring incorrect tax residency. Misrepresentation can lead to serious repercussions, including penalties from tax authorities. If you find that you've made an error post-submission, it’s important to act quickly to rectify the situation, which may involve resubmitting the form with the correct information.

Best practices for maintaining compliance post-submission

Once you have submitted your CRS self certification form, it is vital to maintain comprehensive records related to your tax residency status. This includes storing copies of the completed form, any communication with tax authorities, and relevant tax documents. Keeping such documentation can provide support in case of any queries regarding your tax situation.

You should also be proactive in updating your CRS self certification form when there are changes in your personal circumstances, such as relocation or changes in financial structures. Knowing when and why to refresh your information allows you to remain compliant.

Utilizing pdfFiller for enhanced document management

pdfFiller is an invaluable tool for individuals and teams managing the CRS self certification form. Utilizing this cloud-based solution allows users to access their documents from anywhere, making it ideal for those with busy schedules or remote work arrangements. It ensures that the necessary documents are always available when required.

In addition to access flexibility, pdfFiller provides collaborative features that enable teams to work together on document preparation and review. This is particularly beneficial for organizations that need to ensure compliance across multiple employees, streamlining the entire process.

Real-life scenarios: Successful use of the CRS self certification form

Real-life case studies often highlight the critical importance of accurately filling out the CRS self certification form. For example, an individual who accurately completed their CRS form was able to secure an international investment opportunity without issues arising from their tax status. In contrast, another individual who submitted incorrect tax residency information faced significant penalties and delays in their financial dealings due to complications with tax authorities.

These scenarios serve as valuable lessons on the need for diligence and accuracy when filling out the form, emphasizing that the repercussions of errors can range from fines to missed investment opportunities.

FAQ section on the CRS self certification form

As you navigate the complexities of the CRS self certification form, it is common to have questions. Key concerns include clarifications on what constitutes tax residency and how to address privacy concerns regarding information sharing. Understanding the nuances of these topics can alleviate confusion and streamline the completion process.

Experts recommend maintaining open communication with tax advisors or financial institutions for personalized advice tailored to your individual situation. Additionally, proactively researching the most common pitfalls can equip you with the knowledge to avoid errors, increasing your chances of a smooth submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the crs self certification form in Chrome?

How do I fill out crs self certification form using my mobile device?

How do I complete crs self certification form on an Android device?

What is crs self certification form?

Who is required to file crs self certification form?

How to fill out crs self certification form?

What is the purpose of crs self certification form?

What information must be reported on crs self certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.