Get the free Country: Switzerland Organisation: Swiss National Science ...

Get, Create, Make and Sign country switzerland organisation swiss

Editing country switzerland organisation swiss online

Uncompromising security for your PDF editing and eSignature needs

How to fill out country switzerland organisation swiss

How to fill out country switzerland organisation swiss

Who needs country switzerland organisation swiss?

Country Switzerland Organisation Swiss Form

Understanding Swiss forms: types and functions

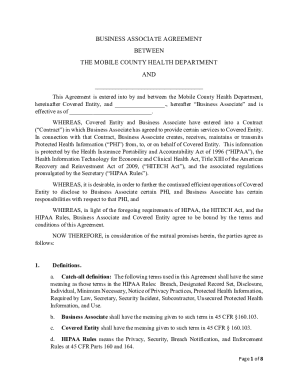

In Switzerland, the organization of forms and documentation is an essential part of navigating both administrative and legal processes. Various types of documents serve specific functions, including administrative forms for local services, legal documents like contracts and agreements, and tax forms necessary for financial compliance. The Swiss government emphasizes clarity and organization in its documentation system, ensuring that citizens and residents have access to the right resources.

Choosing the appropriate form is not merely a procedural step but a crucial aspect of safeguarding your rights and interests. Each document is designed to fulfill particular requirements, whether it’s in the realm of taxation, healthcare, or residency. The structure of these forms helps streamline interactions with public services and legal authorities, reflecting Switzerland's commitment to efficiency.

Key organisations involved in Swiss forms

The Swiss documentation landscape is supported by a complex network of organizations. At the federal level, various authorities are dedicated to overseeing the correct processing and accessibility of forms. The Federal Office of Communications, for example, manages forms related to media and communications, while the Federal Tax Administration oversees tax-related documentation crucial for individuals and businesses alike.

Cantonal agencies also play a significant role in managing forms. Each canton in Switzerland has its administrative procedures and specific forms tailored to local needs. This decentralized approach enables tailored responses to diverse regional contexts, which is a hallmark of Swiss governance. Furthermore, non-governmental organizations actively work to facilitate document accessibility, particularly for expatriates and those less familiar with local languages or processes.

Accessing Swiss forms and templates

Finding the correct Swiss form can be streamlined through several online resources. Official government portals host a plethora of templates and forms categorized by function, ensuring users can locate what they need efficiently. Their systematic design allows easy navigation, whether you're looking for an employment contract or a health insurance application.

Additionally, platforms like pdfFiller offer third-party services that host numerous templates and provide interactive tools for form completion. Utilizing updated document templates is crucial as The Swiss regulations can change, making it necessary to ensure that you are using the correct versions. This helps avoid potential legal issues and misunderstandings.

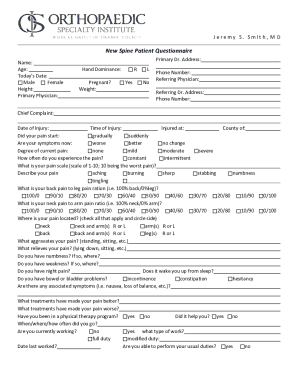

Step-by-step guide to filling out Swiss forms

When it comes to filling out Swiss forms, understanding the format and requirements can significantly reduce errors. Common fields usually include personal information, dates, and specific identifiers relevant to the purpose of the form. Basic familiarity with terms in the three national languages—German, French, and Italian—is beneficial, as many forms accompany instructions in multiple languages.

While filling out forms, precision is key. Here's a useful checklist: First, always read the instructions carefully. Second, double-check your entries for accuracy, especially figures and dates. Finally, if you encounter unfamiliar terms, consulting language resources or translating tools ensures clarity.

Examples of commonly used forms include the application for residency, which necessitates detailed personal information and documentation of residency eligibility, and tax declaration forms, which require a comprehensive account of income sources and deductions.

Editing and modifying Swiss forms

Editing Swiss forms properly is paramount, especially when faced with stringent guidelines on documentation. Using advanced tools like pdfFiller allows users to modify existing forms easily. This can include correcting errors, making necessary adjustments based on changing information, or repurposing forms for different applications. Not everyone is adept at handling PDFs, but platforms focusing on accessibility can bridge this gap.

Collaboration features on pdfFiller also facilitate teamwork. Teams can work on the same document simultaneously, providing real-time feedback, which enhances accuracy and expedites the process. However, common mistakes include oversights like failing to save changes or incorrectly formatting input fields. Always review collaborative efforts to minimize errors.

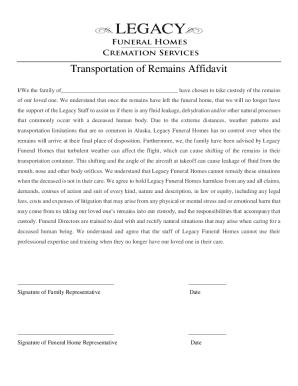

eSigning: legal implications and process

Electronic signatures, commonly termed eSignatures, have gained traction within the Swiss legal framework as a legitimate and secure means of signing documents. The significance of eSigning extends into various domains, including contracts, tax submissions, and official forms, enabling faster processing and improved efficiency.

To eSign a document on pdfFiller, one simply follows a straightforward process involving document upload, signature placement, and finalization. However, security is paramount; eSignatures in Switzerland are subject to regulations ensuring validation and confidentiality. Users should remain informed about security practices to safeguard their documents.

Managing and storing Swiss forms

Effective document management strategies are essential for anyone dealing with Swiss forms. Best practices include organizing forms digitally using platforms like pdfFiller, which offers systematic storage options for easy retrieval. By tagging documents correctly and maintaining a structured filing system, users can minimize time spent searching for necessary files.

Compliance with Swiss regulations is essential as well; individuals should be aware of the specific retention periods applicable to various forms. For instance, tax documentation should typically be maintained for a minimum of ten years. Establishing a thorough record-keeping protocol ensures that mandatory documents are available when needed.

Help and support resources

For individuals navigating Swiss forms, assistance is readily available through various channels. Government contact points provide support for queries related to specific documentation, helping individuals unravel complex legal requirements or administrative hurdles. Moreover, online communities and forums can offer peer support and share firsthand experiences.

On the other hand, pdfFiller’s support features are incredibly user-focused, providing a range of customer service options, including live chat and detailed tutorials. Their FAQs further clarify common concerns surrounding form completion and editing, making the platform user-friendly and accessible for individuals and teams.

Case studies: successful document management

Real-life scenarios emphasizing effective document management further highlight the significance of understanding Swiss forms. For instance, expatriates frequently encounter challenges while navigating residency and work authorization forms. Effective strategies involve consulting resources like pdfFiller to access accurate templates and fill them out correctly, which smooths their transition into Swiss life.

In corporate scenarios, managing employee tax documents can become complex. With pdfFiller, companies can streamline this process by ensuring that all forms are accurate and promptly submitted, enhancing compliance, and easing potential employee concerns. These case studies illustrate lessons learned, emphasizing that proper document management is not just a task but a strategic necessity.

Future trends in document management in Switzerland

The future landscape of document management in Switzerland is increasingly leaning towards digital solutions. This trend promises not only improved accessibility but also enhanced security and efficiency in handling Swiss forms. Emerging technologies, such as AI and blockchain, are expected to shape the future of forms management, making it more intuitive and secure for users.

Anticipated legislative changes may further influence how forms are developed and utilized, potentially paving the way for more robust electronic processes. As organizations like pdfFiller continue to innovate, they play a critical role in facilitating transitions to these advanced document management practices, positioning themselves as leaders in shaping the future of Swiss documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the country switzerland organisation swiss electronically in Chrome?

Can I create an eSignature for the country switzerland organisation swiss in Gmail?

How do I complete country switzerland organisation swiss on an iOS device?

What is country switzerland organisation swiss?

Who is required to file country switzerland organisation swiss?

How to fill out country switzerland organisation swiss?

What is the purpose of country switzerland organisation swiss?

What information must be reported on country switzerland organisation swiss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.