Get the free Customer Identification Form

Get, Create, Make and Sign customer identification form

Editing customer identification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer identification form

How to fill out customer identification form

Who needs customer identification form?

Customer Identification Form - How-to Guide Long-read

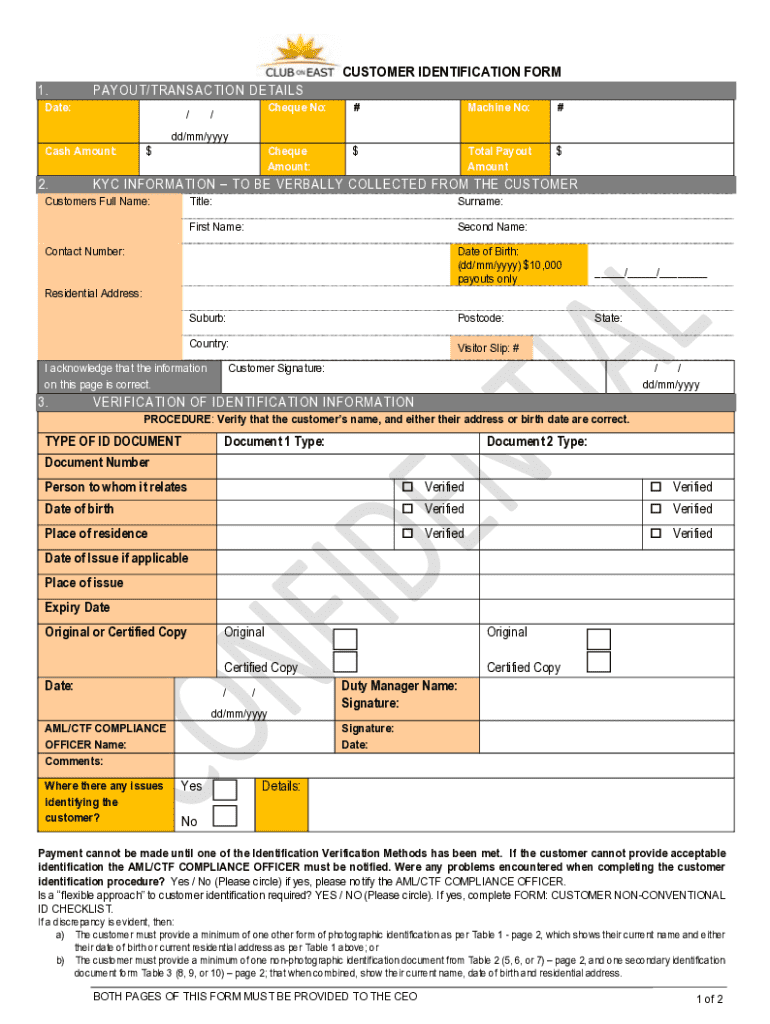

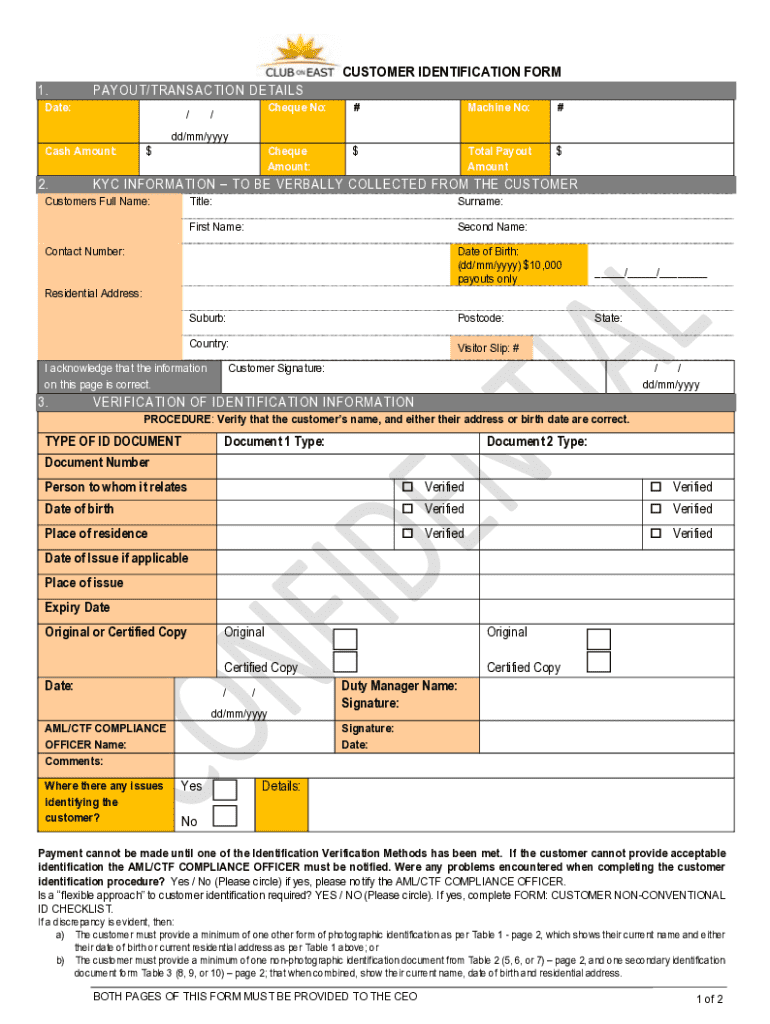

Understanding the customer identification form

A customer identification form (CIF) plays a crucial role in identity verification processes across various financial institutions. Predominantly utilized in banking, lending, and investment sectors, this form ensures that the identity of customers is accurately established. Its primary purpose is to collect personal information that verifies a customer’s identity, helping institutions comply with regulatory requirements intended to prevent fraud, money laundering, and other illicit activities.

Beyond its necessity for compliance, the customer identification form safeguards financial institutions against risks, fortifying both reputational integrity and operational security. By collecting verified information, institutions can foster a trustful relationship with their clientele, which is indispensable for long-term business success.

Who needs to fill out this form?

Individuals and organizations alike engage with customer identification forms when applying for various financial services. For individuals, this may involve opening a bank account, obtaining loans, or investing in financial products. On the organizational front, businesses need to complete these forms when establishing commercial accounts or seeking credit. It's essential that all relevant parties understand their responsibilities in this process. Typically, financial institutions will designate specific team members to guide applicants through form completion, ensuring accuracy and compliance.

In organizations, roles may vary from administrators who initiate the process to compliance officers who ensure all regulatory standards are met. This collaborative approach not only aids in efficient form completion but also mitigates the risks of incomplete or inaccurate submissions.

Key requirements for filling out the customer identification form

Filling out the customer identification form requires various personal details that are crucial for verifying identity. This typically includes the customer’s full name, current residential address, date of birth, and nationality. Each of these elements helps create a comprehensive profile that assists institutions in establishing the legitimacy of their customers. It's imperative to provide accurate and truthful information as discrepancies can lead to delays or rejections of services.

In addition to personal information, preparatory work involves gathering acceptable identification documents. Common forms of identification include government-issued documents, such as passports and driver's licenses. Additionally, supplementary documents like utility bills can prove address legitimacy, enhancing the credibility of the information provided. Ensuring all documentation is ready will streamline the process and potentially reduce the time required to process the form.

Step-by-step guide to completing the customer identification form

Completing the customer identification form is a straightforward process when followed step-by-step. The first step involves accessing the form, which can be conveniently found and downloaded from pdfFiller. Users can take advantage of interactive elements provided on the platform for an enhanced navigation experience, allowing easy orientation of the form's sections.

Once the form is accessed, the second step is to fill out personal information with attention to detail. Carefully entering your name, address, and date of birth eliminates common mistakes that can lead to complications later on. Each section is crucial, and missing information or typos could result in processing delays.

The third step involves providing identification documents. Make sure to follow guidelines on how to attach or upload documents correctly. Different formats may be required for electronic submission, and understanding these requirements can save time. Next is reviewing your submission, which is the final step. Utilizing pdfFiller’s editing tools can aid in correcting any errors found during the review process, ensuring that your form is ready for successful submission.

Best practices for managing your customer identification form

Managing your customer identification form entails an awareness of data privacy policies and best practices. Always ensure that your information is kept secure during the entire process. Familiarizing yourself with how your data will be protected is essential. Most financial institutions adhere to stringent protocols that protect client information from unauthorized access or breaches.

In addition, it's advisable to safely store and access your form. Utilizing cloud storage, such as that offered by pdfFiller, provides a secure way to maintain and retrieve your document over time. Furthermore, features that allow for collaboration mean that team members can conveniently work together on submissions, tracking changes and updates in real time.

Troubleshooting common issues with the customer identification form

Issues can arise during the submission process of your customer identification form, particularly if incorrect information is submitted. If your form is rejected due to inaccuracies, it’s crucial to understand how to rectify these errors effectively. Ensure that you review all provided information thoroughly and resubmit after making necessary corrections. Each institution will have specific guidelines on how to handle re-submissions, so familiarize yourself with these as well.

Technical challenges are another common concern when filling out or submitting the form through pdfFiller. Whether your issue is related to file formats or connectivity, the platform provides troubleshooting resources that can assist you in overcoming these barriers. For more persistent technical challenges, pdfFiller's support team is available to resolve issues promptly.

Further information on customer identification requirements

Understanding the regulatory guidelines surrounding customer identification is essential for compliance. Regulations vary by region, with strict measures established to combat fraud and protect consumer rights. Key regulations such as the USA PATRIOT Act or AML laws dictate the requisite for thorough identification and verification processes in financial institutions.

Additionally, it's pivotal to stay updated on standards and practices related to customer identification. The financial sector is dynamic, often adapting policies to accommodate emerging technologies and greater security protocols. Regularly reviewing these changes will help ensure compliance and maintain operational integrity.

Additional resources and tools on pdfFiller

pdfFiller provides not only customer identification forms but a wide array of related forms and templates that can assist users in various scenarios. Accessing other identification resources helps users streamline documentation processes and maintains consistency in information gathering.

Moreover, pdfFiller’s collaboration features enable teams to work together effortlessly on a single form in real time. This capability significantly enhances productivity, allowing contemporaneous input and review. Alongside this, the platform's eSigning and document management capabilities deliver a comprehensive document workflow solution, making it easier for users to manage all forms and agreements in one place.

Frequently asked questions (FAQs)

As users engage with the customer identification form, common questions arise revolving around submission processes, compliance, and updates. Clarifying these queries promotes understanding and efficient usage of the form. Users frequently inquire about the most common mistakes in form completion and how to avoid them. Additionally, questions regarding the timelines for processing submissions are prevalent, emphasizing the importance of completing the form accurately and promptly.

Updates to the form may also occur, driven by changes in regulations or technology shifts. Understanding how these modifications impact form completion is vital. For further guidance and support, users are encouraged to reach out to designated contacts within their institutions or pdfFiller's customer support team.

Conclusion

The customer identification form is an essential component of identity verification within the financial sector. Its importance cannot be overstated as it not only fulfills compliance requirements but also fosters trust between financial institutions and customers. With tools like pdfFiller, completing and managing this form becomes a streamlined and secure process. Users benefit from cloud-based solutions that simplify document submission and collaboration, ultimately enhancing their experience with necessary financial services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in customer identification form?

Can I sign the customer identification form electronically in Chrome?

Can I create an electronic signature for signing my customer identification form in Gmail?

What is customer identification form?

Who is required to file customer identification form?

How to fill out customer identification form?

What is the purpose of customer identification form?

What information must be reported on customer identification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.