Get the free Contractor’s All Risk Insurance Claim Form

Get, Create, Make and Sign contractors all risk insurance

How to edit contractors all risk insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contractors all risk insurance

How to fill out contractors all risk insurance

Who needs contractors all risk insurance?

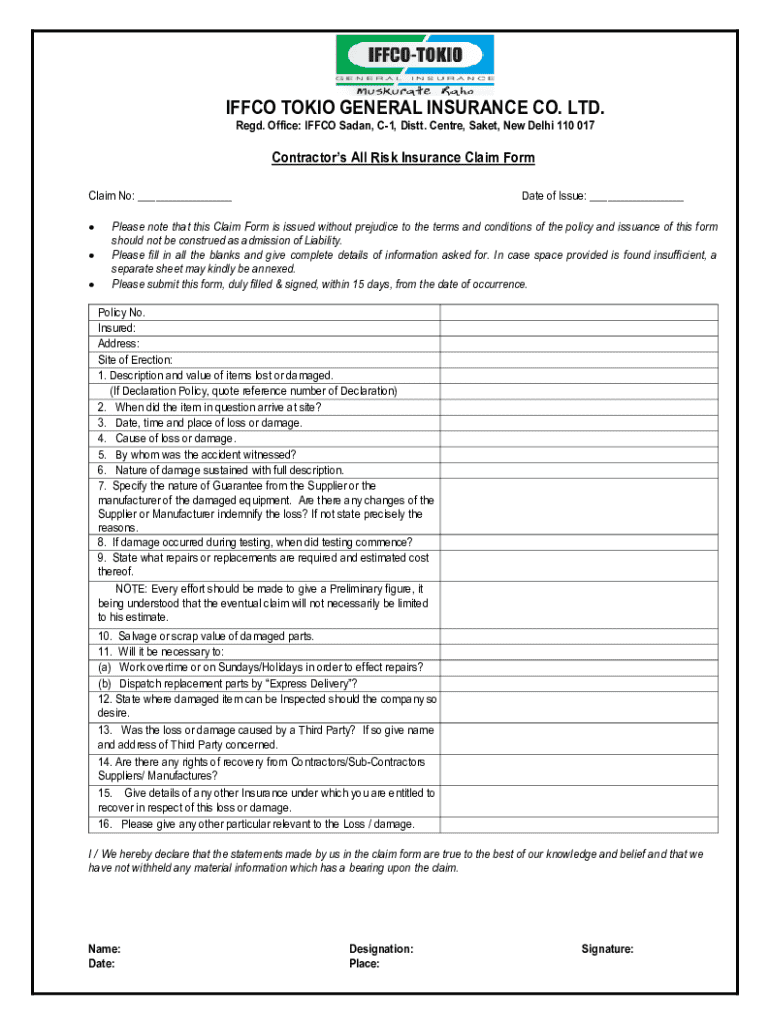

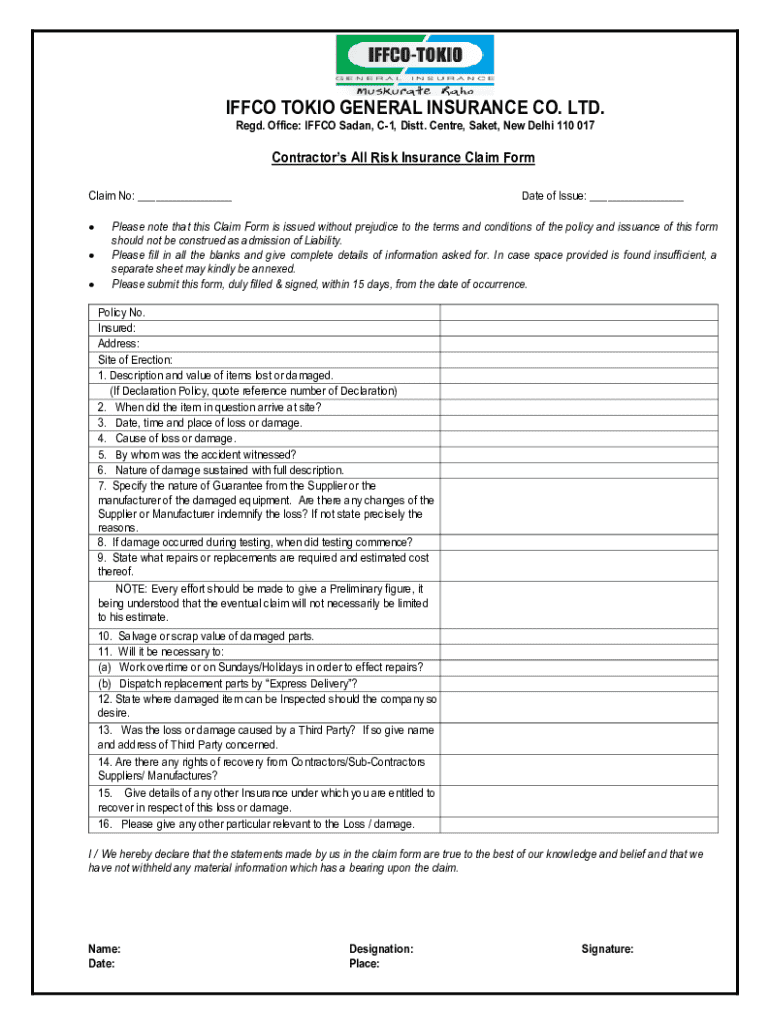

Understanding the Contractors All Risk Insurance Form: A Comprehensive Guide

Understanding contractors all risk insurance

Contractors all risk insurance provides extensive coverage for construction projects, protecting against financial losses due to damage or loss of property during the project’s lifetime. This type of insurance is critical not only for the contractors but also for clients, ensuring that both parties are financially safeguarded against unforeseen circumstances.

The insurance typically covers various risks, including damage to buildings or structures under construction, equipment and materials, and liability for injuries sustained on site. Given the complexities involved in construction, having a robust insurance policy helps minimize financial exposure and enhances trust between contractors and their clients.

Key components of the contractors all risk insurance form

Completing the contractors all risk insurance form involves several critical components that ensure comprehensive coverage. Each section of the form collects essential information about the parties involved and the specifics of the project, enabling the insurer to tailor coverage appropriately.

The first key component is the policy holder information, which includes details about the individual or organization applying for insurance. This section requires accurate details such as name, address, and contact information to ensure proper communication.

Next, project information must be outlined, detailing the nature of the work, project location, and expected timeline. Furthermore, the coverage details section specifies the types of protection included, such as coverage for property damage or bodily injuries, as well as any particular exclusions which should be thoroughly understood by both the contractor and client.

Step-by-step guide to completing the contractors all risk insurance form

Completing the contractors all risk insurance form requires careful attention to detail. Start by gathering all necessary documentation related to the project and your organization, which ensures that all required information is at hand for a streamlined filling process.

1. Gather Necessary Documentation: Collect essential documents like the project plan, contractor license, and financial statements. Organizing these files helps in filling out the form efficiently.

2. Filling Out the Form: Proceed to fill out each section with precision. Make sure that your policy holder information is accurate, the scope of work is detailed adequately, and coverage choices reflect your specific needs.

3. Reviewing the Form for Accuracy: Double-check all filled sections to avoid common mistakes, such as typographical errors or incomplete information. Ensuring the accuracy of your submission can expedite processing.

Leveraging pdfFiller for effective form management

pdfFiller offers a seamless solution for filling out the contractors all risk insurance form. With interactive tools for easy editing, users can input information directly into the PDF, ensuring clarity and accuracy.

The cloud-based platform allows for easy access and collaboration among team members, enabling everyone involved to contribute and review the document from different locations.

The eSigning feature is particularly beneficial for quick approvals, allowing for immediate processing once all parties have signed. Users can easily navigate the eSigning feature, facilitating prompt finalization of the insurance form.

Common pitfalls to avoid when filing the contractors all risk insurance form

Filing the contractors all risk insurance form can present several common challenges. One significant pitfall is providing incomplete information, which can lead to delays in processing or denied claims later on.

Misunderstanding coverage options can also lead to insufficient protection. Ensure that you comprehend all elements of the policy before submission. Additionally, failing to submit necessary supporting documents is a frequent issue that can hinder the processing of the insurance request.

Frequently asked questions (FAQs)

Processing time for the contractors all risk insurance form can vary by provider, but typically ranges from a few days to a couple of weeks depending on the complexity of the project and the completeness of the submission. If you need to update your policy information post-submission, most providers allow for modifications through a formal request with necessary documentation.

It’s critical to manage any changes in project scope effectively after submission; communicate with your insurer about these changes promptly to prevent complications in coverage.

Tips for managing your contractors all risk insurance post-submission

After submitting the contractors all risk insurance form, maintaining organization is essential. Keeping track of important dates, such as policy expiration and renewal deadlines, is crucial to ensure continuous coverage. Set reminders for these dates to avoid lapses in insurance.

Best practices for policy renewal often include reviewing the project scope and coverage needs, potentially adjusting coverage to reflect any changes that have occurred since the last policy period.

Additionally, it's wise to plan for the claims process. Understanding steps to take in case of a loss not only prepares you for potential incidents but also streamlines the recovery process should an event occur.

Real-world examples of utilizing contractors all risk insurance

An effective way to understand the importance of the contractors all risk insurance is through real-world examples. For instance, a contractor managing a large commercial project faced a considerable setback when an electrical fire caused significant damage to the structure. Fortunately, the contractor's comprehensive insurance coverage allowed them to recover the losses swiftly and continue without devastating financial impact.

On the other hand, another contractor assumed they had sufficient coverage, but upon experiencing equipment theft, they learned that their policy excluded theft. This resulted in substantial out-of-pocket costs. These scenarios illustrate the profound implications of fully understanding insurance needs and being adequately covered.

Terminology glossary

Navigating contractors all risk insurance requires familiarity with specific terminology. Here’s a brief glossary of key terms that can enhance your understanding when completing the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in contractors all risk insurance without leaving Chrome?

How do I edit contractors all risk insurance straight from my smartphone?

How do I fill out the contractors all risk insurance form on my smartphone?

What is contractors all risk insurance?

Who is required to file contractors all risk insurance?

How to fill out contractors all risk insurance?

What is the purpose of contractors all risk insurance?

What information must be reported on contractors all risk insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.