Get the free Credit Flexibility Proposal

Get, Create, Make and Sign credit flexibility proposal

How to edit credit flexibility proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit flexibility proposal

How to fill out credit flexibility proposal

Who needs credit flexibility proposal?

Navigating the Credit Flexibility Proposal Form: A Comprehensive Guide

Understanding credit flexibility

Credit flexibility refers to the ability of individuals and businesses to adjust their credit terms to better fit their financial circumstances and goals. This means having the capability to modify repayment schedules, adjust credit limits, or alter interest rates, which ultimately creates a more adaptable financial environment.

The significance of credit flexibility is paramount in both personal and business finance. For individuals, it allows for better management of unexpected expenses and changes in income. For businesses, it can lead to more favorable terms for growth, enabling them to invest in opportunities that require capital.

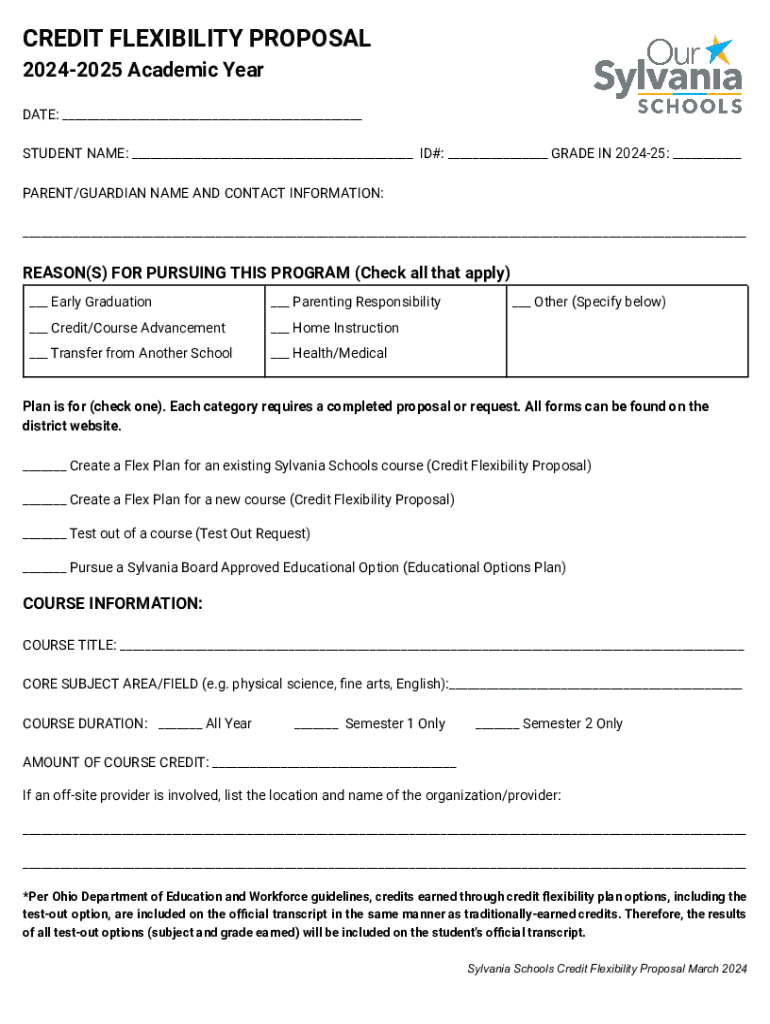

Overview of the credit flexibility proposal form

The Credit Flexibility Proposal Form serves as a structured request for modifications in credit terms. This document is essential not only for individuals seeking adjustments but also for teams within organizations to collectively approach financial institutions.

It plays a vital role in financing decisions by presenting a clear request, supported by necessary documents and financial data. The most important elements of the proposal include personal and financial information, proposed credit terms, and supporting documentation, all designed to showcase the rationale behind the request.

Step-by-step guide to filling out the credit flexibility proposal form

Completing the Credit Flexibility Proposal Form effectively requires preparation and attention to detail. Start by gathering necessary documents, including your identification, financial statements, and any previous correspondence with the lender. This ensures you have a comprehensive view of your financial standing.

Here’s a checklist of items to have on hand:

When filling out the proposal form, ensure you accurately complete each section. This includes:

Common mistakes to avoid when completing the Credit Flexibility Proposal Form include providing inaccurate financial data, failing to attach required documents, or ignoring deadlines for submission. It’s crucial to review your form for completeness before submission.

Editing and reviewing the completed proposal form

Reviewing the completed Credit Flexibility Proposal Form for accuracy is an integral step before submission. Errors can lead to delays in processing your request or even denial, which can derail your financial plans.

Recommended editing techniques include:

pdfFiller’s collaborative tools facilitate teamwork by allowing multiple users to access, edit, and comment on the proposal, ensuring a comprehensive review process.

Signing and submitting the credit flexibility proposal form

Once your Credit Flexibility Proposal Form is complete and reviewed, it’s time to sign and submit it. pdfFiller provides easy options for electronic signing through its eSig functionalities. Electronic signatures are not only legally binding but also more convenient than traditional handwritten signatures.

To submit your proposal digitally, follow these steps:

Managing and storing your proposal document

After submitting your Credit Flexibility Proposal Form, effective document management is critical. pdfFiller delivers robust document management features that allow you to organize and categorize forms for future reference.

You can utilize version control to track changes made to your document over time. It’s essential to have a reliable method for keeping records of submitted proposals, as this provides reference points for future financial discussions.

To retrieve your submitted forms easily, simply log into pdfFiller, and navigate to your document management section, where all necessary documents can be accessed swiftly.

Enhancing future credit flexibility proposals

Improving your approach to credit flexibility proposals involves learning from past experiences. Continuously reviewing previous submissions for feedback and adapting strategies ensures that your future proposals are more likely to succeed.

Interactive tools available in pdfFiller can significantly enhance your document creation and submission process. Here are some essential tools to support ongoing needs:

Frequently asked questions (FAQs)

When dealing with the Credit Flexibility Proposal Form, several questions may arise:

Real-life scenarios and case studies

Illustrating the successful use of the Credit Flexibility Proposal Form can provide valuable insights. Consider an entrepreneur who faced cash flow challenges during a seasonal downturn.

By submitting a well-prepared proposal for adjusted credit terms, this business owner was able to defer payments temporarily, allowing them to reinvest savings into marketing efforts that revitalized sales. The success hinged on accurately filling out the proposal and presenting supporting evidence of their business strategy.

Such scenarios emphasize the transformative potential of effectively leveraging the Credit Flexibility Proposal Form, illustrating how structured documentation can lead to positive financial outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit flexibility proposal directly from Gmail?

How can I modify credit flexibility proposal without leaving Google Drive?

How can I get credit flexibility proposal?

What is credit flexibility proposal?

Who is required to file credit flexibility proposal?

How to fill out credit flexibility proposal?

What is the purpose of credit flexibility proposal?

What information must be reported on credit flexibility proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.