Get the free Charitable and Educational Foundation Scholarship Application

Get, Create, Make and Sign charitable and educational foundation

Editing charitable and educational foundation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable and educational foundation

How to fill out charitable and educational foundation

Who needs charitable and educational foundation?

Comprehensive Guide to Charitable and Educational Foundation Forms

Overview of charitable and educational foundations

Charitable foundations are non-profit entities dedicated to supporting charitable purposes, such as alleviating poverty, advancing education, and promoting health. They play a pivotal role in addressing social challenges and offering assistance to communities in need. Educational foundations, on the other hand, specifically focus on enhancing education, providing funding for schools, scholarships, and educational initiatives.

Together, these foundations are instrumental in fostering social change, driving development, and improving the quality of life for individuals and communities. Their importance lies not only in financial support but also in raising awareness and engaging the public in missions that span various sectors.

Types of charitable and educational foundations

Understanding the landscape of charitable and educational foundations begins with recognizing the different types available. Each category serves unique functions and objectives, contributing to the overarching goal of enhancing societal welfare.

Understanding 501()(3) status

Achieving 501(c)(3) status signifies that an organization is recognized as a tax-exempt, charitable entity in the eyes of the IRS. This designation provides significant financial benefits, enabling both the foundation and its donors to enjoy various tax advantages.

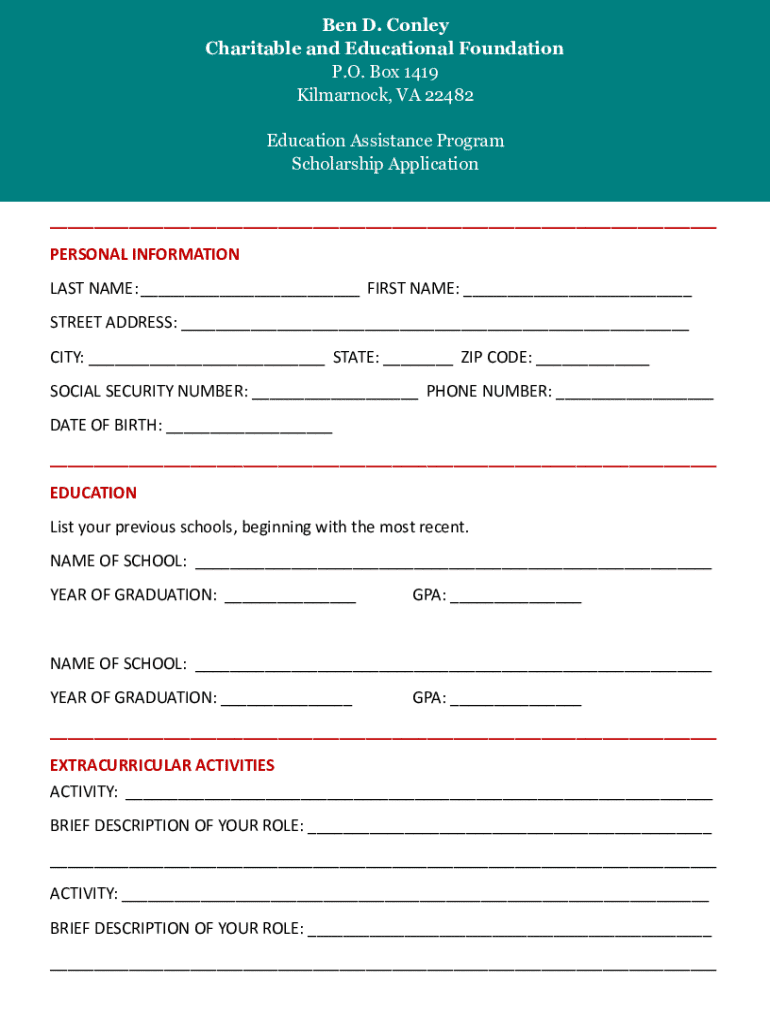

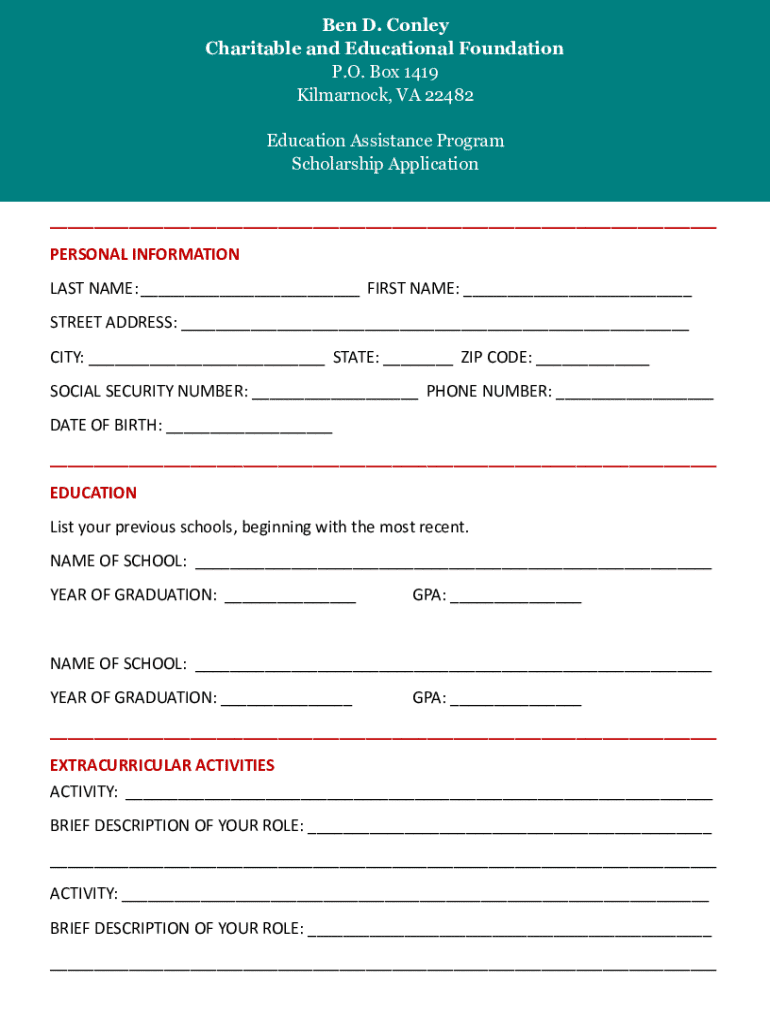

Essential components of the charitable and educational foundation form

Filling out the charitable and educational foundation form requires careful attention to detail. Each component plays a critical role in defining the organization and its goals.

Common mistakes in filling out the foundation form

Navigating the paperwork can be challenging, and there are common pitfalls that aspiring foundation creators often encounter. Understanding these can help improve the chances of a successful application.

Steps to fill out the charitable and educational foundation form

Filling out the charitable and educational foundation form can be streamlined by following a methodical approach. This ensures thoroughness and accuracy in the application process.

Tools for managing foundation documentation

Utilizing tools designed for document management can significantly enhance the organization and operation of a charitable or educational foundation. One such tool is pdfFiller, which offers a range of features for efficient document handling.

FAQs about charitable and educational foundations

Understanding the intricacies of charitable and educational foundations generates questions that frequently arise among those interested in establishing such entities.

Related topics: exploring the landscape of philanthropy

The landscape of philanthropy encompasses a wide array of concepts, each playing a role in addressing society's needs. Nonprofit organizations, donor-advised funds, and varying trends enhance the fabric of giving and support.

Insights from successful foundations

Successful foundations provide valuable case studies that illustrate best practices. Examining their strategies offers lessons for those aspiring to create their own organizations.

Next steps for aspiring foundation creators

Embarking on the journey to establish a charitable or educational foundation requires careful planning and consideration. Potential founders should take deliberate steps to ensure their vision becomes a reality.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete charitable and educational foundation online?

How do I edit charitable and educational foundation online?

How do I make edits in charitable and educational foundation without leaving Chrome?

What is charitable and educational foundation?

Who is required to file charitable and educational foundation?

How to fill out charitable and educational foundation?

What is the purpose of charitable and educational foundation?

What information must be reported on charitable and educational foundation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.