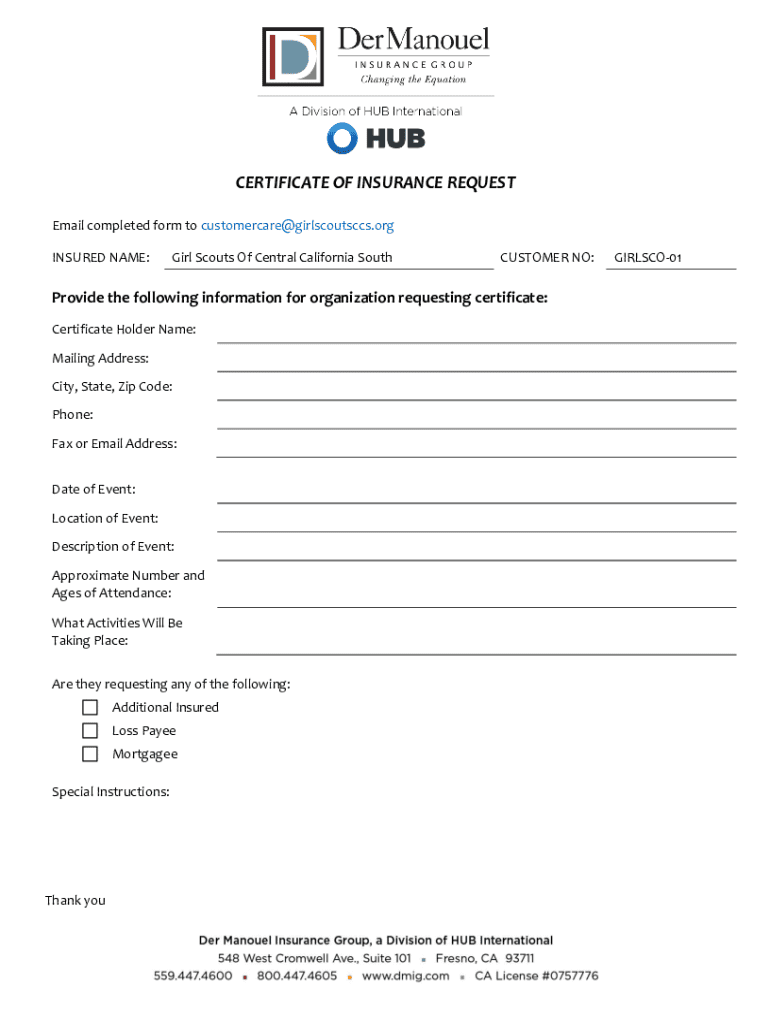

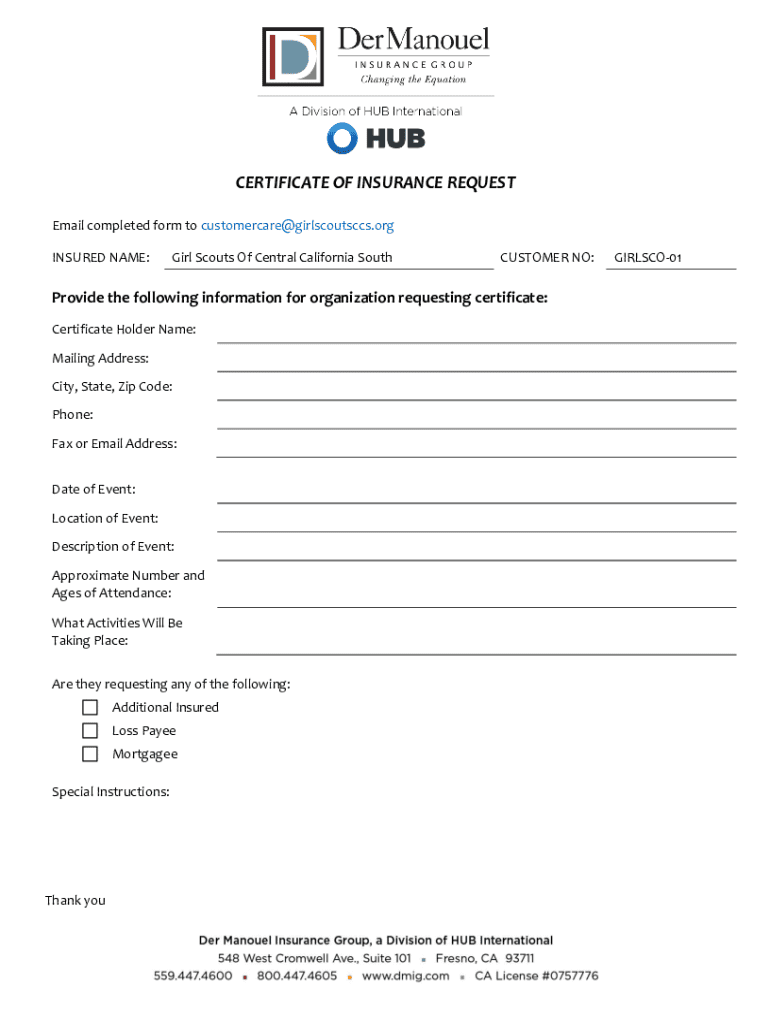

Get the free Certificate of Insurance Request

Get, Create, Make and Sign certificate of insurance request

How to edit certificate of insurance request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance request

How to fill out certificate of insurance request

Who needs certificate of insurance request?

Understanding the Certificate of Insurance Request Form

Understanding the Certificate of Insurance Request Form

A Certificate of Insurance (COI) serves as proof that an organization possesses the necessary insurance coverage for its operations. This document is particularly crucial in business environments where risk management is paramount. For vendors, subcontractors, or event organizers, having a COI can demonstrate professionalism and financial stability.

The Certificate of Insurance Request Form is an essential tool used to formally request this document. It details the specifics of the insurance needed and ensures that all parties are covered during contractual arrangements. Every transaction, whether it involves construction, events, or service provision, benefits from the diligence exercised in obtaining a COI.

The request form typically includes several key areas that must be filled out accurately to facilitate timely processing. Missing or incorrect information can lead to delays or denials of coverage, which can have significant repercussions.

Purpose of a COI Request Form

The primary purpose of the COI request form is to ensure proper coverage is in place for a specified activity or agreement. It provides a clear overview of what is needed, aligning the expectations of all stakeholders involved. Whether engaging a contractor or hosting an event, having a COI protects individuals and organizations from potential liabilities arising from unforeseen incidents.

For example, event organizers often require COIs from vendors to minimize risk during an event, while construction projects may mandate COIs to cover liabilities associated with accidents on-site. This standardized approach to risk verification helps maintain trust and accountability among parties.

Key components of the COI request form

A COI request form is structured to capture specific information essential for the insurance issuer. The following components are typically included:

Detailed breakdown of the COI request form

Understanding each section of the COI request form ensures proper completion and reduces the risk of errors. Start with the Date of Request, as it establishes a record of when the request was initiated. Accurate dates help all parties stay informed regarding timelines.

Next, the Needed By Date is vital. Specifying a timeline for when the COI is needed allows the insurance provider to prioritize the request. Including Event/Activity Dates is equally important as it directly affects the extent and duration of the insurance coverage.

Event activity dates

The start and end dates of the contract or event define when coverage kicks in and when it expires. Without these date parameters, the insurance company may not extend coverage for the required duration, leaving gaps that can result in serious implications for all parties involved.

Address section

Providing a detailed address is not only about location but ensures that the coverage applies to the correct venue. Mistakes here can lead to invalidated claims. The types of insurance policies required should reflect the risk profile associated with the activity, including but not limited to:

Lastly, mentioning whether a COI needs updating upon policy renewal is essential to maintain coverage continuity, avoiding lapses that could expose an organization to risk.

Filling out the COI request form

Filling out the COI request form accurately is crucial to avoid delays in receiving your Certificate of Insurance. Start by gathering all necessary documentation and information. A checklist can include previous COIs, addresses of insured locations, and specific policy requirements.

Next, systematically complete each section of the form. Be precise when writing dates and providing address details. Double-check all policy requirements against your business’s insurance needs to ensure compatibility with your request.

Common pitfalls to avoid

Avoiding common mistakes can save time and prevent complications. Common pitfalls include:

By diligently checking each component of the COI request form before submission, you can significantly reduce potential delays and ensure a smooth process.

How to submit the COI request form

Submitting the COI request form can vary depending on the insurer. Typically, there are several submission methods available. Online submission is increasingly popular, where forms can be filled directly on the insurer’s platform. This method is often the fastest, ensuring quicker processing times.

Email is another common method. Make sure to attach all relevant documents and any completed forms to your email message. It's advisable to include a brief explanation and any deadlines to give context to the insurer.

Follow-up procedures

After submitting your request, follow-up procedures are essential to ensure your COI is being processed. Set reminders to check back with the insurer in case you do not receive timely confirmation. Maintaining clear communication with your contact within the insurance company can facilitate prompt action if issues arise.

Why companies request COIs

Companies request Certificates of Insurance as part of their risk management strategy. A COI protects businesses from liability claims that may arise during events or contractual agreements. For example, if a contractor disrupts normal operations or causes property damage, the COI assures that the necessary coverage is in place to cover such incidents.

Furthermore, in some instances, compliance with legal or contractual obligations requires a COI. Many contracts stipulate that vendors provide proof of insurance before commencing services to mitigate financial risk.

Understanding costs and financial implications

Obtaining a Certificate of Insurance in the US can come with associated costs that organizations should factor into their budgets. On average, the process may involve administrative fees, which can vary considerably among insurance providers.

Factors influencing COI costs generally include:

Understanding these costs can help organizations prepare better and secure the right type of insurance while avoiding unnecessary expenses.

Best practices for requesting a COI

Effective communication with vendors can streamline the COI request process. When crafting your request, clarity is critical. Specify the type of insurance required and any applicable deadlines clearly. This reduces ambiguity and helps ensure all parties take the necessary actions promptly.

Managing timelines effectively is equally vital. Planning your request well in advance of when the COI is required ensures you have ample time for adjustments or follow-ups, limiting last-minute scrambles. Aim to incorporate buffer time after the request date to achieve optimal results.

The role of technology in COI management

The landscape of COI processing is evolving rapidly with advancements in technology. Automation in COI management can enhance efficiency. Cloud-based solutions streamline the process, enabling organizations to manage requests, track documentation, and monitor expiration dates from a unified platform.

Implementing a dedicated COI management system offers significant advantages, such as:

Utilizing these technologies creates a more streamlined, stress-free process for all parties involved in COI requests.

Industry-specific considerations

Different industries have unique requirements when it comes to Certificates of Insurance. For instance, the construction industry often faces stringent insurance mandates due to the inherently high-risk nature of on-site work. Contractors may need specific coverages tailored to various aspects of their work, such as liability for injury or damage during construction.

Similarly, the event planning sector frequently encounters scenarios that necessitate COIs. Venues may require COIs for events to protect against potential liabilities arising from attendee injuries or damages during the event.

Challenges in COI management

Despite the prevalence of COIs, managing them is not without its challenges. A common issue vendors face is lapsing or expired certificates. Sometimes, either party fails to keep track of expiration dates, leading to potential coverage gaps.

The impact of poor COI management can extend beyond financial consequences. It may result in legal complications or damage to business relationships if a vendor cannot provide necessary coverage when required. Therefore, implementing sound management practices is vital.

Future trends in COI handling

The Certificate of Insurance landscape continues to evolve, introducing trends driven by technology and changes in regulation. The increasing role of artificial intelligence and automation signifies a shift towards streamlined processes that enhance efficiency and accuracy in COI management.

Furthermore, as regulatory frameworks adjust, staying informed of compliance guidelines is essential. Businesses must remain agile and adaptable to shifting standards in insurance requirements, ensuring they maintain protective measures in their operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in certificate of insurance request?

How do I edit certificate of insurance request straight from my smartphone?

Can I edit certificate of insurance request on an Android device?

What is certificate of insurance request?

Who is required to file certificate of insurance request?

How to fill out certificate of insurance request?

What is the purpose of certificate of insurance request?

What information must be reported on certificate of insurance request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.