Get the free Contractor’s Exempt Purchase Certificate

Get, Create, Make and Sign contractors exempt purchase certificate

How to edit contractors exempt purchase certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out contractors exempt purchase certificate

How to fill out contractors exempt purchase certificate

Who needs contractors exempt purchase certificate?

Understanding the Contractors Exempt Purchase Certificate Form

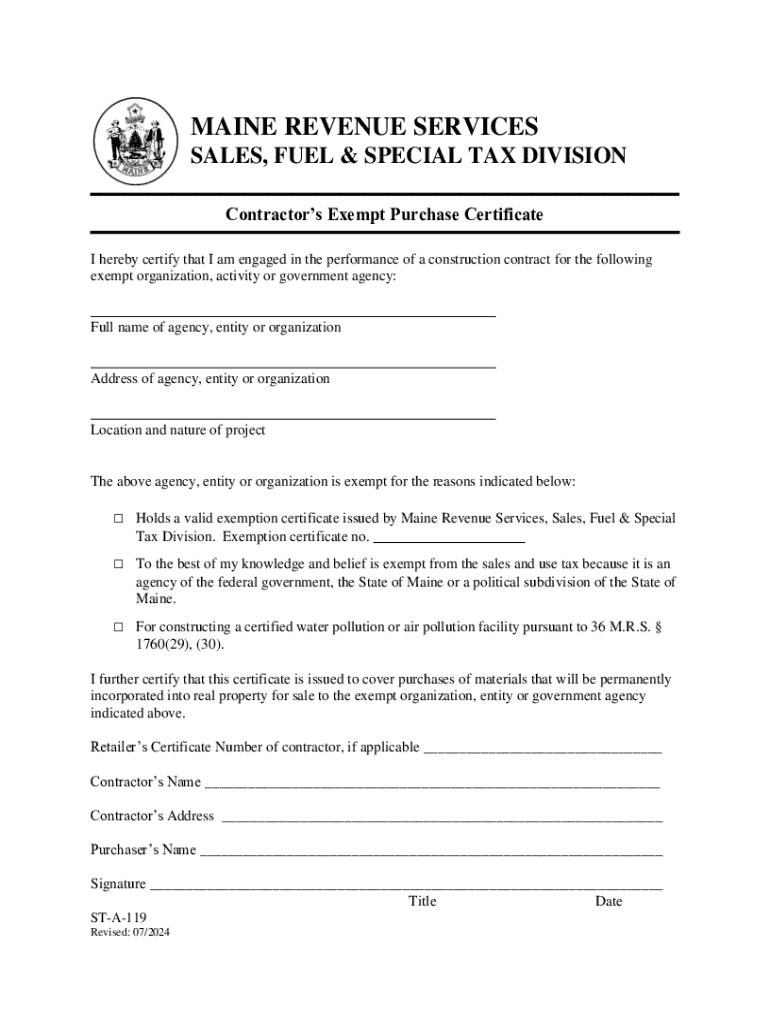

What is the Contractors Exempt Purchase Certificate Form?

The Contractors Exempt Purchase Certificate Form is an essential document that allows contractors to purchase goods and services without paying sales tax in certain situations. This form serves to validate a contractor's claim for tax exemption during the procurement of materials directly related to construction projects. By utilizing this form, contractors can effectively manage their tax liabilities, ultimately reducing project costs and optimizing financial resources.

The importance of this form extends beyond mere tax savings; it helps contractors ensure compliance within the legal frameworks governing transactions. When correctly utilized, the form prevents misunderstandings with suppliers and tax authorities, providing clarity on the tax obligations associated with construction activities.

Who needs the Contractors Exempt Purchase Certificate Form?

The primary users of the Contractors Exempt Purchase Certificate Form are contractors and subcontractors engaged in construction and renovation projects. These entities operate in a specialized market where the acquisition of materials and services is pivotal. Additionally, businesses involved in large-scale procurement operations can leverage the form to ensure compliance and manage costs effectively.

Various categories of organizations may find value in the certificate, including general contractors, specialty trade contractors such as electricians and plumbers, and even suppliers and manufacturers of construction materials. Thus, understanding who can utilize this form is crucial for optimizing the benefits associated with tax exemptions in construction-related transactions.

When and where to use the form

Optimally, contractors should use the Contractors Exempt Purchase Certificate Form when purchasing materials that will be resold or incorporated into a taxable service. Specific scenarios include acquiring raw materials, machinery, and tools directly related to construction projects, or when engaging in significant infrastructure projects where exemptions apply. Recognizing when to issue the certificate is paramount for maintaining compliance and avoiding unnecessary expenses.

Geographically, the requirements for using this form can vary by state or region due to differing tax laws and exemption criteria. It is essential for contractors to familiarize themselves with the relevant regulations in their specific jurisdictions. Resources such as state tax department websites can provide valuable insights into local laws and facilitate better compliance.

Step-by-step guide to filling out the Contractors Exempt Purchase Certificate Form

Filling out the Contractors Exempt Purchase Certificate Form accurately is essential for claiming tax exemptions correctly. Begin by gathering necessary information, which may include your business identification number, tax identification number, and specifics regarding the materials or services being purchased.

Here's a step-by-step guide on how to complete the form correctly:

After completing the form, review it thoroughly to ensure that all details are accurate. Common mistakes such as incorrect tax IDs or omissions can lead to delays or denials of exemptions.

Tips for editing and managing your form with pdfFiller

Utilizing pdfFiller allows contractors to edit their Contractors Exempt Purchase Certificate Form efficiently. With its user-friendly interface, pdfFiller provides various features for modifying PDF documents, enabling instant updates and corrections. Benefits of using electronic templates over traditional paper forms include the ability to save time, minimize errors, and ensure compliance with local regulations.

One of the standout features of pdfFiller is its eSignature integration, permitting users to add electronic signatures for instant approvals. This significantly expedites the process of obtaining necessary approvals from parties involved in the transactions, streamlining collaboration and communication. Team input can also be accommodated via pdfFiller's collaboration features, allowing multiple stakeholders to work on the form simultaneously.

Common questions and answers about the Contractors Exempt Purchase Certificate Form

Even with a clear understanding of the Contractors Exempt Purchase Certificate Form, questions may arise during the usage process. Here are some frequently asked queries regarding the form:

For further assistance, pdfFiller offers robust support channels, including live chat options for real-time help and comprehensive FAQs tailored for users.

Additional resources and tools

To provide better clarity on the Contractors Exempt Purchase Certificate Form, utilizing sample completed forms can be immensely helpful. Visual examples guide users on how to fill out the form correctly, ensuring adherence to required specifications.

Moreover, pdfFiller offers an interactive tool that allows users to generate certificates quickly. This tool acts as a guide through the form creation process, making it considerably faster and error-free. Additionally, for users requiring language assistance, forms are often available in multiple languages to cater to diverse needs.

Understanding legal and compliance issues

Navigating the legal landscape surrounding the Contractors Exempt Purchase Certificate Form requires a robust understanding of state-specific regulations. Each state may have unique requirements regarding documentation, eligibility, and compliance. Understanding these nuances is critical to avoid potential fines or misunderstandings with tax authorities.

Best practices for document management, including periods of retention and proper record-keeping techniques, should be integral to your operational procedures. Ensuring you have accurate records not only aids in audits but also reinforces compliance with local tax laws.

Testimonials and user experiences with pdfFiller

Hearing directly from users adds authenticity and perspective regarding the Contractors Exempt Purchase Certificate Form utility through pdfFiller. Users frequently share success stories about how the platform has transformed their document management practices, particularly in improving accuracy and speed.

Community feedback ranges from praising the effectiveness of electronic signatures to highlighting the ease of collaboration. Many contractors report that pdfFiller has not only saved them time but has also enabled them to maintain organized records, significantly enhancing their operational efficiency.

Connect with us for further support

Engaging with the pdfFiller community offers a wealth of opportunities for support and learning. Users can tap into forums and discussion groups to share insights, ask questions, and learn from shared experiences. Staying updated with the latest features and tips can drastically improve document management practices.

Additionally, following pdfFiller on social media platforms provides an easy way to receive ongoing updates and support to enhance your document workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contractors exempt purchase certificate for eSignature?

How do I make edits in contractors exempt purchase certificate without leaving Chrome?

Can I edit contractors exempt purchase certificate on an Android device?

What is contractors exempt purchase certificate?

Who is required to file contractors exempt purchase certificate?

How to fill out contractors exempt purchase certificate?

What is the purpose of contractors exempt purchase certificate?

What information must be reported on contractors exempt purchase certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.