Get the free County Auditor Form 1016

Get, Create, Make and Sign county auditor form 1016

Editing county auditor form 1016 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out county auditor form 1016

How to fill out county auditor form 1016

Who needs county auditor form 1016?

A Comprehensive Guide to County Auditor Form 1016 Form

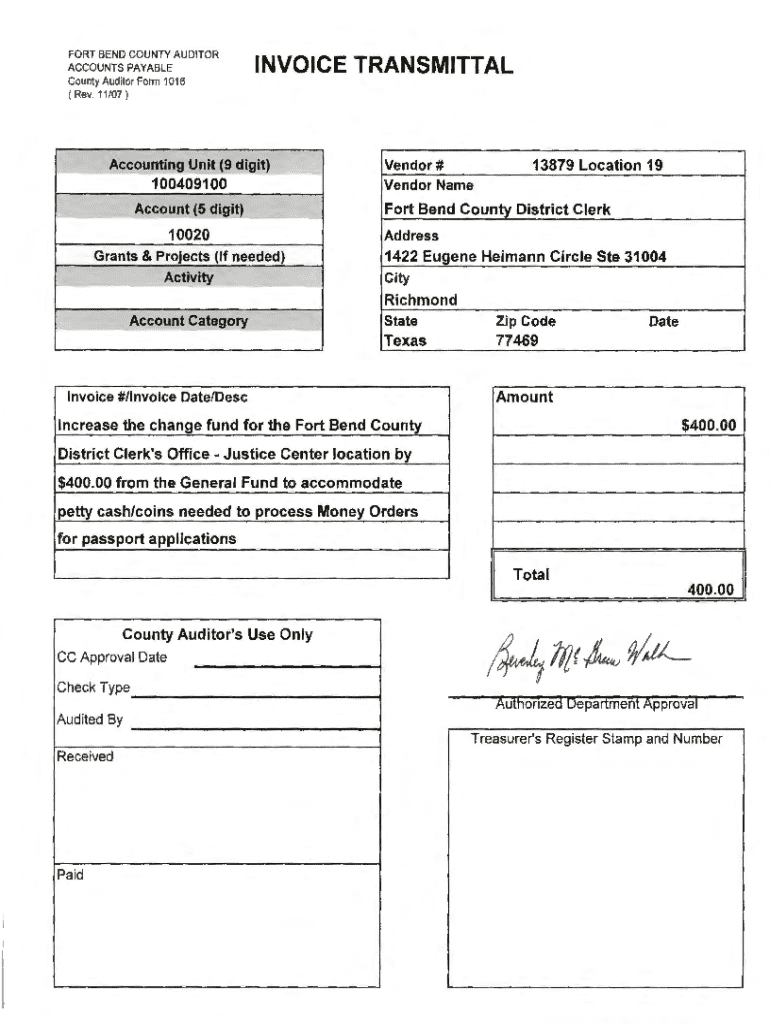

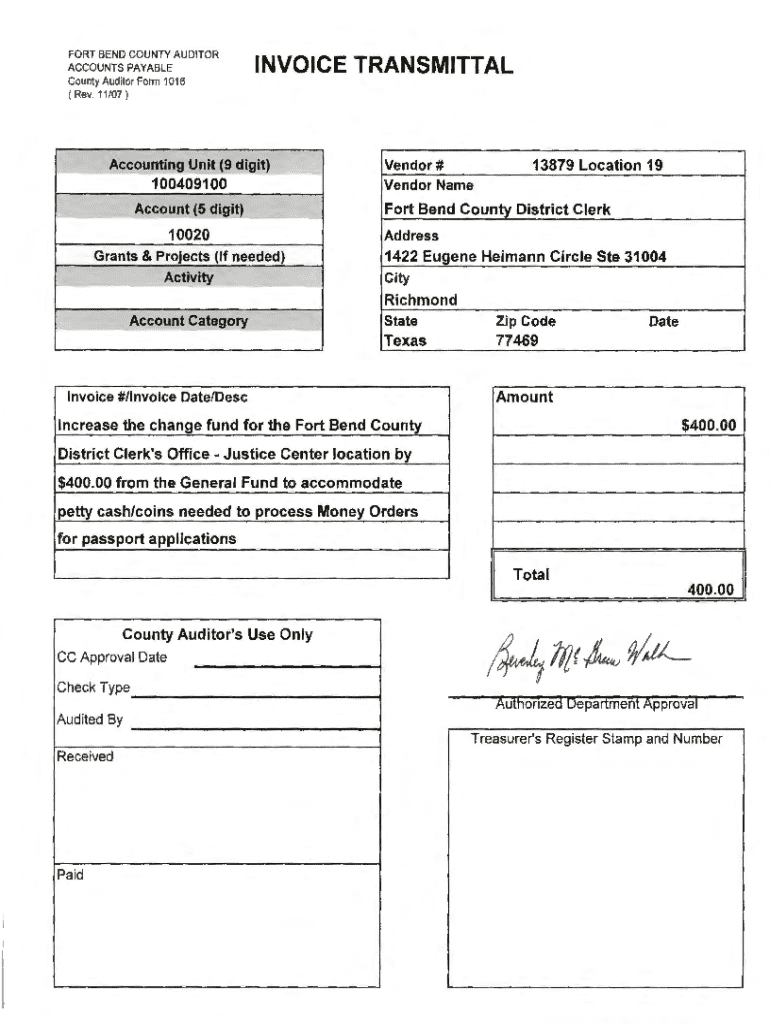

Overview of County Auditor Form 1016

County Auditor Form 1016 is an essential document utilized by local governments to gather financial information and property data. Its primary purpose is to ensure transparency and accuracy in county financial dealings, which affects local budgets and taxation. This form may seem straightforward, but its implications for local governance are significant, influencing budget allocation and public trust. It is commonly used in various scenarios, including property tax assessments, financial disclosures, or during audits, thereby serving as a cornerstone for local accounting practices.

Accessing County Auditor Form 1016

To obtain the County Auditor Form 1016, navigating to the pdfFiller website is your best bet. The platform offers a user-friendly interface where you can easily find and download the form. Simply visit the site, search for 'County Auditor Form 1016,' and select the appropriate download format—either PDF or DOCX. Furthermore, pdfFiller allows you to view the form in various formats without requiring additional software installations.

One of the standout features of pdfFiller is its extensive toolkit that includes options for eSigning, editing, and managing documents. These capabilities enable you to personalize the County Auditor Form 1016 to meet your specific needs effectively, making the process seamless and intuitive.

Step-by-step instructions for completing County Auditor Form 1016

Completing the County Auditor Form 1016 requires attention to detail. Let's break down the sections you will need to fill out:

Editing and making changes to County Auditor Form 1016

Editing the County Auditor Form 1016 may become necessary due to errors or changes in your financial situation. pdfFiller offers an array of editing tools that allow for easy amendments without the need to start from scratch. Common reasons for needing edits include changes in income, expenses, or property information. To make amendments, simply upload the existing form onto pdfFiller, edit the required fields, and save your changes. This flexibility ensures that your submitted form always reflects the most accurate information.

Submitting County Auditor Form 1016

Once your County Auditor Form 1016 is complete, you'll need to submit it. The pdfFiller platform accommodates several submission methods, including online portals, traditional mail, or in-person delivery to your local auditor's office. Each method has its own processing timelines, so it’s essential to choose the one that suits your needs best.

Be aware of deadlines for submission, as failing to submit on time could lead to penalties or complications in processing your form. Setting reminders for key due dates can help you maintain compliance.

Collaborating with teams on form completion

If you are working as part of a team to complete the County Auditor Form 1016, pdfFiller features robust collaboration tools. These allow you to invite team members to review and edit the document in real time, promoting efficiency and accuracy. For effective teamwork, ensure that roles are clearly defined so that each member knows what information they are responsible for. This streamlined collaboration can significantly reduce errors and enhance the submission quality.

FAQ section on County Auditor Form 1016

It’s not uncommon to have questions regarding the County Auditor Form 1016. The following FAQ addresses common concerns:

Troubleshooting common issues

As you navigate the County Auditor Form 1016 process, you may encounter some common technical issues. Here are a few problems and their solutions:

For additional assistance, pdfFiller’s customer support is readily accessible and can help resolve any issues you might encounter during the process.

Advantages of using pdfFiller for County Auditor Form 1016

Utilizing pdfFiller for the County Auditor Form 1016 offers numerous advantages. One of the most significant benefits is the cloud-based access that allows you to work on the form from anywhere with an internet connection. This feature is particularly helpful for busy professionals or teams managing multiple projects.

In addition, pdfFiller provides integrated tools for eSigning, editing, and comprehensive document management. This not only saves time but also enhances accuracy by minimizing the chances of human error. The platform also employs enhanced security features, ensuring that your sensitive information is protected throughout the document's lifecycle.

Staying updated with changes related to County Auditor Form 1016

Staying informed about updates to the County Auditor Form 1016 is crucial. Subscribe to updates via the pdfFiller platform to receive timely notifications on any changes or new requirements. Additionally, keeping track of legislative or regulatory changes that may affect the form's usage ensures that you remain compliant with local regulations.

User testimonials and experiences

Real stories from users who successfully utilized the County Auditor Form 1016 showcase the many benefits afforded by the pdfFiller platform. For instance, one user reported that using pdfFiller significantly expedited the process, allowing for faster submissions and less stress during busy filing periods. Another user expressed satisfaction with the collaborative features, which made teamwork much easier and more organized.

Additional tips for navigating county auditor processes

Navigating the processes associated with the County Auditor can feel daunting. However, following some best practices can simplify the experience. Keep a checklist of required documents and forms to bring to your meetings at the county office. Understanding the broader context of county auditing procedures and policies will also make you more resourceful during interactions with officials.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify county auditor form 1016 without leaving Google Drive?

How do I execute county auditor form 1016 online?

How do I make edits in county auditor form 1016 without leaving Chrome?

What is county auditor form 1016?

Who is required to file county auditor form 1016?

How to fill out county auditor form 1016?

What is the purpose of county auditor form 1016?

What information must be reported on county auditor form 1016?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.