Get the free Credit/sales Agreement

Get, Create, Make and Sign creditsales agreement

How to edit creditsales agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out creditsales agreement

How to fill out creditsales agreement

Who needs creditsales agreement?

A Comprehensive Guide to the Credit Sales Agreement Form

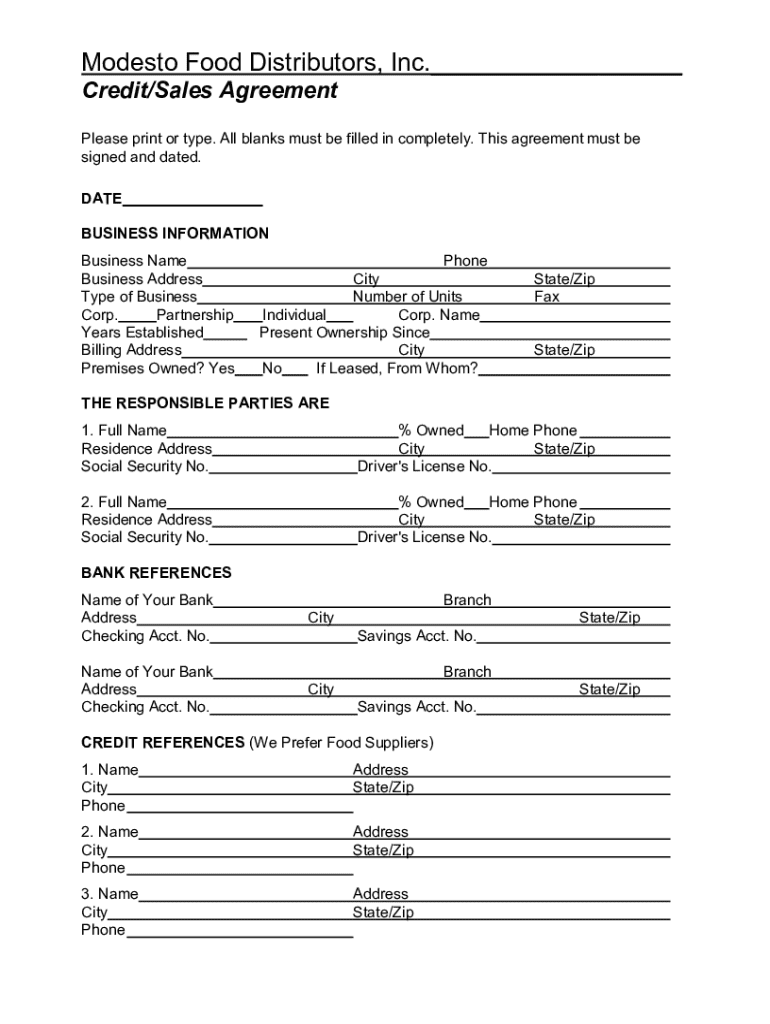

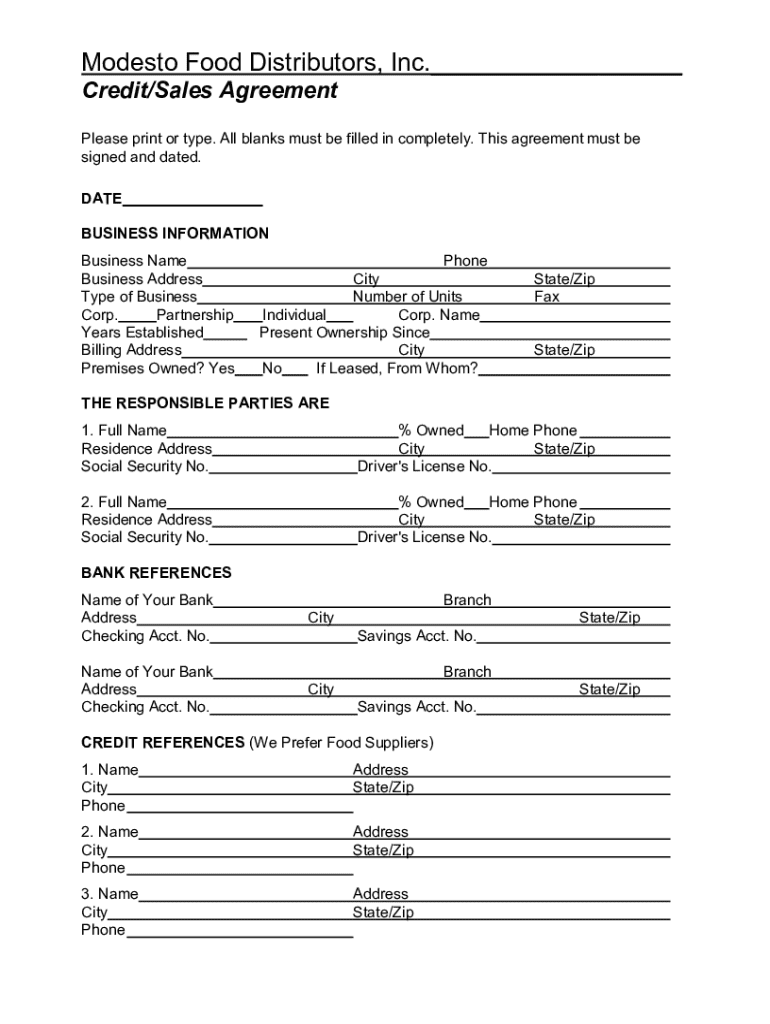

Understanding the credit sales agreement form

A credit sales agreement is a legally binding document between a seller and a buyer, allowing for payment on credit terms instead of full upfront payment. This arrangement is particularly beneficial in business transactions where buyers may not have immediate capital. The primary purpose of this agreement is to outline the specific terms under which credit will be extended, including price, interest, and payment schedules, providing clarity for both parties.

Understanding key terminology is crucial for anyone involved in a credit sales agreement. Credit terms define the conditions under which the credit is extended, including payment timelines. Interest rates outline the cost of borrowing the credit, expressed as a percentage of the principal amount, which is the total amount of credit extended. Familiarity with these terms not only enhances negotiation but also contributes to informed decision-making.

Establishing a credit sales agreement promotes transparency and trust between parties. It safeguards against misunderstandings, ensuring that both buyers and sellers have clear expectations regarding payment structures, thus fostering smoother transactions.

Components of the credit sales agreement form

A well-crafted credit sales agreement includes several essential elements that ensure legal binding and clarity. Firstly, buyer and seller information must be clearly stated, including names, addresses, and contact details. The description of goods or services provided is another critical factor, as it details what is being sold, preventing potential disputes over expectations.

Additionally, the pricing structure and payment terms should be explicitly defined, including total cost, deposit requirements, and any applicable interest rates. The duration of the credit terms lays out the period within which the buyer is expected to make payments, clearly outlining deadlines to avoid confusion.

Optional clauses can also enhance the agreement's clarity and security. For instance, collateral requirements may safeguard the seller’s interests by securing the loan against tangible assets. Similarly, outlining late payment penalties can deter defaults and ensure compliance with agreed-upon terms.

Filling out the credit sales agreement form

Completing the credit sales agreement form can seem daunting, but a methodical approach simplifies the process. To start, gather all required information, including personal or business details for both parties, a description of the goods or services being sold, and the specific terms of payment.

Next, clearly enter the buyer and seller details, ensuring all information is accurate to avoid future complications. The goods or services should be described comprehensively, followed by specifying the payment terms. It’s essential to include total costs, installment amounts, and any applicable interest rates.

Common mistakes include leaving out essential details or providing incorrect information. To avoid issues, double-check each section before finalizing. Additionally, clarity in your language makes the agreement more effective, so use precise terms and avoid jargon when possible.

Editing and customizing the credit sales agreement form

Once the form is filled out, customizing it to fit your specific needs is often necessary. Many users start with pre-existing templates that can be modified to reflect unique agreements. To do this effectively, utilize tools that allow for interactive editing, such as those provided by pdfFiller. These features not only enable easy modifications but also help in maintaining the integrity of the document.

Adding signatures and initials is crucial for validating the agreement. Ensure all parties have an opportunity to review the document before signing. When using pdfFiller, eSignatures facilitate an efficient signing process while remaining legally valid, making it easy to finalize transactions while maintaining compliance with local regulations.

Signing the credit sales agreement form

The significance of signing the credit sales agreement cannot be overstated. An electronic signature offers convenience, especially in an increasingly digitized business world. By using pdfFiller's eSigning feature, users can sign documents remotely, accelerating the transaction process while ensuring that both parties consent to the terms of the agreement.

Understanding the legal standing of eSignatures is also essential. In many jurisdictions, electronic signatures hold the same weight as handwritten ones, provided they comply with local regulations like the ESIGN Act in the United States or eIDAS in Europe. Always check the relevant laws in your area to verify that your electronic signing process is on solid legal ground.

Managing your credit sales agreement

After signing, effective management of your credit sales agreement is crucial. Storing the document securely using cloud-based solutions like pdfFiller not only eases access but also enhances security. This platform allows users to manage documents from anywhere, ensuring that both parties can review terms and conditions as needed.

Version control and document tracking are additional features that come in handy. As amendments or renewals occur, keeping track of different versions ensures that every party is aware of the most current agreement. Utilizing pdfFiller’s collaboration features fosters effective communication, allowing stakeholders to share documents and provide feedback seamlessly.

Understanding your rights and obligations

Enforcing the terms of the credit sales agreement involves an understanding of the rights and obligations of both buyers and sellers. Buyers are typically responsible for adhering to payment schedules as outlined, while sellers must deliver the goods or services as agreed. Recognizing these responsibilities can foster smoother transactions and help avert disputes.

In the event of a default or breach of agreement, knowing your legal options is critical. Buyers may negotiate terms or seek amendments to payment schedules if they face financial difficulties. On the other hand, sellers may need to enforce penalties or pursue legal remedies to recover owed amounts. Understanding these aspects of your agreement helps to ensure that you remain informed and prepared for any challenges that may arise.

Frequently asked questions (FAQs)

The distinction between a credit sales agreement and other sales agreements lies primarily in the payment structure. A credit sales agreement specifically allows for delayed payment, while standard sales agreements typically require full payment upon purchase. This flexibility can facilitate larger transactions and improve cash flow for buyers.

Cancelling a credit sales agreement generally depends on the terms outlined within the document itself. Always refer to the cancellation policy specified in the agreement before taking any action. Should the credit agreement become unenforceable, parties should consult legal counsel to explore options like re-negotiation or settlement.

Disputing terms within a credit sales agreement may also arise, particularly if the agreement is deemed unfair or miscommunicated. Engaging in open dialogue with the other party often leads to resolution, but should this fail, mediation or legal recourse may be necessary.

Related templates and helpful tools

To aid in the management of credit sales agreements, pdfFiller offers a variety of related document templates available for use. These include sales proposal templates for pitches, invoice templates for billing, and purchase order templates for procurement. Utilizing these related documents can streamline your operations, enhancing efficiency in managing your sales process.

In addition to templates, integrating financial management tools can provide broader functionality. These tools facilitate tracking expenses, managing cash flow, and fulfilling compliance requirements, forming a well-rounded approach to document management and financial planning.

Best practices for a successful credit sales agreement

Negotiating favorable terms is vital for ensuring the credit sales agreement serves both parties efficiently. Engage in open discussions about your needs and limits, aiming for an agreement that benefits both sides. Regular reviews and updates of the agreement help adapt to changes in business conditions, safeguarding the interests of all parties involved.

Moreover, staying informed about legal changes affecting credit agreements can protect your rights and obligations. Keeping abreast of relevant legislation ensures that your agreements remain compliant and enforceable, safeguarding against potential legal pitfalls.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my creditsales agreement directly from Gmail?

How do I edit creditsales agreement in Chrome?

How do I fill out creditsales agreement using my mobile device?

What is creditsales agreement?

Who is required to file creditsales agreement?

How to fill out creditsales agreement?

What is the purpose of creditsales agreement?

What information must be reported on creditsales agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.