Get the free Char500

Get, Create, Make and Sign char500

How to edit char500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out char500

How to fill out char500

Who needs char500?

A comprehensive guide to the CHAR500 form

Overview of the CHAR500 form

The CHAR500 form is a crucial document for nonprofits and charities operating in New York. It serves as an annual report detailing an organization's financial status, activities, and governance. The primary purpose is to ensure transparency and compliance with state laws, allowing stakeholders to assess the charity's operations and efficacy.

Filed with the New York State Attorney General's Office, the CHAR500 is not merely a bureaucratic requirement. It plays a significant role in public trust, as it allows donors and the public to understand how nonprofit organizations allocate their resources. This transparency promotes accountability, vital for maintaining the integrity of the nonprofit sector.

Who needs to file the CHAR500 form?

Any organization registered as a charitable entity in New York is typically required to file the CHAR500 form. This includes various types of nonprofits, such as organizations that solicit donations from the public or engage in charitable activities. Common entities include health charities, educational institutions, religious organizations, and any advocacy group that qualifies as a nonprofit under state law.

However, there are exceptions to this rule. Organizations that qualify as 'exempt' may not be required to file the CHAR500. This primarily includes very small organizations, typically those with gross receipts below a certain threshold. It’s crucial for entities to understand their classification to comply appropriately.

Understanding filing requirements

New York nonprofit organizations have to adhere to specified annual reporting requirements based on their revenue levels. Larger charities, typically those with a gross revenue of over $1 million, must file additional schedules along with the CHAR500. Smaller organizations might have different, simplified reporting mandates.

It's essential to be aware of important deadlines. The CHAR500 is due annually, with the exact date depending on the organization’s fiscal year end. Organizations can face penalties for failing to file or for late submissions, thus understanding these deadlines is critical for compliance.

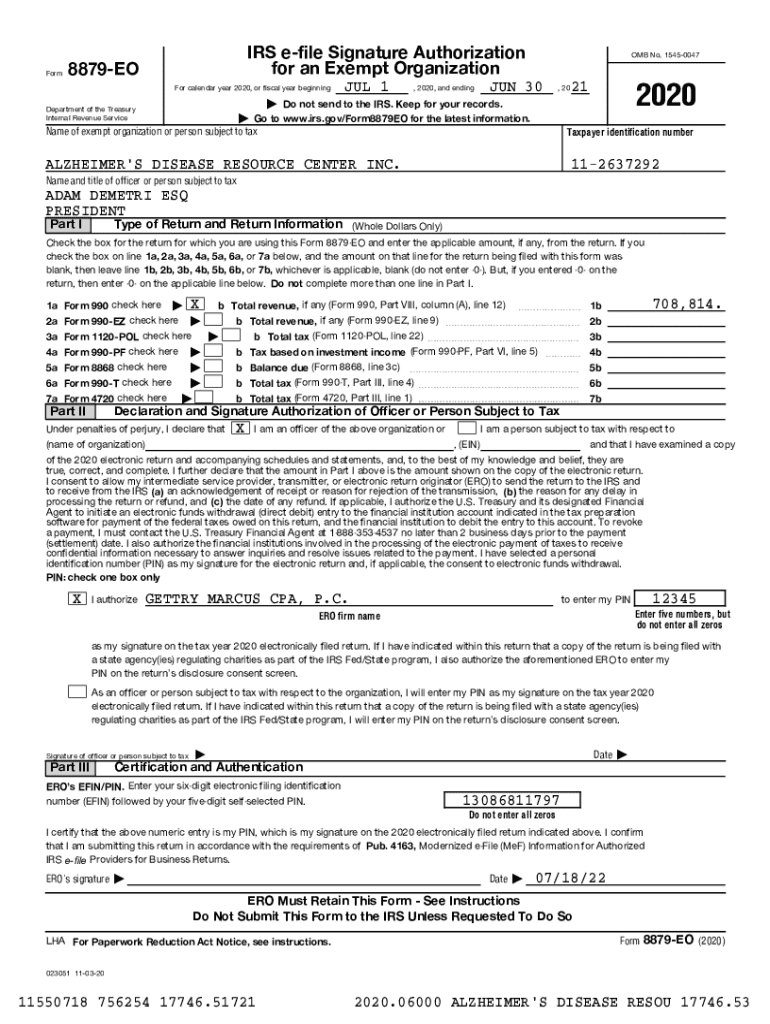

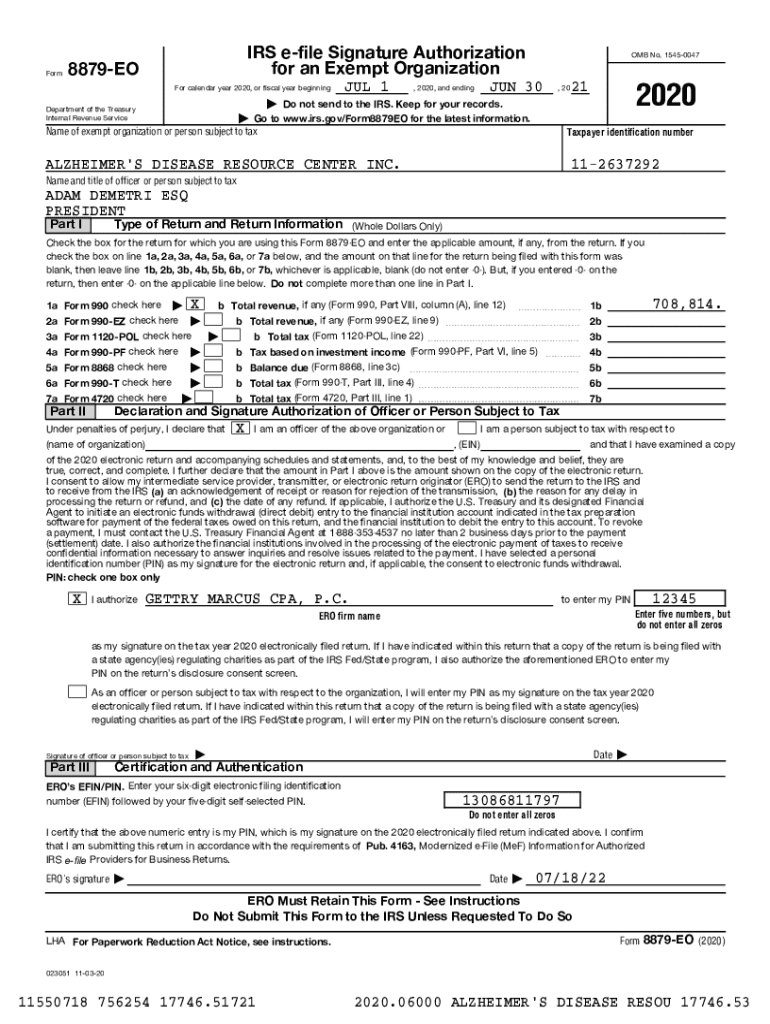

Detailed instructions for filling out the CHAR500 form

Completing the CHAR500 form is designed to be straightforward, but it requires careful attention to detail. The first step is gathering all necessary documentation, which includes financial statements, tax returns, and information regarding the board of directors.

Once documentation is ready, organizations can proceed to fill each section. Start with Section 1, where you provide basic organization identification and contact details. Next, Section 2 focuses on financial information—be prepared to detail sources of revenue and expenditures. Finally, Section 3 requires you to outline governance details, including the makeup of the board of directors.

E-filing vs. paper filing: making the right choice

E-filing the CHAR500 offers several advantages over traditional paper filing. Firstly, the e-filing process is streamlined, allowing users to complete and submit their forms quickly and efficiently. Immediate confirmation is an added benefit, providing peace of mind that your submission has been received.

Furthermore, e-filing minimizes the risk of human error. The online interface often includes tools that guide users through necessary fields and keep track of documents, ensuring everything is completed accurately. To e-file the CHAR500, simply visit platforms like pdfFiller, where you can easily upload your documents and start the filing process.

Tools and resources for successful filing

Utilizing interactive resources significantly aids in the successful completion of the CHAR500 form. Utilizing a filing calendar or reminders can help ensure that dates are not missed. Synchronizing these reminders with your organization’s budgetary cycles can provide a holistic view of compliance timelines.

Additionally, video tutorials can be an excellent resource, offering visual guidance through each section of the CHAR500. By taking a video tour, users can learn how to efficiently navigate pdfFiller's features for document management, ultimately streamlining their filing processes.

Frequently asked questions about the CHAR500 form

New users filing online may have various questions, such as what to expect during the process. It’s essential to familiarize yourself with the e-filing environment to navigate quickly and efficiently. New users should closely follow prompts and ensure they complete each section accurately for a successful submission.

Returning users can benefit from specific tips that enhance their experience. Familiarity with common issues—such as what steps to take if a filing deadline is missed—can mitigate stress and ensure that your organization remains compliant. Understanding how to amend submissions also helps, especially in addressing any discrepancies discovered after filing.

Understanding penalties and compliance

Noncompliance with filing the CHAR500 can lead to significant penalties for your organization. These penalties may include fines and negative implications for your nonprofit’s status, potentially affecting its ability to secure future funding. Late or incorrect filings can damage credibility, leading to donor wariness and loss of trust.

To avoid such consequences, organizations should adopt best practices for record-keeping and stay proactive regarding future filings. Implementing a compliance strategy that schedules regular reviews of financials and necessary paperwork can promote timely filings and ongoing organizational integrity.

Additional guidance on related topics

In addition to filing the CHAR500, nonprofits must be aware of other essential forms necessary for compliance. For instance, Form 990 is also important for federal tax-exempt reporting. Understanding how these forms interrelate and what other documentation may be necessary is key to maintaining overall compliance with both state and federal regulations.

Moreover, ongoing training for board members can be invaluable. Organizations should seek resources that support good governance and effective management practices. Such resources are often available through nonprofit networks and state associations, providing guidance that enhances organizational efficiency and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify char500 without leaving Google Drive?

How do I execute char500 online?

Can I create an electronic signature for the char500 in Chrome?

What is char500?

Who is required to file char500?

How to fill out char500?

What is the purpose of char500?

What information must be reported on char500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.