Get the free Certificate of Exemption - Personal/religious - doh wa

Get, Create, Make and Sign certificate of exemption

Editing certificate of exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of exemption

How to fill out certificate of exemption

Who needs certificate of exemption?

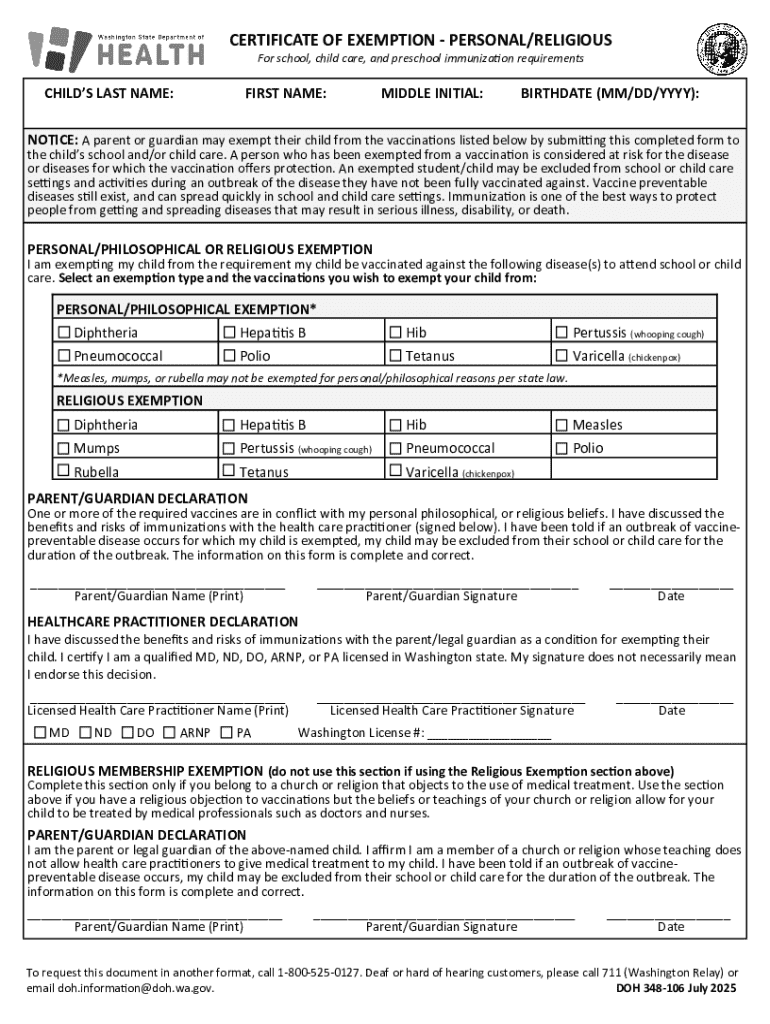

Understanding the Certificate of Exemption Form

Understanding the certificate of exemption form

A certificate of exemption form serves as a critical document that confirms a buyer's eligibility to make purchases without paying sales tax. This form is crucial for various stakeholders, including individuals, businesses, and non-profit organizations that qualify for exemptions due to their specific status or purpose.

The importance of the certificate of exemption form is multifaceted. For businesses, it provides significant cost savings by reducing the overall tax burden. Non-profit organizations utilize this form to enhance their resource allocation by conserving funds that would otherwise be spent on taxes. Individuals and teams that leverage this document can simplify transactions and improve financial planning.

Eligibility criteria for exemption

Understanding who can use the certificate of exemption form is essential for navigating its best application. Generally, both individuals and businesses may be eligible, provided they can demonstrate the need for exemption based on their operational or personal circumstances. Notably, entities such as educational institutions, charities, or governmental organizations typically qualify for such exemptions due to their significant public service contributions.

To determine eligibility, applicants must adhere to specific tax compliance requirements. These can vary based on state regulations, but generally, it includes having a valid tax ID number, being in good standing with tax authorities, and demonstrating that purchases made under the exemption are necessary for the exempt purpose.

Step-by-step guide to completing the certificate of exemption form

Preparing to fill out the certificate of exemption form requires diligent organization. Before you begin, gather all relevant documentation, including your tax ID number and any other paperwork that certifies your exempt status. Having these documents at hand streamlines the completion process, ensuring that you can accurately fill in all required details.

As you begin to navigate the form, break it down section by section. Pay careful attention to each field, ensuring accuracy. Common mistakes often stem from incorrect tax identification numbers or misunderstanding the definitions of exempt purposes. To avoid delays or denials, double-check your entries against your gathered documentation and consult example forms where available.

Editing and customizing your certificate of exemption form

In today’s digital era, leveraging pdfFiller’s online tools can significantly enhance your experience with the certificate of exemption form. This platform allows users to upload their documents seamlessly and make necessary customizations without hassle. Whether it’s adding annotations, comments, or electronic signatures, pdfFiller provides a streamlined process for managing your forms efficiently.

Utilizing a cloud-based document management platform such as pdfFiller is beneficial because it allows for multi-user collaboration. This feature is particularly advantageous for businesses where multiple team members may need to access, edit, or approve the certificate of exemption form. The ease of access from any device further promotes productivity.

Submitting the certificate of exemption form

Once you've completed your certificate of exemption form, the next step is submission. Depending on your local regulations, there are various submission methods available, including online submission through the state tax authority’s website, mailing the form directly, or delivering it in person to the appropriate agency.

Understanding submission deadlines is crucial to ensure your application is processed timely. Keep track of any specific requirements for submission to avoid missing out on potential savings. After submitting the form, confirm receipt to ensure your exemption request is being processed correctly. Most states provide a means to check the status of your submission, helping you stay informed.

Frequently asked questions about the certificate of exemption form

Users often have inquiries surrounding the certificate of exemption form, especially regarding the exemption process itself. Common questions include who qualifies for exemption, how to navigate complications if denied, and the types of exemptions available for different purchasing scenarios.

For additional help, contact your local tax authority or utilize support within pdfFiller, where dedicated resources can provide clarity and guidance. As regulations can differ significantly from one location to another, it may be beneficial to gain specific insights tailored to your unique situation.

Resources and tools for managing your certificate of exemption

To simplify the management of your certificate of exemption form, pdfFiller offers interactive tools and a wealth of resources. Users can explore a variety of customizable form templates tailored to numerous scenarios, ensuring that your document is compliant with all necessary regulations.

Additionally, pdfFiller’s collaborative features facilitate team workflows, allowing multiple members to contribute to the completion and submission processes. To accompany your application, a list of supporting documentation often required can be maintained within the platform, providing easy access when you need to gather necessary files.

Case studies: real-world applications of the certificate of exemption

Examining real-world applications of the certificate of exemption form illustrates its impactful role in tax planning. Businesses that have successfully utilized the form report significant cost savings, liberating funds to invest in growth and development, ultimately improving operational efficiency. Non-profits have similarly demonstrated how the use of this exemption can lead to enhanced service delivery, allowing them to stretch their donor contributions further.

These case studies highlight not just the practicality but the necessity of understanding and effectively utilizing the certificate of exemption form as a strategic financial tool. Such examples serve as a valuable resource for those considering applying for tax exemptions, ensuring they recognize both the opportunities and necessary precautions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit certificate of exemption in Chrome?

How do I fill out the certificate of exemption form on my smartphone?

How do I edit certificate of exemption on an Android device?

What is certificate of exemption?

Who is required to file certificate of exemption?

How to fill out certificate of exemption?

What is the purpose of certificate of exemption?

What information must be reported on certificate of exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.