Get the free Cosigner Agreement

Get, Create, Make and Sign cosigner agreement

Editing cosigner agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cosigner agreement

How to fill out cosigner agreement

Who needs cosigner agreement?

The Ultimate Guide to Co-Signer Agreement Forms

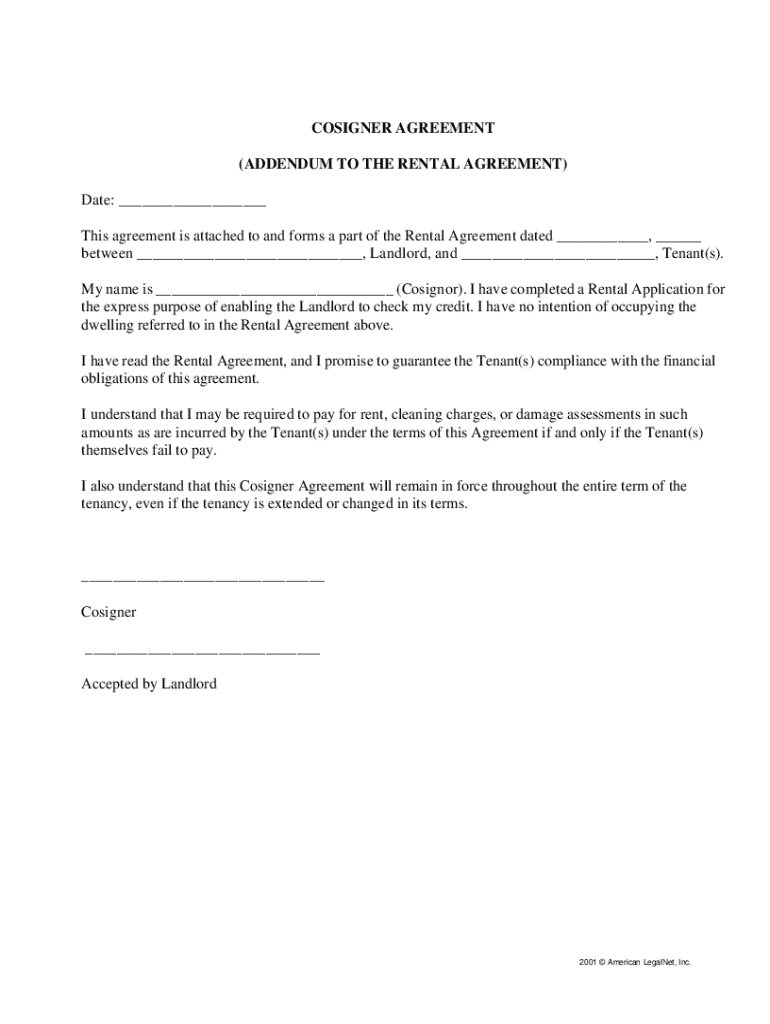

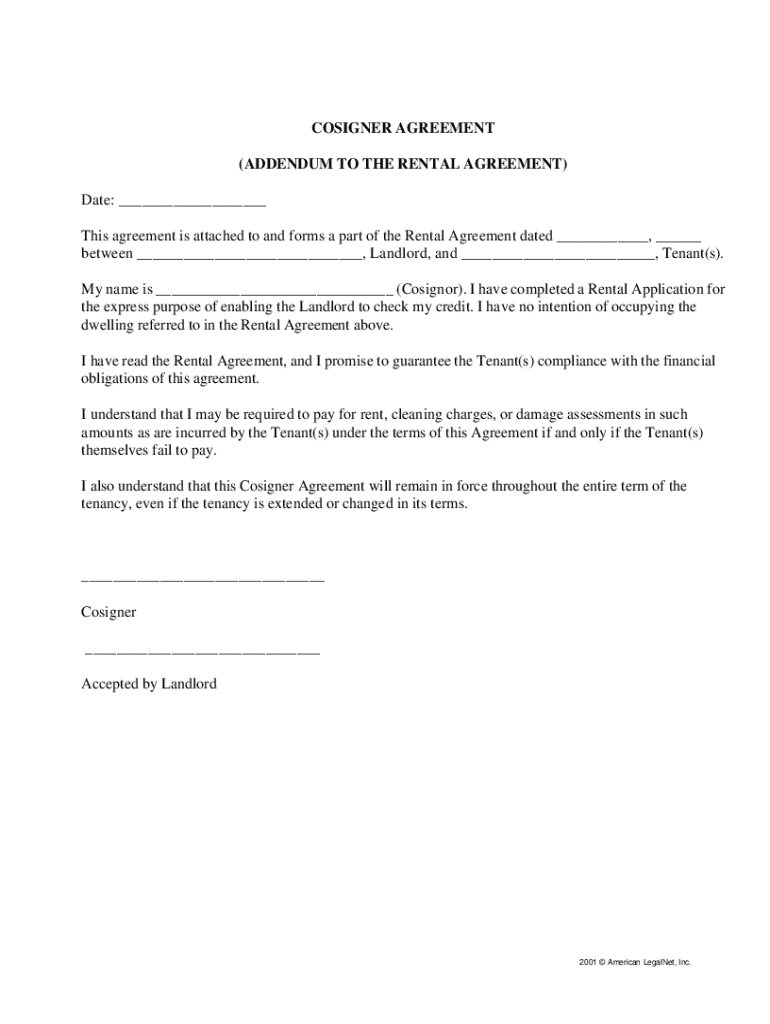

Understanding the co-signer agreement

A co-signer agreement is a legal document that involves three parties: the borrower, the co-signer, and the lender or landlord. It serves as a guarantee that the loan or lease payment will be made, offering an additional layer of security for the lender. The importance of a co-signer agreement cannot be overstated, particularly for borrowers with limited credit history or low income. By having a co-signer, individuals can increase their chances of securing loans or rental agreements without high interest rates that may accompany offers made to those deemed higher risk.

Legally, co-signing means the co-signer agrees to take on the financial responsibility if the primary borrower fails to meet their obligations. This agreement can have significant implications, as it can affect the co-signer’s credit score and ability to take on new debt. Understanding these nuances is crucial before entering into any agreement.

Key components of a co-signer agreement typically include identification details of the involved parties, an outline of financial obligations, and a clear definition of the responsibilities of the co-signer. Each of these elements plays a pivotal role in establishing expectations and legal responsibilities.

When to use a co-signer agreement

Many common scenarios warrant the use of a co-signer agreement. Renting an apartment is one of the most prevalent situations, especially in competitive markets where landlords prefer tenants with a more robust financial stability background. A co-signer can bridge the gap in income or creditworthiness, enabling the primary tenant to secure a lease.

Obtaining loans can also require a co-signer, particularly for those with limited credit history. Young adults seeking their first auto loans or individuals seeking mortgages with less-than-stellar credit often benefit from having a co-signer. Additionally, large purchases such as vehicles, appliances, and even some educational loans may also require a co-signer to assure lenders of repayment.

In each of these scenarios, the inclusion of a co-signer can lead to benefits such as increased chances of loan approval and potential lower interest rates due to reduced risk for the lender. Thus, understanding the strategic use of a co-signer agreement can be invaluable.

Creating your co-signer agreement

Filling out a co-signer agreement form can initially seem daunting. However, breaking it down into sections can simplify the process. Start with the identification section, where each party's legal name, address, and contact details should be recorded accurately. This is essential to avoid any future disputes.

Next, outline the financial obligations involved, detailing the loan amount, repayment schedule, and any additional costs. It’s crucial for everyone involved to fully comprehend the terms laid out. Legal jargon may seem intimidating, but understanding the definition of terms like 'default' and 'liability' will help clarify responsibilities.

To make the process even smoother, consider using interactive tools like pdfFiller. Their platform offers features such as autofill options and easy template integration, allowing you to create professional-looking documents quickly.

Sample co-signer agreements

Co-signer agreements can vary significantly depending on their purpose. A residential lease co-signer agreement serves to secure a rental property, while a loan co-signer agreement outlines the responsibilities related to financial loans. Importantly, knowing the differences between personal and commercial agreements can prevent misunderstandings.

When drafting your agreement, ensure it includes essential clauses such as the governing jurisdiction, details regarding dispute resolution, and the area of liability. An example structure could involve a clear breakdown of borrower rights, the co-signer's obligations, and the reliever's positions in differing circumstances.

Checklist for co-signer agreement completion

Before finalizing your co-signer agreement, it’s essential to ensure accuracy and clarity throughout the document. Begin with a verification of personal information of all parties, confirming that identification details, such as addresses and names, match legal documents.

It’s also critical to understand all legal terminology included in the form. Each party must grasp their responsibilities and the implications of default. Finally, outline clear procedures for signing and set a timeline for when the agreement will be finalized.

Managing your co-signer agreement

Once your co-signer agreement is established, aspects of management become paramount. Consider options for editing and storing your agreements securely. Utilizing pdfFiller allows for easy document editing. Users can amend their agreements when necessary and keep versions organized without losing crucial information.

Understanding the implications of changes is also essential. If modifications to the agreement are necessary, both the co-signer and borrower should be notified and agree to any adjustments. Keeping a unified communication line can prevent future issues.

Signing the co-signer agreement

When it comes to signing your co-signer agreement, adopting best practices can streamline the process. Electronic signatures are increasingly accepted and offer a convenient alternative to traditional ink signatures. With pdfFiller’s eSignature feature, you can easily sign documents online, saving time and ensuring secure records.

After signing, ensure all parties receive a copy of the finalized document. Retaining a signed copy of the agreement is vital for future reference. It serves as proof of commitment and clarifies responsibilities for both parties.

Frequently asked questions

Understanding co-signer agreements often leads to a series of questions. For instance, what happens if a borrower defaults? Should the co-signer be approached to cover missed payments? Typically, yes, as the co-signers accept this responsibility voluntarily.

Can a co-signer be removed from an agreement? Under specific conditions, such as refinancing the loan or paying the debt in full, it may be possible. Additionally, are there alternatives to using a co-signer? Options like joint applications, secured loans, or exploring government-backed loans may be available to borrowers.

Related documents and templates

When dealing with a co-signer agreement, other relevant forms may come into play. A lease agreement template can provide a framework for rental situations, while a loan agreement template can assist borrowers in outlining the loan terms outline.

The release of a co-signer agreement is vital once the borrower has fulfilled their obligations. Understanding these related documents helps create a comprehensive perspective on the responsibilities and rights associated with co-signing.

Support and assistance

Navigating the nuances of a co-signer agreement can sometimes require additional help. That’s where pdfFiller’s customer support becomes invaluable. They offer assistance related to form completion and editing, ensuring users can clarify their understanding of their agreements.

Furthermore, there are various resources available for individuals needing legal guidance. Whether it's understanding your liabilities as a co-signer or clarifying responsibilities, resources to help can make entering into a co-signer agreement much less daunting.

Additional popular documents

To enhance your document management capabilities, several popular documents relate closely to co-signer agreements. Lease addendum forms can provide additional provisions, while power of attorney forms allow another party to act on behalf of an individual regarding financial matters.

Additionally, financial guarantee documents can serve as further assurance in lending situations. Utilizing these forms alongside your co-signer agreement can create a well-rounded approach to managing financial commitments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cosigner agreement in Gmail?

How can I edit cosigner agreement from Google Drive?

Can I sign the cosigner agreement electronically in Chrome?

What is cosigner agreement?

Who is required to file cosigner agreement?

How to fill out cosigner agreement?

What is the purpose of cosigner agreement?

What information must be reported on cosigner agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.