Get the free Cash payment of termination benefits information sheet

Get, Create, Make and Sign cash payment of termination

Editing cash payment of termination online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash payment of termination

How to fill out cash payment of termination

Who needs cash payment of termination?

Comprehensive Guide to Cash Payment of Termination Form

Overview of cash payment for termination

A cash payment of termination benefit refers to the monetary compensation owed to an employee upon the termination of their employment. This type of payment can arise from various circumstances, such as layoffs, voluntary resignations, or company restructuring. Understanding your rights in relation to these payments is crucial for ensuring you receive everything owed to you, which can significantly affect your financial stability. Knowledge of how and when cash payments apply not only assists in planning your next steps but also empowers you to negotiate appropriately with your employer.

Eligibility criteria for cash payments

Eligibility for cash termination payments can depend on various factors, including whether an employee is full-time or part-time and the duration of employment. Generally, full-time employees are more likely to qualify for cash payments than part-time workers. Employers often offer payment benefits based on the length of service, which can be a determining factor in the calculation of payouts. However, it is crucial to read the employment contracts and company policies thoroughly to understand the specifics.

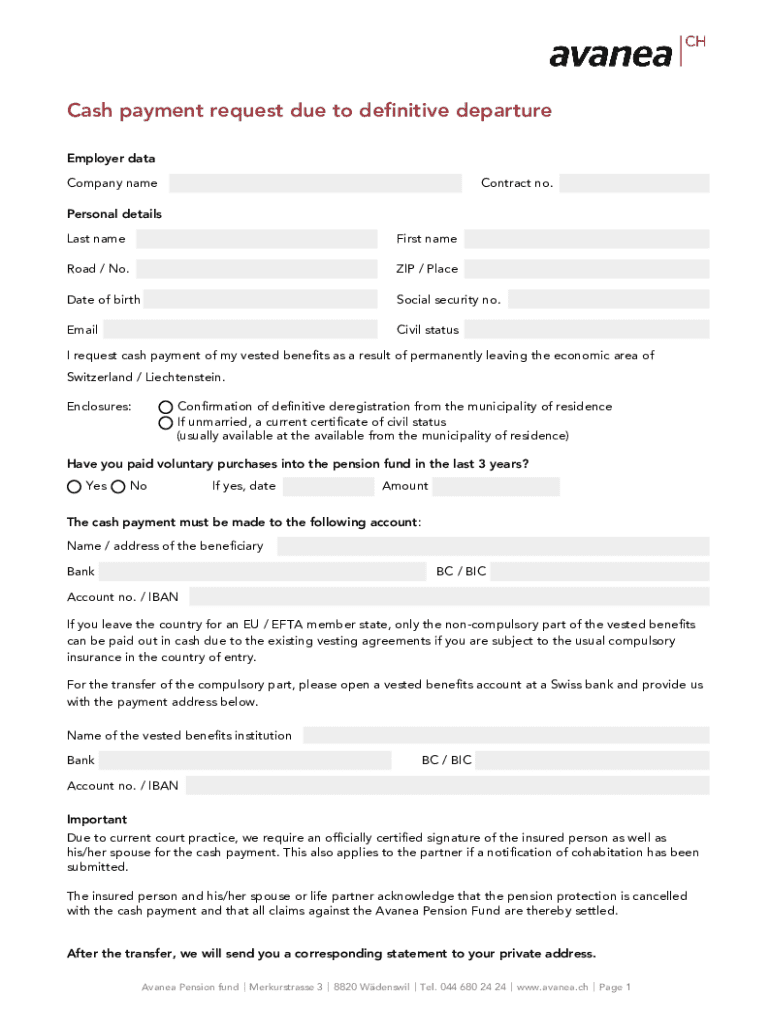

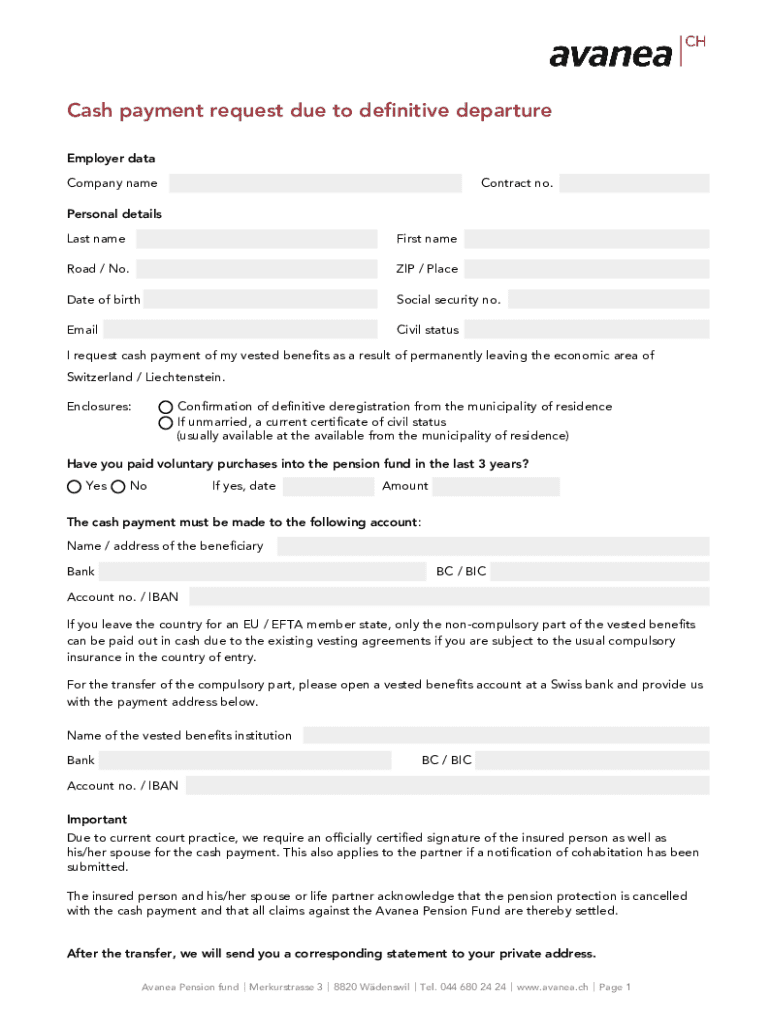

Understanding the cash payment termination form

The cash payment termination form is a vital document that facilitates the processing of your termination benefits. This form typically includes several key components designed to capture essential information regarding your employment and the nature of your termination. What you’ll find in this form are required personal information fields, details on the basis of your termination, and instructions for completion to ensure accuracy and compliance.

Step-by-step guide to completing the cash payment termination form

Completing the cash payment termination form requires careful attention to detail. Follow this structured approach to ensure accuracy throughout the process, which can significantly influence the timeliness of your payment.

Cash payment calculation

The calculation of cash termination benefits is a process influenced by multiple factors. Typically, the length of service plays a significant role; longer employment often correlates with higher payouts. Employment agreements may also stipulate severance packages, affecting overall financial entitlements. Understanding how these factors influence your final payment can enable you to better manage your expectations while negotiating your termination benefits.

Managing your cash payment of termination benefits

After you submit your cash payment termination form, it’s essential to monitor the progress of your application. Typically, processing times can vary widely depending on the company's internal procedures. It’s advisable to follow up regularly, especially if you do not receive a response within a reasonable timeframe. Understanding how to track your payment status can also be an asset; many organizations provide online portals for this purpose, streamlining your ability to stay informed without needing to engage in prolonged communication.

Tax implications of cash termination payments

Receiving a cash payment for termination benefits comes with tax obligations that you must consider. Generally, these payments are subject to federal and state tax withholding based on the total amount received. Understanding how these taxes are applied will help you avoid surprises when tax season arrives. Ensure you save all documentation related to these payments, as they will be necessary for accurate tax reporting in the future.

Common FAQs about cash payment termination form

As you navigate the cash payment termination form, you might have several questions. Below we address some of the most common concerns. Understanding the answers to these questions can simplify the completion process and alleviate any uncertainties.

Related forms and documentation

While the cash payment termination form is essential, other forms related to the employment termination process may also be beneficial. From a payment in lieu of notice form to severance agreement templates, having these documents handy can assist in ensuring a smooth transition. Knowing where to access these forms is equally vital and can save time during the often stressful transition period.

Importance of proper document management

Managing documents related to termination is critical for several reasons. Using tools like pdfFiller not only ensures that your documents are organized and accessible but also allows you to securely handle sensitive information. Interactive tools available enhance your ability to edit, sign, and manage documents online with ease — adding a layer of efficiency to often complex processes. This makes document handling less distressing during periods of transition.

Conclusion and next steps

Navigating the landscape of cash payment termination forms requires diligence and understanding. By following a detailed, step-by-step approach, you can ensure that your rights are upheld and that you receive the benefits entitled to you. Utilizing resources and tools offered by pdfFiller can enhance your experience, guiding you toward efficient document management processes.

User support and contact information

As you complete and submit your cash payment termination form, questions may arise. For additional assistance or specific inquiries, reaching out to customer support can be helpful. A dedicated support team can guide you through the complexities of the process, ensuring that you clearly understand each step.

Additional topics of interest

Consider exploring related topics on employment rights and exit procedures to further inform your understanding of your situation. Engaging with content about financial planning after a termination can also provide insights as you move forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cash payment of termination directly from Gmail?

How do I make edits in cash payment of termination without leaving Chrome?

How can I edit cash payment of termination on a smartphone?

What is cash payment of termination?

Who is required to file cash payment of termination?

How to fill out cash payment of termination?

What is the purpose of cash payment of termination?

What information must be reported on cash payment of termination?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.