Get the free Ct-1065/ct-1120si Ext

Get, Create, Make and Sign ct-1065ct-1120si ext

How to edit ct-1065ct-1120si ext online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1065ct-1120si ext

How to fill out ct-1065ct-1120si ext

Who needs ct-1065ct-1120si ext?

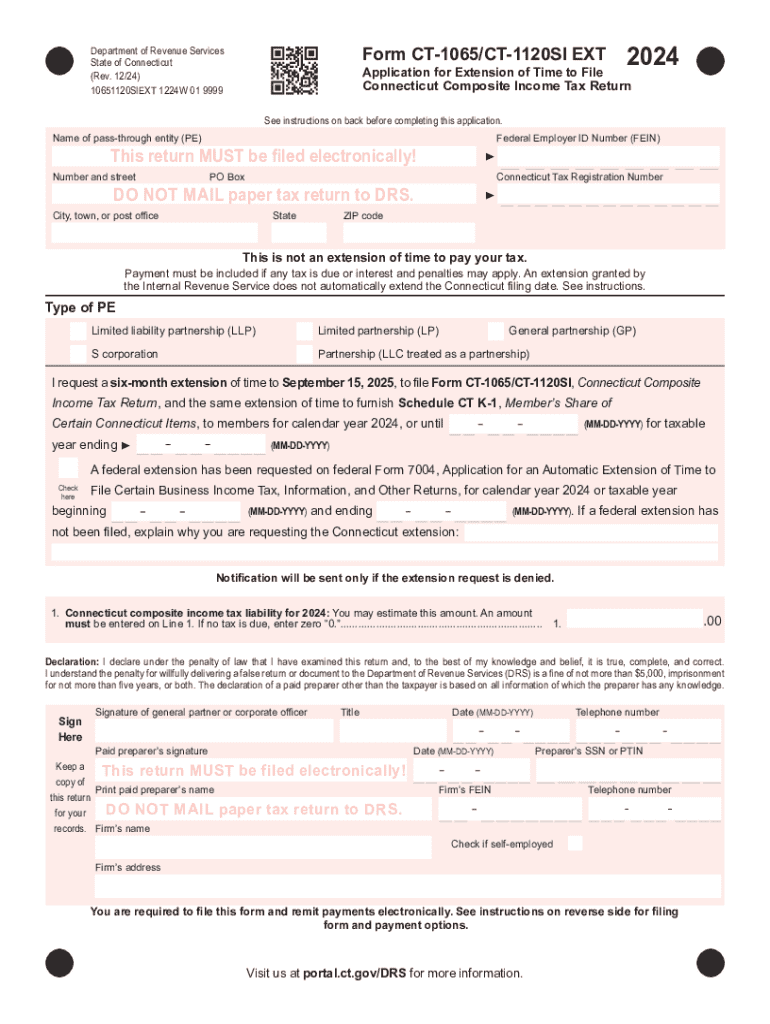

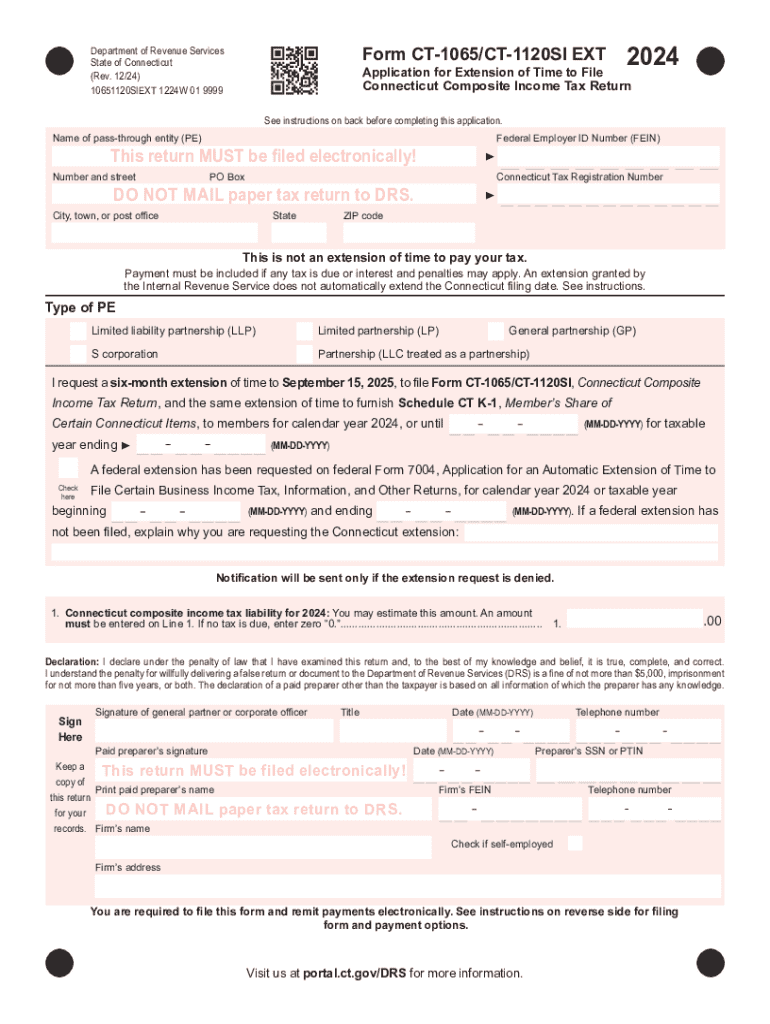

Comprehensive Guide to the ct-1065ct-1120si Ext Form

Understanding the ct-1065ct-1120si form

The ct-1065ct-1120si form is essential for partnerships and S corporations operating in Connecticut. It serves as an income tax return that these entities must file annually. Filing this form is crucial not only for compliance with state tax laws but also for accurate revenue representation to stakeholders and the IRS.

Any partnership or S corporation that conducts business within Connecticut is required to file the ct-1065ct-1120si form. This includes businesses engaged in providing services, selling goods, or conducting any operations under the laws of the state. Understanding when and how to complete this form ensures that your business remains compliant and avoids potential penalties.

Key features of the ct-1065ct-1120si form

The ct-1065ct-1120si form comprises various sections designed to gather all necessary information from the taxpayer. Its structure allows for a thorough breakdown of income, deductions, and credits applicable to the entity.

The form includes interactive elements that enhance user experience. Editable fields allow taxpayers to fill information directly, reducing errors and facilitating a smoother submission process.

Step-by-step guide to filling out the ct-1065ct-1120si form

Before you begin the filling process, gather essential documents encompassing income statements, previous tax returns, partnership agreements, and any documentation supporting deductions or credits.

Begin with Section 1, which focuses on Basic Information. Accurate completion of personal and entity details is essential. Ensure names match legal documents to avoid discrepancies.

Moving to Section 2, you will calculate your income. Ensure all revenue streams are accounted for, along with any related taxes to comprehend total taxable income. Keeping detailed records here can save you time and ensure accuracy.

In Section 3, document any Deductions and Credits. Research applicable deductions to maximize your tax benefits and consult tax professionals if in doubt. It’s crucial to leverage all available deductions as they can significantly impact your tax liability.

Finally, Section 4 requires your signature. Opt for eSigning, which simplifies the submission process and enhances security. eSigning confirms your review and acceptance of the information provided, which is critical to protect against fraud.

Editing and customizing your ct-1065ct-1120si form

Editing your ct-1065ct-1120si form can be streamlined using tools available on the pdfFiller platform. These tools allow easy modification of text and insertion of additional fields. Collaborative environments facilitate teamwork, enabling multiple stakeholders to input necessary information.

Additionally, utilizing cloud storage solutions allows you to access and share your forms from anywhere. This flexibility is invaluable, particularly for teams working remotely or on-the-go.

Common challenges and how to overcome them

Filling out the ct-1065ct-1120si form can come with its share of challenges, such as frequent errors that taxpayers may encounter. These can range from incorrect data entries to missing essential supporting documents.

Moreover, technical issues can arise when filling out online forms. If problems occur, consult the help section on pdfFiller or reach out to customer support for assistance. Familiarizing yourself with troubleshooting procedures can greatly enhance your overall user experience.

Examples and case studies of effective form usage

Consider a small local coffee shop functioning as an S corporation. Their use of the ct-1065ct-1120si form allowed them to report income accurately and claim deductions for operational expenses. Using pdfFiller simplified their interactions with both accountants and tax authorities.

Another case involves a partnership of graphic designers who utilized the form to delineate their profits and losses. With testimonials praising the ease of use of pdfFiller, they managed to file their taxes promptly without complications, favorably impacting their business operations.

Best practices for managing your documents

Digital document management is paramount. Maintain organizational tips such as categorizing forms by year and type. Establish folders in your cloud storage to simplify navigation, ensuring you or your team can retrieve documents promptly.

Implementing these practices fosters a disciplined approach to document management, solidifying your operation's efficiency and compliance.

Conclusion on the utility of the ct-1065ct-1120si form in tax management

Utilizing the ct-1065ct-1120si form effectively empowers partnerships and S corporations to manage their tax obligations confidently. Relying on platforms like pdfFiller can enhance your document management approach, making eSigning, collaboration, and editing seamless.

As tax laws evolve, staying informed and adapting your documentation techniques ensures you're prepared for the future. The ct-1065ct-1120si form is not just a filing requirement; it is a tool for strategic financial management, paving the way for continued business growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ct-1065ct-1120si ext from Google Drive?

How can I edit ct-1065ct-1120si ext on a smartphone?

How do I fill out ct-1065ct-1120si ext using my mobile device?

What is ct-1065ct-1120si ext?

Who is required to file ct-1065ct-1120si ext?

How to fill out ct-1065ct-1120si ext?

What is the purpose of ct-1065ct-1120si ext?

What information must be reported on ct-1065ct-1120si ext?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.